Trading stocks is a dynamic and unique career in and of itself. However, due to easy entry to the market and the potential for huge profits quickly, non-professional people enter the activity. The number of De-mat accounts created at various countries’ central depository systems indicates that the number of traders and investors joining the capital markets has reached historic highs. Most of them lose some or all of their money due to their unquenchable avarice before giving up or going back to learning the fundamentals. Even cautious buyers occasionally engage in trading, which depletes their wealth.

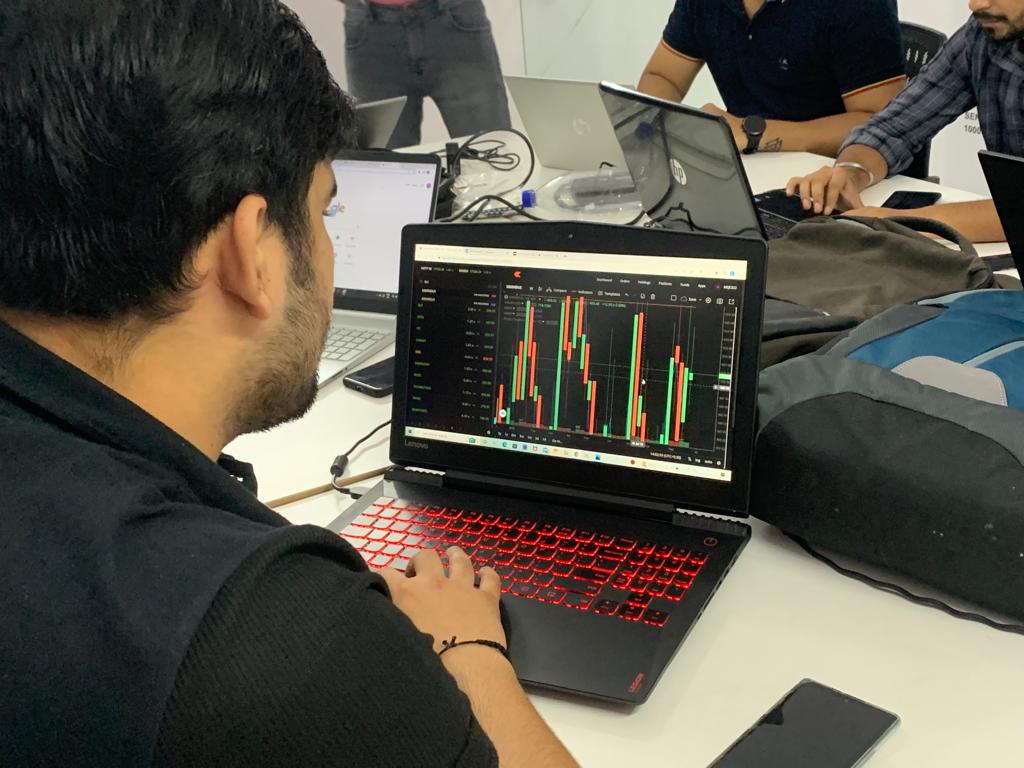

Life Style of a Trader

The prevalence of sleep disorders has increased as a result of contemporary socioeconomic and lifestyle variables. There needs to be advocacy for proper sleep hygiene, amount, and quality.

The week on the Indian stock exchanges runs from Monday to Friday. Trading is permitted on the equity exchange from 9:00 AM to 3:30 PM.

The commodity market, however, is available from 10 AM to 11:30 PM. Occasionally, suggestions to advance market timings were made. SEBI published a discussion document outlining the advantages of extending market hours. (SEBI, 2018). The ideas were mostly abandoned, though, for operational reasons.

Participants in the financial markets have lost two hours of slumber per day over the past century. Following a weekend of daylight saving time, the markets have experienced sharp declines that are ascribed to sleep asynchronies.

Stress in Life of a Trader

Griffith, Najand, and Shen (2019) investigated small investor mood measurement in the dimensions of fear, gloom, joy, and stress to forecast market returns and market volatility. Fear significantly and persistently affects market results. Stress has a one-day lag and is observed to have a relatively smaller effect on returns.

Joy and happiness have no bearing on forecasting returns. According to studies, optimistic investors who are joyful are more likely to anticipate positive market gains. The stressful nature of stock market trading often makes the trader’s worst adversary the merchant. The trader has an advantage if they are conscious of stress level measurement technology like Ambient Intelligence.

Mental Health of a Trader

Well-documented, violent stock market shocks and crashes are discussed in research groups. Examining the connections between behavioral agreement, correlation to stock market returns, and market volatility reveals a phase transition between the indicators.

Significant coupling strength causes a rise in all three variables.

Trading participants ignore their random factors and adhere to the market trend when coupling strength is equivalent to one. A lot of studies have been done on the effects of events on stock markets, including how they affect liquidity and volatility. Economic and Financial.

stress can potentially lead to human capital loss in the form of suicide or murder-suicide. Financial trading is a job that requires careful risk management. Dynamic and unpredictable markets frequently cause trades to skip the risk management step, which can result in financial loss and, in the worst instances, suicide. Mental health studies have found a close relationship between trading risk, financial debt, and stock market failure.

For some experienced traders, trading stocks is a type of self-employment. In general, self-employment increases job and life satisfaction but may also raise mental health issues, despite the fact that the self-employed do not see it as mentally challenging.

If you liked this article, do visit our Instagram page to follow more of such content.

FOR COURSES RELATED INFORMATION, CLICK HERE