Fundamental Analysis

A note on Financial Ratios

Firstly, We have learned how to interpret financial statements throughout the course of the last few chapters. Now, we’ll concentrate on examining these financial accounts. Studying the “Financial Ratios” is the most excellent technique to assess financial statements. Benjamin Graham, the founder of fundamental analysis, popularised the theory of financial ratios. Financial ratios assist in interpreting the results and facilitating comparisons with prior years and businesses in the same sector as well, A typical financial ratio calculates its value using information from the financial statement. We must be familiar with a few characteristics of financial ratios before we can begin to grasp them.

Definitely, The financial ratio of a corporation by itself tells us very little about that business. How helpful do you believe it is to know that Ultratech Cements Limited has a profit margin of 15%, for example? Really not much, though. Although a 15% profit margin is good, how can I tell if it is the best?

Let’s assume that you determine ACC Cement’s profit margin to be 12 percent. It makes sense to compare the profitability now that we are contrasting two similar businesses. Undoubtedly, Ultratech Cements Limited appears to be the more successful business of the two. I’m trying to make the point that Financial Ratios on their own are frequently fairly meaningless. However, Only when you compare the ratio with another business of like size or when you examine the trend in financial ratios does the ratio make sense. To achieve the best inference, the ratio must be studied after it has been computed (either through comparison or by monitoring the ratio’s historical trend).

Additionally, you should be aware of this while calculating ratios. Companies and financial years may use different accounting policies. Before calculating the financial ratio, a fundamental analyst should be aware of this aspect and change the data appropriately as well.

Financial Ratios

Financial ratios can be “rather informally” divided into the following groups:

Ratios of Profitability

Ratios of Leverage

Ratios of Valuation

Running Ratios

Firstly, The analyst can assess the company’s profitability with the use of the profitability ratios. The ratios demonstrate how effectively the business can produce profits. Along with this, The competitiveness of the management is also indicated by a company’s profitability. A company’s profitability is a key factor since the profits are required for corporate expansion and to pay dividends to its shareholders.

In fact, The company’s long-term ability to maintain its ongoing business operations is measured by the leverage ratios, often known as solvency ratios or gearing ratios. The degree to which a corporation uses debt to support its expansion is indicated by its leverage ratios. Keep in mind that the business must fulfill its responsibilities in order to continue operating.

Solvency ratios put the company’s commitment in perspective and allow us to determine its long-term viability.

Generally, To determine how inexpensively or expensively the stock is trading, valuation ratios compare the company’s stock price with either its profitability or its overall value. This ratio enables us to determine whether the present share price of the company is regarded as high or low. In plainer terms, the valuation ratio contrasts the price of a security with the benefits of its ownership as well.

Beyond, The operating ratio commonly referred to as the “activity ratio,” gauges how effectively a company can turn its assets—both current and noncurrent—into income. This ratio enables us to assess the effectiveness of the company’s management.

In essence, ratios (regardless of the category to which they belong) communicate a message, typically one that is relevant to the financial status of the organization. For instance, the “Profitability Ratio” might communicate the effectiveness of the business, which is often assessed by calculating the “Operating Ratio”. Perhaps, These overlaps make it challenging to categorize these ratios. As a result, the ratios are categorized “rather loosely.

The Profitability Ratios

Under “The Profitability Ratio,” we shall examine the following ratios:

The margin of EBITDA (Operating Profit Margin)

EBITDA Increase (CAGR)

APT Margin

Growth PAT (CAGR)

Income from Equity (ROE)

Income from Assets (ROA)

Capital Employed Return (ROCE)

The margin of EBITDA:

It should be noted, The EBITDA margin, also known as earnings before interest, taxes, depreciation, and amortization measures management effectiveness. It reveals the effectiveness of the business’s operational strategy. The EBITDA Margin reveals the company’s operating profitability (in percentage terms). To determine how effectively the management controls expenses, it is usually advisable to compare the company’s EBITDA margin to that of its rivals.

We must first determine the EBITDA in order to compute the EBITDA Margin.

Operating revenues minus operating expenses is EBITDA.

Total Revenue – Other Income = Operating Revenues

Total Expense – Finance Cost – Depreciation and Amortization = Operating Expense

Total Revenue – Other Income] / EBITDA is known as the EBIDTA margin.

Using Amara Raja Batteries Limited as an example, the EBITDA Margin calculation for FY14 is as follows:

EBITDA is initially calculated, and it is calculated as follows:

Total Revenue minus Other Income minus Total Expense minus Finance Cost minus Depreciation & Amortization

It should be noted Income from investments and other non-operational activity is referred to as other income. Other income would undoubtedly bias the results if it were included in the EBITDA calculation. This forces us to subtract Other Income from Total Revenues.

[3482 – 46] – [2942 – 0.7 – 65]

= [3436] – [2876]

= 560 billion

the EBITDA Margin is as follows:

560 / 3436

equals 16.3%

At this point, I’d want to ask you two questions:

What do Rs. 560 crores in EBITDA and a 16.3% EBITDA margin mean?

How favorable or unfavorable is a 16.3% EBITDA margin?

The first query is quite straightforward. A company with an EBITDA of Rs. 560 Crs. has kept Rs. 560 Crs. from its operating income of Rs. 3436 Crs. This also indicates that the corporation paid Rs. 2876 Cr. toward expenses out of a total of Rs. 3436 Cr. The corporation kept 16.3 percent of its revenue at the operating level for its operations while paying out 83.7 percent of its income in expenses.

Now for the second question, to which you, ideally, should not have a response.

First and foremost, Keep in mind that we did touch on this subject earlier in the chapter. A financial ratio by itself tells us virtually nothing. We should either look at the trend or evaluate it in relation to similar items to make sense of it. With this in mind, a 16.3% EBITDA margin provides very little insight.

Surely, It seems as though ARBL has kept its EBITDA at an average of 15%, and closer inspection reveals that the EBITDA margin is rising. This is encouraging since it demonstrates the management’s operating capabilities are reliable and effective.

EBITDA increased from Rs. 257 Cr. in 2011 to Rs. 560 Cr. in 2014. Accordingly, there will be a 21% CAGR in EBITDA over the next four years.

Please note that module 1 of our discussion included the CAGR formula.

It is obvious that the EBITDA margin and EBITDA growth both seem to be fairly excellent. But we’re still unsure if it’s the best. Compare these figures against those of its rivals to see if it is the best. It would be Exide batteries Limited in the instance of ARBL. I’d advise you to apply the same strategy to Exide and contrast the outcomes.

The margin of PAT:

Moreover, The Profit After Tax (PAT) margin is determined at the level of ultimate profitability, whereas the EBITDA margin is calculated at the operating level. Only operating costs are taken into account at the operating level; other costs, such as depreciation and financing charges, are not considered.

There are tax expenses in addition to these costs. To determine the company’s total profitability, we subtract all costs from Total Revenues before calculating the PAT margin as well.

[PAT/Total Revenues] = PAT Margin

PAT is mentioned in the Annual Report in explicit terms. On a total revenue of Rs. 3482 Cr., ARBL’s PAT for FY14 is Rs. 367 Cr (including other income). The PAT margin as a result is:

= 367 / 3482

equals 10.5%

We can plainly notice a margin expansion, hence the PAT and PAT margin trend appears outstanding. The 4-year CAGR growth is 25.48 percent, which is once more respectable. It goes without saying that it is always a good idea to compare ratios with the company’s rivals.

ROI (Return on Equity):

The Return on Equity (RoE) ratio is important because it enables investors to evaluate the return that shareholders receive for each unit of invested capital. Importantly, RoE gauges an organization’s capacity to make money off of the investments of its shareholders. Likewise, In other words, RoE demonstrates the effectiveness of the business in producing profits for its shareholders. Clearly, It goes without saying that the better it is for the shareholders, the higher the RoE.

In actuality, this is one of the crucial statistics that aid the investor in determining the company’s investable qualities. To give you some context, the average RoE of the best Indian companies is from 14 to 16 percent. Personally, I favor investing in businesses with RoEs of 18 percent and more.

This ratio is evaluated in comparison to other businesses operating in the same sector and is tracked over time.

Additionally, keep in mind that if the RoE is strong, the company is producing a sizable amount of cash. As a result, there is less need for outside funding. Therefore, a greater ROE denotes better managerial performance.

In case, Using the formula [Net Profit / Shareholders Equity* 100], RoE may be determined.

Without a doubt, RoE is a crucial ratio to compute, but like many financial ratios, it also has some limitations. Think about this hypothetical situation to help you comprehend its downsides.

Let’s say Vishal owns a pizzeria. Vishal wants an oven, which will cost him Rs. 10,000. The oven is beneficial to Vishal’s company. He does not seek external debt and pays for the oven out of his own pocket. You would agree that according to his balance sheet, he has an asset worth Rs. 10,000 and shareholder equity of Rs.

Let’s say Vishal makes $2500 in profit in his first year of business. How does he rate? It’s not difficult to calculate this:

RoE = 2500/10000*100

equals 25 percent.

Let’s now alter the narrative a little. With only Rs. 8000, Vishal borrows Rs. 2000 from his father to buy an oven that costs Rs. 1000. What would his balance sheet look like, in your opinion?

In terms of liability, he would have:

Equity of Shareholders = Rs. 8000

Debt = 2000 Rupees

Vishal now owes a total of Rs. 10,000. He possesses an asset worth Rs. 10,000 to balance this out on the asset side. Check out his RoE right now:

RoE = 2500 / 8000*100

equals 31.25 percent

When there was an additional loan, the RoE increased considerably. What if Vishal had only 5000 rupees and borrowed another 5000 from his father to purchase the oven? His balance sheet would seem as follows:

In terms of liability, he would have:

Shareholder Equity is equal to Rs.

debt equals 5000

The entire amount owed by Vishal is Rs. 10,000. He possesses an asset worth Rs. 10,000 to balance this out on the asset side. Check out his RoE right now:

RoE = 2500 / 5000 *100

50 percent

The RoE is undoubtedly higher the more debt Vishal seeks to fund his asset, which is necessary to produce profits. A high RoE is fantastic, but not at the expense of a large debt load. The issue is that running a business becomes extremely dangerous when there is a large quantity of debt since the cost of financing skyrockets. Because of this, carefully reviewing the RoE becomes crucial. Implementing a method known as the “DuPont Model” is one way to do this.

‘DuPont Model’ is also called DuPont Identity.

RoE is calculated as Net Profit / Shareholder Equity multiplied by 100.

However, by breaking down the RoE formula, we were able to acquire an understanding of three different business-related areas. Let’s examine the three elements that make up the RoE formula according to the DuPont model:

Net Profit Margin = Net Profits / Net Sales * 100

Importantly, The ability of the business to make money is expressed by this first component of the DuPont Model. Simply put, this is the PAT margin that we discussed earlier in this chapter. Low net profit margins are a sign of rising costs and heightened competition.

Asset turnover is calculated as Net Sales / Average Total Asset.

The asset turnover ratio is a measure of the effectiveness with which a corporation generates revenue by using its assets. A higher ratio indicates that the company is utilizing its resources more effectively. A lower ratio could be a sign of management or production issues. The outcome is expressed as occurring multiple times annually.

Average Total Assets / Shareholders’ Equity = Financial Leverage

We can answer the question, “How many units of assets does the company have for every unit of shareholders’ equity,” with the use of financial leverage. For instance, if the financial leverage is 4, the corporation may finance assets worth Rs. 4 for every Rs. 1 in equity. A corporation that is highly leveraged will have more financial leverage as well as higher debt levels, thus an investor should proceed with caution. The outcome is expressed as occurring multiple times annually.

As you can see, the DuPont model divides the RoE formula into three separate parts, each of which provides information on the operating and financial capacities of the company.

Now, let’s use the DuPont Model to get Amara Raja’s RoE for FY 14. We must determine the values of the individual components in order to do this.

As I have said, the net profit margin is the same as the PAT margin. According to our earlier calculations, ARBL’s Net Profit Margin is 9.2%.

Asset Turnover is calculated as Net Sales / Average Total Assets.

According to the FY14 Annual Report, ARBL’s net sales total Rs. 3437 Cr.

The average total assets in the denominator can be found on the balance sheet, as is known. However, what does the word “Average” mean?

The entire asset for FY14, according to ARBL’s financial sheet, is Rs. 2139 crores. The given figure pertains to the Financial Year 2014, which began on April 1, 2013, and ended on March 31, 2014. This suggests that the company must have started operating with assets carried forward from the previous financial year at the beginning of the financial year 2014 (April 1, 2013). (FY 2013). The company added to its existing portfolio of assets during the current fiscal year (FY 2014), bringing the total to Rs. 2139 crores.

Whether There is no doubt that the company’s asset value changed significantly from the beginning to the end of the financial year.

In light of this, which asset value should I use as the denominator when calculating the asset turnover ratio? Should I take into account the asset value at the start of the year or the asset value at the end? The standard procedure is to average the asset values from the previous two fiscal years to prevent confusion.

Do keep in mind this method of averaging line items since we will apply it to other ratios.

From the annual report of ARBL, we learn:

FY14’s net sales were Rs. 3437 crores.

In FY13, total assets were Rs. 1770 Cr.

FY14’s total assets were Rs. 2139 crore.

Assets on Average = (1770 + 2139) / 2

= 1955

Turnover of Assets = 3437 / 1955

= 1.75 times

This indicates that the company is making Rs. 1.75 in profits for every Rs. 1 in deployed assets.

The financial leverage, the final factor, will now be calculated.

Average Total Assets / Average Shareholder Equity is financial leverage.

We know that Rs. 1955 is the average amount of assets. Simply examine the equity of the shareholders. We shall take into account “Average Shareholder equity” rather than just current year shareholder equity for similar reasons as why we took into account “Average Assets” rather than just current year assets.

For FY13, shareholders’ equity was Rs. 1059 billion.

Owners’ Equity for the Fiscal Year 2014 was Rs. 1362 Cr.

Rs. 1211 crores are the average shareholder equity.

Money Leverage = 1955 divided by 1211

= 1.61 times

Financial Leverage of 1.61 is really good given ARBL’s low debt level. According to the figure above, ARBL can support Rs.1.61 worth of assets for every Rs.1 in equity.

Now that we have all the information necessary to calculate RoE for ARBL, we will do so:

RoE is calculated as Net Profit Margin X Asset Turnover X Financial Leverage.

9.2 percent times 1.75 times 1.61

25.9% of the total. I must admit, it’s quite remarkable!

Surely, I am aware that this method of calculating RoE is time-consuming, but it may be the ideal method because it allows us to gain important business insights. The DuPont model provides answers to both the quantity and the quality of the return.

However, you can use the following method to quickly calculate the RoE:

RoE equals Net Profits / Average Shareholder Equity

According to the annual report, the PAT for FY14 is Rs. 367 Cr.

RoE = 367 / 1211

equals 30.31 percent

ROI (Return on Asset):

If you are familiar with the DuPont Model, comprehending the next two ratios should be easy. Return on Assets (RoA) measures how successfully an entity can use its assets to generate profits. Investments in non-productive assets are constrained in a well-managed business. Ron thus represents how effectively management uses its resources. It goes without saying that the ROA should be higher.

Ron is equal to [Net income plus interest*1-tax rate]. Average Total Assets

The Annual Report informs us that:

Rs.367.4 Cr. was the net income for FY 14.

Additionally, we know that the Total Average Assets (FY13 and FY14) = Rs. 1955 Cr. from the Dupont Model.

What does interest * (1- tax rate) actually mean? Well, if you give it some thought, the company’s loan is also used to fund the assets, which are then utilized to produce profits. Therefore, in a way, the debtholders (individuals or organizations who have loaned money to the company) are also a part of the business. According to this viewpoint, an investor in the company also owns the interest that is paid out. The corporation gains from a “tax shield,” which allows it to pay less in taxes when interest is paid out.

For these reasons, when computing the ROA, we must include interest (by taking into account the tax shield).

Taking into account the tax benefit it would be, the interest cost (financing cost) is Rs. 7 Cr.

= 7* (32 percent – 1)

= 4.76 Cr. Please be advised that the average tax rate is 32%.

ROA would therefore be –

Ron = [367.4 + 4.76] / 1955

~ 372.16 / 1955

19,03 percent

RCE: Return on Capital Employed

While, Taking into account the total amount of capital the company uses, the Return on Capital Employed shows how profitable the business is.

Both equity and debt are included in total capital (both long-term and short-term).

Profit before Interest and Taxes / Total Capital Employed is known as ROCE.

Equity + Long-Term Debt + Short-Term Debt equals Total Capital Employed.

In the Annual Report of ARBL, we learn:

Profit before Interest and Taxes: 537.7 crores rupees

Capital Used Overall:

debt due soon: Rs. 8.3 Cr.

Long-term Debt: Rs. 75.9 Cr.

Equity of Shareholders = Rs.1362 Cr.

Total capital employed: 1446.2 Crs (8.3 Crs + 74.9 Crs + 1362).

ROCE = 537.7 / 1446.2

equals 37.18 percent0

The Leverage Ratios

In our discussion of Return on Equity and the DuPont analysis, we briefly touched on the subject of financial leverage. The usage of leverage (debt) has two sides to it.

Well-run businesses look to borrow money if they anticipate a scenario in which they may use the cash in a way that creates a greater return than the interest payments they must make to service their debt. Do keep in mind that using debt to finance assets wisely also boosts the return on equity.

However, if a business takes on excessive amounts of debt, the interest paid to pay the debt reduces the shareholders’ profit share. Thus, the line dividing good debt from bad debt is quite thin. Leverage ratios primarily address the total amount of debt held by the company and aid in our understanding of its financial leverage.

The following leverage ratios will be examined:

The ratio of Interest Coverage

The ratio of Debt to Equity

The ratio of Debt to Assets

The ratio of Financial Leverage

Amara Raja Batteries Limited (ARBL) has served as our example up to this point, but in order to better grasp leverage ratios, let’s look at a business that has a significant amount of debt on its balance sheet. I’ve selected Jain Irrigation Systems Limited (JISL), however, you are welcome to compute the ratios for any business you choose.

The ratio of Interest Coverage:

The debt service ratio or debt service coverage ratio are other names for the interest coverage ratio. The interest coverage ratio enables us to gauge how much the company is making in comparison to its interest expense. This ratio aids in determining how readily a business can make interest payments. For instance, if the company’s interest expense is Rs. 100 and its income is Rs. 400, it is obvious that it has enough money to pay its debts. However, a low-interest coverage ratio may indicate a heavier debt load and a larger risk of insolvency or default.

The interest coverage ratio is calculated using the following formula:

[Earnings before Tax/Interest Payment]

EBIT stands for “Earnings before Interest and Tax.”

EBITDA – Amortization and Depreciation

Applying this ratio to Jain Irrigation Limited will be helpful.

EBITDA is calculated as [Revenue – Expenses].

We subtract the finance cost ($467.64Cr) and the depreciation and amortization cost ($204.54Cr) from the total expenses ($5730.34Cr).

EBITDA is therefore equal to Rs. 5828.13 – 5058.15 Cr.

EBITDA = 769.98 crore rupees

We are aware that EBITDA is equal to EBIT less (D&A).

= Rs.769.98 – 204.54

= Rs. 565.44

The finance Cost is known to be Rs. 467.64.

Consequently, interest coverage is:

= 565.44/ 467.64 = 1.209x

The number above has an “x” that stands for a multiple. 1.209x should therefore be read as 1.209 “twice.”

An interest coverage ratio of 1.209x indicates that Jain Irrigation Limited is producing an EBIT of 1.209 times for each Rupee that is due in interest payments.

The ratio of Debt to Equity

This ratio is quite simple to understand. The Balance Sheet contains both of the necessary inputs for this calculation. It calculates how much total loan capital there is in relation to total equity capital. A ratio with a value of 1 indicates that debt and equity capital are distributed equally. One should exercise caution because a larger debt-to-equity ratio (more than 1) suggests increased leverage. A ratio of less than 1 denotes a considerably larger equity basis in comparison to debt.

[Total Debt/Total Equity] is the formula used to compute the debt-to-equity ratio.

Please take note that the total debt shown here includes both short- and long-term debt.

Total debt equals long-term debt plus short-term debt, which adds up to 1497.663 + 2188.915 = 3686.578 crore rupees.

There are Rs. 2175.549 billion in equity.

As a result, the debt-to-equity ratio will be calculated using the formula: = 3686.578 / 2175.549 = 1.69.

The ratio of Debt to Assets:

This ratio aids in our comprehension of the company’s asset financing strategy. It informs us of the percentage of total assets that are financed by debt.

Total Debt / Total Assets is the calculation method to determine the same.

We are aware that JSIL owes a total of Rs. 3686.578000.

We may estimate the total assets at Rs. 8204.447 Cr. from the balance sheet:

As a result, the debt-to-asset ratio is 3686.578/8204.44, which equals 0.449 or 45 percent.

This means that debt capital or creditors account for nearly 45 percent of the assets held by JSIL (and therefore 55 percent is financed by the owners). It goes without saying that the investor would be more concerned the greater the proportion, as it signifies higher leverage and risk.

The ratio of Financial Leverage

When discussing Return on Equity in the last chapter, we had a quick glance at the financial leverage ratio. The financial leverage ratio shows us how much equity is being used to support the assets.

The Financial Leverage Ratio is calculated as follows: Average Total Asset / Average Total Equity.

I am aware that the average total assets are Rs. 8012.615, according to JSIL’s FY14 balance sheet. The typical amount of equity is Rs. 2171.75. Consequently, the financial leverage ratio, sometimes known as the “leverage ratio,” is equal to 3.68: 8012.615 / 2171.755.

Accordingly, JSIL supports Rs. 3.68 worth of assets for each dollar worth of equity. Keep in mind that the higher the figure, the greater the company’s leverage.

Operating Ratios

Undoubtedly, Operating ratios, often known as “activity ratios” or “management ratios,” show how effectively a company’s operational activity is doing. The operational ratios in some ways also show how effective the management is. These ratios are known as asset management ratios because they show how well the organization is using its assets.

Popular operating ratios include:

-

The ratio of Fixed Asset Turnover

-

The ratio of Working Capital Turnover

-

The ratio of Total Asset Turnover

-

The ratio of Inventory Turnover

-

Inventory Days in Stock

-

The ratio of Receivables Turnover

-

days with outstanding sales (DSO)

The P&L statement and balance sheet data are combined in the aforementioned ratios. Calculating these ratios for Amara Raja Batteries Limited will help us grasp what they mean.

The operational ratios of a company must be compared to those of its peers and competitors, or these ratios should be compared over time for the same company, to truly understand how good or terrible they are.

Turnover of Fixed Assets

The ratio calculates how much revenue is produced in relation to the amount invested in fixed assets. It reveals how efficiently the business utilizes its facilities and tools. Property, plant, and equipment are examples of fixed assets. A higher ratio indicates that the organization is managing its fixed assets successfully and efficiently.

Operating Revenues / Total Average Asset = Fixed Assets Turnover

The assets taken into account for determining the fixed assets turnover should be assets that are net of accumulated depreciation, which is nothing more than the company’s net block. It should also contain any ongoing capital projects. For the same reasons as in the previous chapter, we also use the average assets.

= (767.864 + 461.847)/2

= Rs.614.855 Cars

Since the operational revenue for FY14 was estimated to be Rs. 3436.7 Crs, the fixed asset turnover ratio is as follows:

= 3436.7 / 614.85

=5.59

Do bear in mind the company’s stage as you evaluate this ratio. A really well-established business could not be using its cash to invest in fixed assets.

However, a developing business may invest in fixed assets, leading to annual growth in the value of those assets. This is also true for ARBL, where the fixed asset value for FY13 was Rs. 461.8 Crs. and the FY14 fixed asset value was Rs. 767.8 Crs.

Capital-intensive sectors mostly utilize this ratio to assess how successfully a company is using its fixed assets.

Turnover of working capital

Working capital is the term used to describe the funds needed by a business to carry out its daily activities. The business needs specific types of assets to perform its daily operations. These assets often include cash, receivables, inventory, and so forth. If you’re aware that these are recent assets.

Current liabilities are used to finance current assets in a well-managed business. We can calculate the company’s working capital by dividing current assets by current liabilities.

Current Assets – Current Liabilities equals Working Capital.

A positive working capital figure indicates that the business has excess working capital and can easily manage its daily operations. The corporation, however, has a working capital deficit if the working capital is negative. When a business has a working capital shortfall, they typically ask its bankers for a working capital loan.

Working capital management is a broad topic in corporate finance in and of itself. Inventory management, cash management, debtor management, etc. are all included. The Chief Financial Officer (CFO) of the organization makes an effort to effectively manage working capital. Of course, we won’t discuss this because we would be deviating from our main point.

Net sales to working capital is another name for the working capital turnover ratio. The company’s revenue per unit of working capital is measured by the working capital turnover. If the ratio is 4, it means that for every rupee of working capital the company generates $4 in revenue.

The working capital turnover calculation formula is as follows:

Revenue / Average Working Capital Equals Working Capital Turnover.

Let’s put the identical plan into action for Amara Raja Batteries Limited. First, we must determine the working capital for the FY13 and the FY14, and then we must determine the average

We are aware that ARBL generates Rs. 3437 Cr. in operating revenue. As a result, the working capital turnover ratio is equal to 5.11 times (3437 divided by 672.78).

According to the figure, the company is making Rs. 5.11 in revenue for every Rs. 1 in working capital. The higher the working capital turnover ratio, the better; this shows that the company is making more money from sales than it is spending on funding those sales.

Asset Turnover in Total

Likewise, This ratio is fairly simple to understand. It shows how much revenue the business can make with the available resources. Both fixed and current assets are included in the assets in this situation. When compared to historical data and competition data, a company’s total asset turnover ratio is higher, indicating that its assets are being effectively utilized to increase sales.

Operating Revenue / Average Total Assets equals Total Asset Turnover.

Following are the average total assets for ARBL:

The total assets for the fiscal years 2013 and 2014 were respectively 1770.5% and 2139.4%. The average asset size would therefore be Rs. 1954.95 Cr.

In FY 14, operating income was Rs. 3437 Cr. As a result, Total Asset Turnover is equal to 3437 / 1954. 95 = 1.75 times

The ratio of Inventory Turnover

Moreover, The finished goods that a business keeps in its store or showroom with the hope of selling them to potential customers are referred to as inventory. The business typically keeps some additional units of finished items in its warehouse in addition to the goods it keeps in the store.

In case, If a business sells well-liked goods, the inventory will be depleted quickly and will need to be replenished frequently. This process is known as “Inventory turnover.”

Consider a bakery that sells warm bread as an illustration. The baker presumably knows how many pounds of bread he will likely sell each day if the bakery is well-known.

He might, for instance, sell 200 pounds of bread each day. This requires him to keep a daily inventory of 200 pounds of bread. Therefore, the rate of inventory replenishment and turnover is extremely high in this instance.

Particularly, This might not apply to all businesses. Consider a car company, for example. Evidently, selling cars is more difficult than selling bread. If a producer makes 50 automobiles, it can take some time before he can sell them all. Assume he needs three months to sell 50 cars, which is the capacity of his inventory. This indicates that he changes his inventory every three months. As a result, he changes his inventory four times a year.

Finally, a particularly well-liked product would have a high inventory turnover rate. The “Inventory Turnover Ratio” clearly demonstrates this.

To determine the ratio, use the following formula:

Inventory turnover is calculated as [Cost of Goods Sold/Average Inventory].

The cost incurred in producing the finished good is known as the cost of goods sold. This information is available from the company’s P&L Statement. Let’s put this into practice for ARBL.

Materials used to cost Rs. 2101.19 crores, and stock-in-trade acquisitions cost Rs. 211.36 crores. The cost of products sold is directly correlated with these line items. Along with this, I’d like to look through the “Other Expenses” section to see if there are any expenses connected to the cost of the goods sold.

There are two costs that are directly associated with production: the cost of power and fuel, which is Rs. 92.25 Crs., and the cost of stores and spare parts, which is Rs. 44.94 Crs.

Thus, the cost of goods sold is calculated as follows: cost of materials consumed + cost of the stock purchased + cost of stores & spare parts + cost of fuel & electricity.

= 2101.19 plus 211.36 plus 44.94 plus 92.25 COGS = Rs. 2449.74 crore

The numerator is now taken care of. We just use the average inventory for FY13 and FY14 as the denominator. According to the balance sheet, inventory was Rs. 292.85 crores in FY13 and Rs. 335.00 crores in FY14. The median comes to Rs. 313.92 Crs.

The ratio of inventory turnover is:

= 2449.74/313.92, which is 7.8 or 8.0 times annually.

This indicates that Amara Raja Batteries Limited changes its inventory eight times a year, or once every 1.5 months. It goes without saying that one should compare this statistic to the numbers of its competitors in order to truly understand how excellent or awful it is.

Inventory Days Counted

The “Inventory number of Days” reveals how long the firm needs to turn its inventory into cash, in contrast to the Inventory turnover ratio, which indicates how frequently the company “replenishes” its inventory. The shorter the period of time, the better. A low number of days with an inventory suggests that the company’s goods are in high demand. The formula to determine the number of days in an inventory is as follows:

Inventory Turnover / Inventory Days = 365

The number of inventory days is typically computed annually. As a result, the number 365 in the formula above denotes the number of days in a year.

For ARBL, divide 365 by 7.8 to arrive at 46.79 47.0 days.

This indicates that ARBL needs around 47 days to turn its inventory into cash. In order to gauge how well a firm’s products are selling, it goes without saying that the inventory days of the company should be compared to those of its rivals.

Now, I want you to consider the following situation. What would you think about it?

The inventory turnover ratio of one particular business is high.

The inventory number of days is extremely low due to a high inventory turnover ratio.

On the surface, this company’s inventory management appears to be effective. A good indicator of swift inventory replenishment is a high inventory turnover ratio for the company. A low inventory number of days along with a high inventory turnover show that the business can swiftly turn its items into cash. This demonstrates excellent inventory control once more.

What happens, then, if a business has a fantastic product that sells quickly but a meager capacity for production? Even under this scenario, there will be a high inventory turnover and few inventory days. However, a low production capacity can be concerning because it calls into doubt the company’s ability to produce:

-

Why can’t the business boost its production?

-

Do they lack the resources necessary to enhance production?

-

Why can’t they apply for a bank loan if they need money?

-

Have they tried to get a loan from a bank but have been unsuccessful?

-

Why can’t they raise a loan, if they can’t?

-

What if the management has a poor track record, which is why the banks are hesitant to offer a loan?

-

Why can’t the corporation raise output if money isn’t an issue?

-

Is it tough to find raw materials? Is the required raw material subject to governmental regulation? (like Coal, power, Oil, etc).

-

Is the business unscalable if raw materials are difficult to access?

As you can see, investing in the company may not be wise if any of the aforementioned statements are true. The fundamental analyst should read the annual report from beginning to end, paying particular attention to the management discussion & analysis report, in order to completely comprehend the production concerns (if any).

This means constantly double-checking the production information whenever you observe great inventory statistics.

The ratio of Accounts Receivable Turnover

Knowing the receivable turnover ratio should be simple after understanding the inventory turnover ratio. The ratio of accounts receivable to total revenue shows how frequently a given period is filled with cash inflows from consumers and debtors. Naturally, a bigger number means that the business receives payments more frequently.

To calculate the same, use the following formula:

Receivables Accounts Revenue divided by Average Receivables is the turnover ratio.

We are aware of the balance sheet

Trade Receivable: Rs.380.67 Cr. for the FY13

Trade Receivable: Rs. 452.78 Cr. for FY14

For FY13, the average Receivable was Rs. 416.72

Operating Income for the Fiscal Year 2014: Rs. 3437 Cr.

In light of this, the Receivable Turnover Ratio is equal to: = 3437 / 416.72 = 8.24 times annually 8.0 times

Accordingly, ARBL receives money from its clients once per month and a half, or 8.24 times a year.

Average Collection Period, Days Sales in Receivables, and Days Sales Outstanding (DSO)

The ratio of days sales outstanding shows the typical cash collection time or the interval between invoicing and collection. The efficiency of the company’s collecting department is demonstrated by this calculation. The money can be used for other purposes more quickly the sooner it is recovered from the debtors. To calculate the same, use the following formula:

Days Sales Outstanding divided by the Receivable Turnover Ratio (365)

Calculating for ARBL, the answer is = 365 / 8.24 = 44.29 days.

This indicates that it takes ARBL around 45 days from the moment an invoice is raised until it can collect payment on the invoice.

The DSO and Receivables Turnover both show the company’s credit policy. A well-run business should find the ideal balance between its credit policies and the credit it gives to its clients.

The Valuation Ratio

In general, valuation refers to the estimation of something’s “value.” The price of a stock is referred to as “something” in the context of investments. Regardless of how appealing a business first seems, the valuation of the company is ultimately what counts when making an investment decision. The amount you pay to acquire a business is determined by valuations. When compared to an exciting company with a sky-high valuation, a mediocre business with an absurdly low valuation can be a fantastic investment opportunity.

We may get a sense of how market players evaluate the stock price using the valuation ratios. These ratios aid in our comprehension of how appealing the stock price is from an investment standpoint. The purpose of valuation ratios is to evaluate a stock’s price in relation to its advantages. The value ratios of a company should be examined with the company’s rivals, just like all the other ratios we had looked at.

The share price of the company divided by some measure of its financial success is how valuation ratios are often calculated. The following three crucial valuation ratios will be examined:

Price to Sales Ratio (P/S)

The ratio of Price to Book Value (P/BV) and

Price-to-Earnings Ratio (P/E)

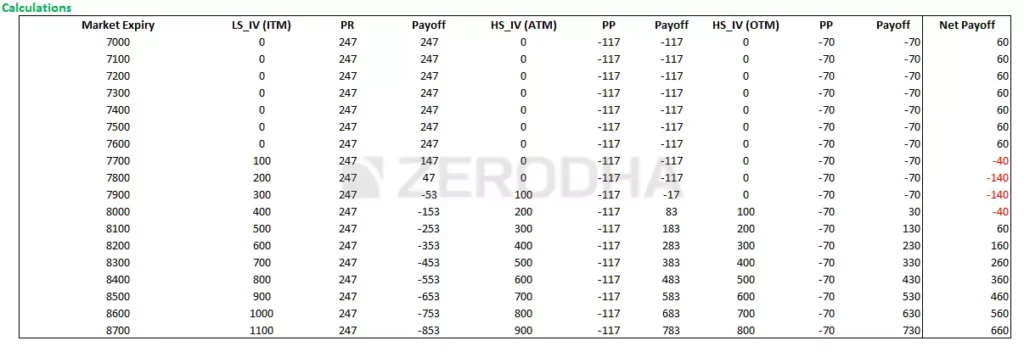

Let’s use the Amara Raja Batteries Limited (ARBL) example to put these ratios into practice and observe how ARBL does. One crucial element in the valuation ratio calculations is the stock price of ARBL. As of October 28, 2014, while I am writing this chapter, ARBL is trading at Rs. 661 per share.

To calculate the aforementioned ratios, we also need to know how many shares of ARBL are currently outstanding. If you recall, we calculated a similar amount in chapter 6. There are 17,08,12,500 shares outstanding in total, or 17.081Crs.

Price to Sales Ratio (P/S)

Investors frequently value their investments using sales rather than profitability. The earnings amount could not be accurate because some businesses might be going through an earnings cycle low. Additionally, because of the significant write-offs that are relevant to that business, certain accounting standards may make a prosperous company appear to have no earnings at all. Investors would thus choose to utilize this ratio.

This ratio evaluates the company’s stock price in relation to its share-based revenue. The P/S ratio is calculated using the following formula:

Current Share Price / Sales Per Share is the price-to-sales ratio.

Let’s compute the equivalent for ARBL. We’ll start with the numerator:

Total Revenues / Total Shares equals Sales per Share.

The P&L report for ARBL informs us that:

Revenues totaled Rs. 3482 Cr.

Shares Outstanding: 17.081 billion

Sales per share = 3482 divided by 17.081

Thus, the sales per share are equal to Rs. 203.86.

This indicates that ARBL makes sales totaling Rs.203.86 for each outstanding share.

Price to Sales Ratio is equal to 661/203.86.

= 3.24 times, or 3.24

A P/S ratio of 3.24 means that the stock is worth 3.24 times more than 1 rupee in sales. It goes without saying that the firm is valued more the greater the P/S ratio. In order to accurately determine how expensive or inexpensive the stock is, one must compare the P/S ratio with those of its rivals.

You should keep the following in mind while calculating the P/S ratio. Consider that Company A and Company B are competing to sell the same product. Each of the two businesses brings in Rs. 1000. However, Company A keeps Rs. 250 in PAT, whereas Company B keeps Rs. 150. In this instance, Company A has a profit margin of 25% while Company B has a profit margin of 15%.

Therefore, Company A’s sales are worth more than Company B’s sales. In light of this, Company A may be trading at a higher P/S. Every rupee of revenue that Company A generates results in a bigger profit being retained, hence the value might be justified.

Remember to look at the profit margin whenever you feel that a certain company is trading at a higher price from the P/S ratio perspective.

The ratio of Price to Book Value (P/BV)

We must first comprehend what the phrase “Book Value” means in order to comprehend the Price to Book Value ratio.

Think of a scenario where the business must shut down and all assets must be sold. What is the bare minimum that the company will get when it is liquidated? This can be answered by looking at the “Book Value” of the firm.

The money that is still on the table after a corporation settles its debts is simply its “Book Value.” Think of the company’s book value as its salvage value. If a firm has a book value of Rs. 200 crores, then this is the amount of money the company may anticipate receiving after selling everything and paying off its obligations. The book value is typically stated as a per-share figure. For instance, if the book value per share is Rs. 60, the shareholder might anticipate receiving Rs. 60 per share if the firm decides to liquidate. Following are the steps to calculate the “Book Value” (BV):

BV is calculated as [Share Capital + Reserves (excluding revaluation reserves)/Total Shares].

Let’s compute the equivalent for ARBL:

From the balance statement of ARBL, we learn:

Share Capital = 17.1 crore rupees

Reserves are Rs. 1345.6 billion.

Reserves for Revaluation = 0

17.081 shares total.

The Book Value per Share is, therefore, equal to [17.1+1345.6-0] / 17.081.

= 79.8 rupees per share

This indicates that the shareholders might expect to get Rs. 79.8 per share if ARBL were to liquidate all of its assets and settle its debt.

Moving forward, we can calculate the price to the company’s book value by dividing the stock’s current market price by its book value per share. The P/BV shows how often stock is trading above and beyond a company’s book value. It is obvious that the stock is more expensive the greater the ratio.

Let’s figure this out for ARBL. We are aware of:

The share price of ARBL is Rs.661 at the moment.

ARBL’s BV is 79.8 per share.

P/BV = 661/79.8

= 8.3 times, or 8.3

This indicates that ARBL is trading at more than 8.3 times its book value.

A high ratio could be a sign that the company is overvalued in comparison to its equity or book value. An undervalued corporation in relation to equity or book value may be indicated by a low ratio.

Price to Earnings Ratio (P/E)

The most well-known financial ratio is probably the price-to-earnings ratio. Everyone enjoys looking at a stock’s P/E ratio. Because of its widespread use, the P/E ratio is frequently referred to as the “financial ratio superstar.”

By dividing the current stock price by the Earnings Per Share, one can determine a stock’s P/E ratio (EPS). Let’s first define “Earnings per Share” (EPS) so that we can better comprehend the PE ratio.

On a per-share basis, EPS calculates a company’s profitability. Assume, for instance, that a corporation with 1000 outstanding shares makes a profit of Rs. 200 000. If so, the following would be the earnings per share:

=200000 / 1000

= 200 rupees each share.

Consequently, the EPS gives us an idea of the earnings produced on a per-share basis. Obviously, the better it is for its shareholders, the greater the EPS.

We may calculate the Price to Earnings ratio by dividing the current market price by the EPS. The P/E ratio gauges how many market participants are ready to pay for a stock for each dollar of profit it makes. For instance, if a company’s P/E is 15, it simply means that the market participants are willing to pay 15 times as much for every unit of profit the company generates. The stock is more expensive the higher the P/E.

Let’s figure out the P/E for ARBL. From its annual report, we learn that

PAT = 367 Rupees

17.081 billion shares total.

EPS is calculated as PAT divided by the total number of shares.

= 367 / 17.081

= Rs.21.49

ARBL’s current market price is 661.

P/E is therefore 661 / 21.49.

= 30.76 times.

This indicates that market players are willing to pay Rs.30.76 to purchase a share of ARBL for every unit of profit made by the company.

Imagine that ARBL’s price increases to Rs. 750 but the EPS stays at Rs. 21. 49. In this case, the new P/E would be:

= 750/21.49

= 34.9 times

The stock’s P/E increased while the EPS, at Rs. 21.49 per share, remained unchanged. What caused this, in your opinion?

Since we know that a company’s stock price rises when expectations for the company rise, it is obvious that the P/E Ratio increased as a result of the increase in stock price.

Keep in mind that the denominator of the P/E Ratio is ‘earnings’. Keep in mind the following important aspects when examining the P/E ratio:

P/E provides information about the stock’s current trading price. Never invest in stocks that are being valued highly. Regardless of the business or industry to which it belongs, I personally wouldn’t say that I prefer to invest in companies that are selling for more than 25 or, at most, 30 times their annual earnings.

The earnings, which are the P/E ratio’s denominator, are manipulable.

Make sure the company is not frequently altering its accounting practices because this is one way it tries to influence its profits.

Be mindful of how depreciation is handled. Earnings may increase if less depreciation is provided.

Something is definitely wrong if the company’s earnings are rising but not its cash flows or sales.

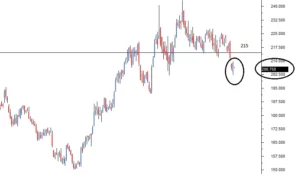

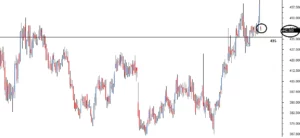

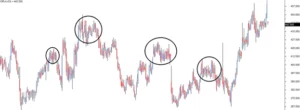

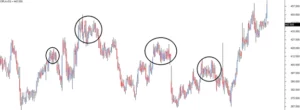

The Index Valuation

The P/E, P/B, and Dividend Yield ratios are used to determine the value of stock market indices like the BSE Sensex and the CNX Nifty 50. The daily index valuation is typically published by stock exchanges. We can tell how pricey or inexpensive the market is trading by looking at the index valuations. The National Stock Exchange adds up the market capitalization of all 50 stocks and divides that total by their combined earnings to arrive at the CNX Nifty 50 P/E ratio. Monitoring the Index P/E ratio provides insight into how market participants currently evaluate the state of the market.

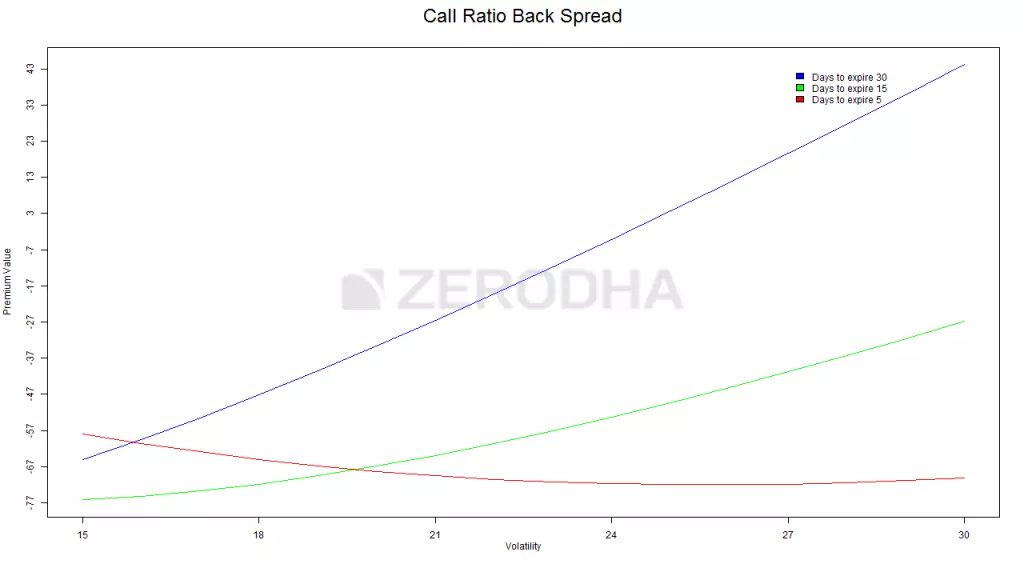

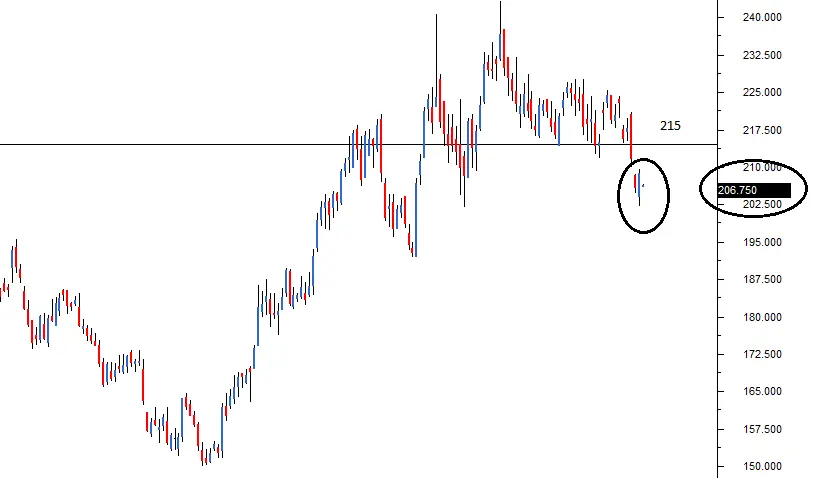

Several significant observations can be drawn from the P/E chart above, including:

Early in 2008, when the Index reached its highest valuation of 28x, there was a significant meltdown in the Indian markets.

The valuation was reduced by the revisions to roughly 11x (late 2008, early 2009). The Indian market’s current valuation was the lowest it had ever been.

Typically, the P/E ratio for Indian indices is between 16 and 20, with an average of 18x.

We are trading at roughly 22x as of today (2014), which is higher than the typical P/E ratio.

These observations allow for the following inferences to be made:

When the market’s P/E valuations are above 22x, one must exercise caution when investing in stocks.

Historically, when values are 16x or less, that is when it is best to invest in the markets.

By accessing the National Stock Exchange (NSE) website, one can quickly learn the Index P/E valuation each day.

Click on Products > Indices > Historical Data > P/E, P/B & Div > Search on the NSE homepage.

You can find the most recent P/E valuation of the market by typing today’s date into the search area. Please take note that the NSE refreshes this data every day at 6:00 PM.

Clearly, the Indian market is trading near the higher end of the P/E range as of today (November 13); history shows that we should exercise caution when making investment decisions at this level.

CONCLUSION

A valuable financial indicator for a corporation is its financial ratio. The ratio provides very little information on its own.

To form a judgment, it is best to research the ratio’s most recent trend or contrast it with that of the company’s competitors.

Profitability, leverage, valuation, and operating ratios are subcategories of financial ratios. Each of these groups provides the analyst with a distinct perspective on the company’s operations.

EBITDA is the amount of profit a business makes after deducting its operating costs from operating revenue.

EBITDA margin represents the company’s operating-level profitability as a percentage.

PAT margin measures the company’s overall profitability.

The Return on Equity (ROE) ratio is highly valued. It shows the shareholders’ rate of return on their initial investment in the business.

It’s not a good sign to have a high ROE and large debt.

Definitely, The DuPont Model assists in breaking down the ROE into distinct pieces, with each element shedding insight into various business-related topics.

The DuPont technique is perhaps the most effective way to determine a company’s ROE.

Return on Assets (ROA) measures how effectively a company uses its assets.

Undoubtedly, Return on Capital Employed (ROCE) measures the entire profit the business makes after accounting for both stock and debt.

The ratios must be compared to those of other businesses in the same industry in order to be useful.

Additionally, ratios should be examined both as a single moment in time and as a sign of longer-term trends.

Interest Coverage, Debt to Equity, Debt to Assets, and Financial Leverage Ratios are all examples of leverage ratios.

The primary purpose of the leverage ratios is to analyze the company’s debt in relation to its capacity to pay down long-term debt.

The ability of the corporation to earn money (at the EBIT level) in relation to its financing costs is measured by the interest coverage ratio.

The debt to equity ratio calculates how much equity capital there is in comparison to debt capital. The debt to equity ratio of 1 indicates that debt and equity are equal.

The debt to asset ratio enables us to comprehend how the organization finances its assets (especially with respect to the debt)

The financial leverage ratio enables us to determine how much owner equity is used to finance the assets.

The Fixed Assets Turnover, Working Capital Turnover, Total Assets Turnover, Inventory Turnover, Inventory Days, Receivables Turnover, and Day Sales Outstanding Ratios are among the Operating Ratios, often known as Activity Ratios.

Measured by the fixed asset turnover ratio, revenue is compared to the amount invested in fixed assets to determine how much revenue was created.

The working capital turnover ratio reveals how much profit the business makes for each working capital unit.

The company’s potential to create profits with the specified number of assets is indicated by its total asset turnover.

The inventory turnover ratio reveals how frequently the business refreshes its inventory each year.

The inventory number of days indicates how long it takes the business to turn its inventory into cash.

1. A fantastic combination is one with a high inventory turnover and, thus, a low inventory number of days.

2. Make sure, though, that this does not result in a reduction in productivity.

27. The Receivable turnover ratio reveals how frequently a company receives money from its clients and customers throughout a specific time frame.

28. The Days Sales Outstanding (DSO) ratio represents the gap between billing and collection, or the average cash collection period.

29. In general, valuation refers to the estimation of something’s “value.”

30. P&L statements and balance sheet inputs are used in valuation ratio calculations.

31. The price-to-sales ratio contrasts the share price of the company with its earnings per share.

Simply dividing the sales by the number of shares results in the sales per share.