Firstly, A single candlestick design, as the name implies, made up of a single candle. As you may expect, the trade signal is generate based on one day’s trading activity. Trades based on a single candlestick pattern can be tremendously rewarding if the pattern is accurately identified and executed.

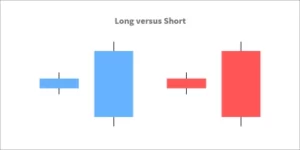

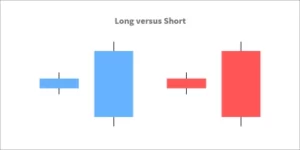

Secondly, When trading with candlestick patterns, one must pay attention to the length of the candle. The length represents the day’s range. The longer the candle, in general, the more intensive the buying or selling activity. If the candles are short, it indicates that the trade action was quiet.

At last, The following illustration depicts the long/short – bullish and bearish candle.

Moreover, Trades must also be fit depending on the length of the candle. Trading on muted short candles should be avoid. We shall comprehend this viewpoint as we learn about specific patterns.

The Marubozu

Importantly, The Marubozu is the first single candlestick pattern we’ll learn. In Japanese, the word Marubozu means “Bald.” We shall soon understand the terminology’s context. The bullish marubozu and the bearish marubozu are the two forms of marubozu.

Furthermore, Let us first establish the three most important candlestick rules. We discussed it in the previous chapter, and I’ve reprinted it below for your convenience:

Surely, Marubozu is likely the only candlestick pattern that breaches guideline number three, which is to look for a past trend. A Marubozu can emerge anywhere on the chart, regardless of the previous trend, and the trading implications are the same.

Definitely, Marubozu defines in the textbook as a candlestick with no upper and lower shadows (therefore appearing bald). As depicted below, a Marubozu possesses only the true body. There are, however, exceptions. We will investigate these exceptions as soon as possible.

Without a doubt, The bearish marubozu represents the red candle, while the bullish marubozu represents the blue candle.

Undoubtedly, In a bullish marubozu, the lack of the upper and lower shadows indicates that the low is equal to the open and the high is equal to the close. As a result, whenever the Open = Low and the High = Close, a bullish marubozu forms.

Especially, A bullish marubozu suggests that there is so much purchasing interest in the stock that market participants were willing to buy it at every price point during the day so the stock closed near its day high. Whatever the previous trend was, the performance on the marubozu day implies that sentiment has shifted and the stock is now positive.

Surely, The anticipation is that this quick shift in attitude will result in a wave of bullishness, which will last for the next few trading sessions. As a result, when a bullish marubozu appears, a trader should search for purchasing chances. The buying price should be around marubozu’s closing price.

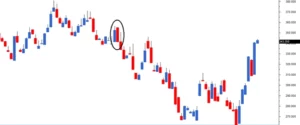

Last but not least, The circled candle in the above chart (ACC Limited) is a bullish marubozu. It’s worth noting that the bullish marubozu candle lacks an upper and lower shadow. The candle’s OHLC data is as follows: Open = 971.8, High = 1030.2, Low = 970.1, Close = 1028.4

It should be noted, Please keep in mind that the textbook definition of a marubozu is Open = Low and High = Close. However, there is a slight exception to this rule. When measured in percentage terms, the price change is little; for example, the difference between high and close is 1.8, which is 0.17 percent of high. This is where the second rule comes into play: be flexible, quantify, and verify.

Also, With the occurrence of a Marubozu, the expectation has shifted to the upside, and one would be a buyer of the stock. The following is the trade setup for this:

Stoploss = 970.0 and Buy Price = Around 1028.4

As a present, candlestick patterns do not provide us with a target. However, we will return to the topic of defining goals later in this session.

As well as, When do we buy the stock after we’ve decided to buy it? The answer is dependent on your risk tolerance. For example, Assume two categories of traders with differing risk profiles: risk-takers and risk-averse traders.

Clearly, The risk taker would purchase the shares on the same day that the marubozu accepted. The trader must, however, authenticate the occurrence of a marubozu. Validation is a simple process. At 3:30 p.m., Indian markets close. So, at about 3:20 PM, check to see if the current market price (CMP) is roughly equal to the day’s high price and the day’s opening price is roughly equal to the day’s low price.

Indeed, If this condition is encounter, you can buy the stock around the closing price because the day is building a Marubozu. However, It is also important to notice that the risk-taker is buying on a bullish/blue candle day, therefore adhering to Rule 1, i.e., buying on strength and selling on weakness.

Another risk-averse trader would buy the stock the following day, that is, the day after the pattern has formed. To comply with rule number one, before purchasing the trader, confirm that the day is bullish. This means that a risk-averse buyer can only purchase the stock near the end of the day.

Besides, The disadvantage of buying the next day is that the buy price is far higher than the indicated buy price, and so the stop loss is rather large. As a result, the risk-averse trader buys only after double-checking that the bullishness is truly established.

According to the ACC’s graph above, both the risk taker and the risk-averse would have profited from their trades.

Another case in point is Asian Paints Ltd, where both the risk-taking and risk-averse traders would have profited.

Accordingly, A bullish Marubozu has encircled in the chart above. The risk-taker would have opened a deal to buy the stock near the close of the day, only to lose money the next day. On the other hand, The risk-averse, on the other hand, would have avoided purchasing the stock totally since the next day occurred to be a red candle day. According to the rule, we should only buy on blue candle days and sell on red candle days.

The Stoploss on Bullish Marubozu

What if, after purchasing, the market reverses its course and the deal fails? As I previously stated, candlestick patterns include a risk control system. In the case of a bullish marubozu, the stock’s low serves as a stop loss. If the markets go in the opposite direction after you execute a buy trade, you should quit the stock if the price breaches the marubozu low.

While Here’s an example of a bullish marubozu that qualified as a purchase for both risk-averse and risk-taking investors. O = 960.2, H = 988.6, L = 959.85, C = 988.5 is the OHLC

However, the pattern eventually collapsed, and one would have had to take a loss. The stop loss for this trade would be the Marubozu low, which is 959.85.

In addition to this, Booking a loss is a necessary element of the game. Even seasoned traders experience this. The nicest part about following the candlestick is that the losses cannot continue endlessly. Apart from this, If the transaction begins to move in the opposite direction, there is a clear agenda for what price one must get out of the deal. In this situation, taking a loss would have been the logical thing to do as the stock continued to fall.

Of course, there may be times when the stop loss trigger and you exit the trade. However, the stock may reverse course and begin to rise after you exit the deal. But, regrettably, this is part of the game and cannot keep away from. Whatever happens, the trader should follow the regulations and not look for reasons to break them.

Previously, Bearish Marubozu denotes excessive pessimism. In this case, the open is equal to the high and the close is equal to the low. Close = High, while Open = Low.

A bearish marubozu signifies that there is so much selling pressure in the stock that market participants sold at every price point during the day, causing the stock to close near its day low. Whatever the previous trend was, Even so, the behavior on the marubozu day implies that sentiment has shifted and the stock is now bearish.

The idea is that this abrupt shift in attitude will carry forward over the following several trading sessions, and hence shorting possibilities should consider. The selling price should be close to marubozu’s closing price.

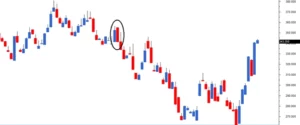

Whereas, The circled candle in the chart above (BPCL Limited) indicates the presence of a bearish marubozu. It’s worth noting that the candle lacks an upper and lower shadow. The candle’s OHLC data is as follows:

Close = 341.7, Open = 355.4, High = 356.0, Low = 341.

As previously discussed, a tiny variance between the OHLC figures resulting in modest upper and lower shadows is acceptable as long as it is within a fair range.

Remember, once you start a trade, you should stick with it until either the target or the stop loss encounter. If you try to do something else before any of these event triggers, your trade will almost certainly fail. Staying on track with the plan is therefore critical.

Absolutely, A trade can initiate based on the individual’s risk tolerance. On the same day, around the closing, the risk-taker can initiate a short transaction. He must, of course, ensure that the candle is creating a bearish marubozu. To accomplish this at 3:20 PM, The trader must confirm whether the open is roughly equal to the high and the current market price is roughly comparable to the low. If the condition runs into, it is a bearish marubozu, and a short trade can open.

Despite, If the trader is wary of taking risks, he can wait until the next day’s close. After establishing that the day is a red candle day, the short trade will be complete at 3:20 PM the following day. This is important to guarantee that we follow the first guideline of buying strength and selling weakness.

In the BPCL chart above, both risk takers and risk-averse investors would have profited.

Moreover, Cipla Limited is another chart where the bearish marubozu has been successful for both risk-taking and risk-averse traders. Remember, these are short-term trades, and profits must book quickly.

Here’s a chart of a bearish marubozu pattern that would not have worked out for the risk-taker, but a risk-averse trader would have avoided the transaction because of rule 1.

The Trade Trap

We discussed the length of the candle earlier in this chapter. Trading should be avoided during a modest (less than 1% range) or extended candle (above 10 percent range)

A small candle implies low trading activity, making it harder to determine the trade’s direction. A lengthy candle, on the other hand, suggests high activity. The positioning of stop loss would be a difficulty with long candles. The stop loss would be high, and the penalty for paying would be severe if the deal went bad. As a result, trading on candles that are either too short or too lengthy should be avoided.

Conclusion

- Remember the rules that govern how candlesticks work.

- Marubozu is the sole pattern that breaks rule number three, i.e. Look for the previous pattern.

- A bullish Marubozu signifies that you are bullish.

- Buy near the close of a bullish Marubozu.

- Maintain the Marubozu’s low as the stop loss.

- A bearish Marubozu suggests that you are bearish.

- Sell near the close of a bearish Marubozu.

- Maintain the Marubozu’s high as the stop loss.

- An ambitious trader can enter the trade the same day the pattern appears.

- Risk-averse traders can place the transaction the following day, as long as it follows rule number one, i.e. buy strength and sell weakness.

- Candles with unusual lengths should not be traded.

- A short candle implies low activity.

- Long candles imply high activity; nevertheless, setting stop loss becomes difficult.