Max pain & PCR ratio

Basics of stock market

• Induction

• Bull call spread

• Bull put spread

• Call ration Back spread

• Bear call ladder

• Synthetic long & Arbitrage

• Bear put spread

• Bear call spread

• put ration back spread

• Long straddle

• Short straddle

• Max pain & PCR ratio

• Iron condor

13.1 – My experience with Option Pain theory

The “Options Pain” theory undoubtedly has a place on the never-ending list of controversial market theories. Option Pain, also known as “Max Pain,” has a sizable fan base, in addition, to probably an equal number of detractors. I’ll be open; I’ve participated on both sides. When I first started investing with Option Pain, I was never able to consistently generate income. Over time, though, I discovered ways to improvise on this theory to fit my own risk tolerance, and that produced a respectable outcome. I’ll go over this as well later in the chapter.

Anyway, this is my attempt to explain the Option Pain theory to you and to discuss my likes and dislikes of Max Pain. This chapter can serve as a guide for how to decide which camp you want to be in.

You must be familiar with the idea of “Open Interest” in order to understand Option Pain theory.

So let’s get going.

13.2 – Max Pain Theory

Here is a step-by-step explanation of how to determine the Max Pain value. You might find this a little perplexing at this point, but I still advise reading it. Things will become more clear once we use an example.

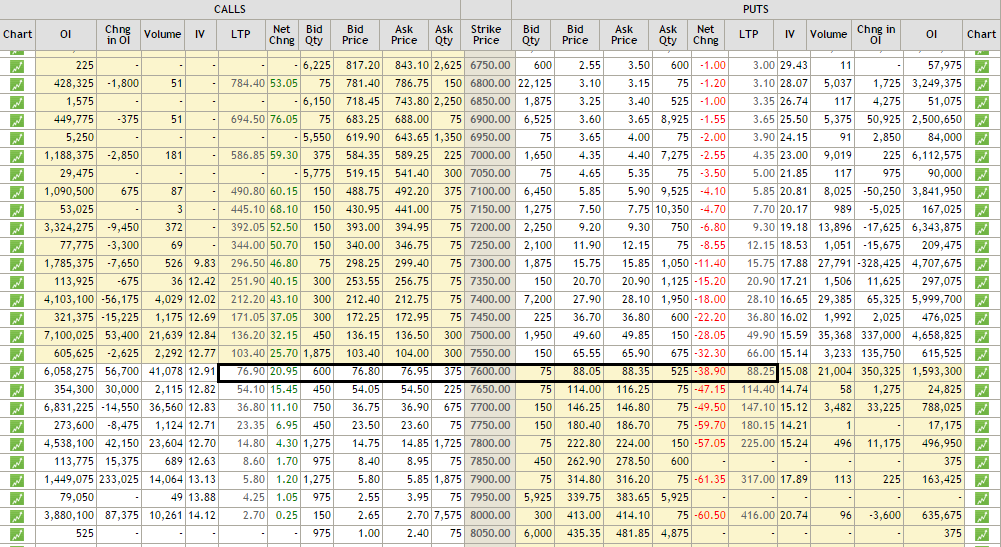

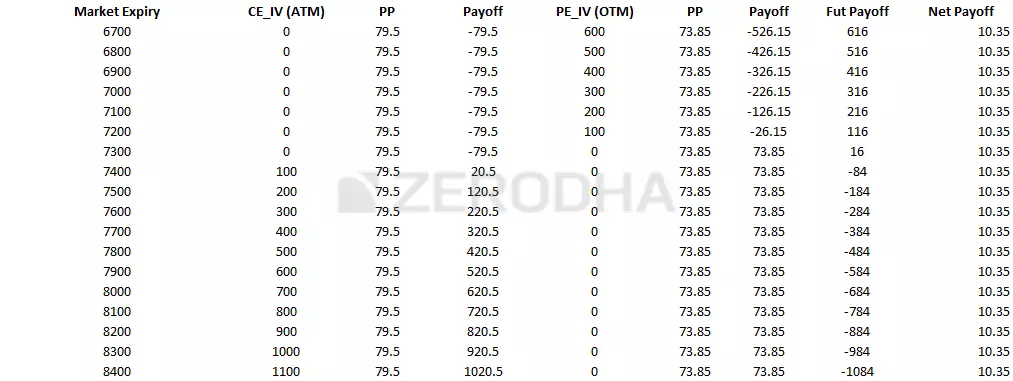

Step 1: Make a list of the different exchange strikes and note the open interest in calls and puts for each strike.

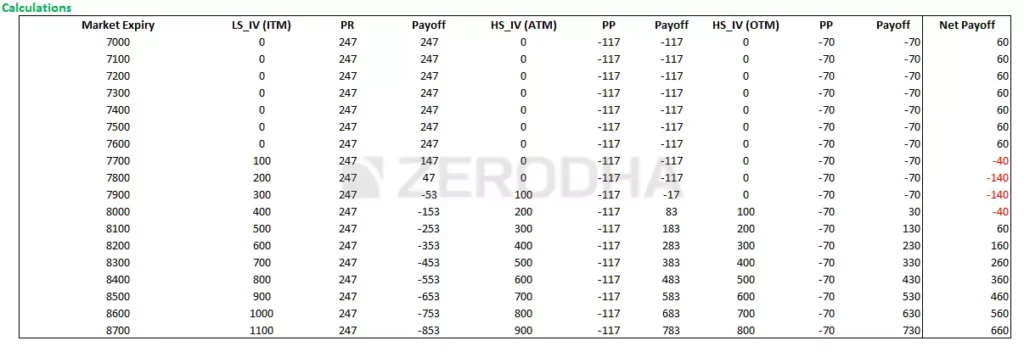

Step 2: Assume that the market will expire at each of the strike prices you have noted.

Step 3: Assuming the market expires as per the assumption in step 2, figure out how much money is lost by option writers (both call option and put option writers).

Step 4: Total the money that calls and put option writers have lost.

Step 5: Determine the strike at which option writers lose the least amount of money.

The point at which option buyers experience the most suffering is the level at which option writers lose the least amount of money. The market will therefore most likely end at this price.

Let’s use a very straightforward example to illustrate this. I’ll assume there are only 3 Nifty strikes available in the market for the purposes of this example. I have noted the open interest for the respective strike for both call and put options.

Situation 1: Assume that the market closes at 7700

Keep in mind that you will only lose money when writing a call option if the market rises above the strike. Similarly, you will only lose money when the market moves below the strike price when you write a put option.

Therefore, none of the call option writers will experience a loss if the market expires at 7700. Therefore, the premiums received by call option writers for the 7700, 7800, and 7900 strikes will be kept.

The writers of put options, however, will have difficulties. The 7900 PE writers will be discussed first.

7900 PE writers would lose 200 points at the 7700 expiries. OI being 2559375, the loss in rupees would be equal to –

= 200 * 2559375 = Rs.5,11,875,000/-

7800 PE writers would suffer a 100 loss.

= 100 * 4864125 = Rs.4,864,125,000/-

It won’t cost 7700 PE writers any money.

Therefore, if the markets expire at 7700, the total amount of money lost by option writers would be –

Call option writers’ total losses plus put option writers’ total losses

= 0 + Rs.511875000 + 4,864125000 = Rs.9,98,287,500/-

Remember that the total amount of money lost by call option writers equals the sum of the losses suffered by writers of 7700 CE, 7800 CE, and 7900 CE.

Similarly, the total amount of money lost by put option writers is equal to the sum of the losses of the writers of the 7700 PE, the 7800 PE, and the 7900 PE.

Scenario 2: Assume that the market closes at 7800.

The writers of the following call options would lose money at 7800:

Using its Open, 7700 CE writers would lose 100 points.

get the loss’s rupee value.

100*1823400 = Rs.1,82,340,000/-

Sellers of the 7800 CE and 7900 CE would both make money.

The seller of the 7700 and 7800 PE wouldn’t suffer a loss.

The loss in rupees would be equal to 100 points for the 7900 PE, multiplied by the open interest.

100*2559375 = Rs.2,55,937,500/-

Therefore, when the market expires at 7800, the total loss for option writers would be –

= 182340000 + 255937500

= Rs.4,38,277,500/-

Scenario 3 – Assume markets expire at 7900

At 7900, the following call option writers would lose money –

7700 CE writer would lose 200 points, the Rupee value of this loss would be –

200 *1823400 = Rs.3,646,800,000/-

7800 CE writer would lose 100 points, and the Rupee value of this loss would be –

100*3448575 = Rs.3,44,857,500/-

7900 CE writers would retain the premiums received.

Since market expires at 7900, all the put option writers would retain the premiums received.

So therefore the combined loss of option writers would be –

= 3646800000 + 344857500 = Rs. 7,095,375,000/-

So at this stage, we have calculated the total Rupee value loss for option writers at every possible expiry level. Let me tabulate the same for you –

get the loss’s rupee value.

100*1823400 = Rs.1,82,340,000/-

We can quickly determine the point at which the market is likely to expire now that we have determined the combined loss that option writers would sustain at various expiry levels.

According to the theory of option pain, the market will expire at a point where option sellers will experience the least amount of suffering (or loss).

The combined loss at this point (7800), which is significantly less than the combined loss at 7700 and 7900, is approximately 43.82 Crores, as can be seen from the table above.

That is all there is to the calculation. For the sake of simplicity, I’ve only used 3 strikes in the example.

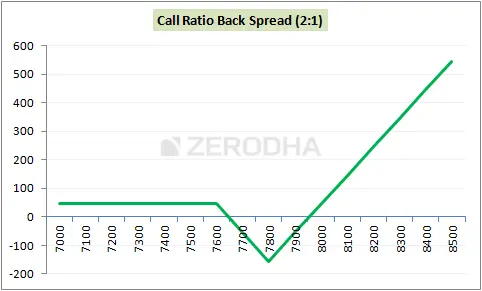

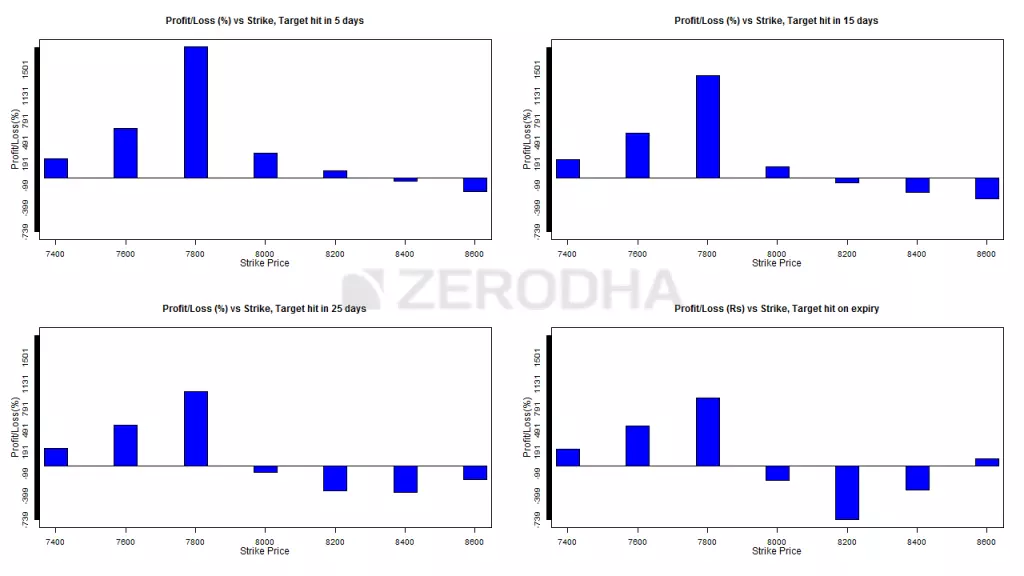

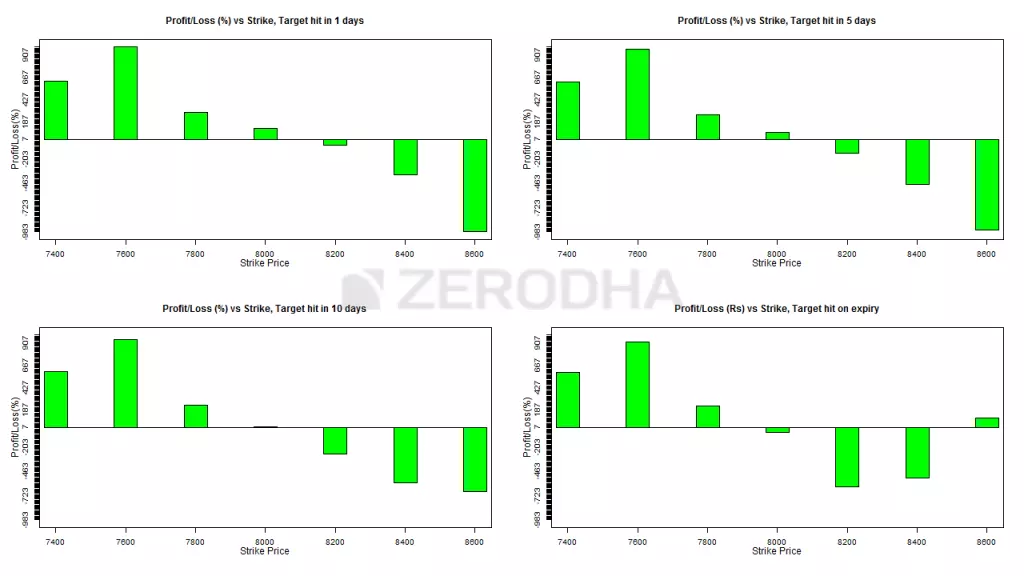

For all the available strikes, we assume the market would expire at that point and then compute the Rupee value of the loss for CE and PE option writers. This value is shown in the last column titled “Total Value”. Once you calculate the total value, you simply have to identify the point at which the least amount of money is lost by the option writer. You can identify this by plotting the ‘bar graph’ of the total value. The bar graph would look like this –

As you can see, the 7800 strike is where option writers would lose the least money, so in accordance with the theory of option pain, this is the strike where the market for the May series is most likely to expire.

How can you put this information to use now that you’ve determined the expiry level? Well, there are many applications for this knowledge.

The majority of traders identify the strikes they can write using this maximum pain level. Since 7800 is the anticipated expiration level in this scenario, one can choose to write call options above 7800 or put options below 7800 and keep all of the premiums.

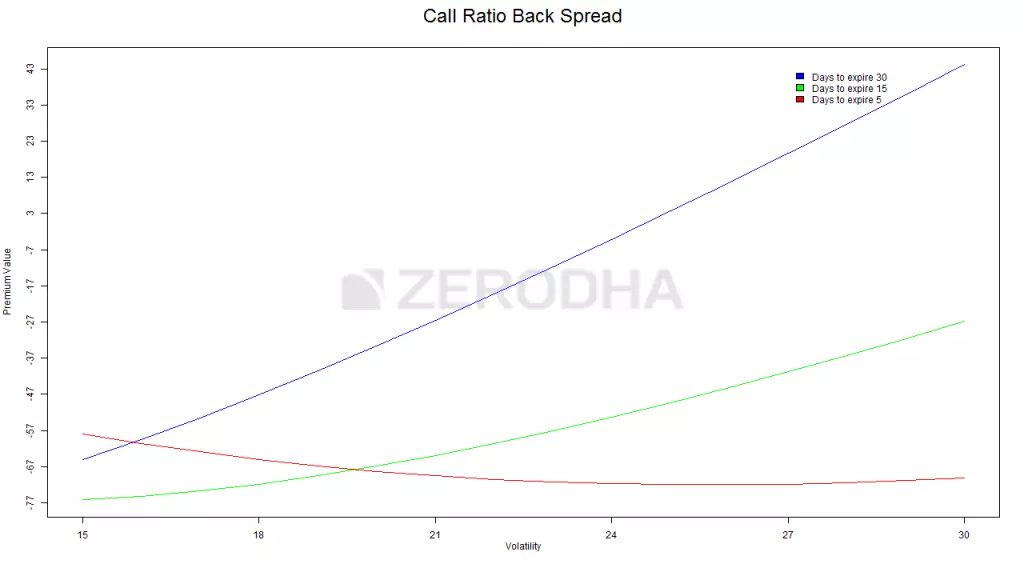

As a result, I eventually modified the traditional option pain theory to fit my risk tolerance. What I did was as follows:

Every day, the OI values change. As a result, the option pain may suggest 8000 as the expiry level on May 20 and 7800 as the expiry level on May 10. To perform this calculation, I froze on a specific day of the month. When there were 15 days left until expiration, I preferred to do this.

In accordance with the standard option pain method, I determined the expiry value.

I would include a “safety buffer” of 5%. The theory suggests 7800 as the expiry at 15 days, so I would then add a 5 percent safety buffer. As a result, the expiration value would be 7800 plus 5% of 7800.

The market could end anywhere between 7800 and 8200, in my opinion.

I would create strategies with this expiration range in mind, with writing call options beyond 8200 being my favourite.

Simply put,

I wouldn’t write a put option because panic spreads more quickly than greed. This implies that markets may decline before rising.

I would typically refrain from averaging during this time and instead hold the sold options until they expired.

13.5 – The Put Call Ratio

Calculating the Put Call Ratio is a fairly straightforward process. The ratio enables us to determine whether the market is extremely bullish or bearish. The PCR test is typically used as a contrarian indicator. In other words, if the PCR shows extreme bearishness, we expect the market to turn around, so the trader adopts a bullish stance. Likewise, traders anticipate a market reversal and decline if the PCR shows extreme bullishness.

Simply dividing the total open interest of Puts by the total open interest of Calls yields the PCR formula. The outcome typically ranges in and around one. Look at the illustration below:

As of 10th May, the total OI of both Calls and Puts has been calculated. Dividing the Put OI by Call OI gives us the PCR ratio –

37016925 / 42874200 =

0.863385

The following interpretation is correct:

If the PCR value is higher than 1, say 1.3, it means that more puts than calls are being purchased. This indicates that the markets have become very bearish and are thus somewhat oversold. Search for reversals and anticipate an increase in the markets.

Low PCR values, such as 0.5 and below, show that more calls than puts are being purchased. This indicates that the markets have become very bullish and are thus somewhat overbought. One can watch for reversals and anticipate a decline in the markets.

It is possible to attribute all values between 0.5 and 1 to normal trading activity, so they can all be disregarded.

This is obviously a general approach to PCR. It would be sensible to identify these extreme values by historically plotting the daily PCR values over, say, a period of one or two years. For instance, a value of 1.3 for the Nifty can signify extreme bearishness, whereas 1.2 for the Infy could mean the same thing. You must understand this, so backtesting is helpful.

Why PCR is used as a contrarian indicator may be a mystery to you. The reason for this is a little difficult to understand, but the general consensus is that if traders are bullish or bearish, then the majority of them have already taken their respective positions (hence a high/low PCR), and there aren’t many other players who can enter and move the positions in the desired direction. Therefore, when the position eventually squares off, the stock or index will move in the opposite direction.

That’s PCR for you, then. There are numerous variations of this that you may encounter. Some prefer to take volumes instead of OI, while others prefer to take the total traded value. But I don’t believe that overanalyzing PCR is necessary.

13.6 – Final thoughts

And with that, I’d like to conclude the 36 chapters and two modules long module on options!

In this module, we have covered nearly 15 different option strategies, which, in my opinion, is more than enough for retail traders to engage in profitable options trading. Yes, you will come across many fancy option strategies in the future; perhaps your friend will suggest one and demonstrate its technicalities but keep in mind that fancy does not necessarily equate to profitable. The best tactics can sometimes be straightforward, elegant, and straightforward to use.

The information we’ve provided in Modules 5 and 6 are written with the goal of providing you with a clear understanding of what options trading is.

What can be accomplished with options trading and what cannot? What is necessary and what is not have both been considered and discussed. Since these two modules cover the majority of your questions and concerns about options, they are more than enough.

So kindly read through the information provided here at your own pace, and I’m confident you’ll soon begin trading options the right way.

Last but not least, I sincerely hope you enjoy reading this as much as I did writing it for you.

Good luck and keep making money!

For Visit: Click here to know the Directions.