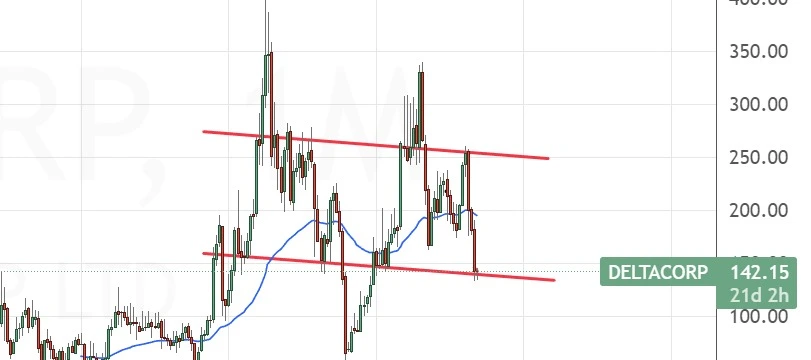

Do you play PUBG? or are you into the gaming industry? Don’t worry, It doesn’t matter if you play or not. However, learning more about technical and fundamental analysis is important if you want to earn in the stock Market. Let’s analyse Delta Corp NSE: 142.25 apiece.

Delta Corp has been in the news for its recent 28% imposed GST on its business. Since then the stock price fell from Rs 242 to 142 Today. Maybe it is time to take a look at this.

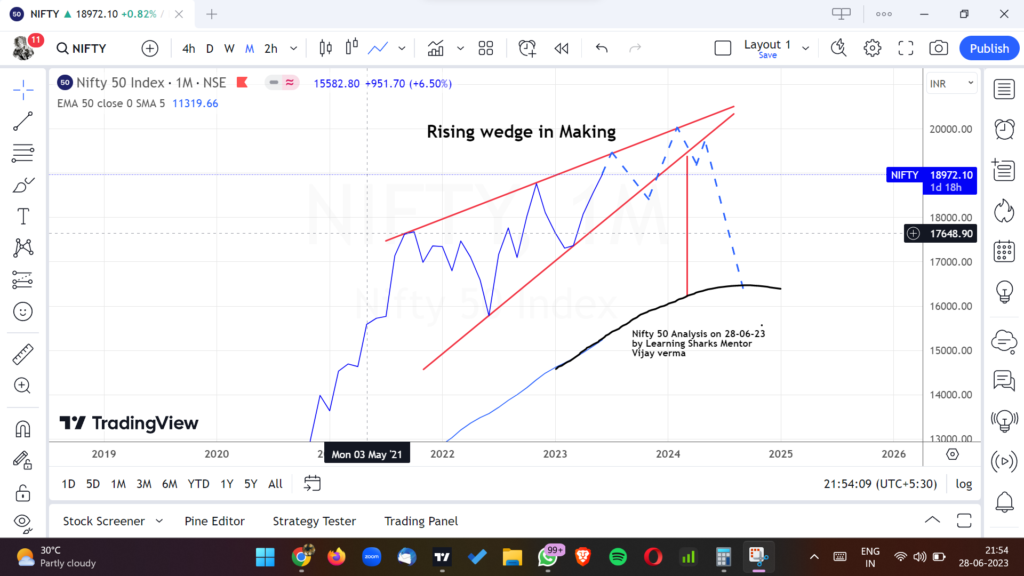

Considerably, the stock seems to be on its support right now, so we could see an upside from here. Few new positions can be made during this time as the company is doing well fundamentally.

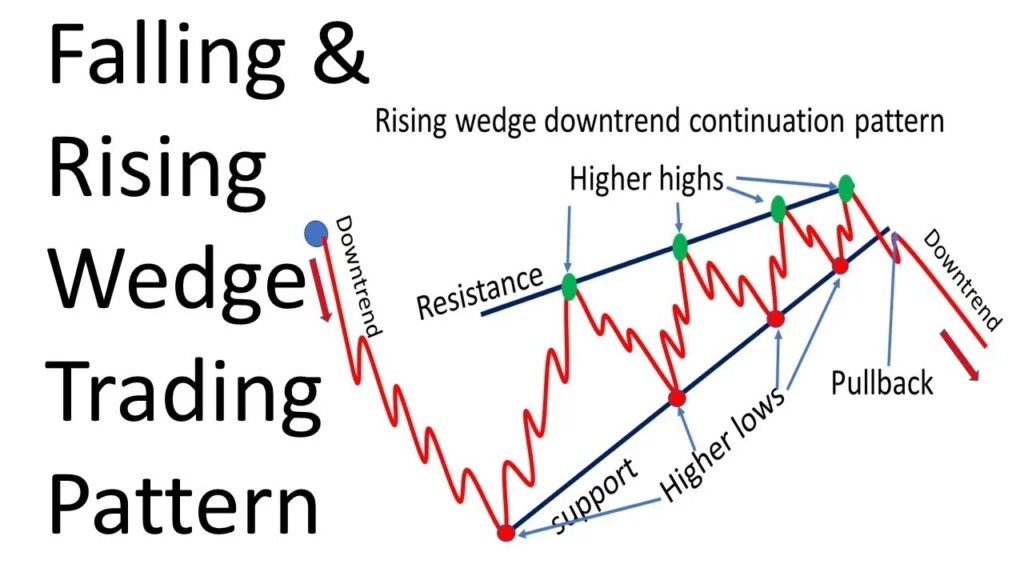

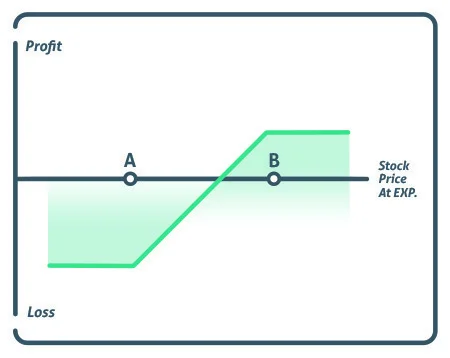

If you know a bit about breakout trading, or support and resistance,. You will find this stock trying to break its resistance in a smaller time frame.

As the stock is getting close to its resistance, It could break. Again, this is just for the educational purposes. If you wanna trade in a stock, you need to learn proper ways to make money.

Let’s look at the fundamentals of the Delta Corp

Profit & Loss

Consolidated Figures in Rs. Crores / View StandalonePRODUCT SEGMENTS

| Mar 2012 | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | TTM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales + | 365 | 425 | 559 | 300 | 375 | 455 | 608 | 798 | 773 | 419 | 616 | 1,021 | 1,043 |

| Expenses + | 264 | 330 | 408 | 233 | 244 | 293 | 360 | 482 | 486 | 397 | 477 | 654 | 685 |

| Operating Profit | 101 | 95 | 151 | 67 | 131 | 161 | 247 | 315 | 288 | 22 | 139 | 366 | 359 |

| OPM % | 28% | 22% | 27% | 22% | 35% | 36% | 41% | 40% | 37% | 5% | 23% | 36% | 34% |

| Other Income + | 13 | 13 | 16 | 2 | 2 | 9 | 29 | 35 | 33 | 27 | 30 | 46 | 55 |

| Interest | 11 | 15 | 33 | 51 | 41 | 35 | 10 | 2 | 16 | 14 | 16 | 24 | 10 |

| Depreciation | 6 | 8 | 17 | 35 | 36 | 36 | 37 | 38 | 49 | 53 | 56 | 59 | 60 |

| Profit before tax | 96 | 85 | 117 | -17 | 56 | 99 | 228 | 311 | 256 | -18 | 98 | 329 | 344 |

| Tax % | 30% | 40% | 44% | -64% | 36% | 28% | 32% | 37% | 28% | -42% | 30% | 20% | |

| Net Profit + | 67 | 49 | 64 | -28 | 36 | 71 | 155 | 196 | 185 | -26 | 68 | 262 | 273 |

| EPS in Rs | 2.24 | 1.29 | 1.55 | -0.99 | 1.66 | 3.18 | 5.81 | 7.26 | 6.85 | -0.90 | 2.51 | 9.77 | 10.17 |

Here is the list of courses, that you can go through here

#stockmarket #sharemarket #deltacorp