Long straddle

Basics of stock market

• Induction

• Bull call spread

• Bull put spread

• Call ratio Back Spread

• Bear call ladder

• Synthetic long & Arbitrage

• Bear put spread

• Bear call spread

• put ration back spread

• Long straddle

• Short straddle

• Max pain & PCR ratio

• Iron condor

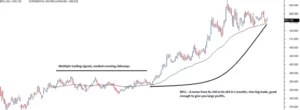

10.1 – The Directional dilemma

How often do you find yourself in a position where you decide to trade long or short after giving it a lot of thought, only to see the market move in the exact opposite direction shortly thereafter? Your entire plan, strategy, work, and resources are wasted. I’m positive that we have all been in a situation like this. In fact, this is one of the main reasons why most experienced traders adopt a variety of directional betting strategies that are resistant to the unpredictability of the market.

Market Neutral or Delta Neutral strategies are those whose profitability is largely independent of market direction. In the upcoming chapters, we’ll learn about some market-neutral tactics and how Such trading tactics can be used by everyday retail traders. Let’s start off with a “Long Straddle.”

10.2 – Long Straddle

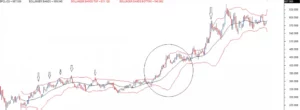

The simplest market-neutral strategy to use is probably the long straddle. The direction that the market moves has no bearing on the P&L once it has been implemented. The market must move, regardless of the direction, it moves in. A positive P&L is produced as long as the market is moving (regardless of the direction it is moving). All that is required to execute a long straddle is –

- Buy a Call option

- Buy a Put option

Ensure –

- Both the options belong to the same underlying

- Both the options belong to the same expiry

- Belong to the same strike

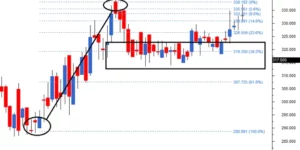

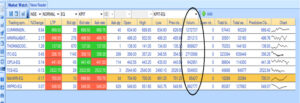

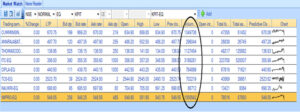

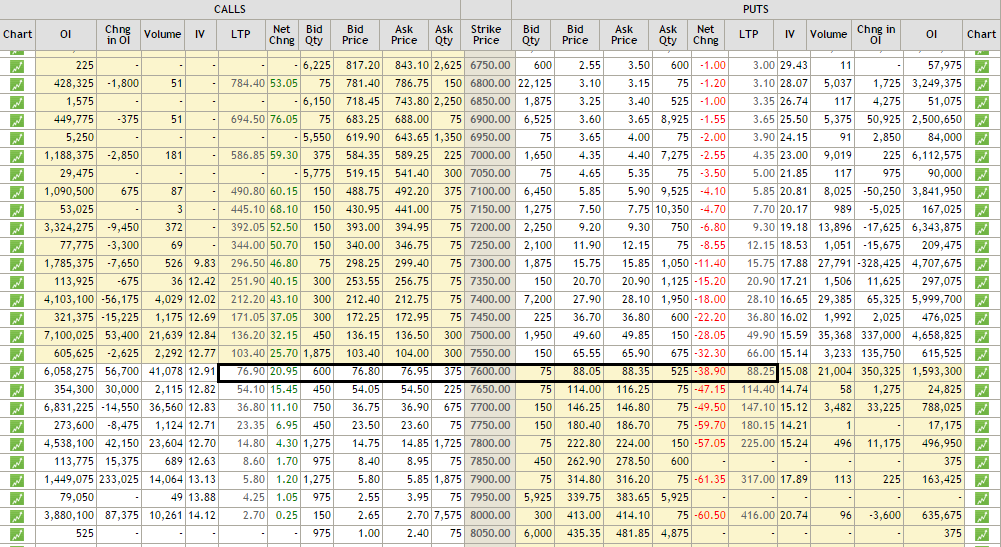

Here is an illustration of how to execute a long straddle and how the overall strategy performed. The market is currently trading at 7579, making the strike price of 7600 “At the money” as of the time of this writing. We would have to buy the ATM call and put options simultaneously if we wanted to long straddle.

Based on the scenarios discussed above, we can draw a few conclusions:

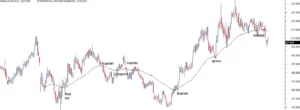

Technically speaking, this is a ladder and not a spread. The first two option legs, however, produce a traditional “spread” in which we sell ITM and buy ATM. It is possible to interpret the spread as the difference between ITM and ITM options. It would be 200 in this instance (7800 – 7600).

Net Credit equals Premium collected from ITM CE minus Premium paid to ATM and OTM CE

Spread (difference between the ITM and ITM options) – Net Credit equals the maximum loss.

When ATM and OTM Strike, Max Loss occurs.

When the market declines, the reward equals Net Credit.

Lower Strike plus Net Credit equals Lower break-even.

Upper Breakeven is equal to the sum of the long strike, short strike, and net premium.

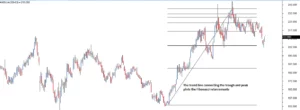

Take note of how the strategy loses money between 7660 and 8040 but ends up profiting greatly if the market rises above 8040. You still make a modest profit even if the market declines. However, if the market does not move at all, you will suffer greatly. Because of the Bear Call Ladder’s characteristics, I advise you to use it only when you are positive that the market will move in some way, regardless of the direction.

In my opinion, when the quarterly results are due, it is best to use stocks (rather than an index) to implement this strategy.

10.3 – Effect of Greeks

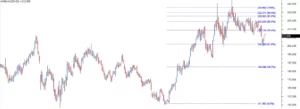

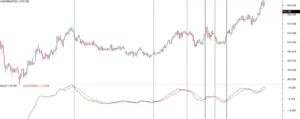

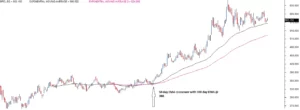

Volatility does play a significant role when using the straddle. If I said that volatility makes or breaks the straddle, I wouldn’t be exaggerating. Therefore, the success of the straddle depends on a fair assessment of volatility. View the graph below for more information.

The cost of the strategy is shown on the y-axis, which is just the sum of the option premiums, and volatility is shown on the x-axis. With 30, 15, and 5 days until expiration, the blue, green, and red lines show, respectively, how the premium rises as volatility rises. As you can see, this is a linear graph, and regardless of the time until expiration, the cost of the strategy rises as volatility does. In a similar vein, strategy costs drop as volatility does.

Look at the blue line; it indicates that setting up a long straddle will cost you 160 when volatility is 15%. Keep in mind that the price of a long straddle is equal to the total premium needed to purchase both call and put options. When volatility is 15%, setting up a long straddle costs Rs. 160; however, assuming all other factors remain the same, when volatility is 30%, setting up the same long straddle costs Rs. 340. So long as – you are likely to double your investment in the straddle.

You set up the long straddle at the start of the month

The volatility at the time of setting up the long straddle is relatively low

After you set up the long straddle, the volatility doubles

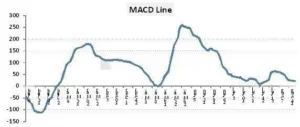

Similar observations can be drawn from the green and red lines, which show the price to volatility behavior at 15 and 5 days from expiration, respectively. This also means that if you execute the straddle when volatility is high and declines after you execute the long straddle, you will lose money. This is a very important thing to keep in mind. Let’s now quickly talk about the delta of the overall strategy. Since we are long on the ATM strike, both options’ deltas are close to 0.5.

The call option has a delta of + 0.5

The put option has a delta of – 0.5

The delta of the call option cancels out the delta of the put option, leaving a net delta of zero. Remember that delta displays the bias in the position’s direction. A bullish bias is indicated by a +ve delta, whereas a bearish bias is indicated by a -ve delta. Given this, a 0 delta means that there is absolutely no bias toward the market’s direction. Therefore, all strategies with zero deltas are referred to as “Delta Neutral,” and Delta Neutral strategies are protected from the direction of the market.

10.4 – What can go wrong with the straddle?

On the surface, a long straddle appears fantastic. Consider the fact that you stand to gain financially regardless of how the market performs. All you require is an accurate estimation of volatility. So what could possibly go wrong with a straddle? Well, two things stand in the way of your ability to profit from a long straddle.

Theta Decay – In the absence of other factors, options are depreciating assets, which is especially detrimental to long positions. The time value of the option decreases as expiration draws nearer. Holding onto out-of-the-money or in-the-money options into the final week before expiration will result in rapid premium loss because time decay accelerates exponentially during this period.

Remember that the break-even points in the earlier example we discussed were 165 points away from the ATM strike. Taking into account the ATM strike at 7600, the lower breakeven point was 7435 and the upper breakeven point was 7765. To achieve breakeven, the market must move 2.2 percent (either way) in percentage terms. This means that for you to start profiting from the time you start the straddle, the market or the stock must move at least 2.2 percent in either direction. and this transfer must be completed in no more than 30 days. Furthermore, a move of 1 percent over and above 2.2 percent on the index is required if you want to make a profit of at least 1 percent on this trade. A significant change in the index

We can sum up what really needs to go in your favor for the straddle to be profitable by keeping the previous two points plus the effect on volatility in perspective.

When applying the strategy, the volatility ought to be quite low.

During the strategy’s holding period, the volatility should rise.

The market should move significantly; it makes no difference in which way it moves.

The anticipated large move is time-bound and ought to occur quickly – well before the expiration

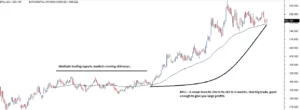

My trading long straddles have taught me that they are profitable when placed around significant market events, and the impact of such events should be greater than what the market anticipates. Please read the following paragraphs carefully as I will go into more detail about the “event and expectation” part. Consider the Infosys outcomes as an illustration.

Event – Quarterly results of Infosys

Expectation – ‘Muted to flat’ revenue guideline for the coming few quarters.

Actual Results: Infosys announced a “muted to flat” revenue guideline for the upcoming quarters, as was predicted. A long straddle would probably collapse if it were set up against the backdrop of such an event (and its expectation), and eventually, the expectation would be met. This is due to the fact that volatility tends to rise around significant events, which tends to raise premiums.

In other words, if you buy ATM calls and put options close to an event, you are essentially buying options at a time of high volatility. When events are made public and the result is known, the volatility and consequently the premiums fall like a stone. Due to the “bought at high volatility and sold at low volatility” phenomenon, this naturally breaks the straddle down, causing the trader to lose money. I frequently see this happening, and regrettably, I’ve seen plenty of traders lose money precisely because of it.

Favorable Outcome – Now imagine that they announce an “aggressive” guideline in place of the “muted to flat” guideline. This would essentially catch the market off guard and raise premiums significantly, making for a successful straddle trade. This indicates that there is a different perspective to consider: you should evaluate the outcome of the event a little more favorably than the market as a whole.

A straddle cannot be set up with a subpar evaluation of the events and their result. This may seem like a challenging proposition, but trust me when I say that a few good years of trading experience will actually enable you to assess situations far more accurately than the market as a whole. In order to be clear, I’d like to reiterate all the angles that must line up for the straddle to be profitable:

The volatility should be relatively low at the time of strategy execution

The volatility should increase during the holding period of the strategy

The market should make a large move – the direction of the move does not matter

The expected large move is time-bound and should happen quickly – well within the expiry

Long straddles are to be set around major events, and the outcome of these events is to be drastically different from the general market expectation.

For Visit: Click here to know the directions.