Introduction

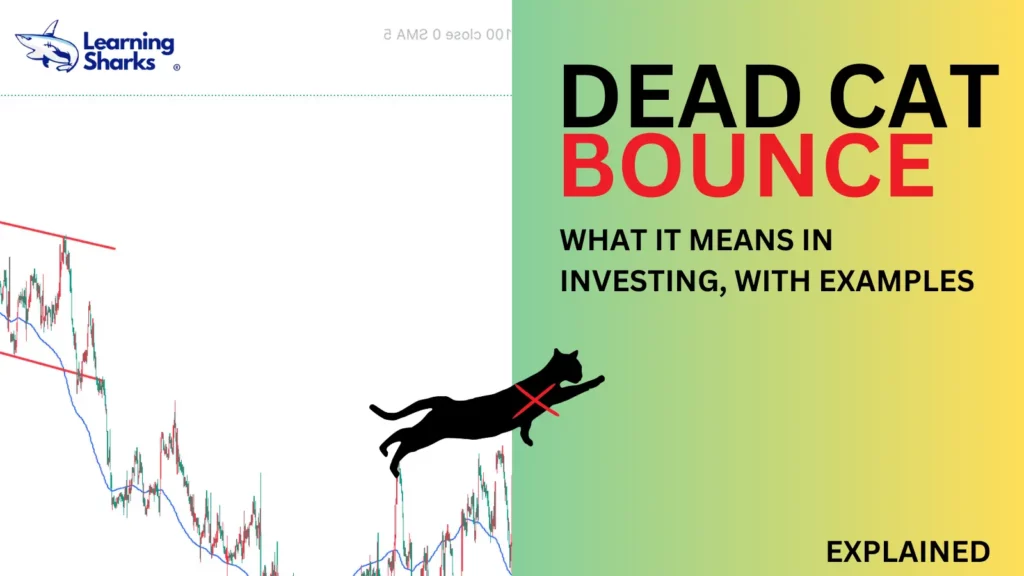

Risk management is critical in the stock market. The stock market is a naturally volatile environment in which risks can arise from a variety of sources, including market trends, economic conditions, company performance, and geopolitical events. As a result, investors must have a well-defined risk management strategy in place to help them mitigate potential losses and maximize returns.

Investors can make informed investment decisions and reduce the impact of market fluctuations on their portfolios by implementing risk management techniques. In this context, the purpose of this essay is to investigate the concept of risk management in the stock market, its significance, and the various strategies that investors can employ to effectively manage risk.

Understanding Risk in the Stock Market

Defining Risk

In the context of the stock market, risk refers to the possibility of loss or fluctuation in investment value. It is influenced by a variety of factors, including market volatility, economic conditions, company-specific events, and geopolitical influences. As an investor, you must recognize and assess these risks in order to protect your capital and maximize your returns.

Types of Risks in Stock Market Investing

- Market Risk: Market risk is caused by macroeconomic factors such as interest rates, inflation, and market conditions in general. It affects all securities and is impossible to completely eliminate. Diversification and asset allocation, on the other hand, can help to mitigate its impact.

- Company-Specific Risk: This type of risk is related to specific businesses and their operational, financial, or management issues. Poor earnings, legal disputes, or changes in leadership can all have a significant impact on a company’s stock price.

- Liquidity Risk: Liquidity risk refers to the difficulty of buying or selling shares without causing significant price changes. Liquidity risk is higher in stocks with low trading volumes and few market participants.

- Regulatory Risk: Changes in regulations or shifts in government policies can have a significant impact on stock prices. Investors must keep up to date on regulatory developments that may affect their investments.

- Currency Risk: Currency risk occurs when investing in foreign markets because fluctuations in exchange rates can affect investment returns. When considering international investments, it is critical to assess currency risk.

Key Strategies for Effective Risk Management

1. Diversify Your Portfolio

Diversification is a fundamental risk-management strategy that entails spreading investments across various asset classes, industries, and geographical regions. You can reduce the impact of individual stock or sector-specific risks by diversifying your portfolio. It is recommended that you diversify your investments across stocks, bonds, commodities, and other asset classes based on your risk tolerance and investment objectives.

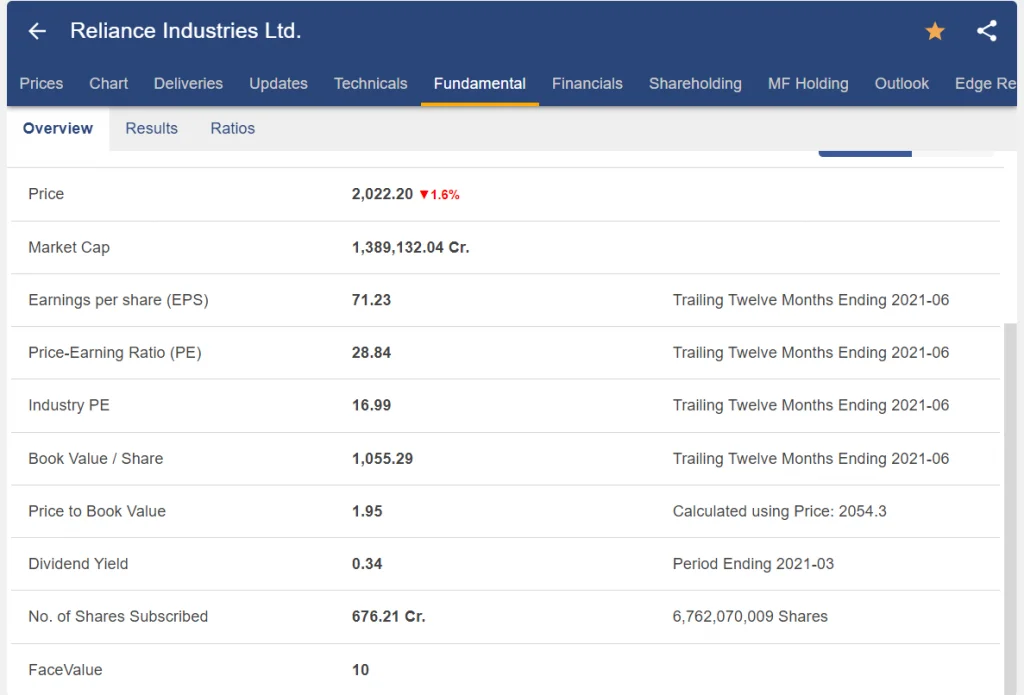

2. Conduct Thorough Research

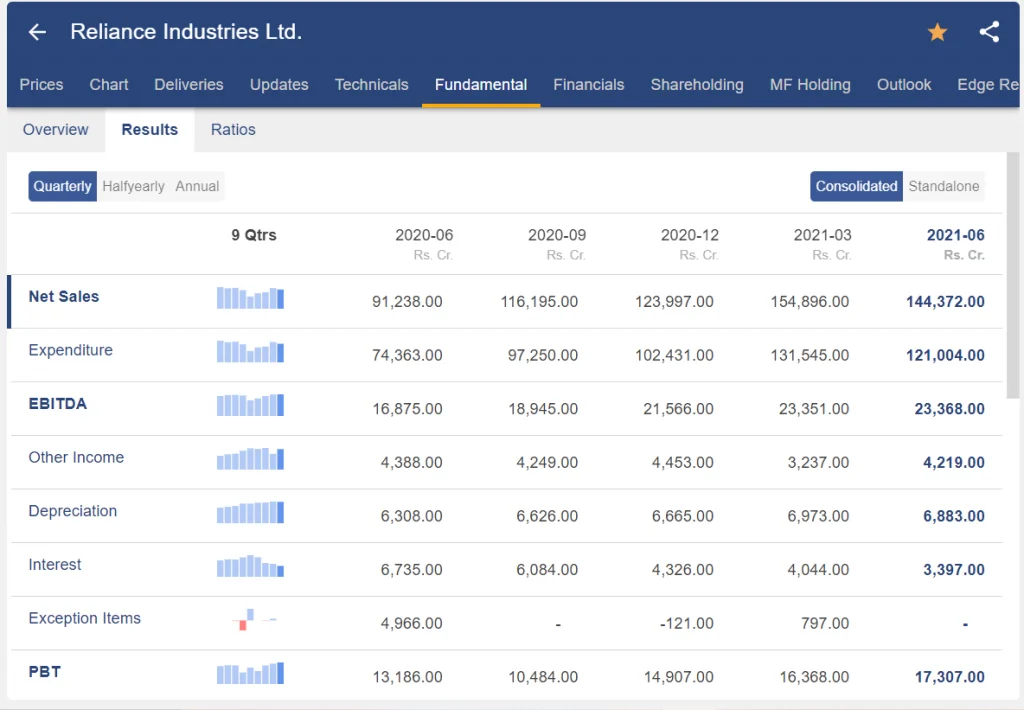

In the stock market, knowledge is power. Conduct extensive research on companies, industries, and market trends before investing. Financial statements, annual reports, news articles, and analyst opinions can all be used to gain insight into the potential risks and rewards of various investments. This information will help you make better decisions and reduce risks.

3. Set Realistic Financial Goals

Setting clear financial objectives is critical for effective risk management. Define your investment goals, time horizons, and risk tolerance. Setting realistic goals allows you to align your investment strategy and avoid unnecessary risks. Review and update your goals on a regular basis to account for changes in your financial situation and market conditions.

4. Implement Stop Loss Orders

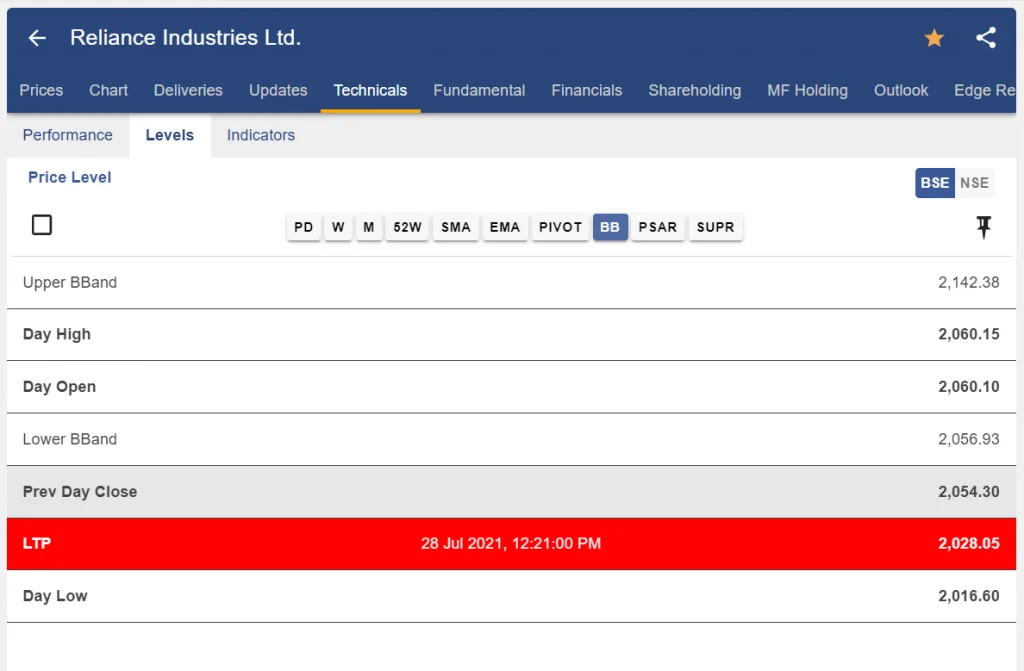

Stop loss orders are effective risk management tools that sell a stock automatically if it reaches a predetermined price. They assist in limiting potential losses by executing trades when the market moves against you. Stop loss orders can give you peace of mind and protect your investments during market volatility.

5. Stay Informed and Adapt

The stock market is volatile, and staying up to date on market developments is critical. Subscribing to reputable financial news sources, following industry experts, and monitoring economic indicators are all good places to start. Furthermore, remain flexible in the face of changing market conditions and adjust your investment strategy accordingly. This proactive approach will allow you to detect and respond to potential risks in real time.

How Does Risk Management Work?

Risk management involves identifying potential risks, assessing their likelihood and potential impact, and implementing risk-mitigation or risk-aversion strategies.

Several steps are usually involved in the risk management process:

- Risk Identification: The first step in risk management is identifying potential risks to the investment portfolio. This can be accomplished through a variety of methods, including historical data analysis, market research, and expert opinions.

- Risk Assessment: After identifying potential risks, they are evaluated based on their likelihood of occurrence and potential impact on the investment portfolio. This step entails determining the severity of the risk and the likelihood of its occurrence.

- Risk Evaluation: Once the risks have been assessed, they are ranked in order of priority and importance. This step entails determining which risks are the most critical and must be addressed immediately.

- Risk Treatment: The final step in the risk management process is to put in place strategies to mitigate or avoid the risks that have been identified. Diversification, hedging, and active portfolio management are all methods for accomplishing this.

Conclusion

Finally, risk management is an important aspect of stock market investing. Because the stock market is inherently volatile and rife with risks, implementing a well-defined risk management strategy is critical for mitigating potential losses and maximizing returns. The importance of risk management in the stock market cannot be overstated, as it allows investors to navigate the market’s complexities and achieve their investment goals while maintaining some control over their portfolios. Investors can maximize their returns and achieve long-term financial success by prioritizing risk management in their investment strategy.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en