Research analysts are professionals who conduct research and provide analysis on various securities, such as stocks, bonds, and commodities, to help inform investment decisions. They gather information on market trends, economic conditions, and company-specific data to analyze the potential performance of different securities.

Research analysts may work for investment banks, brokerage firms, mutual funds, or hedge funds, and their findings and recommendations may be used by traders, portfolio managers, and individual investors to make informed investment decisions.

The role of research analysts may involve creating financial models, analyzing financial statements, and conducting market and industry research. They may also be responsible for creating reports and presentations to communicate their findings and recommendations to clients and colleagues.

Overall, the goal of a research analyst is to provide insights and analysis that help investors make informed decisions, maximize returns, and minimize risk.

How much do research analysts get paid in India?

The salary of a research analyst in India can vary greatly depending on several factors, such as the type of employer, years of experience, and location. On average, starting salaries for entry-level research analysts in India can range from INR 2-5 lakhs per annum, while experienced research analysts can earn upwards of INR 8-15 lakhs per annum or more.

However, it’s important to keep in mind that salaries can vary greatly based on the specific industry and type of employer. For example, research analysts working for large investment banks or multinational financial institutions may earn significantly higher salaries than those working for smaller firms or startups.

Additionally, salaries can also vary depending on the specific sector being analyzed, with research analysts specializing in sectors such as technology, pharmaceuticals, or energy likely to command higher salaries than those focusing on other industries.

Ultimately, the salary of a research analyst in India will depend on a number of individual factors, including education, experience, and performance.

Is a research analyst better than a fundamental analyst?

Whether being a research analyst or a fundamental analyst is “better” is subjective and depends on personal preference and career goals. Both roles involve conducting research and providing analysis to inform investment decisions, but they approach the task in different ways.

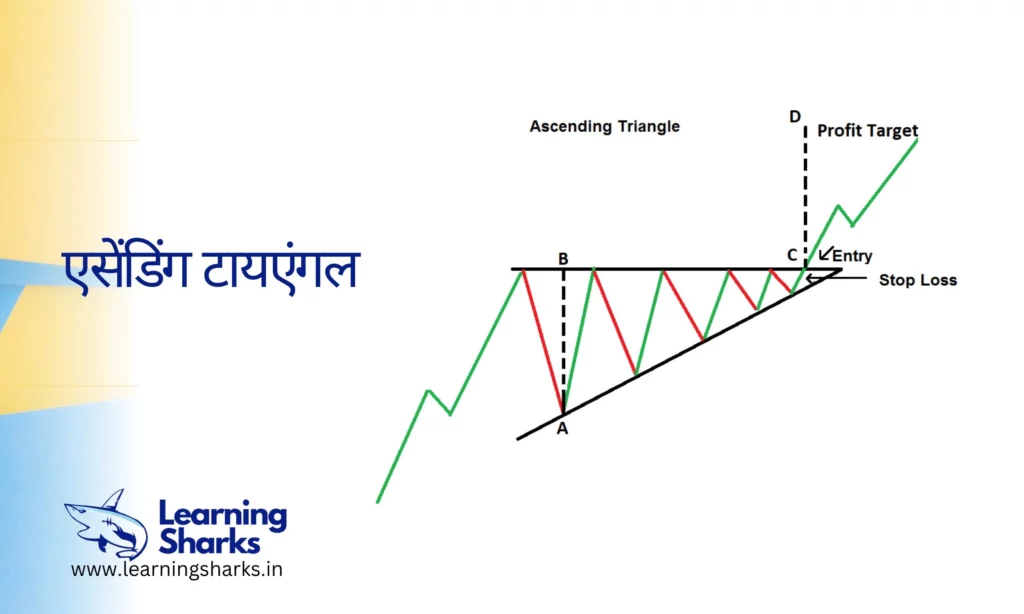

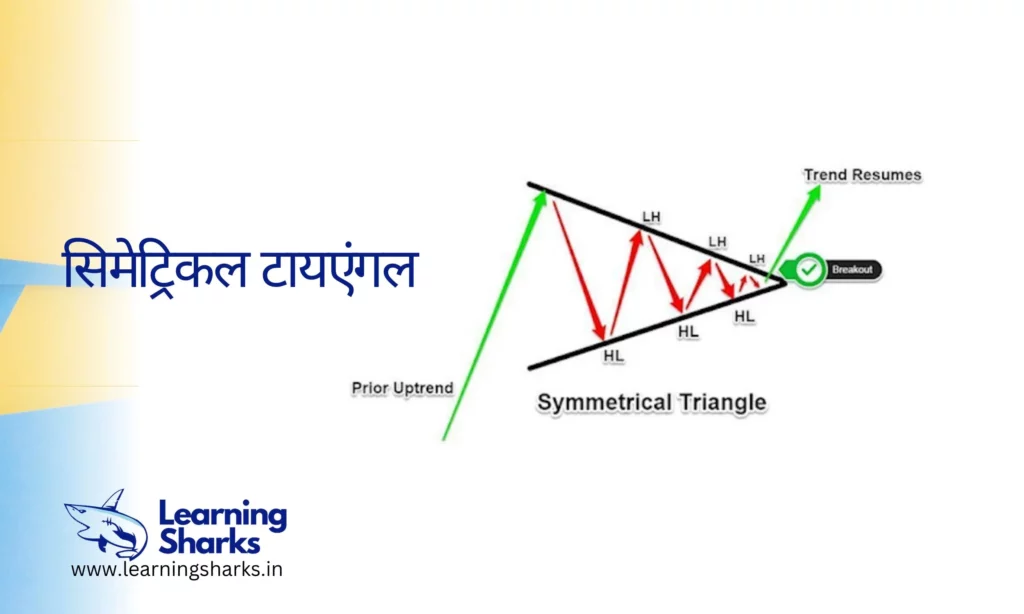

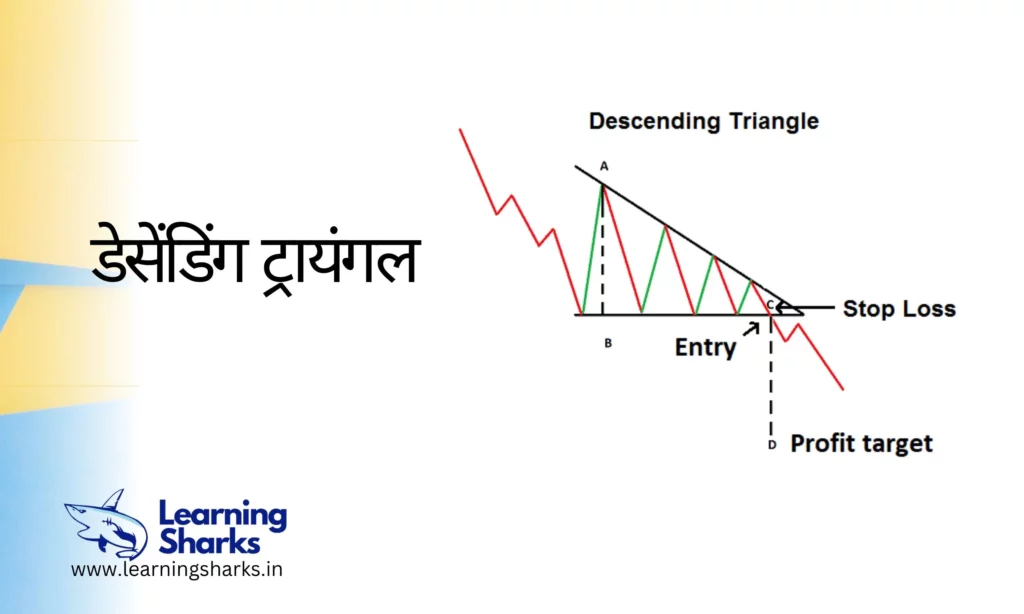

Research analysts generally use technical analysis to study market trends and chart patterns to predict potential price movements, while fundamental analysts focus on analyzing the financial health and performance of a company. Fundamental analysts review financial statements, management performance, and other factors to determine the intrinsic value of a security and make buy or sell recommendations based on that analysis.

Both research and fundamental analysis can provide valuable insights for informed investment decisions, and each approach has its own strengths and weaknesses. Some investors prefer the more quantitative, data-driven approach of research analysis, while others prefer the more qualitative, company-focused approach of fundamental analysis.

Ultimately, the choice between a career as a research analyst or a fundamental analyst will depend on individual interests, skills, and career goals. Some professionals may choose to specialize in one type of analysis, while others may use a combination of both approaches.

To apply for the research analyst job, click here. To know more about the research analyst exam click here