TOP 7 MISTAKE NEW TRADER MAKE

WHO ARE THE TRADER?

Trader is someone who basically do trading for there financial growth.Trader can buy and sell their positions Within the trading Hours and the word coming from the trading, Trading means where trader buy and sell there assets,for there own financial growth this finomina is known as trading.Overall we all know that before investing money there are some risk.So from this blog you will be able to understand what are the “TOP 7 MISTAKE NEW TRADER MAKE” with a brief explanation in this topic you will be able to understand some risks which new trader make and we will also discuss about how to overcome from this risk.

Why People Chose Trading?

There are many ways to make money in the stock market, such as trading,investing in stocks, and mutual funds. The best way to make money in the stock market is through long-term investment in stocks, as this carries a lower risk compared to other methods and can provide great returns over time. Many people enter the stock market without knowledge, thinking they will become rich overnight, but end up losing money instead. There are many other ways, like trading, that we’ve talked about before In the stock market, there are many types of trading, such as intraday trading, swing trading, options trading, and futures trading. For people who have knowledge of the stock market and want to earn money quickly, they can choose trading.

Type Of Trading

SWING TRADING: Swing trading means where trader sell there assets as Soon as possible they can sell there assets within one day or one month but last for one month.

INTRADAY-TRADING: Intraday trading means in which trader sell there Trade throughtout the day or we can say within a one day this is known as Intraday trading.

SCALP-TRADING: Scalp trading means where trader have to sell or buy There security with in a minute or a second this is known as scalp trading.

Some top 7 mistakes are:

*Pay no attention to risk managemnet

* Shortfall of knowledge

* Underestimating risk

* Rash trading

* Ignoring to conduct reserach.

* Dosen’t make plan for trading.Therefore there are some risk which new trader should avoide.But new trader should be aware about some precaution that we can avoide these mistake.Some precatuion’s are:

* Develope through mistake.

* Fousing on trade log.

Pay no attention to risk management

Pay no attention to risk management means trader before investing money in trading usually underestimate the risk which maybe occur in future therefore “always pay attention to risk management.” Trader should be able to understand the stratagies for trading . They have

to follow the guidence of some experties to be more strong in trade market. Here are some ways to uvercome from risk mangement :

- Make Plan: Always make best plan or stratgies to for your growth .

- Continuously educate yourself: Be updated be conceted to the stock market news to reduce your risk management you may also join some classes for better knowldge in trading like you can join LEARNING SHARKS as well as SMTA also.

- Always Be Discipline: Always be discipline means stick to your plan

which you make for trading so it will help you to reduce mistake which may be you do in trading .

what is Over trading

Overtrading is a term that use when we are driven by our emotions and do trades frequently it is called over trading this mistake mostely done by new traders who enter in stock market with expectation to make profit faste it a mistake that every trader done at some point in life. Overtrading can cause a significant amount of money lost if it is not stopped in time .In process of trading every trade cuts some amount of fees for trading platform or trading brokers it become big lose if we do some unnecessary Trading Overtrading has more possibilities that you get lost more money because you spend more time in stock market trade . overtrading is directly linke to emotional trading.

what is emotional trading?

As we talk about in the upper paragraph “new traders who enter in the stock market with the expectation to make profit fast” Emotional trading is a term that is used when a trader gets a trade based on emotions like- fear, greed, and excitement This type of trading has no strategy to follow, no chart analysis. Most traders’ intention in entering the stock market trading or stock market is to earn money quickly.That is why most of the time new traders get into overtrading in overtrading trading people buy a stock that has more price fluctuation this stock is called “penny stock” In this stock you need to buy and sell frequently and their price fluctuates evry point so you need to buys and sell multipal time according to price and it not suitable for new traders who enter the market recently

Shortfall of knowledge

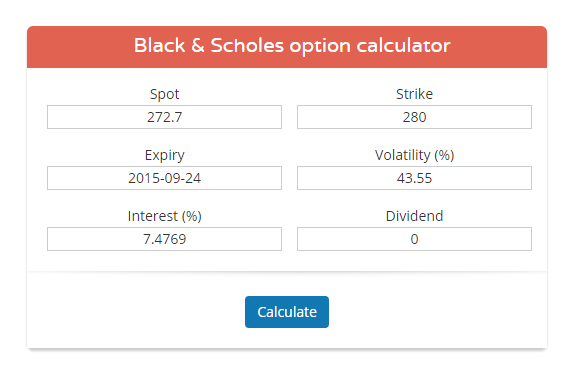

Some new traders often enter the market without prior knowledge or experience, leading many to view trading as gambling. This mindset can result in poor decision-making, and without proper risk management, they can incur significant losses. Risk management is crucial in trading you need to know how much is your capacity to face loose in one trade. You need to make sure you set stop-loss before trade start.

SOME PRECAUTIONS ON TRADING

Develope through mistake:

So our first question is raised in our mind that how we can over come from our mistake.LEARNING FROM OUR MISTAKE is key to being a good trader in market. So here our some points that how we can develope through mistakes. BEING EDUCATED: Being educated means before start trading we should know about what is stock market, what is trading ,what is going on in trading market and being updated about market. There are some way how you can be educated some of them are:

- always read newspaper to being updated what are the crruent news regarding trading.

- always set goal like what would be your next step in trading.

- always keep eye on trading market.

- BE CLAM: Be clam means when the new trader start trading very first time they should always be clam for better understanding about the trading. There are some reason why you have to clam your mind while trading.

- Always be ready to face loss in trading becuse as a new trader there are some chances that you have to face loss so that time you have to handle this very clamly.

- Always make plan with a peace mind , with calm mind this helps you to make great straggies for trading.

- Do not be overconfident when you gain some profits in trading you should be clam and follow your next straggies. DO NOT THINK NEGITIVE: Do not think negivite means not always focus on your financial growth, keep start learning from your mistake to grow in Trading.

Fousing on trade log:

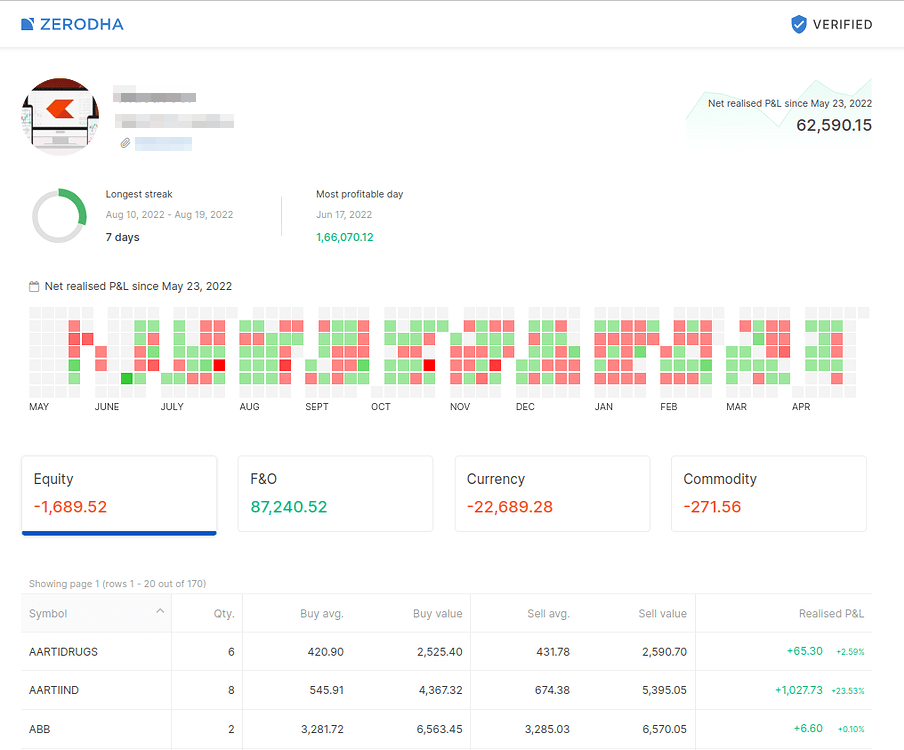

Trade log is important as it record all important recodes regading trading time it hepls to make better strategies for better growth in trading it analyze your all data of trading trade log also guide you how you can overcome from your mistake. It also helps you for tax purpose as it has clear history of your trading. Here are some key points of trade log : Analyze your recode: Analyze your record means trader can track there profit and loss in trading. Learning from mistake: Learning from mistake means they can preview there mistake from trade log so that they can not repeat there mistake. Regurality in trading: Regurality in trading means trader should be regular in trading to make profit in trading.

..What strategy is used before trading?

..Let’s talk about strategy. What is Strategy?

..Strategy is a plan or method for achieving a goal or result. so you need to know what is your goal ..before planning a strategy there are many

types of trading

- Position Trading

- Swing Trading

- Day Trading

- Price Action Trading

- Algorithmic Trading

- News Trading

- Trend Trading

- Range Trading

Based on your goal you can make plans

ex: for position trading in position trading you need to check a few points

.Support and resistance

.breakout

.pullback

.Seek guidence or assitance: Seek guidence and assitance means you should follow the tips of suppoter and mentor as well. There are some key points how the mentor’s can help us or guide us they are:

- Sharing there experience: As a mentor they have great knowldge of trading as they do as much trading in there time so by sharing there experience new trader be able to do better in there trading.

- Education: The book which is suggested by the mentors are the best guidence for new trader because mentor give the best book as per there knowldge.