What Is The Stock Market? How Does It Work?

By selling shares of stock, the stock market assists businesses in raising money to support their operations and builds and maintains wealth for individual investors.

Companies offer ownership holdings to investors in order to raise capital on the stock market. Shares of stock are the name for these equity investments. Companies can get the money they need to run and grow their operations without taking on debt by listing shares for sale on the stock exchanges that make up the stock market.

By swapping their funds for shares on the stock market, investors gain. Investors profit as a result of corporations using that money to invest in developing and expanding their operations as the value of their stock increases over time, resulting in capital gains. As their revenues increase, businesses also distribute dividends to their shareholders.

Individual stock performance over time varies greatly, but the stock market as a whole has historically provided investors with average annual returns of close to 10%, making it one of the most dependable ways to increase your money.

Stock Market vs Stock Exchange

The stock market and stock exchange are not the same things, even though the phrases are sometimes used interchangeably. Consider a stock market as a whole rather than as a collection of individual stock exchanges, such as the Nasdaq or New York Stock Exchange (NYSE) in the United States.

When individuals discuss the stock market’s performance, they are referring to the hundreds of publicly traded companies that are listed on various stock exchanges. Additionally, the stock market can be conceived of as covering a very wide range of securities other than just stocks, including bonds, mutual funds, exchange-traded funds (ETFs), and other types of securities.

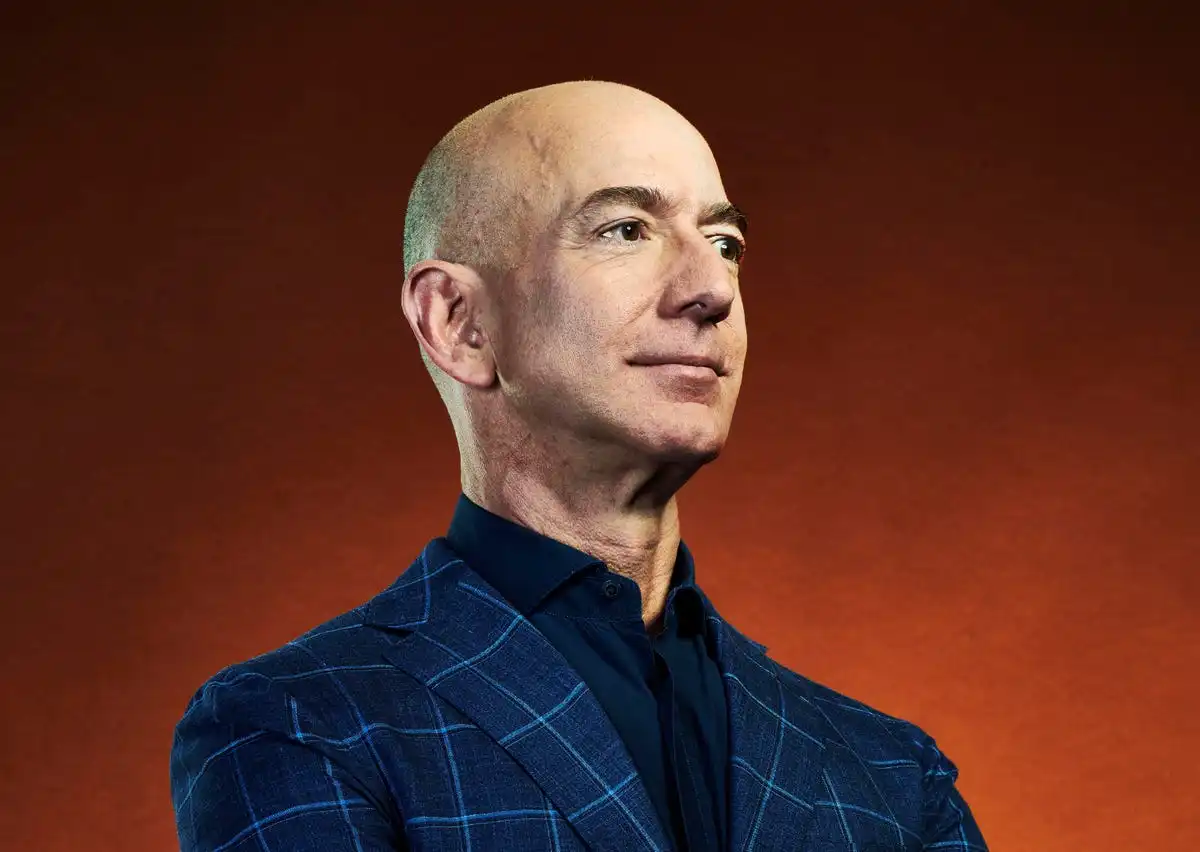

Image credit - Finlearn Academy

What Is a Stock Market Index?

A hypothetical portfolio of investment holdings known as a market index is used to represent a certain area of the financial market. The prices of the underlying holdings are used to calculate the index value. Some indices are valued according to market capitalization, revenue, float, and fundamental weighting. The unique influence of each item in an index can be modified through the use of weighting.

Other Types of Markets

The stock market generally refers to markets and exchanges where equity shares and related securities are traded. Other types of financial assets have their own markets.

- Over-the-Counter (OTC) Markets. OTC describes securities trading that takes place outside of major stock exchanges. OTC trades are primarily made directly between sellers and buyers, and prices may or may not be publicly available. Most bonds are traded OTC, and many stocks—including penny stocks—are also traded over-the-counter

- Commodities Markets. Raw materials like steel, coal and oil are traded on commodities markets. There are around 50 major commodity markets worldwide that facilitate trade in a wide range of commodities.

- Derivatives. Derivatives are financial contracts like options whose value is tied to an underlying asset. These are essentially contractual bets about whether individual securities’ values will rise or fall. For experienced investors, derivatives can be extremely lucrative ways to hedge their bets when investing, and they can be incredibly risky for beginners.

- Foreign Exchange Markets. Forex trading is a borderless, international market for exchanging currencies. Forex traders take advantage of the constantly fluctuating value of different currencies to make profits, and help provide liquidity for international trade.

- Cryptocurrency. Bitcoin, Ethereum and other cryptocurrencies are traded on specialized crypto exchanges.

How to Invest in the Stock Market

The method to get started if you wish to invest in the stock market is simpler than you would think:

Choose the account type that you want to open. There is truly an investment account for everything, from retirement savings to college savings, from short-term goals to long-term.

- Decide what kind of account you want to open. From retirement savings to college savings, from short-term goals to long, there really is an investment account for everything.

- Open a brokerage account. Once you’ve decided what kind of account you want, you’re ready to open an account at a provider called a brokerage. When choosing a company, consider their fees and available investment options.

- Deposit money. To get started, you need to make an initial deposit. You can also set up recurring deposits to automate your investments going forward.

- Choose your investments. Once your account is open, you can buy and sell securities. You can opt for individual stocks and bonds or mutual funds, index funds and exchange-traded funds (ETFs) that contain hundreds of individual securities. Many experts recommend a diversified, fund-based approach to minimize the risk any one bad investment loses you money.

- Purchase your investments. Once you’ve settled on what you want to buy, simply enter the ticker symbol in the buy field and indicate how many shares you want to buy.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-01-c68c49b8f38741a6b909ecc71e41f6eb.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-02-59df8834491946bcb9588197942fabb6.jpg)

:max_bytes(150000):strip_icc():format(webp)/amd-14c0b5c720dd442890bfa294e34f9fe7.png)

:max_bytes(150000):strip_icc():format(webp)/figure-2-ascending-triangle-58222d4a5f9b581c0b82a562.jpg)

:max_bytes(150000):strip_icc():format(webp)/figure-3.-descending-triangle-58222fcb3df78cc2e85eb8a5.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-04-9b163938fd4245b0a9cb34d1d0100136.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-a19b59070c434400988fca7fa83898dd.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-06-3848998d3a324c7cacb745d34f48f9cd.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Double_Top_Definition_Oct_2020-01-b7e6095a764243cc9f79fdaf1214a7b6-454914f6f2b84ed59d960e31fc3cd07b.jpeg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-07-ab3993632d064e9bb4f29a6a9e734db5.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-08-45a332df392d4466afa20fbdf74c79c4.jpg)