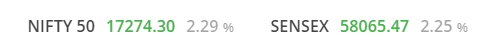

The Delhivery share price has been continuously falling in the last few trading sessions. while the company has been doing fine with the sales yet the numbers in the backend are quite skeptical. As of today, the price has been corrected from 707 All time high to 383 CMP.

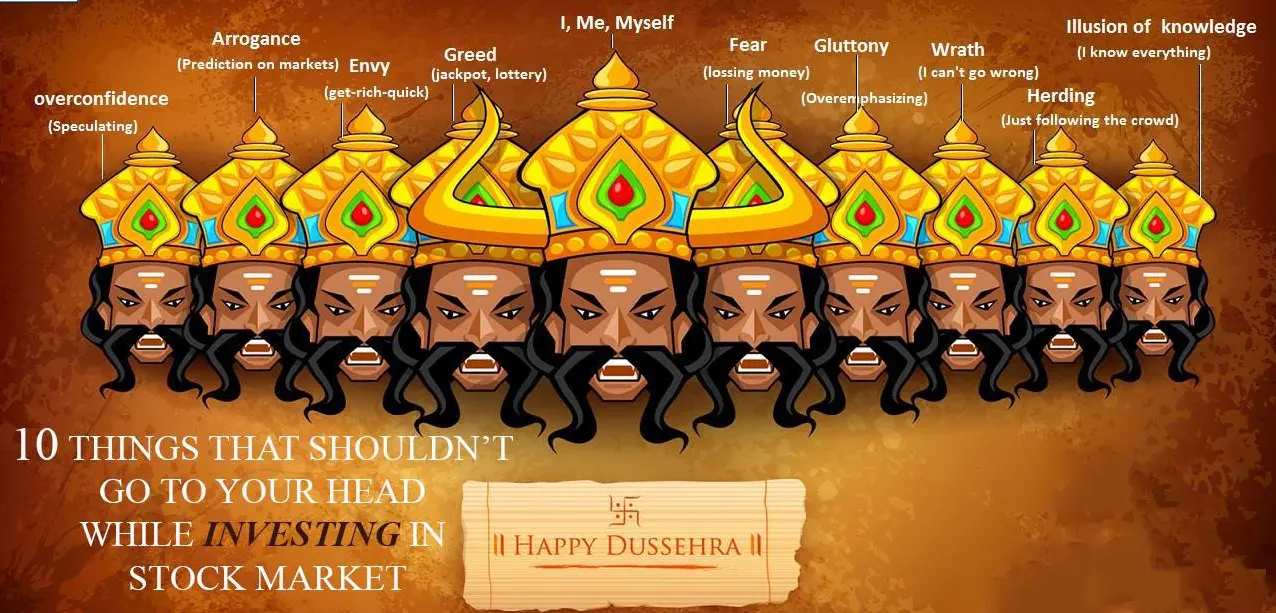

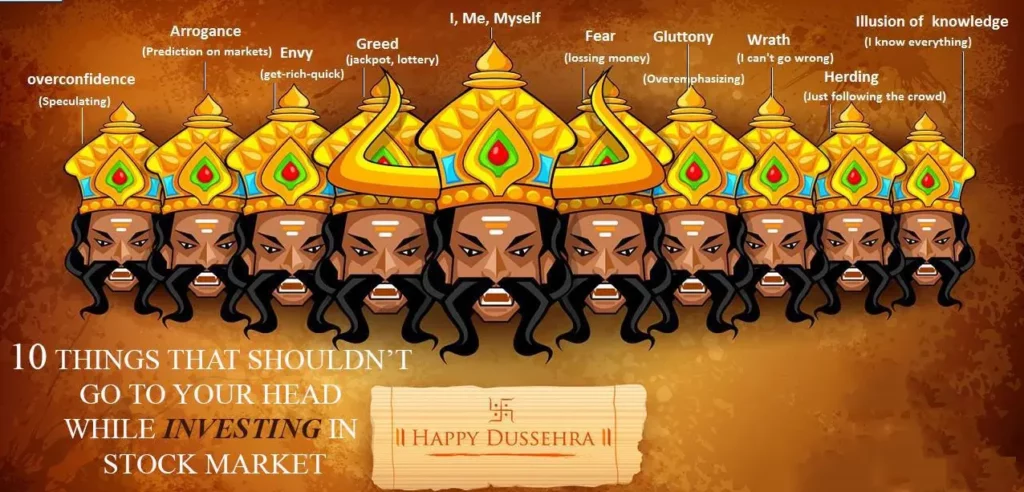

Delivery companies came with a lot of hope in the share market. With increasing online deliveries, especially during the festive season like Diwali. Although it is not the same care with the dehlivery share price.

When will the price stop?

As per the technical of this stock. Delhivery’s share price Should have its major support at 317. Immediate support could be close to 350. As Delhivery share price has no reason to go upright. It should be hovering around this price only for the next few months.

Delhivery share price 383

Price of dehlivery’s share price as per the last trading session oct 383. You can check the live price here.

If you are a beginner in the share market and want to learn how to trade. Check out our stock market courses.