Technical analysis

• Technical analysis

• Introduction

• Types of charts

• Candlesticks

• Candle sticks patterns

• Multiple candlestick Patterns

• Trading – get started

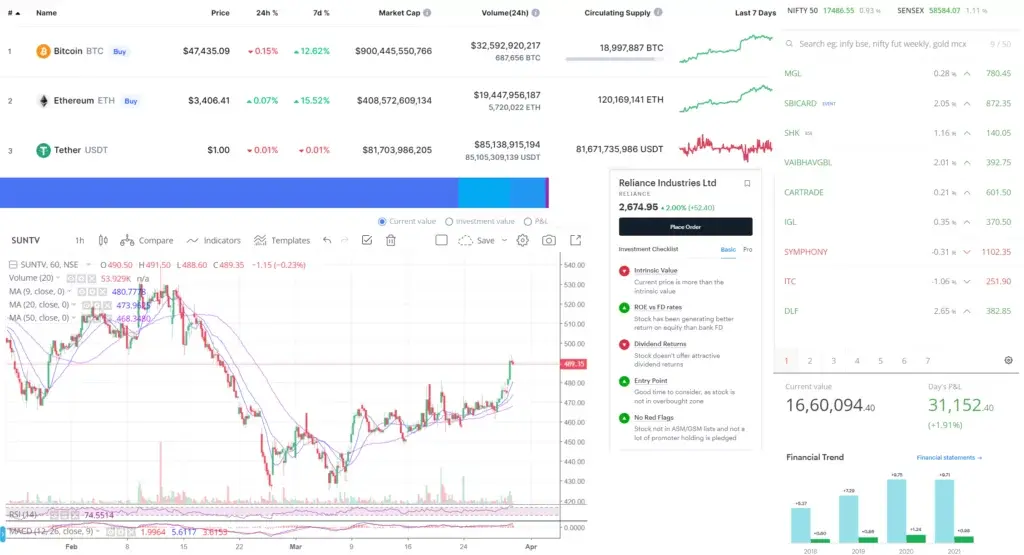

• Trading view

• Support & resistance

• Volume trading

• News and Events

• Moving averages

• Indicators

• Fibonacci Retracements

• Notes

Firstly, The previous session got us started on the right foot by providing us with a basic knowledge of the stock market. Using the prior session as a guide, we now understand that creating a well-researched perspective is important for stock market success.

A good point of view should have a directed perspective and contain information like:

- First, the Price at which stocks should be purchased and sold

- Second, There is risk involved.

- Third, the Anticipated reward

- At last, the Typical holding period

Importantly, Technical Analysis (commonly known as TA) is a popular approach for doing that. Besides, It assists you in developing a point of view on a certain stock or index and in defining the trade while keeping the entry, exit, and risk in mind.

Undoubtedly, Technical Analysis, like other research approaches, has its own set of characteristics, some of which can be rather complicated. However, technological advancements have made it simple to explain. As we progress through this subject, we will find these characteristics.

What is Technical Analysis?

Consider the following analogy.

Furthermore, Consider yourself on vacation in a distant nation where you are unfamiliar with the language, culture, climate, and food. On the first day, you conduct typical tourist activities, and by the evening, you are starving. You want to end your day with a delicious meal. You inquire about an excellent restaurant and are told about a fantastic food street nearby. You decide to give it a shot.

Unexpectedly, several vendors are selling various types of food. Everything appears to be unique and intriguing. You have no idea what you’re going to have for dinner. To make this situation worse, you can’t ask around because you don’t speak the language. So, given all of this, how will you choose what to eat?

You have two alternatives option for deciding what to eat.

Option 1

For example, You go to a vendor and find out what they are cooking/selling. Examine the ingredients, and cooking style, and probably taste a little to see if you enjoy the food. As well as, You repeat this process with a few vendors, and you’ll most likely end up eating at the restaurant that satisfies you the best. The benefit of this method is that you know exactly what you’re eating because you researched it independently. On the other hand, the technique you used is not truly scalable. Especially, There could be around 100 vendors, and with limited time, you can probably cover about 4 or 5 of them. As a result, there’s a strong chance you missed the best-tasting food on the street!

Option 2

Another, You stand in a corner and watch the sellers. You strive to discover a merchant who is drawing the most attention. When you encounter such a vendor, you make a simple assumption: ‘The seller has so many customers, so he must be providing the best cuisine!’ ‘You decide to go to that particular vendor for dinner based on your assumption and the crowd’s desire. Never, you may be eating the best-tasting food available on the street.

The accessibility of this method is an advantage. You must find the seller with the most customers and bet that it is good based on the preferences of the crowd. On the other hand, the crowd does not always have to be correct.

Option 1 is fairly similar to Fundamental Analysis in that you thoroughly research a few firms. In the following module, we will go over the Fundamental Analysis in greater depth.

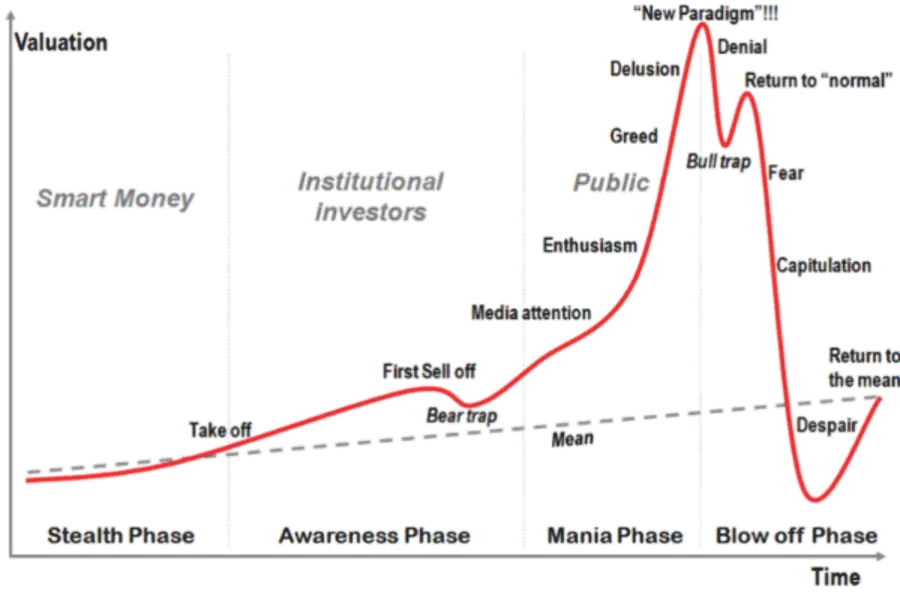

Option 2 is similar to Technical Analysis in that it looks for opportunities based on the current trend, also known as the market’s preference.

Technical analysis is a study technique used to find trading opportunities in the market based on the activities of market participants. A stock chart can be used to display market players’ activity. Patterns evolve inside these charts throughout time, and each pattern offers a different message. A technical analyst’s task is to identify these patterns and form an opinion.

Technical analysis, like any other research technique, is based on several assumptions. As a technical analyst, you must trade the markets while keeping these assumptions in mind. Of course, as we go along, we’ll get a better understanding of these assumptions.

Also, at this time, it is appropriate to shed some light on an issue involving FA and TA. People frequently argue over whether a certain research strategy is a better approach to the market. However, there is no such thing as the best research strategy. Every study method has advantages and disadvantages. It would be pointless to compare TA with FA to determine which is the superior approach.

Both strategies are distinct and incomparable. A wise trader would spend time learning both approaches for identifying exceptional trading or investing chances.

Setting Expectations

Technical analysis is frequently viewed by market participants as a quick and easy technique to make a windfall profit in the markets. Technical analysis, on the other hand, is everything but quick and easy. Yes, a windfall gain is feasible if done correctly, but to get there, one must put in the necessary effort to understand the technique.

The trading crisis is unavoidable if you regard TA as a quick and easy strategy to make money in markets. When a trading disaster occurs, the responsibility is sometimes placed on technical analysis rather than the trader’s inability to apply Technical Analysis to markets. As a result, before digging deeper into technical analysis, it is critical to establish expectations about what technical analysis can and cannot do.

- Traders:-Short-term trades are best identified using TA. Use TA to find long-term investment opportunities. Fundamental analysis is the best tool for identifying long-term investment opportunities. If you are a fundamental analyst, you may also apply TA to calibrate the entry and exit locations.

- Return per trade:-TA-based trades is often of short duration. Expecting large returns in a short period is unrealistic. The key to success with TA is to uncover numerous short-term trading chances that can provide you with small but regular returns.

- Holding period:-Technical analysis trades can last anywhere from a few minutes to a few weeks, and usually not longer. This will be covered further when we consider periods.

- Risk:-Traders frequently initiate a trade for a specific reason; nevertheless, if the stock suffers a negative movement, the trade begins to lose money. In such cases, traders typically cling on to their losing detox recouping their losses. Remember that TA-based trades are short-term; if the deal goes bad, remember to reduce your losses and move on to find another chance.