I saw the latest Bollywood film, ‘Piku,’ yesterday. I must admit, it’s quite nice. After seeing the film, I was thinking about what made me like Piku so much – was it the overall storyline, Amitabh Bachchan’s superb acting, Deepika Padukone’s lovely screen presence, or Shoojit Sircar’s brilliant direction? Well, I suppose it was a combination of all of these elements that made the film enjoyable.

This also made me understand that there is a striking parallel between a Bollywood film and an options deal. Similar to a Bollywood film, for an options trade to be successful in the market, multiple forces must align in the option trader’s favour. These forces are known as ‘The Options Greeks.’ These forces occur in real-time on an option contract, causing the premium to rise or fall on a minute-by-minute basis. To complicate matters further, these forces not only effect premiums directly but also influence one another.

To put this in context, consider these two Bollywood actors: Aamir Khan and Salman Khan. Moviegoers would know them as two independent acting factions of Bollywood (similar to the option Greeks). They have the ability to independently alter the result of the film in which they appear (think of the movie as an options premium). However, if you put both of these individuals in the same movie, odds are they will try to bring each other down while simultaneously pushing themselves up and trying to make the movie a success. Do you notice the juggling going on around here? This may not be a perfect analogy, but I believe it conveys what I’m trying to say.

Options premiums, options Greeks, and the market’s natural demand supply situation all have an impact on one another. Despite the fact that all of these forces operate as independent agents, they are all intertwined. The option’s premium reflects the eventual result of this mixing. The most crucial thing for an options trader is to examine the variation in premium. Before executing an option trade, he must have an understanding of how these elements interact.

So, without further ado, allow me to introduce you to the Greeks –

- Delta – Measures the rate of change of options premium based on the directional movement of the underlying

- Gamma – Rate of change of delta itself

- Vega – Rate of change of premium based on change in volatility

- Theta – Measures the impact on premium based on time left for expiry

Delta of an option

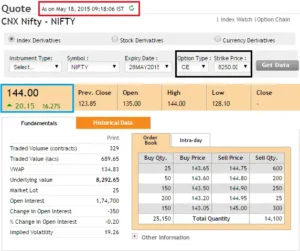

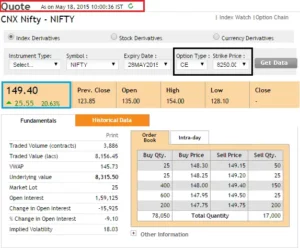

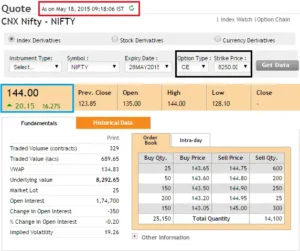

Take note of the following two screenshots, which are from Nifty’s 8250 CE option. The first photo was obtained at 09:18 a.m., when the Nifty was trading at 8292.

A little while later…

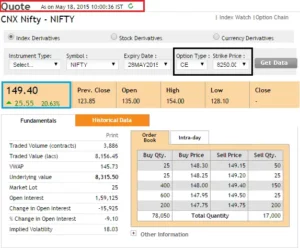

Notice the difference in premium – at 09:18 AM, when the Nifty was at 8292, the call option was trading at 144, but by 10:00 AM, the Nifty had climbed to 8315 and the call option was trading at 150.

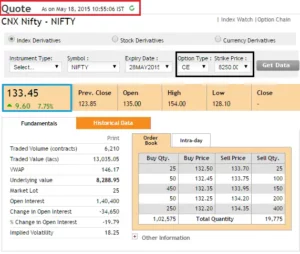

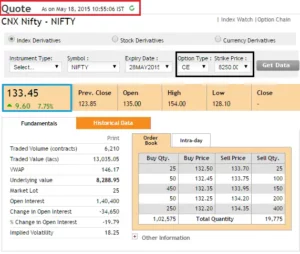

In fact, here’s another image from 10:55 a.m. – The Nifty fell to 8288, as did the option premium (declined to 133).

One thing is evident from the above observations: as the spot price changes so do the option premium. As we already know, the call option premium rises in proportion to the increase in spot value, and vice versa.

Keeping this in mind, imagine you projected that the Nifty will reach 8355 by 3:00 PM today. The images above show that the premium will undoubtedly fluctuate – but by how much? What will the 8250 CE premium be worth if the Nifty reaches 8355?

This is when the ‘Delta of an Option’ comes in helpful. The Delta quantifies how an option’s value moves in relation to the underlying. In simplified terms, an option’s Delta helps us answer queries such as, “How many points would the option premium change for every one point movement in the underlying?”

As a result, Option Greek’s ‘Delta’ measures the effect of market directional movement on the Option’s premium.

The delta is a variable number –

- Some traders choose to utilise the 0 to 100 scale for a call option between 0 and 1. So a delta value of 0.55 on a scale of 0 to 1 corresponds to a delta value of 55 on a scale of 0 to 100.

- A put option has a value between -1 and 0 (-100 to 0). As a result, a delta value of -0.4 on the -1 to 0 scale corresponds to -40 on the -100 to 0 scale.

We will soon learn why the delta of the put option is negative. - At this point, I’d want to give you an idea of how this chapter will look; please keep this in mind as I believe it will be useful.

At this point, I’d like to give you an idea of how this chapter will look; please keep this in mind as I believe it will help you connect the dots better –

- We will learn how to use the Delta value for Call Options.

- A simple explanation of how the Delta values are calculated

- Learn how to use the Delta value for Put Options.

- Delta vs. Spot Characteristics, Delta Acceleration (continued in next chapter)

- Delta-based option positions (continued in next chapter)

So let’s get going!

Delta for a Call Option

We know that the delta is a number between 0 and 1. What does it indicate if a call option has a delta of 0.3 or 30?

As we all know, the delta measures the rate of change of the premium for each unit change in the underlying. A delta of 0.3 implies that for every one point change in the underlying, the premium is likely to change by 0.3 units, or for every one hundred point change in the underlying, the premium is likely to change by 30 points.

The following example should help you better grasp this –

Nifty @ 10:55 AM is at 8288

Option Strike = 8250 Call Option

Premium = 133

Delta of the option = + 0.55

Nifty @ 3:15 PM is expected to reach 8310

At 3:15 PM, what is the most likely option premium value?

This is a rather simple calculation. The option’s Delta is 0.55, which means that for every 1-point movement in the underlying, the premium is predicted to vary by 0.55 points.

We estimate the underlying to move by 22 points (8310 – 8288), hence the premium should rise by 22 points.

= 22*0.55

= 12.1

Therefore the new option premium is expected to trade around 145.1 (133+12.1)

Which is the sum of the old premium Plus the predicted premium change?

Consider another scenario: what if one forecasts a decline in the Nifty? What will become of the premium? Let’s sort it out –

Which is the sum of old premium + expected change in premium

Let us pick another case – what if one anticipates a drop in Nifty? What will happen to the premium? Let us figure that out –

Nifty @ 10:55 AM is at 8288

Option Strike = 8250 Call Option

Premium = 133

Delta of the option = 0.55

Nifty @ 3:15 PM is expected to reach 8200

What is the likely premium value at 3:15 PM?

We are expecting Nifty to decline by – 88 points (8200 – 8288), hence the change in premium will be –

= – 88 * 0.55

= – 48.4

Therefore the premium is expected to trade around

= 133 – 48.4

= 84.6 (new premium value)

As shown in the preceding two cases, the delta assists us in determining the premium value depending on the directional movement of the underlying. This knowledge is highly valuable when trading options. Assume you anticipate a tremendous 100-point increase in the Nifty and decide to purchase an option based on this forecast. There are two Call alternatives available, and you must choose one.

Call Option 1 has a delta of 0.05

Call Option 2 has a delta of 0.2

Now the question is, which option will you buy?

Let us do some math to answer this –

Change in underlying = 100 points

Call option 1 Delta = 0.05

Change in premium for call option 1 = 100 * 0.05

= 5

Call option 2 Delta = 0.2

Change in premium for call option 2 = 100 * 0.2

= 20

As you can see, a 100-point move in the underlying has distinct consequences for different possibilities. Clearly, the trader would be better off purchasing Call Option 2. This should give you a hint: the delta assists you in choosing the best option strike to trade. Of course, there are other dimensions to this, which we will investigate shortly.

Let me ask a very critical question at this point: why is the delta value for a call option limited to 0 and 1? Why can’t the delta of a call option go beyond 0 and 1?

To further appreciate this, consider two cases in which I purposefully keep the delta value above 1 and below 0.

Scenario 1: Delta greater than 1 for a call option

Nifty @ 10:55 AM at 8268

Option Strike = 8250 Call Option

Premium = 133

Delta of the option = 1.5 (purposely keeping it above 1)

Nifty @ 3:15 PM is expected to reach 8310

What is the likely premium value at 3:15 PM?

Change in Nifty = 42 points

Therefore the change in premium (considering the delta is 1.5)

= 1.5*42

= 63

Do you see what I mean? According to the answer, a 42-point shift in the underlying increases the value of the premium by 63 points! In other words, the option is increasing in value faster than the underlying. Remember that the option is a derivative contract; its value is derived from the underlying, hence it can never move faster than the underlying.

If the delta is one (the maximum delta value), it indicates that the option is moving in line with the underlying, which is acceptable, but a value greater than one is not. As a result, the delta of an option is limited to a maximum value of 1 or 100.

Scenario 2: Delta lesser than 0 for a call option

Nifty @ 10:55 AM at 8288

Option Strike = 8300 Call Option

Premium = 9

Delta of the option = – 0.2 (have purposely changed the value to below 0, hence negative delta)

Nifty @ 3:15 PM is expected to reach 8200

What is the likely premium value at 3:15 PM?

Change in Nifty = 88 points (8288 -8200)

Therefore the change in premium (considering the delta is -0.2)

= -0.2*88

= -17.6

For a moment we will assume this is true, therefore the new premium will be

= -17.6 + 9

= – 8.6

As you can see in this example, when the delta of a call option falls below zero, the premium also falls below zero, which is impossible. Remember that the premium, whether call or put, can never be negative at this stage. As a result, the delta of a call option is lower limited to zero.

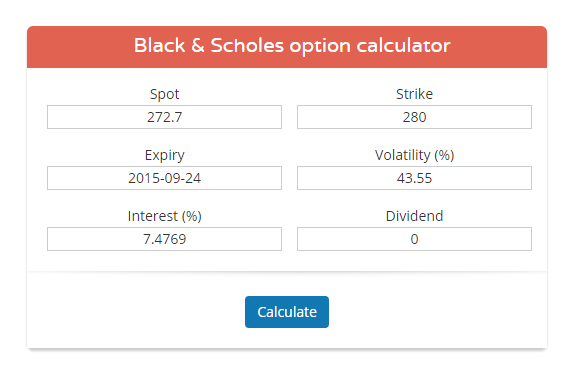

Who decides the value of the Delta?

The delta value is one of the numerous outputs of the Black and Scholes option pricing model. As I explained before in this chapter, the B&S formula accepts a large number of inputs and produces a few critical outputs. The option’s delta value and other Greeks are included in the output. After we’ve gone over all of the Greeks, we’ll go through the B&S formula to solidify our comprehension of the alternatives. However, for the time being, you should be aware that the delta and other Greeks are market-driven values determined using the B&S algorithm.

However, the following table will assist you in determining the approximate delta value for a given option –

| Option Type | Approx Delta value (CE) | Approx Delta value (PE) |

|---|

| Deep ITM | Between + 0.8 to + 1 | Between – 0.8 to – 1 |

| Slightly ITM | Between + 0.6 to + 1 | Between – 0.6 to – 1 |

| ATM | Between + 0.45 to + 0.55 | Between – 0.45 to – 0.55 |

| Slightly OTM | Between + 0.45 to + 0.3 | Between – 0.45 to -0.3 |

| Deep OTM | Between + 0.3 to + 0 | Between – 0.3 to – 0 |

Of course, you may always use a B&S option pricing calculator to determine the exact delta of an option.

Delta for a Put Option

Keep in mind that the Delta of a Put Option might range from -1 to 0. The negative sign simply indicates that when the underlying increases in value, the value of the premium decreases. Consider the following details while keeping this in mind:

| Parametres | Value |

| Underlying | Nifty |

| Strike | 8300 |

| Spot value | 8268 |

| Premium | 128 |

| Delta | -0.55 |

| Expected Nifty Value (Case 1) | 8310 |

| Expected Nifty Value (Case 2) | 8230 |

Note – 8268 is a slightly ITM option, hence the delta is around -0.55 (as indicated from the table above).

The goal is to evaluate the new premium value while keeping the delta value at -0.55. Pay close attention to the calculations below.

Case 1: Nifty is expected to move to 8310

Expected change = 8310 – 8268

= 42

Delta = – 0.55

= -0.55*42

= -23.1

Current Premium = 128

New Premium = 128 -23.1

= 104.9

I’m subtracting the value of delta here because I know that the value of a Put option decreases as the underlying value rises.

Case 2: Nifty is expected to move to 8230

Expected change = 8268 – 8230

= 38

Delta = – 0.55

= -0.55*38

= -20.9

Current Premium = 128

New Premium = 128 + 20.9

= 148.9

I’m including the delta value here since I know that the value of a Put option increases when the underlying value falls.

I hope the following two illustrations have clarified how to use the delta value of the Put Option to calculate the new premium value. Also, I’ll omit describing why the delta of the Put Option is limited to -1 and 0.

In fact, I would encourage readers to utilise the same logic we used to understand why the delta of a call option is bound between 0 and 1 to understand why the delta of a put option is bound between -1 and 0.

In the following chapter, we will delve deeper into Delta and examine some of its properties.

Model Thinking

The preceding chapter provided an overview of the first Greek choice – the Delta. Aside from explaining the delta, the last chapter had another secret agenda: to lead you down the path of’model thinking.’ Let me explain what I mean: the last chapter offered a new window for weighing possibilities. The window opened up several option trading viewpoints; ideally, you no longer think about options in a one-dimensional manner.

For example, if you have a positive market perspective in the future, you may not trade in this manner: ‘My view is optimistic, thus it makes sense to either buy a call option or collect a premium by selling a put option.’

Rather, you may strategy as follows: “My perspective is bullish because I expect the market to move by 40 points; therefore, it makes sense to buy an option with a delta of 0.5 or greater because the option is predicted to gain at least 20 points for the given 40 point move in the market.”

Can you see the distinction between the two cognitive processes? While the former is more naive and casual, the later is more defined and measurable. The expectation of a 20-point increase in the option premium resulted from a calculation discussed in the previous chapter –

Expected change in option premium = Option Delta * Points change in underlying

The given formula is only one part of the whole strategy. As we uncover more Greeks, the evaluation metre gets more quantitative, and trade selection becomes more scientifically streamlined. The point is that future thinking will be directed by formulae and figures, with limited room for “casual trading thoughts.” I know many traders that trade based on a few odd notions, and some of them may be profitable. However, not everyone will enjoy this. When you put numbers in context, your chances improve – and this happens when you develop’model thinking.’

Please keep the model thinking framework in mind when studying options, since this will assist you in setting up systematic trades.

Delta versus the spot price

In the last chapter, we discussed the relevance of Delta and how it may be used to calculate the predicted change in premium. Before we continue, here’s a quick recap of the previous chapter –

- The delta of call options is positive. A call option with a delta of 0.4 indicates that for every 1 point increase or decrease in the underlying, the call option premium increases or decreases by 0.4 point.

- The delta of put options is negative. A -0.4 delta put option means that for every 1 point loss/gain in the underlying, the put option premium gains/losses 0.4 points.

- The delta of TM options is between 0 and 0.5, the delta of ATM options is 0.5, and the delta of ITM options is between 0.5 and 1.

Let me make some deductions based on the third point. Assume the Nifty Spot is at 8312, the strike at issue is 8400, and the option type is CE (Call option, European).

- When the spot is 8312, what is the estimated Delta value for the 8400 CE?

- Because 8400 CE is OTM, Delta should be between 0 and 0.5. Let us suppose Delta is 0.4.

- What do you believe the Delta value is if the Nifty spot moves from 8312 to 8400?

- Because the 8400 CE is now an ATM option, the delta should be roughly 0.5.

- What do you believe the Delta value is if the Nifty spot moves from 8400 to 8500?

- Delta should be closer to one now that the 8400 CE is an ITM option. Let’s pretend it’s 0.8.

- Finally, if the Nifty Spot falls sharply from 8500 to 8300, what happens to the delta?

- With the drop in spot, the option has reverted to ITM from OTM, and so the delta value has dropped from 0.8 to, say, 0.35.

- What conclusions may you draw from the above four points?

- Clearly, as and when the spot value changes, so does the moneyness of an option, and therefore the delta.

This is an important element to note: the delta changes as the spot value changes. As a result, delta is a variable rather than a fixed item. As a result, if an option has a delta of 0.4, its value is likely to change in tandem with the underlying’s value.

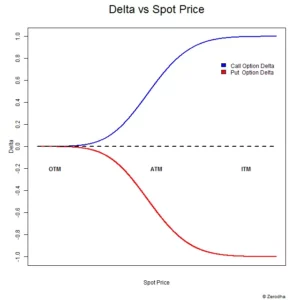

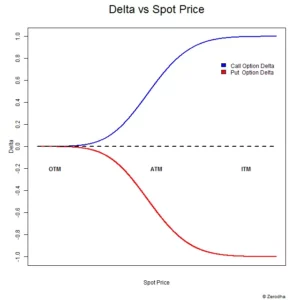

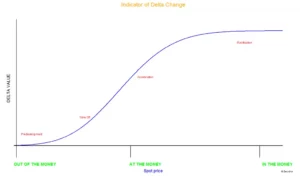

Take a look at the chart below, which depicts the fluctuation of delta relative to the spot price. The chart is broad and does not pertain to any specific option or strike. There are two lines, as you can see –

- The blue line depicts the delta behaviour of the Call option (varies from 0 to 1)

- The red line depicts the delta behaviour of the Put option (varies from -1 to 0)

Let us understand this better –

This is an intriguing graphic, and I recommend that you focus just on the blue line and disregard the red line. The delta of a call option is represented by the blue line. The graph above captures a few important delta characteristics; let me list them for you (meanwhile, keep in mind that as the spot price changes, so does the moneyness of the option) –

- Examine the X-axis: when the spot price moves from OTM to ATM to ITM, the moneyness increases from left to right.

- Examine the delta line (blue line) – as the spot price rises, so does the delta.

- At OTM, the delta is flattish near 0 – this means that no matter how much the spot price falls (from OTM to deep OTM), the option’s delta will remain at 0.

- Remember that the delta of the call option is lower bound by 0.

- When the spot moves from OTM to ATM, the delta begins to rise (remember, the option’s moneyness rises as well).

- Take note of how the delta of an option falls between 0 and 0.5 for options less than ATM.

- At ATM, the delta reaches 0.5.

- When the spot transfers from ATM to ITM, the delta begins to exceed the 0.5 mark.

- When the delta reaches a value of one, it begins to plump up.

- This also means that once the delta increases beyond ITM, to say deep ITM, the delta value remains constant. It remains at its highest value of one.

The delta of the Put Option exhibits similar features (red line).

The Delta Acceleration

If you are familiar with the options market, you may have heard weird stories about traders doubling or tripling their money by trading OTM options. Let me tell you a story if you haven’t heard one before: The election results were revealed on May 17, 2009 (Sunday), the UPA Government was re-elected at the centre, and Dr.Manmohan Singh was re-elected as the country’s Prime Minister for a second term. Stock markets prefer stability in the centre, and we all anticipated the market would rally the next day, May 18, 2009. The previous day, the Nifty closed at 3671.

Zerodha did not exist at the time; we were simply a group of traders trading our own capital alongside a few clients. One of our associates took a tremendous risk a few days before the 17th of May when he purchased long-term options (OTM) for Rs.200,000/-. Given that no one can truly anticipate the outcome of a general election, this was a daring gesture. Obviously, he would benefit if the market rose, but the market rose for a variety of reasons. We were just as curious as he was to see what would happen. Finally, the results were announced, and we all knew he’d make money on May 18th – but none of us knew how much he’d benefit.

The 18th of May 2009 is a day I will never forget: markets opened at 9:55 a.m. (that was the market opening time back then), it was a big bang open the market, Nifty quickly touched an upper circuit, and the markets froze. Within a few minutes, the Nifty rose nearly 20% to conclude the day at 4321! Because the market was hot, the exchanges decided to close it at 10:01 AM… As a result, I had the shortest working day of my life.

Here is a chart highlighting that day’s market movement –

Our good associate had made a lovely fortune throughout the entire process. His option was valued at Rs.28,00,000/- at 10:01 AM on that lovely Monday morning, a staggering 1300 percent gain gained overnight! This is the type of deal that practically all traders, including myself, hope to have.

Anyway, let me ask you a few questions about this story, which will get us back to the primary point –

- Why do you believe our employee chose to purchase OTM options rather than ATM or ITM options?

- What would have occurred if he had instead purchased an ITM or ATM option?

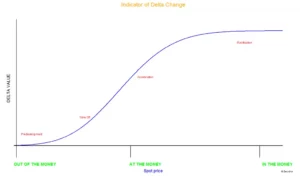

The answers to these questions can be found in this graph –

This graph discusses ‘Delta Acceleration’; there are four delta stages indicated in the graph; let us look at each one.

Before we proceed with the following conversation, please consider the following points:

- I would recommend that you pay close attention to the following conversation; these are some of the most crucial aspects to understand and remember.

- Remember and revise the delta table from the previous chapter (option type, approximate delta value, and so on).

- Please keep in mind that the delta and premium amounts used here are an educated guess for the sake of example –

Predevelopment – This is the period where the choice is between OTM and deep OTM. The delta is close to zero in this case. Even if the option moves from deep OTM to OTM, the delta will remain close to zero. For example, if the spot price is 8400, the 8700 Call Option is Deep OTM, with a delta of 0.05. Even if the spot rises from 8400 to, say, 8500, the delta of the 8700 Call option will not change significantly because the 8700 CE is still an OTM option. The delta will remain a tiny non-zero value.

So, if the premium on 8700 CE is Rs.12 when spot is at 8400, the premium is anticipated to move by 100 * 0.05 = 5 points when Nifty moves to 8500 (100 point move).

As a result, the new premium is Rs.12 + 5 = Rs.17/-. The 8700 CE, on the other hand, is now regarded somewhat OTM rather than deeply OTM.

Most importantly, while the rise in premium value is tiny (Rs.5/-), the Rs.12/- option has increased by 41.6 percent to Rs.17/- in percentage terms.

Conclusion – Deep OTM options tend to put on an outstanding percentage, but for this to happen, the spot must move by a significant amount.

Recommendation: Avoid buying deep OTM options because the deltas are extremely small and the underlying must move dramatically for the option to be profitable. There are better values elsewhere. However, selling deep OTM makes sense for the same reason, but we shall examine when to sell these options when we take up the Greek ‘Theta’.

Takeoff and Acceleration – This is the point at which the option changes from OTM to ATM. This is where you get the most bang for your money, and thus the most risk.

Consider the following: Nifty spot at 8400, strike at 8500 CE, option slightly out of the money, delta at 0.25, premium at Rs.20/-

The spot increases from 8400 to 8500 (100 points), therefore let’s do some math to figure out what occurs on the premium side –

underlying change = 100

8500 CE delta = 0.25

Change in premium = 100 * 0.25 = 25

New premium equals Rs.20 + Rs.25 = Rs.45/-

125 percent change in percentage

Do you see what I mean? OTM options respond substantially differently for the same 100 point move.

Conclusion: The somewhat OTM option, with a delta of 0.2 or 0.3, is more sensitive to changes in the underlying. The percentage change in the marginally OTM options is really astounding for any major change in the underlying. In reality, this is exactly how option traders double or triple their money, by purchasing slightly out-of-the-money options when the underlying is expected to move significantly. But I’d like to point out that this is only one face of the cube; there are many more to discover.

Recommendation – Purchasing somewhat OTM options is more expensive than purchasing deep OTM options, but if you play your cards well, you may make a fortune. Consider purchasing slightly OTM options whenever you buy options (of course assuming there is plenty of time to expiry, we will talk about this later).

Let us now look at how the ATM option would react to the same 100-point shift.

Spot = 8400

Strike = 8400 (ATM)

Premium = Rs.60/-

Change in underlying = 100

Delta for 8400 CE = 0.5

Premium change = 100 * 0.5 = 50

New premium = Rs.60 + 50 = Rs.110/-

Percentage change = 83%

Conclusion – ATM options are more susceptible to spot changes than OTM options. Because the ATM’s delta is substantial, the underlying does not need to change by a large amount. Even if the underlying changes only slightly, the option premium changes. However, purchasing ATM options is more expensive than purchasing OTM options.

Recommendation: Purchase ATM options when you want to be safe. Even if the underlying does not move significantly, the ATM option will move. As a corollary, unless you are quite certain of what you are doing, do not attempt to sell an ATM option.

Stabilization – As the option moves from ATM to ITM and Deep ITM, the delta begins to stabilise at one. The delta begins to flatten out as it reaches the value of one, as seen by the graph. This indicates that the option can be ITM or deep ITM, but the delta is set at 1 and does not alter.

Let’s see how this goes.

Nifty Spot = 8400

Option 1 = 8300 CE Strike, ITM option, Delta of 0.8, and Premium is Rs.105

Option 2 = 8200 CE Strike, Deep ITM Option, Delta of 1.0, and Premium is Rs.210

Change in underlying = 100 points, hence Nifty moves to 8500.

Given this let us see how the two options behave –

Change in premium for Option 1 = 100 * 0.8 = 80

New Premium for Option 1 = Rs.105 + 80 = Rs.185/-

Percentage Change = 80/105 = 76.19%

Change in premium for Option 2 = 100 * 1 = 100

New Premium for Option 2 = Rs.210 + 100 = Rs.310/-

Percentage Change = 100/210 = 47.6%

Conclusion – The deep ITM option outperforms the somewhat ITM option in terms of absolute change in the number of points. However, in terms of percentage change, the situation is reversed. Obviously, ITM options are more sensitive to changes in the underlying, but they are also the most expensive.

Most notably, notice the change in the deep ITM option (delta 1) for every 100-point change in the underlying, there is a 100-point change in the option premium. This means that purchasing a deep ITM option is equivalent to purchasing the underlying itself. This is due to the fact that whatever changes occur in the underlying, the deep ITM option will also change.

Recommendation: Purchase the ITM choices if you want to play it safe. When I say safe, I’m referring to the deep ITM choice versus the deep OTM option. ITM options have a high delta, indicating that they are most sensitive to changes in the underlying.

Because a deep ITM option moves in lockstep with the underlying, it can be used to replace a futures contract!

Think about this –

Nifty Spot @ 8400

Nifty Futures = 8409

Strike = 8000 (deep ITM)

Premium = 450

Delta = 1.0

Change in spot = 30 points

New Spot value = 8430

Change in Futures = 8409 + 30 = 8439 à Reflects the entire 30 point change

Change Option Premium = 1*30 = 30

New Option Premium = 30 + 450 = 480 à Reflects the entire 30 point change

So, both futures and Deep ITM options react similarly to changes in the underlying. As a result, you are better off purchasing a Deep ITM option to reduce your margin burden. However, if you choose to do so, you must always ensure that the Deep ITM option remains Deep ITM (in other words, that the delta is always 1), as well as keep an eye on the contract’s liquidity.

I imagine that the knowledge in this chapter is an overdose at this point, especially if you are researching the Greeks for the first time. I recommend that you take your time and learn this one bit at a time.

There are a few more perspectives to investigate about the delta, but we shall do so in the following chapter. However, before we finish this chapter, let us summarise the material using a table.

This table will assist us to understand how different options behave differently when the underlying changes.

I considered Bajaj Auto as the foundation. The price is 2210, and the underlying is expected to change by 30 points (which means we are expecting Bajaj Auto to hit 2240). We’ll also assume there’s plenty of time before expiration, so time isn’t really an issue.

| Moneyness | Strike | Delta | Old Premium | Change in Premium | New Premium | % Change |

| Deep OTM | 2400 | 0.05 | Rs.3/- | 30* 0.05 = 1.5 | 3+1.5 = 4.5 | 50% |

| Slightly OTM | 2275 | 0.3 | Rs.7/- | 30*0.3 = 9 | 7 +9 = 16 | 129% |

| ATM | 2210 | 0.5 | Rs.12/- | 30*0.5 = 15 | 12+15 = 27 | 125% |

| Slightly ITM | 2200 | 0.7 | Rs.22/- | 30*0.7 = 21 | 22+21 = 43 | 95.45% |

| Deep ITM | 2150 | 1 | Rs.75/- | 30*1 = 30 | 75 + 30 =105 | 40% |

As you can see, each option behaves differently for the same underlying move.

Before I finish this chapter, I told you a narrative earlier in this chapter and then asked you a few questions. Perhaps you can go back over the questions again now that you have the answers.

Add up the Deltas

Here’s an intriguing feature of the Delta: the Deltas can be totaled up!

Let me clarify by returning to the Futures contract for a second. We know that for every point movement in the underlying’s spot price, the futures price moves by one point. For instance, if the Nifty Spot goes from 8340 to 8350, the Nifty Futures will move from 8347 to 8357. (i.e. assuming Nifty Futures is trading at 8347 when the spot is at 8340). If we were to apply a delta value to futures, we would plainly assign a delta of one because we know that for every one point change in the underlying, the futures also move by one point.

Assuming I purchase one ATM option with a delta of 0.5, we know that for every one point move in the underlying, the option moves by 0.5 points. In other words, possessing one ATM option is equivalent to holding half a futures contract. Given this, holding two such ATM contracts is equivalent to holding one futures contract because the delta of the two ATM options, 0.5 and 0.5, adds up to a total delta of one! In other words, the deltas of two or more option contracts can be summed to determine the position’s total delta.

Let us look at a few example cases to better grasp this –

Case 1 – Nifty spot at 8125, trader has 3 different Call option.

| Sl No | Contract | Classification | Lots | Delta | Position Delta |

| 1 | 8000 CE | ITM | 1 -Buy | 0.7 | TRUE |

| 2 | 8120 CE | ATM | 1 -Buy | 0.5 | TRUE |

| 3 | 8300 CE | Deep OTM | 1- Buy | 0.05 | TRUE |

| Total Delta of positions | TRUE |

Observations –

- The ‘Long’ position is indicated by the positive sign next to 1 in the Position Delta column.

- The sum of the locations is positive, i.e. +1.25. This suggests that the underlying and combined positions are both moving in the same direction.

- The combined position varies by 1.25 points for every one point movement in the Nifty.

- If the Nifty moves 50 points, the combined position will move 50 * 1.25 = 62.5 points.

Case 2 – Nifty spot at 8125, trader has a combination of both Call and Put options.

| Sl No | Contract | Classification | Lots | Delta | Position Delta |

| 1 | 8000 CE | ITM | 1- Buy | 0.7 | TRUE |

| 2 | 8300 PE | Deep ITM | 1- Buy | – 1.0 | TRUE |

| 3 | 8120 CE | ATM | 1- Buy | 0.5 | TRUE |

| 4 | 8300 CE | Deep OTM | 1- Buy | 0.05 | TRUE |

| Total Delta of positions | 0.7 – 1.0 + 0.5 + 0.05 = + 0.25 |

Observations –

- The delta of the combined locations is positive, i.e. +0.25. This suggests that the underlying and combined positions are both moving in the same direction.

- With the addition of Deep ITM PE, the overall position delta has decreased, implying that the combined position is less vulnerable to market directional movement.

- The combined position varies by 0.25 points for every one point movement in the Nifty.

- If the Nifty moves 50 points, the combined position will move 50 * 0.25 = 12.5 points.

- It is important to remember that deltas of calls and puts can be added as long as they belong to the same underlying.

Case 3 –Nifty spot at 8125, the trader has a combination of both Call and Put options. He has 2 lots Put option here.

| Sl No | Contract | Classification | Lots | Delta | Position Delta |

| 1 | 8000 CE | ITM | 1- Buy | 0.7 | TRUE |

| 2 | 8300 PE | Deep ITM | 2- Buy | -1 | TRUE |

| 3 | 8120 CE | ATM | 1- Buy | 0.5 | TRUE |

| 4 | 8300 CE | Deep OTM | 1- Buy | 0.05 | TRUE |

| Total Delta of positions | 0.7 – 2 + 0.5 + 0.05 = – 0.75 |

Observations –

- The delta of the combined positions is negative. This implies that the underlying and combined option positions move in opposite directions.

- With the addition of two Deep ITM PE, the entire position has turned delta negative, indicating that the combined position is vulnerable to market direction.

- The combined position varies by – 0.75 points for every 1-point movement in the Nifty.

- If the Nifty moves 50 points, the position will move 50 * (-0.75) = -37.5 points.

Case 4 – Nifty spot at 8125, the trader has Calls and Puts of the same strike, same underlying.

| Sl No | Contract | Classification | Lots | Delta | Position Delta |

| 1 | 8100 CE | ATM | 1- Buy | 0.5 | TRUE |

| 2 | 8100 PE | ATM | 1- Buy | -0.5 | TRUE |

| Total Delta of positions | + 0.5 – 0.5 = 0 |

Observations –

- The positive delta of the 8100 CE (ATM) is + 0.5.

- The negative delta of the 8100 PE (ATM) is -0.5.

- The combined position has a delta of zero, indicating that any change in the underlying position has no effect on the combined position.

- For example, if the Nifty moves 100 points, the change in option positions is 100 * 0 = 0.

- Positions with a combined delta of 0 are often known as ‘Delta Neutral’ positions.

- Any directional shift has no effect on Delta Neutral locations. They act as if they are immune to market fluctuations.

- Delta neutral positions, on the other hand, respond to other variables such as volatility and time. This will be discussed at a later time.

Case 5 – Nifty spot at 8125, trader has sold a Call Option

- The’short’ position is indicated by the negative sign next to 1 in the Position Delta column.

- As we can see, a short call option generates a negative delta, indicating that the option position and the underlying move in opposing directions. This makes sense given that an increase in spot value results in a loss for the call option. seller

- Similarly, if you short a PUT option, the delta becomes positive.

- -1 * (-0.5) = +0.5

Finally, examine the following scenario: the trader owns a 5 lot long deep ITM option. We know that the total delta for such a position is + 5 * + 1 = + 5. This indicates that for every one point movement in the underlying, the combined position changes by five points in the same direction.

It should be noted that the identical result may be obtained by shorting 5 deep ITM PUT options –

– 5 * – 1 = + 5

-5 represents 5 short positions and -1 represents the delta of deep ITM Put options.

The preceding case study talks should have given you an idea of how to add up the deltas of the individual locations and calculate the overall delta of the positions. When you have many option positions running concurrently and want to detect the overall directional impact on the positions, this technique of adding up the deltas comes in handy.

In fact, I would strongly advise you to always add the deltas of different positions to obtain a perspective – doing so will help you appreciate the sensitivity and leverage of your whole position.

Also, here is another important point you need to remember –

Delta of ATM option = 0.5

If you have 2 ATM options = delta of the position is 1

As a result, for every point change in the underlying, the entire position changes by one point (as the delta is 1). This means that the option’s movement is similar to that of a Futures contract. However, keep in mind that these two options should not be used as a substitute for a futures contract. Remember that the futures contract is solely affected by market direction, whereas options contracts are affected by numerous other variables outside market direction.

There may be instances when you would like to use options instead of futures (mostly for margin purposes), but you must be fully informed of the repercussions of doing so; more on this later.

There may be instances when you would like to use options instead of futures (mostly for margin purposes), but you must be fully informed of the repercussions of doing so; more on this later.