Basics of stock market

• Why invest?

• who regulates

• financial interdependence

• IPOs

• Stock Market returns

• Trading system

• Day end settlements

• Corporate actions

• News and Events

• Getting started

• Rights, ofs,fpo and more

• Notes

Overview of Financial Intermediaries

At this time corporate entities are actively involved in making this work for you from the point at which you access the market —say, let’s buy a stock—to the point at which the stocks arrive and hit your DEMAT account. These organisations quietly carry out their duties in the background while always abiding by SEBI regulations, ensuring a simple and straightforward experience for your stock market transactions. The Financial Intermediaries are the general name for these organizations.

Also, interdependent financial intermediaries work together to form the ecosystem that supports the financial markets. You can learn more about these financial intermediaries and the services they provide by reading this chapter.

The Broker of Stock

One of the most crucial financial intermediaries you should be aware of is the stockbroker. Whereas stockbroker is a business that has registered with the stock exchange as a trading member and has a stockbroking licence. They adhere to the rules established by SEBI.

Your entry point into stock exchanges is a stockbroker. To begin, you must open a “Trading Account” with a broker who satisfies your requirements. Your requirement might be as straightforward as the broker’s office’s proximity to your home. At the same time, finding a broker who can give you a single platform through which you can conduct business on numerous exchanges around the world can be challenging. We’ll go over what these requirements might be later on, as well as how to pick the best broker at this time.Firstly you can conduct financial transactions in the market using a trading account. A trading account is a broker account that enables the investor to buy and sell securities.

How to deal with broker

First, assuming you have a trading account, you must communicate with your broker whenever you want to make a transaction in the markets. There are a few common ways you can communicate with your broker

1.You can meet the dealer in the broker’s office and go there to tell him what you want to do. An employee of the stock broker’s office known as a dealer executes these transactions on your behalf.

2.You can call your broker and place an order for your transaction by providing your client code (account code) during the call. While you are still on the call, the dealer on the other end will execute the order for you and confirm its status.

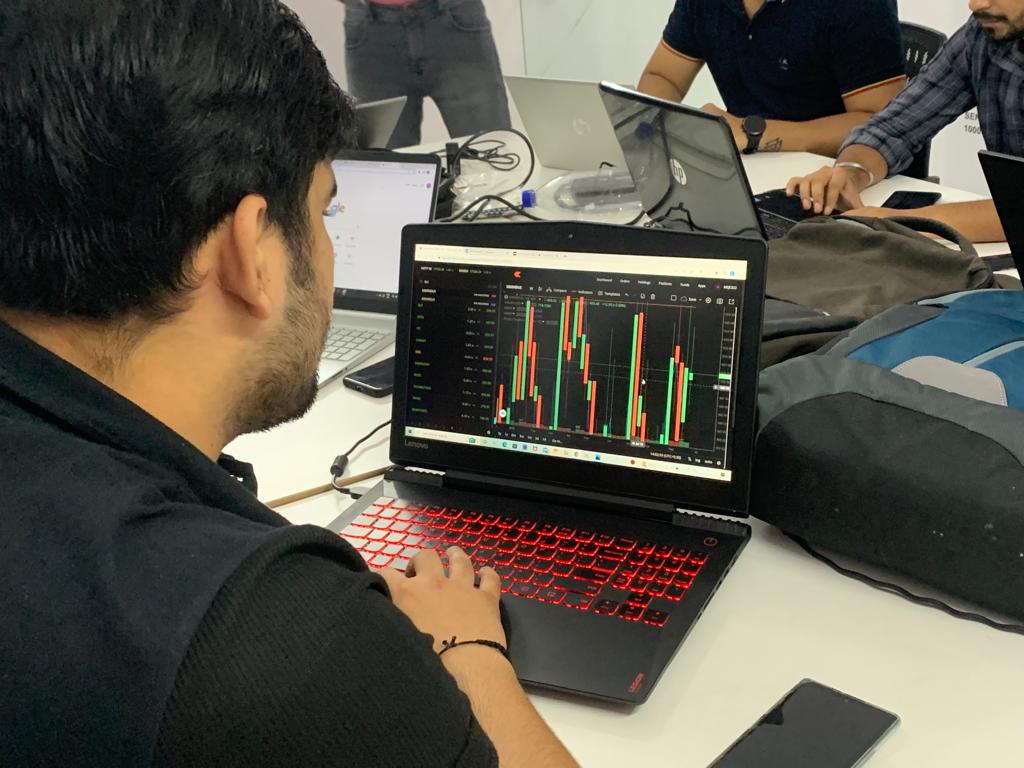

3.Do it yourself: This is arguably the most popular market trading strategy. Through a programme referred to as the “Trading Terminal,” the broker grants you access to the market. Once you’ve logged in to the trading platform, you can view real-time market price quotes and submit your own orders.

The basic services provided by the brokers include…

- Give you access to markets and letting you transact

- Give you trading margins; we’ll talk about this in more detail later.

- Dealing support is available if you need to call and trade. If you have problems with the trading terminal, contact software support.

- Create contract notes for the exchanges A contract note is a document that confirms in writing the actions you have taken throughout the day.

- Make it easier to transfer money between your trading account and bank account.

- Give you access to a back-office login so you can view a summary of your account.

- For the services he delivers, the broker is paid a fee known as the “brokerage charge” as well as that simply brokerage. Finding a broker who strikes a balance between the fee he charges and the services he offers is up to you because brokerage rates vary.

Depository Participants and Depository

Producing the property papers is the only way to prove your ownership of a property after you purchase it. Importantly, keeping the property papers in a safe location becomes crucial.

The only way to prove your ownership of a share, which represents a portion of a company, is to present your share certificate. A share certificate is nothing more than a piece of paper proving your ownership of company shares.

Prior to 1996, share certificates were printed on paper; however, after 1996, they were converted to digital format. “Dematerialization,” also known as DEMAT, is the process of converting a paper share certificate into a digital share certificate.

Whereas Share certificates must be digitally stored in DEMAT format. The “DEMAT Account” is where the digital share certificate is kept. A Depository is a type of financial intermediary that provides the Demat account service. All the shares you purchased in electronic form will be stored in a DEMAT account in your name. Consider your DEMAT account to be a virtual safe for your shares.

Infosys example

For instance, if your plan is to purchase Infosys stock, all you have to do is open a trading account, check the stock’s prices, and place your order. Your trading account’s function is finished once the transaction is finished. The Infosys shares will automatically arrive and sit in your DEMAT account after you make a purchase.

Similar to buying Infosys shares, selling them only requires opening a trading account and doing so. This completes the transaction part… However, the shares that are currently in your DEMAT account will be debited in the background, and the shares will then move out of your DEMAT account.

At present, only two depositaries are offering you DEMAT account services. They are The National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited. There is virtually no difference between the two, and both of them operate under strict SEBI regulations.

You cannot open a DEMAT account by walking into a Depository, just as you cannot open a trading account by walking into the office of the National Stock Exchange. Contact a Depository Participant if you want to open a DEMAT account (DP). Your DEMAT account is created with a Depository with the aid of a DP. A DP serves as the Depository’s agent. Of course, even the DP is subject to the rules established by the SEBI.

Banks

The role that banks play in the market ecosystem is very simple. They assist in making the money transfer between your bank account and trading account easier. A bank account that is not in your name cannot have money transferred from it.

Even so you can transfer money between and trade through various bank accounts that you can link to your trading. You can add up to 2 secondary bank accounts in addition to 1 primary bank account at Zerodha. All the bank accounts can be used to deposit money, but only the primary bank account can receive withdrawals. Additionally, dividend payments and buyback proceeds will be transferred to the main bank account. Your trading account, as well as the Depository, Registrar, and transfer agents, are all connected to your primary bank account (RTA).

Finally you must have realised by this point that the three financial intermediaries each use a different trading account, DEMAT account, and bank account to conduct their business. You will have a very seamless experience thanks to the interlinking and electronic operation of all three accounts.

NSCCL and ICCL

NSCCL – National Security Clearing Corporation Ltd and Indian Clearing Corporation are wholly owned subsidiaries of National Stock Exchange and Bombay Stock Exchange.

Even so, clearing corporation’s responsibility is to guarantee the settlement of your trades and transactions. For instance, if you were to purchase 1 HDFC share at Rs. 1,363.55 per share, that share must have previously been sold to you for Rs. 1,363.55. You will have Rs. 1,363.55 taken out of your trading account for this transaction, and someone else must credit that amount to the sale of HDFC. The clearing corporation’s responsibility in a transaction like this is to guarantee the following:

1.dentify the buyer and seller and match the debit and credit process

2. Ensure no defaults – The clearing company also makes sure neither party defaults. For example, after selling the shares, the seller shouldn’t be able to cancel the deal and default on his obligations.

3. Practically speaking, you don’t need to know much about the NSCCL or ICCL since you won’t be dealing with them directly as a trader or investor. You should be aware that some professional institutions are subject to strict regulation and work to ensure efficient clearing activity.