Typically, “SL” in the stock market refers to “Stop Loss.” A stop loss is an order made by a trader or investor to sell a stock at a certain price, so limiting potential losses on a position. The order is activated when the stock price reaches or drops below the specified stop price, and the stock is automatically sold to stop additional losses. Stop Loss orders are a risk management strategy that investors employ to safeguard their stock market investments.

- Stop Loss: “SL” is frequently used to refer to “Stop Loss.” An order to purchase or sell a stock when it reaches a specific price is known as a stop loss order. To reduce their potential losses on a stock position, traders and investors employ it. The order is activated when the stock price reaches or drops below the specified stop price, and the stock is then sold (in the case of a stop-loss sell order) to stop additional losses.

- Stock Symbol: “SL” may also serve as an acronym for a specific company’s stock symbol. Stock symbols are abbreviations or characters that are used only on stock markets to identify publicly traded corporations. Depending on the exchange and timeframe, “SL” might, for instance, stand in for the stock symbol for a corporation like Schlumberger Limited or Standard Life Aberdeen plc.

- Singapore Exchange: “SL” could be a reference to the Singapore Exchange. A stock exchange where a variety of financial items, including stocks, are traded is this one. On the Singapore Exchange, stock symbols frequently end in “.SI.”

You would need to take into account the context in which it is used—or supply more information for clarification—to ascertain the precise meaning of “SL” in the stock market.

How SL work in stock market

In the stock market, a stop loss (SL) order is a risk management strategy used to reduce potential losses on a stock position. This is how it goes:

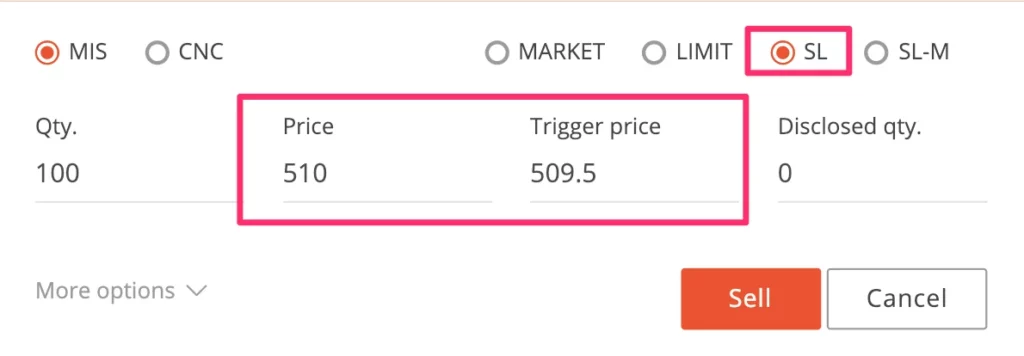

- Placing the Order: You may also place a Stop Loss order when you purchase a stock. In the event that the stock price swings against you, this order indicates a price at which you are prepared to sell it.

- Monitoring the Stock: After placing your Stop Loss order, you must keep an eye on the stock’s price. The Stop Loss order is activated if the stock’s price falls to or below your stop price.

- Order execution: When the Stop Loss order is activated, it transforms into a market order and will be carried out at the following market price. Because market prices might change, it’s possible that your order will be filled slightly above or below the stop price you chose.

- Flexibility: Prior to being activated, Stop Loss orders can be changed or cancelled at any moment. This enables you to modify your risk management plan or adjust to shifting market conditions.

Advantages and Disadvantages

Advantages

- Risk control: Risk control is the main benefit of employing Stop Loss orders. They aid in limiting possible losses on a stock position and help you avoid suffering losses that are more than what you can bear.

- Stop Loss orders: can aid traders and investors in exercising emotional restraint and preventing impulsive, emotional judgements. The temptation to stick onto a losing position in the hopes that it would turn around is diminished when one is aware that there is a fixed exit point.

- Peace of Mind: Investors who use stop loss orders benefit from peace of mind since they know they have a plan in place to protect their money. This might lessen the tension and anxiety that come with stock market investing.

- Automation: When the stop price is reached, Stop Loss orders, once issued, are automatically carried out. This is practical and guarantees that the order is filled even if you aren’t watching the market closely.

Disadvantages

- Whipsawing: One significant disadvantage is the potential for whipsawing, which happens when a stock’s price briefly goes below the stop price and activates the order before quickly rising again. When the market quickly rebounds as a result, this may lead to selling at a loss.

- Market Gaps: Stocks may exhibit price gaps, where the stock begins at a significantly different price than its prior close, in extremely volatile markets or following big news events. In such circumstances, stop loss orders might not be carried out at the targeted stop price.

- Overconfidence: Putting too much faith in Stop Loss orders alone can make you feel insecure. Not all risks, such as overnight gaps or extreme market events, are covered by them.

- Tight Stops: Using very close stop prices while setting stop loss orders might cause frequent order triggering owing to minute price changes, incurring exorbitant trading costs.

- Missed Opportunities: Placing Stop Loss orders too close to the market price could cause a position to be prematurely closed out before it has had a chance to rebound. This may result in lost chances to gain possible benefits.

- The use of stop loss orders: does not ensure that you will sell at the desired price, so keep this in mind. They become market orders after being activated and are carried out at the current market price, which may differ from the stop price.

Conclusion

In summary, stop loss orders are useful instruments for managing risk in the stock market, but they can have drawbacks. It’s crucial for traders and investors to use them wisely while taking into account their unique risk tolerance, market conditions, and the particular equities they are trading. Additionally, rather than serving as the only method of risk management, stop loss orders should be a part of a larger trading or investment plan.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en