Dr. Seuss’s tale “How the Grinch Stole Christmas” is a metaphor for contemporary life. The Grinch snuck into town and attempted to spoil everyone’s Christmas by taking gifts and other materialistic Christmas symbols, but he was unable to take away the holiday spirit from peoples’ hearts. The residents of the town felt a sense of community and appreciated what they had. The tale ought to serve as a reminder of the necessity of pursuing psychological equilibrium in the midst of our frantic life. It is imperative that you make an effort to establish a personal connection with them. Although trading is significant, it is not the main factor. One of the numerous things you do is this.

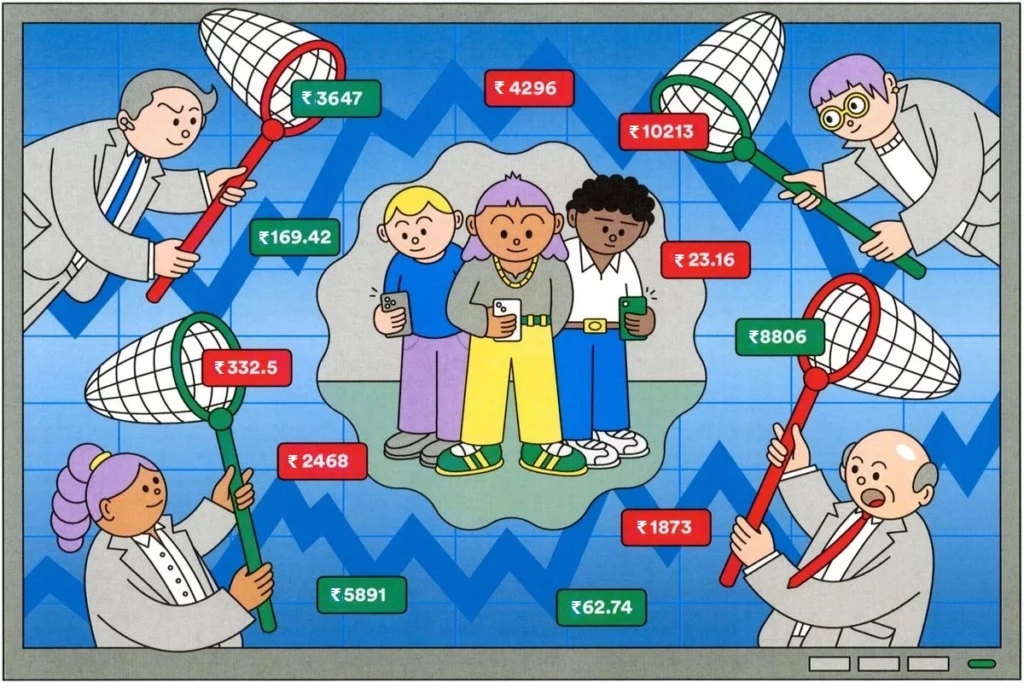

A demanding career is trading. It calls for perseverance in the face of setback after setback and intense concentration on maintaining your level of performance. But a relentless pursuit of success typically ends in failure over time. Traders who keep their focus on peak performance succeed over the long term. Additionally, achieving psychological equilibrium is necessary for developing a peak performance mindset: Rather than concentrating entirely on trading, make sure that your life has several facets. Make sure you enjoy yourself in activities other than trading. Enjoy life to the fullest and spend time in satisfying relationships. Don’t be all business and relentlessly focused on making money.

Don’t forget to appreciate the benefits of being a trader, several seasoned traders caution. Trading grants you the freedom to spend time with your loved ones, family, and friends. Trading gives people the means to live happily. Therefore, whether or not you had a successful year, treat yourself by taking a well-earned vacation. Your desire to improve your life is one of the reasons you trade. It’s critical to keep that in mind. It’s crucial to appreciate all that life has to offer. It will chew at you if you are not living life to the utmost. You’ll ask yourself, “Why am I spending my life trading?” in the back of your head. Remember your trading goals during this time.

Maintain a healthy balance between your trading career and the pursuits that give your life a greater purpose. You’ll be able to develop the peak performance attitude, which is a crucial component of continuously lucrative trading, if you make sure to lead a balanced life.