Topics Covered

- Share Market Timings in India

- Pre-opening session

- Section 1: From 09:00 AM to 09:08 AM

- Section 2: From 09:08 AM to 09:12 AM

- Section 3: From 09:12 AM to 09:15 AM

- Normal session

- Post-closing session

- Section 1: From 03:30 PM to 03:40 PM

- Section 2: From 03:40 PM to 04:00 PM

- Muhurat trading

- Muhurat trading

- Conclusion

Share Market Timings in India

To effectively trade or invest in the financial markets, you need to have the right knowledge about the stock market timings in India. All over the country, the share market timings are the same. Therefore, once you get to know what the stock market timings are, you can buy, sell, or invest in shares from any part of the country during that time. These timings are also the same whether you want to trade on any of the two major stock exchanges in India, namely the BSE and the NSE.

The regular market trading hours are from 09:15 AM and close at 03:30 PM. There’s a pre-opening session before 09:15 AM and a post-closing session after 03:30 PM.

Pre-opening session

Pre-opening sessions typically last from 9:00 AM to 9:00 AM. It is further broken down into three parts. For a brief period, you may submit orders to purchase or sell shares during one of these timeslots. The pre-opening session’s specifics are listed below.

Section 1: From 09:00 AM to 09:08 AM

You may submit orders to purchase or sell various shares on the stock market during these eight minutes. Any orders you may have placed can also be changed or canceled. The orders placed during this portion of the pre-opening session are given preference in the order queue when the regular trading session starts at 09:15 AM.

Section 2: From 09:08 AM to 09:12 AM

You are not permitted to make any changes to or cancel any orders during these four minutes. In order to execute price matching, this section is required. Demand and supply are compared when prices are matched. At market opening at 09:15 AM, it aids in determining the final values at which various shares will be traded.

Section 3: From 09:12 AM to 09:15 AM

This three-minute period serves as a sort of transition between the pre-opening session and regular trading hours. It acts as a buffer to make entering the main trading session easier. Once more, you cannot place, amend, or cancel any orders within these three minutes.

Normal session

The continuous trading session takes place throughout this time, which is from 09:15 AM and 3:30 PM. You are free to trade throughout this session, place orders to buy or sell stocks and change or cancel those orders at any time. A bilateral order matching technique is used during this window. It follows that each sell order is matched with a buy order that was placed at the same stock price, and vice versa, with each buy order and each sell order.

Post-closing session

This session starts at 3:30 PM, after the regular trading session ends. There are two parts to the post-closing session, which lasts until 4:00 PM.

Section 1: From 03:30 PM to 03:40 PM

The weighted average of the stock prices transacted between 03:00 and 03:30 is used to calculate the closing prices of equities during these ten minutes. The weighted average values of all the securities that are listed in an index, such as the Sensex or the Nifty, are taken into account when calculating the closing prices of those indices.

Section 2: From 03:40 PM to 04:00 PM

Orders for purchases and sales are still accepted throughout this 20-minute period. However, orders are only confirmed if there are enough buyers and sellers in the market.

Muhurat trading

In India, all weekends and significant public/national holidays are observed by a closed stock market, as promptly announced by exchanges. However, the stock market is open for an hour as part of a Muhurat trading session on Samvat, the day after Diwali each year. The pre-opening session, regular session, and post-closing session are further components of muhurat trading. Since Diwali is regarded as an auspicious day, this trading hour occurs every Samvat. The NSE and BSE websites provide notice of the new time and date for this session each year.

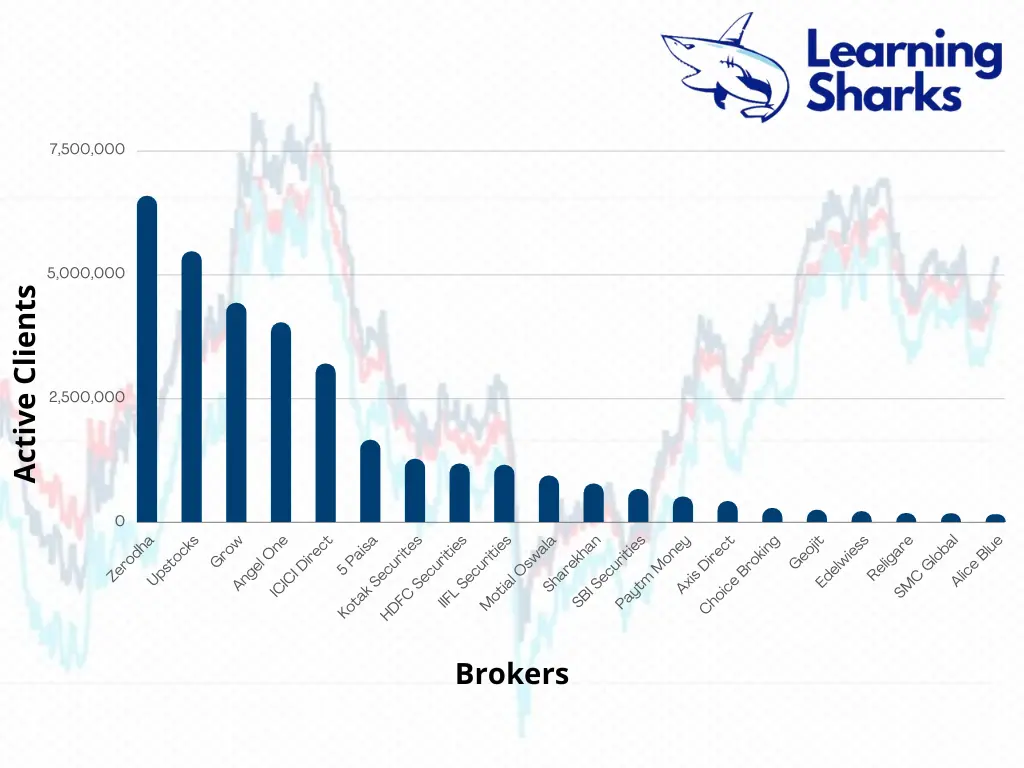

To trade or invest in the markets, you must be informed of the NSE and BSE stock market timings in India. All you need to begin your journey in the stock market is a trading account and an offline or online Demat account in order to trade or invest in the markets. With any Indian registered brokers, you can open an online Demat and trading account. When registering with any of the brokers, you must go through a proper KYC.

What are Aftermarket Orders?

After the post-closing session, no transactions can take place. However, traders or investors can place aftermarket orders for shares of chosen companies. The same would be allocated at the opening market price the following trading day.

Conclusion

Being aware of the stock market timings is vital to earning profits, especially if you pursue intraday trading. All you need is an online Demat account and trading account to get started on your journey of trading or investing in the share market. You can open an online Demat and trading account with any one of the many depository participants in India, like IIFL.