Basics of stock market

• Why invest?

• who regulates

• financial interdependence

• IPOs

• Stock Market returns

• Trading system

• Day end settlements

• Corporate actions

• News and Events

• Getting started

• Rights, ofs,fpo and more

• Notes

IPO, OFS, and FPO – How are they different?

Firstly, A company is first introduced to the publicly traded stock markets through an initial public offering. The promoters of the business decision to sell a specific number of shares to the general public during the IPO. Chapters 4 and 5 provide a thorough explanation of the rationale for going public as well as the IPO procedure.

Secondly, Going public is primarily done to raise money for expansion projects or to pay out early investors. The company’s promoters might still require additional funding after the IPO. They are listed on the exchange and traded in the secondary market. There are three possibilities: Rights Issue, Offer for Sale, and Public Offer Subsequent.

The Broker of Stock

Importantly, The promoters have the option to solicit additional. By funding from their current investors. They provide them with new shares at a reduced price.

In proportion to the existing shares held by shareholders, the company issues new shares. For instance, a 1:4 rights issue would offer 1 additional share for every 4 shares already held.

This option may seem appealing, but it restricts the company from raising money from a select group of shareholders. Who may not want to make additional investments?

Since, When shares are created and offered to shareholders as part of a rights issue, the value of the previously held shares is diminished.

OFS

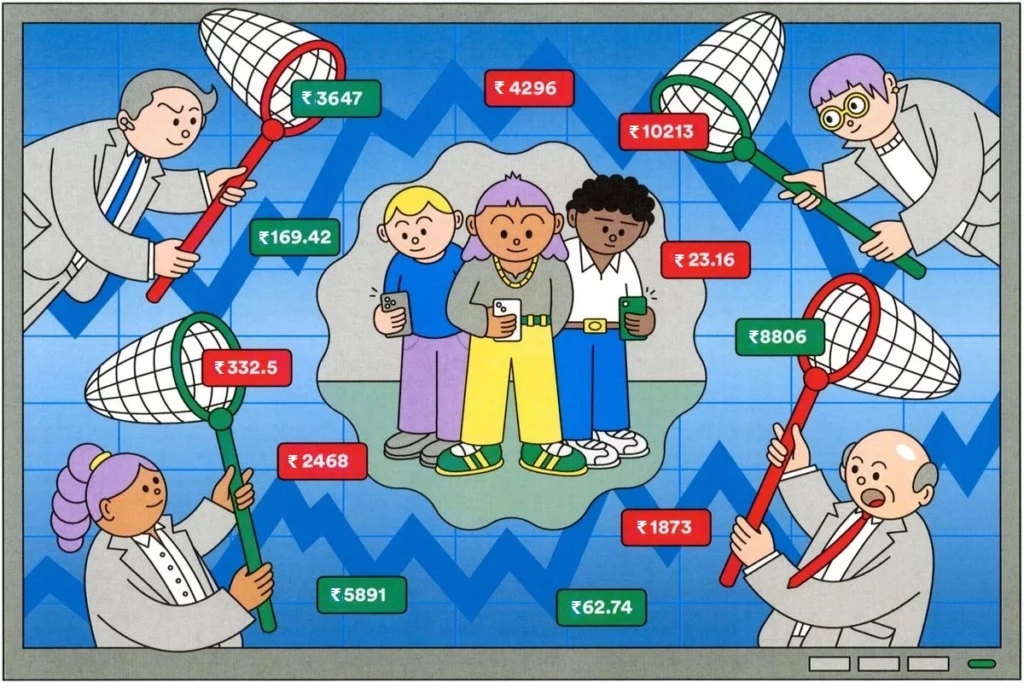

Undoubtedly, The promoters can choose to offer the secondary issue of shares to the whole market. Unlike a rights issue restricted to existing shareholders. Moreover, The Exchange provides a separate window through the stockbrokers for the Offer for Sale.

The exchange allows a company to route funds through OFS only if the Promoters want to sell out their holdings. Maintain minimum public shareholding requirements (Govt. PSU has a public shareholding requirement of 25%).

Also, there is a floor price set by the company, at or above which both Retail and Non-Retail investors can make bids. The shares are allotted, and if bids are at a cut-off price or above will be settled by the exchange into the investor Demat account in T+1 days.

For example, an Offer for Sale is NTPC limited. Which offered a maximum of 46.35 million shares at a floor price of Rs 168 and was fully subscribed in the 2-day period. The OFS was held on 29th August 2017 for Non-Retail Investors and 30th August 2017.

FPO

Definitely, The goal of an FPO is to raise additional capital after it has been listed, but it uses a different application and shares allocation process. Without a doubt, An FPO allows for the creation of new shares as well as the diluting of existing ones. Similar to an IPO, an FPO requires the appointment of Merchant Bankers to draught a Draft Red Herring. Furthermore, The prospectus that must then be approved by SEBI before bidding can begin within a three to five-day window.

Shares are allocated based on the Cut-off Price decided after the book-building process. Investors can place their bids through ASBA. At last, FPOs are rarely used now that OFS has been available since 2012 because of the drawn-out approval process.

Accordingly, The FPO is made public knowledge after the company selects a Price Band. Interested parties can apply offline at a bank branch or online through the ASBA portal using Internet Banking. Especially, Following the close of the bidding, the demand-based cut-off price is announced. The additional shares awarded are listed on the exchange for trading in the secondary markets.

Certainly, Engineers India Ltd. underwent an issue in February 2014 with a price range of Rs. 145–Rs. 150, is an example of an FPO. There was a threefold oversubscription for the issue. The shares were trading at Rs 151.1 on the day the issue officially began. The lower price band was 4.2% less expensive than the going rate.

Difference between OFS and FPO

- An OFS is used to offload Promoters’ shares while an FPO is used to fund new projects.

- Dilution of shares is allowed in an FPO leading to change in the Shareholding structure. While OFS does not affect the number of authorized shares.

- Only the top 200 companies by Market Capitalisation can use the OFS route to raise funds while all listed companies can use the FPO option.

- Ever since SEBI introduced OFS, FPO issues have come down, and companies prefer to choose the OFS route to raise funds