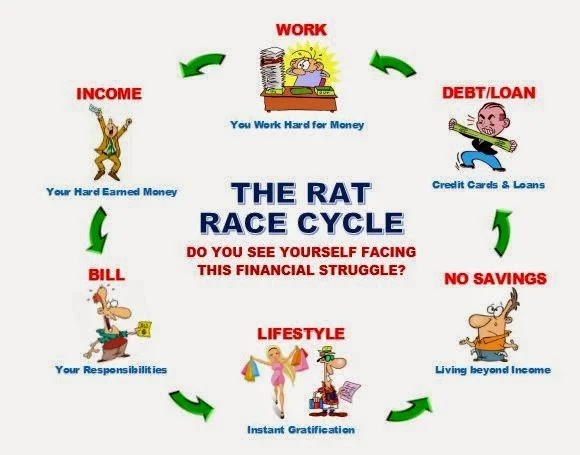

Buying or selling stocks or other financial instruments with the purpose of keeping them for a long time—typically from a few weeks to several months—is known as position trading in the Indian stock market. Investors that are less concerned with short-term price volatility and more confident in the long-term potential of the securities they trade frequently employ this method.

The following list includes salient qualities and characteristics of positional trading in the Indian stock market:

- Longer Time Horizon: Positional traders have a longer time horizon for their investments than day traders or swing traders do. They seek to profit from the long-term price trend by basing their bets on fundamental analysis, technical analysis, or a mix of the two.

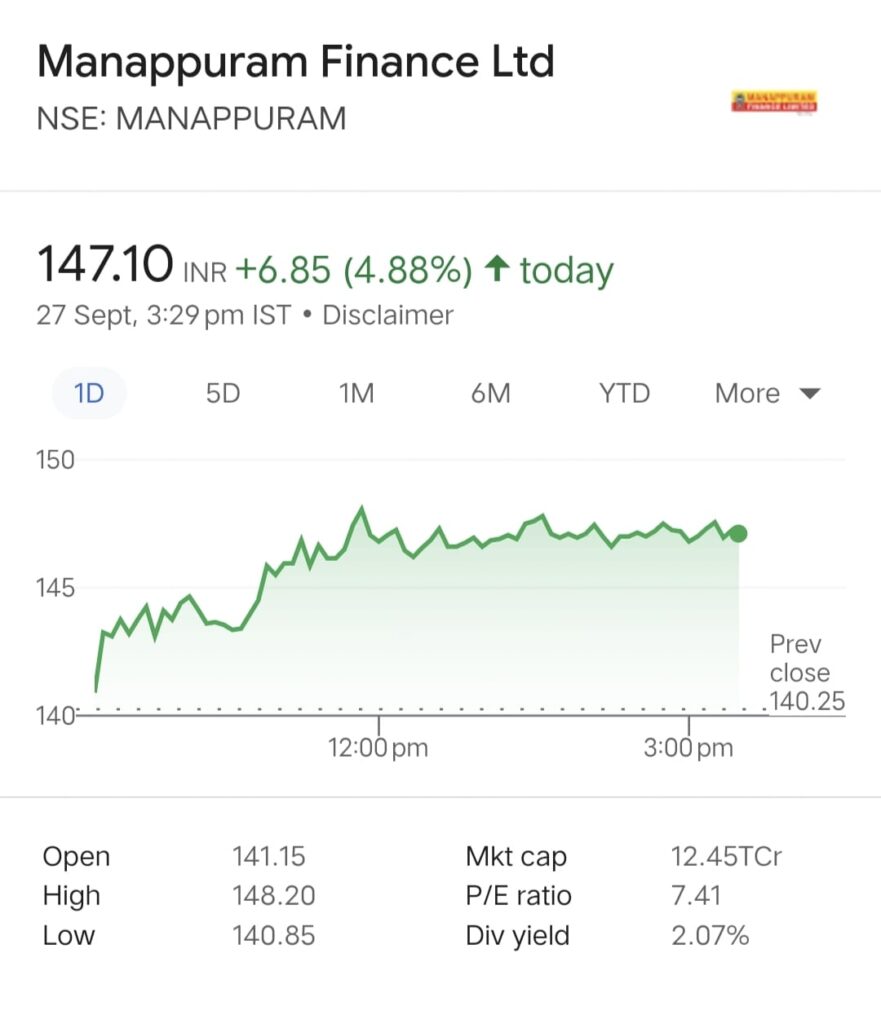

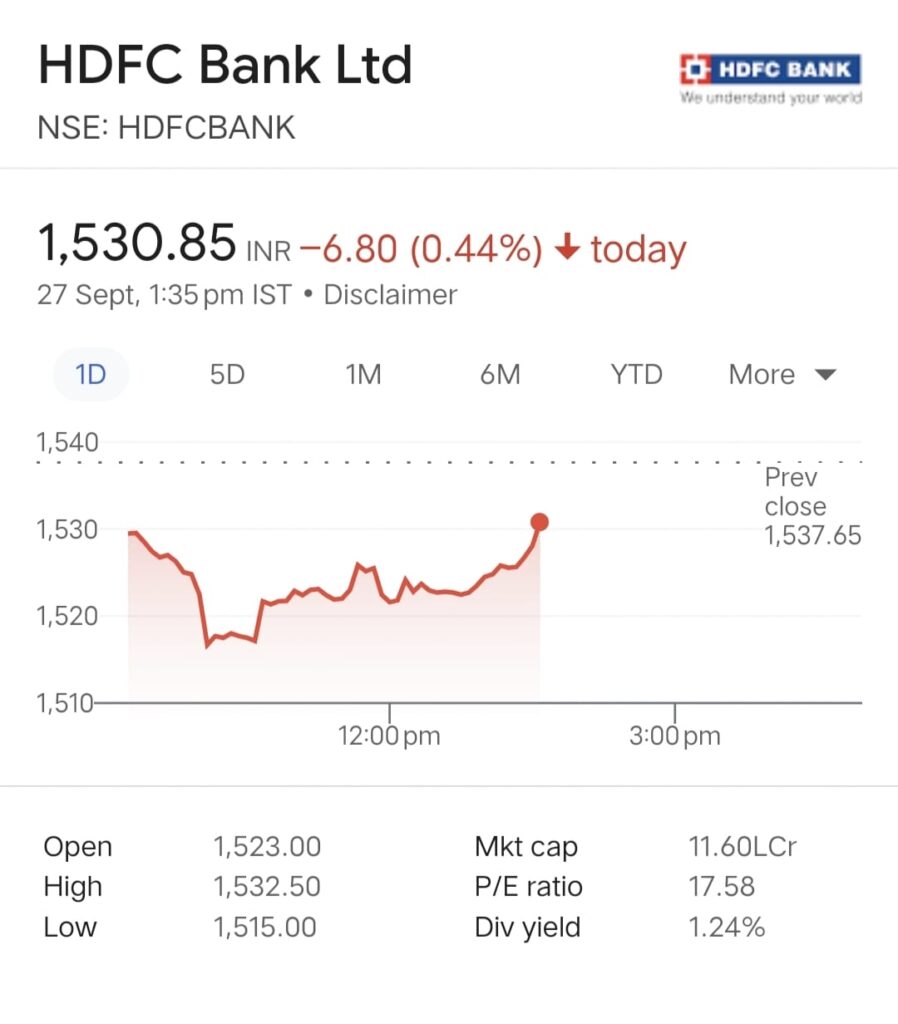

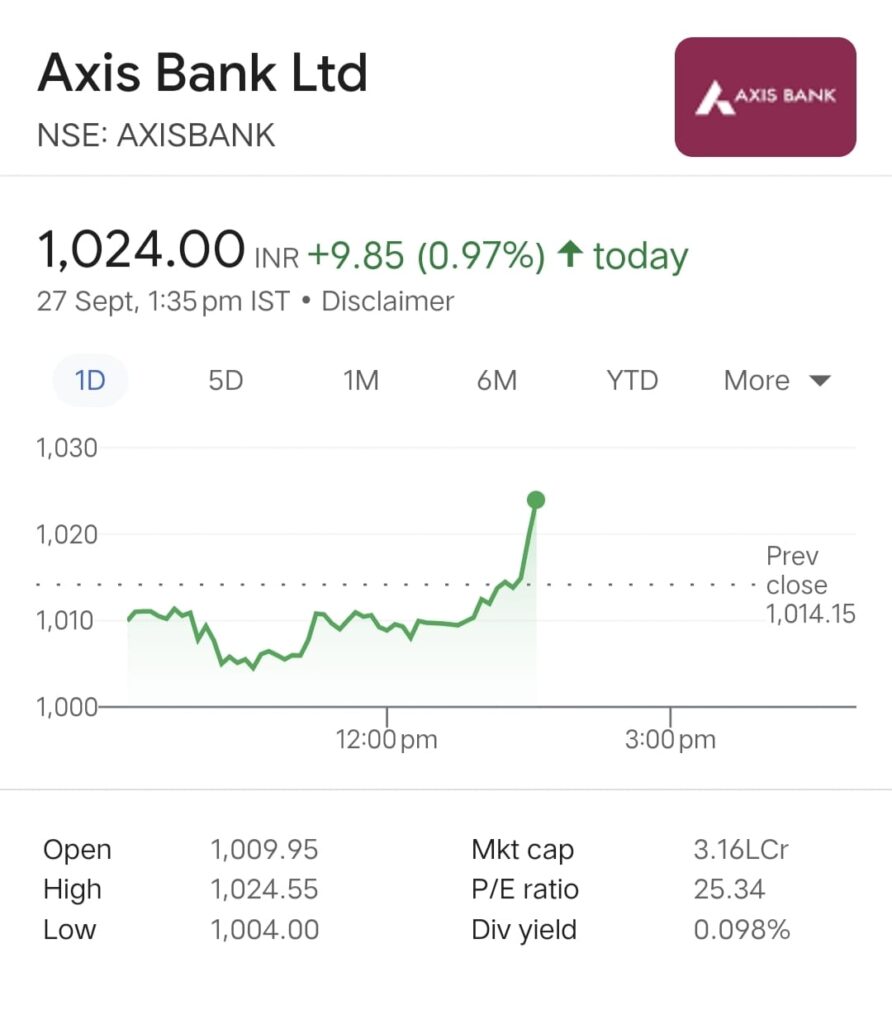

- Fundamental Analysis: Positional traders frequently concentrate on fundamental analysis, which entails assessing a company’s financial standing, earnings potential, market trends, and other elements that may have an impact on the stock’s long-term performance. They frequently take into account elements like sales growth, earnings reports, and competitive positioning.

- Technical Analysis: Some traders who take positions also use technical analysis, which entails examining past price patterns and charts to find potential entry and exit points. Trading decisions are based on technical indicators and chart patterns.

- Risk management: To safeguard their investments over the long run, positional traders frequently use risk management techniques. In order to reduce possible losses, this may involve placing stop-loss orders, diversifying their portfolio, and adjusting position sizes.

- Less Frequent Trading: Positional traders make fewer deals over a longer period of time than day traders, who make many trades in a single day. This lowers transaction costs and enables them to concentrate on fewer, carefully thought-out investments.

- Market Trends:Positional traders frequently try to capitalise on significant market trends. In an effort to benefit from larger market moves, they might purchase equities during bullish (raising) trends or sell them during bearish (falling) trends.

- Patience:Patience is a crucial quality for positional traders. They are prepared to put up with short-term market swings and maintain their positions until their investing thesis is proven correct.

- Exit Strategy: Positional traders have an established exit strategy. When a predetermined profit target is attained, when certain technical or fundamental requirements are satisfied, or if the trade is not going according to plan, they may elect to sell their positions.

- Research and Analysis: Thorough research and analysis are essential for successful position trading. The most recent news, economic trends, and company-specific events that may affect their positions must be kept up with by traders.

- Tax considerations: Depending on variables like the holding term and the applicable tax system, positional trading may or may not be taxed differently in India. Traders need to be aware of how their trades will affect their taxes.

Positional trading is a tactic that works well for people who have a longer time horizon for their investments and who have the analytical skills and decision-making capacity to make wise bets. To be successful in positional trading on the Indian stock market, traders must have a clearly defined trading plan and risk management technique.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en