Best Telegram Channel For Intraday Trading

Step into the fast-paced world of intraday trading where every moment counts! Do you find yourself spending hours researching market trends only to fall short of your desired results? Well, it’s time to upgrade your trading game with our list of the 10 best intraday Telegram channels that offer intraday telegram tips, insights, and strategies to help you make profitable trades.

What is Intraday trading

The Buying and selling of the stock on the same trading day is known as intraday trading. This is quite famous among the trades that gain capital with high risk and reward. Choosing a stock for intraday trading is quite tasking work. The

Stock must have high liquidity, volatility, Strong Volumes, and hefty volume.

Top 10 telegram channels for intraday

It does not matter what kind of investment or trading you are interested in whether it is Intraday, Swing trading, Futures and options, Commodities, forex, etc. These telegram channels are going to provide you with the latest news, trends, sector rotation, and New updates as Learning Sharks tells you here are the top 10 best telegram channels for intraday trading.

Telegram Channel Name | No. of Subscribers | Telegram Channel Link |

Rupee Gainers | 10,011 | |

Nifty 50 Stocks | 42, 083 | |

Stocks Times | 62, 312 | |

Hindustan Trader | 49, 737 | |

chaseAlpha | 36,095 | |

VISION TRADING | 9,912 | |

equity99 | 1,41,848 | |

Usha’s Analysis | 2,15, 686 | |

CA Jagadeesh | 23 009 |

1. Rupee Gainers

Rupee Gainers the one of the biggest telegram channels for the finance world. The telegram channel is created to share information of the Indian rupee and Indian stock market. It provides the real-time update and financial reports of the Indian stock market. Currently, they are offering a subscription for investment advice, and as per the Learning Sharks’ research, 70% of their subscriber are profitable.

Top Features and the company information

Total Subscribers of the company: 250000

Founded in: 2019

2. Nifty 50 Stocks

The Nifty 50 stocks are the leading stock advisory channel. This channel mainly focused on intraday trading and swing trading. They also provide real-time data on the stock market like trend, sector rotation, and trending news which can affect the stock market

Top Features and the company information

Total Subscribers of the company: 400000

Founded in: 2019

Free tips and tricks

Education reels and videos

3. Stock Times

Stock Times is the leading stock research group which is owned by Ashish Kumar for all your investment options. The Telegram channel is for both noob and experienced traders. The approach is quite simple they provide simple practical knowledge and course video which is absurdly free.

Top Features and the company information

Daily Stock Market update

Free Investing Tips

Future and options calls

Channel followers: 62000

4. Hindustan Trader

Hindustan Trader is a popular channel on the telegram offering chart analysis, fundamental analysis and company information. This channel provides the information, strategies, and learning to their valuable followers

Top Features and the company information

Daily free 3-4 options call and intraday calls

Free Investing Tips

Helpline support as well

Live trading on YouTube

Channel followers: 50000

5. ChaseAlpha

ChaseAlpha is a start-up founded by a Pune-based trader. He provides intraday and swing trading calls to his followers, mainly trading in futures and options.

Top Features and the company information

Paid subscription

Exclusive free course for intraday trading

Channel subscribers: 12000

6. Vision trade

Vision Trading is one of the best Telegram channels for intraday trading. Along with trading, they offer a wide range of services, stocks, currencies, and commodities. They have their own software, like TradingView and Scanner, which is paid.

Top Features and the company information

Paid subscription

Exclusive free course for intraday trading

Channel subscribers: 12000

7. equity99

Equity99 is one of the oldest telegram pages, they provide intraday calls and future and options calls to the subscribers, and they also provide long-term and short-term recommendations about the stocks and mutual funds on telegram

Top Features and the company information

Mainly they focus on stop-loss strategies

Provide authentic call

90% accurate information

8. Usha’s Analysis

I think this is the most hated telegram channel but as per Learning Sharks Research they provide 70% accurate trading tips, they have the best business strategies for swing trading but intraday trading and the future and option 95% of their calls are worthless.

Top Features and the company information

Transparent analysis < Swing Trading>

Educational Content

Channel Subscriber: 7000

9. CA Jagadeesh

The most followed trading channel is trading with ca Abhi. This channel provides stock market news updates and tips for stock trading. The owner of this channel is the CA who believe in long-term investing. They also provide the intraday signals to their followers.CA Jagdish is the financial planner and the swing trading splices. He is known for his good understanding of swing trading. The recommendation he gives is totally for the experienced trader.

Top Features and the company information

Advanced trading tools

SEBI Registered

Offers educational material and webinars

How to join the intraday trading tips channel

Step 1 : You can download Telegram free from the Google Play Store or app store.

Step 2 : Log in to telegram with your phone number

Step 3 : Go to the search bar and search for your favourite

Step 4 : Then you can join the group yourself

Things to know before joining the telegram channel

1. Check the credibility of the telegram page and channel by yourself Must check the rating and the subscriber feedback.

2. The channel must be SEBI Registered and must be owned by a public figure.

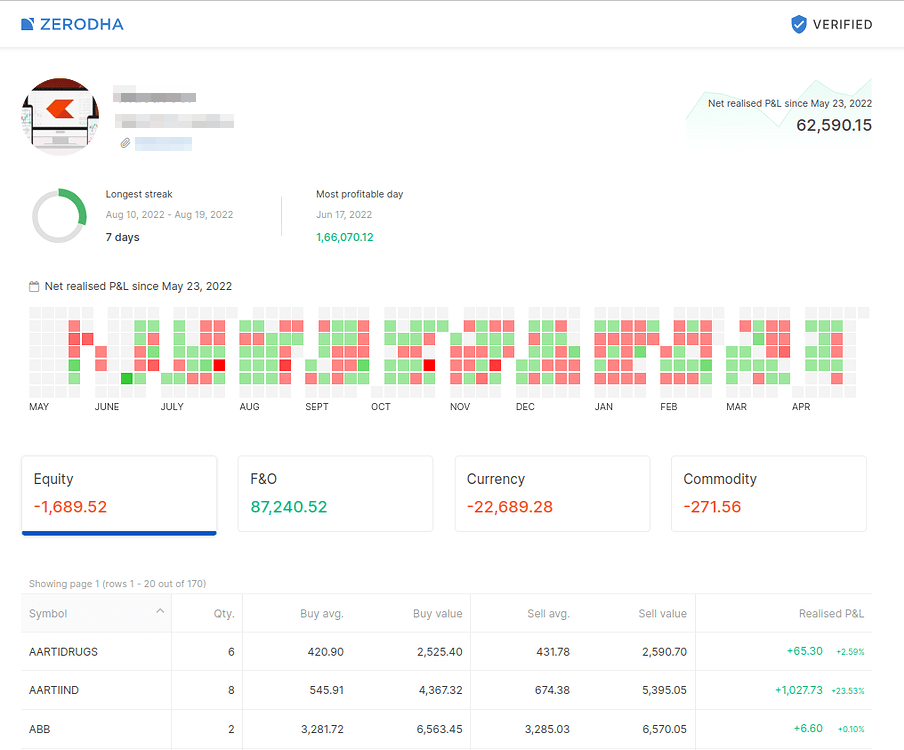

3. P&l Statement Of the admin must be publically available.