The stock increased by another 5% to Rs 263.65 during its first trading session on Tuesday, bringing the overall gains to 166% over the stated issue price of Rs 100.

It offers services such as airport rescue and fire fighting vehicles, high-rise building rescue, evacuation, and fire-fighting equipment, industrial fire engines, runway rubber removal, and paint removal machines, runway sweeping, and bay cleaning, among others.

Anlon Technology Solutions, the newest Dalal Street debutant, gave its investors a strong listing pop of 150% on Tuesday. Even in the SME market, it is one of the best listing pops in the near future.

Anlon Technology Solutions, which made its debut on the NSE’s SME platform, reached a settlement price of Rs 250 per share on Tuesday, increasing by 150% over its initial offering price of Rs 100 per share.

The stock increased by another 5% to Rs 263.65 during its first trading session on Tuesday, bringing the overall gains to 166% over the stated issue price of Rs 100.

Anlon Technology Solutions’ initial public offering (IPO) was open for subscription between December 29, 2022, and January 2, 2023. The company sold its shares for between Rs 95 and Rs 100 each in order to raise Rs 15 crore.

Let’s look at the fundamentals of the stock.

Profit & Loss

Figures in Rs. Crores

| Mar 2020 | Mar 2021 | Mar 2022 | |

|---|---|---|---|

| Sales + | 13.69 | 14.35 | 19.34 |

| Expenses + | 12.67 | 13.07 | 15.23 |

| Operating Profit | 1.02 | 1.28 | 4.11 |

| OPM % | 7.45% | 8.92% | 21.25% |

| Other Income + | 0.13 | 0.09 | 0.25 |

| Interest | 0.07 | 0.14 | 0.75 |

| Depreciation | 0.13 | 0.19 | 0.20 |

| Profit before tax | 0.95 | 1.04 | 3.41 |

| Tax % | 28.42% | 29.81% | 28.74% |

| Net Profit | 0.69 | 0.74 | 2.43 |

| EPS in Rs | 690.00 | 740.00 | 2,430.00 |

| Dividend Payout % | 0.00% | 0.00% | 0.00% |

Balance Sheet

Figures in Rs. CroresCORPORATE ACTIONS

| Mar 2020 | Mar 2021 | Mar 2022 | |

|---|---|---|---|

| Share Capital + | 0.01 | 0.01 | 0.01 |

| Reserves | 1.71 | 2.45 | 4.88 |

| Borrowings + | 0.18 | 1.61 | 5.81 |

| Other Liabilities + | 9.15 | 11.46 | 10.27 |

| Total Liabilities | 11.05 | 15.53 | 20.97 |

| Fixed Assets + | 1.73 | 1.59 | 3.87 |

| CWIP | 0.00 | 0.00 | 0.00 |

| Investments | 0.00 | 0.00 | 0.00 |

| Other Assets + | 9.32 | 13.94 | 17.10 |

| Total Assets | 11.05 | 15.53 | 20.97 |

The issue received a whopping 428.6 subscriptions, with the non-institutional bidder allocation receiving 883.58 subscriptions and the retail bidder quota receiving 447.06 subscriptions. It was reserved 54.53 times for institutions that met the criteria.

Each lot in the issue cost Rs 1.2 lakh and had a fixed lot size of 1,200 shares. Each lot at listing cost Rs 3 lakh, giving the investors who received the share allocation a profit of Rs 1.8 lakh.

Conclusion

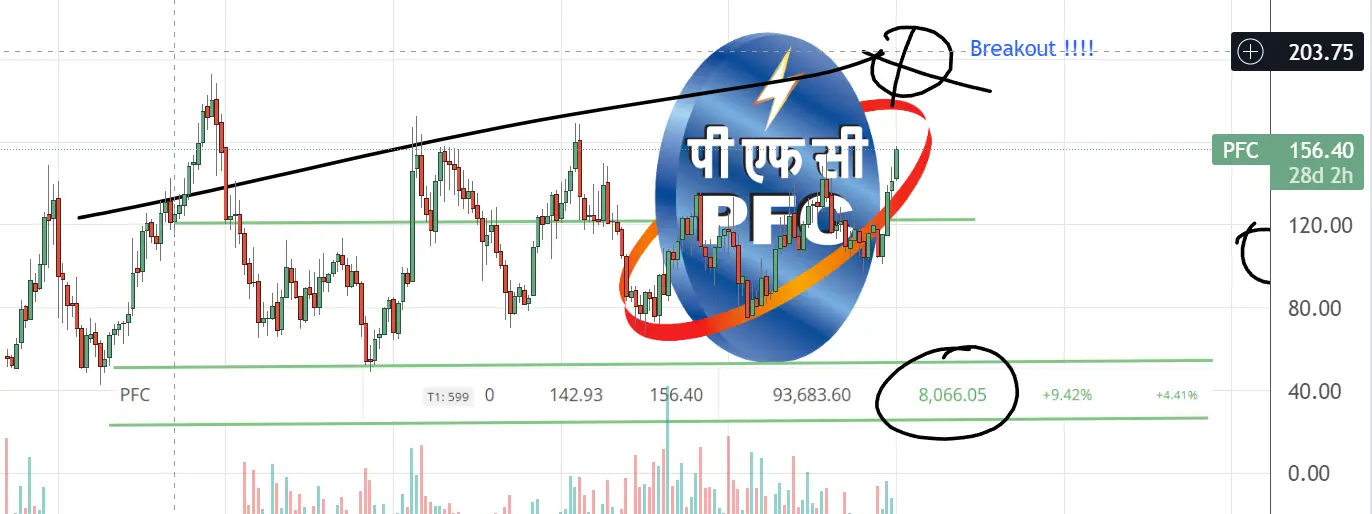

Overall, the company seems to be doing good in terms of profitability. One can make this stock a part of their portfolio for the long term. However, it is advised to wait for the stock to find it support and resistance.

This is purely for educational purposes. If you are interested in the stock market courses, you can visit our courses page.

#anlontechnologyshareprice #latestshareprice #stockmarket #sharemarket