You must be wondering what’s there to talk on the rain. We cannot control it. As if we can control stock market either. Is your portfolio in red? No biggie, it’s been with everyone. it’s getting so hot outside. we think they are related.

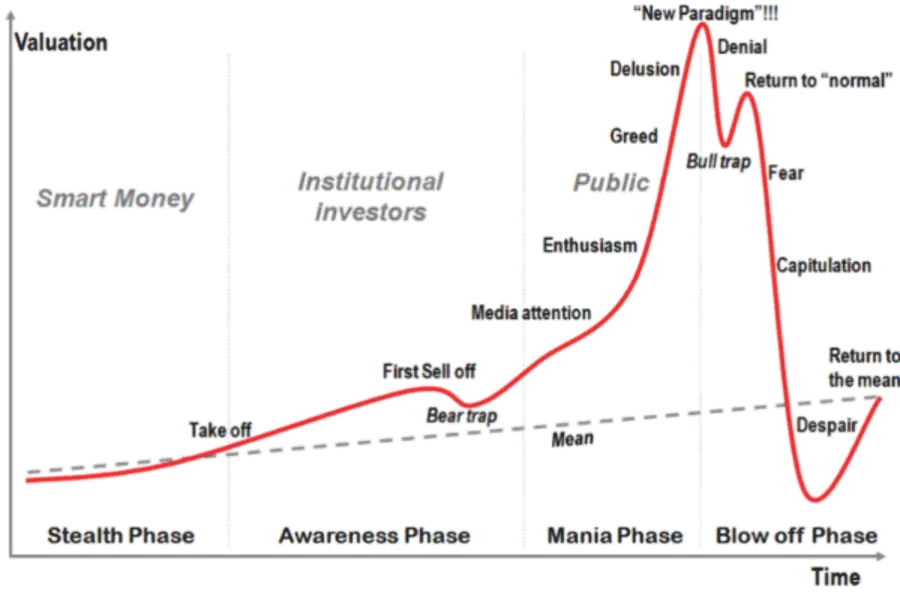

The stock market has been facing a downfall like anything. FII are selling like crazy. When will it stop? this must be your question. Don’t worry, this is not the first time, is it?

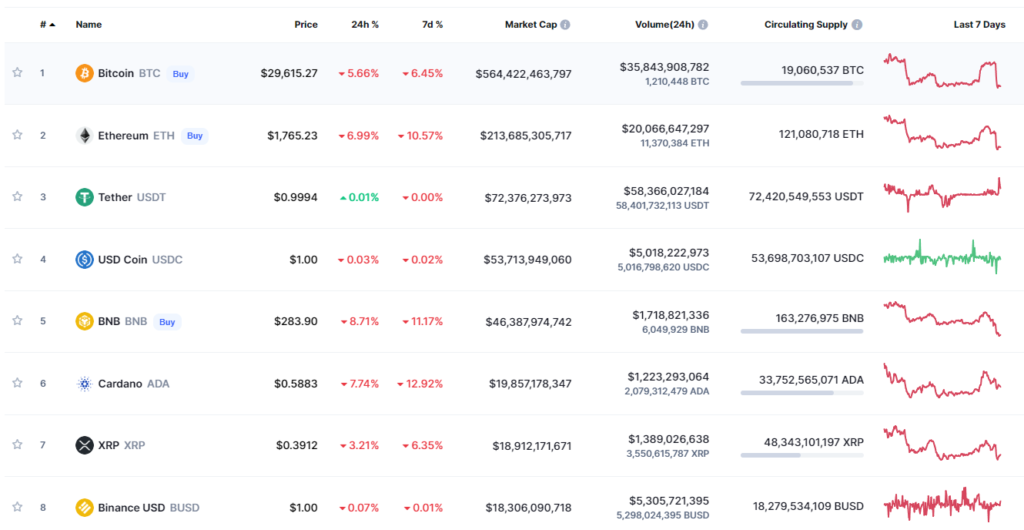

Today, NIFTY 50 is trading at 15554.30 -0.88 % and SENSEX 52150.17 -0.74 %. The last time we have seen a crash was back in 2019. We all witnessed a v shape recovery. can we expect it again?

where is this economy headed?

We follow the US economy even though we do not rely much on the west. The U.S has been under tremendous stress. Biden’s comments over the market just make it worst. People are losing trust in the economy’s stability. We are in India, we should not worry that much. Of course, the herd mentality will impact our stock market. Ones who sell it now will regret it.

Should you buy it?

Well, you can start accumulating the shares. There are amazing stocks one can buy with strong fundamentals. Focus on buying those. Some of the stocks are down 50% from their 52-week high. Consider accumulating those. The stock market is a cycle. Operators wait for the retailers to get then, then they start selling only to buy. you should be happy that you are getting a buying opportunity soon.

How is weather related to the stock market?

Looking at history, it has been seen that June and July have always been the worst months. For the stock market, they act unfavourably. Which makes it sensible too for some reason. Matter of fact, December also isn’t the best. We do hope we see the rain in your portfolio.

Learning sharks stock market institute has been around teaching students trading and investing. If you are in the market and facing loss. Probably, you are not invested in the right share.

Learn to trade and invest in the stock market from experts.

#stockmarket #weather #stockmarketinstitute #stockmarketcrash #opportunity