Psychology and Risk Management

• What to expect

• Risks

• Position sizing

• illusion of control

• Accepting critisism

• Paralyzed by fear

• Loss is a feedback, not a failure

• The flexible trader

• Focusing on the positive

• Short straddle

• The dynamics of greed

• The herd mentality

• Notes

The most challenging aspect of trading is finding a trading strategy that will work reliably. The possible strategies are endless. Some traders carefully backtest historical data and try to find a strategy that worked in the past, and bet that it will work in the future. Other traders intuitively feel that there are some points during the trading day that the markets are overbought and try to capitalize on a reversal. Regardless of the strategy, one uses, though, one must have faith in the strategy when it comes time to execute the trade. There’s only so much that can be done before a trade is executed, but once you’ve done all the preparation you can do, you must decisively put on the trade and trade your plan.

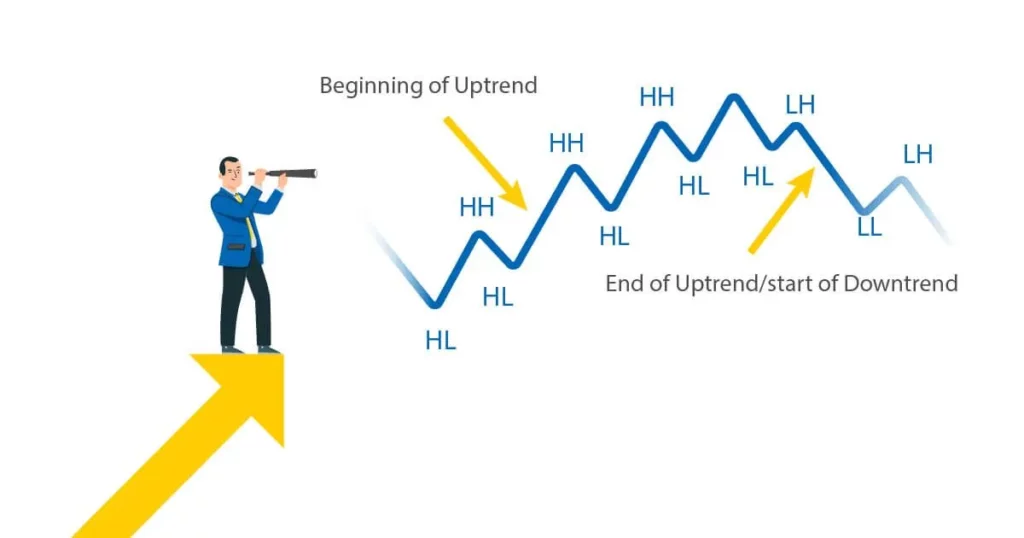

Often, it is simpler to say than to do. When a tactic consistently produces positive results, it is simple to put your belief in it. A approach, though, occasionally seems to work more intermittently. One may begin to question the plan at these points. So what do you do? It is tempting to just give up on the plan and try something fresh. But if one switches back and forth between approaches, one cannot trade consistently. It is vital to persist with a strategy for long enough to see if it works in order for the law of averages to operate in one’s favour.

Make sure you profit from a successful plan when you find one. There are times when you experience a run of favourable circumstances. The probabilities are definitely in your favour, but to take advantage of chance, you must force yourself to make trade after trade. Such a move may appear random and haphazard to the investor with a scientific bent, but studies of probability show that there are instances in which heads appears repeatedly in a long string in a hypothetical coin toss. A run of successes might happen similarly in the markets. It would be prudent to capitalise on a winning streak if you found one.

However, if you make trading mistakes or your confidence is low, you won’t be able to profit from it. This is when having developed trading abilities is beneficial. The more abilities you possess, the easier it will be for you to execute trades correctly and profit from market circumstances that will help your approach produce a winning streak.

Similar to winning streaks that occur when a strategy consistently works, poor luck runs can also occur. Even though it makes sense, a plan doesn’t actually work. There isn’t much you can do in these circumstances.

The psychological challenge is in knowing when to change course and when to continue with a course of action. There isn’t a straightforward answer. On the one hand, you don’t want to stick with it and blow out your account, but you also don’t want to give up on it too soon. Choosing how much of your account you will allocate to a specific strategy in advance is one option.

Let’s take an example where your technique is predicted to be successful 80% of the time based on previous data analysis. You might choose to use the method for a dozen trades and risk around 25% of your capital. In other words, you would be willing to lose 25% of your capital in the worst-case situation.

Unfortunately, there isn’t a secure, guaranteed technique to choose whether to continue with or abandon a strategy. Ultimately, you must make a decision, and it can just be a matter of making an educated guess based on your prior experiences. Because of this, trading is primarily psychological in nature. Being a successful trader ultimately comes down to having the capacity to make the proper choice when it matters most.