We will share the essential tactics and knowledge you require to succeed in stock market investing in this in-depth guide. Our expert knowledge will enable you to make well-informed decisions and maximize your returns, whether you are a novice investor or seeking to hone your abilities.

Understanding the Stock Market

Stock Market Basics

To become a successful investor, it’s vital to grasp the fundamental concepts. Stocks represent ownership in a company, and their prices fluctuate based on various factors, including company performance, market sentiment, and economic conditions.

Market Indices

Market indices, such as the S&P 500 and Dow Jones Industrial Average, measure the performance of a group of stocks. These benchmarks provide insights into the overall market’s health and can guide your investment decisions.

Building a Solid Investment Strategy

Define Your Financial Goals

Before you start investing, determine your financial objectives. Are you looking for long-term growth, income, or both? Having a clear goal will help shape your investment strategy.

Diversification

Diversifying your investment portfolio across various asset classes, industries, and geographical regions can reduce risk. Consider allocating your funds to stocks, bonds, and other assets to achieve a balanced and resilient portfolio.

Risk Tolerance

Understanding your risk tolerance is essential. Some investors are comfortable with higher risks for potentially higher returns, while others prefer a more conservative approach. Assess your risk tolerance and align your investments accordingly.

Fundamental Analysis

Conduct thorough research on companies before investing. Analyze financial statements, competitive positioning, and industry trends to identify fundamentally strong stocks.

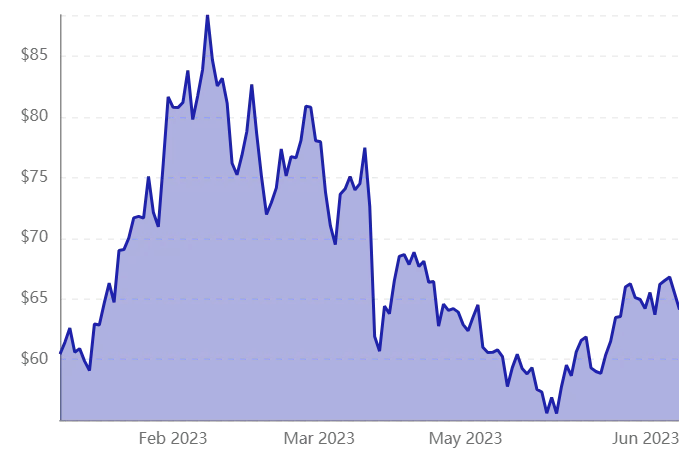

Technical Analysis

Technical analysis involves studying price charts and patterns to predict future price movements. Combining technical analysis with fundamental analysis can provide a well-rounded perspective.

Investment Strategies

Long-Term Investing

Investing with a long-term perspective allows you to ride out market fluctuations. Historically, long-term investors have seen substantial returns on their investments.

Value Investing

Value investors seek undervalued stocks that have the potential for growth. They believe that the market often undervalues quality companies, offering an opportunity for profit.

Dividend Investing

Dividend stocks provide a consistent income stream through regular dividend payments. This strategy is favored by income-focused investors.

Growth Investing

Growth investors target companies with high growth potential, even if they may not pay dividends. These stocks are often associated with higher volatility.

Risk Management

Stop-Loss Orders

Implementing stop-loss orders can limit your potential losses by automatically selling a stock if it reaches a specified price.

Portfolio Monitoring

Regularly monitor your investments to stay informed about market developments and adjust your portfolio as needed.

Tax-Efficient Investing

Tax-Advantaged Accounts

Utilize tax-advantaged accounts like IRAs and 401(k)s to minimize your tax liability and boost your long-term returns.

Conclusion

Mastering stock market investing is a journey that requires continuous learning and adaptation. By understanding the basics, defining your goals, and employing sound investment strategies, you can build a successful portfolio that withstands market volatility and delivers long-term financial growth.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en