HISTORY OF MARKET CRASH IN INDIA KNOWN AND UNKNOWN

— The Harshad Mehta Scam

The Indian stock market’s “Sunny Deol,” “The Big Bull,” and ultimately the name of his swindle all applied to Harshad Mehta. Broker Harshad Mehta was renowned for leading a lavish, opulent lifestyle. He took advantage of rules that prevented banks from making stock market investments in the 1980s and 1990s.

Harshad Mehta promised banks a high return and took money from banks to invest in the stock market. Mehta would invest in particular securities, and as a result of the significant investments made on behalf of the banks, the demand for such shares would increase. He would then sell the goods and give the banks a share of the revenues.

He sold all of his market holdings that day as a result of the overvalued equities, which caused the stock markets to crash.

Market me Sabse bada jokhim, jokhim na lene mein hai.”

-Harshad Mehta

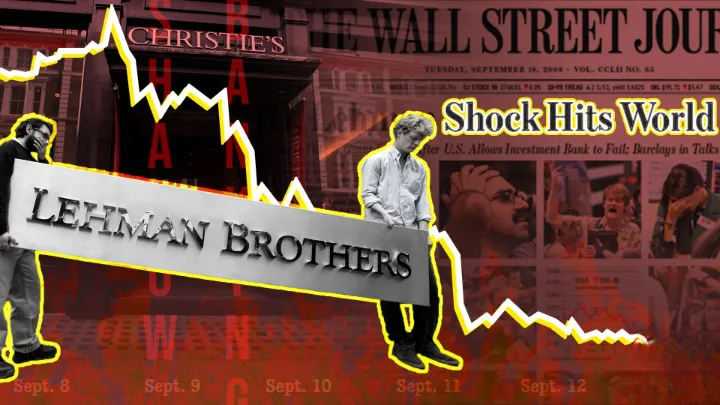

— The 2008 Financial Crisis

On January 21, 2008, the BSE dropped 1,408 points to 17,605, causing one of the biggest losses in investor wealth. Due to a technical problem, the BSE temporarily halted trading at 2:30 p.m. despite the fact that its circuit filter permits up to 15% movements before halting trading for an hour.

Analysts at HSBC Mutual Fund and JP Morgan attributed the decline, which the media dubbed “Black Monday,” to a variety of factors, including a change in the global investment environment, worries about a US recession, selling by FIIs and foreign hedge funds to reallocate money from risky emerging markets to safer developed markets, a reduction in US interest rates, and international bourses.

“If a financial institution is too big to fail, it is too big to exist.”

– Bernie Sanders, U.S.

2007’s disasters

Throughout the financial crisis of 2007-2008, the Indian stock markets crashed on many occasions in 2007 and 2008. In 2007, the stock markets had five significant declines.

2 April 2007: The Sensex slid 617 points to 12,455, and it continued to drop significantly throughout the day. Following the Reserve Bank of India’s [Get Quote] decision to provide incentive to the cash reserve ratio and repo rate, the Sensex started out with a significant negative gap of 260 points at 12,812, according to Rediff experts. Due to relentless selling, primarily in the auto and banking business sectors, the index reached fresh lows.

Some people don't like change, but you need to embrace change if the alternative is disaster

2015’s disasters

The Sensex declined 854 points to 26,987 on January 6, 2015.

The BSE Sensex dropped 1,624 points and the NSE dropped 490 points on August 24, 2015. The indexes ended the day at 25,741 points, with the Nifty closing at 7,809 points. The cause of the crash was attributed to a ripple effect caused by worries of a Chinese slowdown, since the Yuan had been devalued two weeks prior, causing a drop in currency rates and quick selling of equities in China and India.

Shanghai’s stock exchange also dropped by 8.5 percent. Analysts cited a range of additional explanations for the drop, including weak first-quarter profits for several Indian businesses, grim management comments that cast doubt on their comeback, and more.

I always tried to turn every disaster into an opportunity.

COVID -19

When the Union budget for FY 2020-21 was delivered in the lower house of the Indian parliament on February 1, 2020, the Nifty plunged by more than 3% (373.95 points), while the Sensex fell by more than 2%. (987.96 points). The worldwide collapse caused by the coronavirus epidemic focused in China also contributed to the decline.

The Sensex plunged 1448 points and the Nifty fell 432 points on February 28, 2020, as a result of rising global tensions caused by coronavirus, which the World Health Organization has indicated has pandemic potential.

Both the BSE and the NSE declined for the whole week, concluding with the biggest weekly drop since 2009.

Markets dropped by roughly 1000 points on March 4 and 6, wiping away many crores of value. Yes Bank was taken over by the RBI for rebuilding on March 6, 2020, and will be merged into SBI. This was done to safeguard the bank’s seamless operation, since it had been suffering for a few years to cope with tremendous strain owing to the cleansing of bad loans.