What Is a Bear Market and How Should You Invest in One?

Investors are aware that a bull market is one in which stock prices have increased and a bear market is one in which stock prices have decreased. But what constitutes a “bear market” exactly?

Let’s take a look at the actual definition of a bear market, what causes a bear market to occur, the difference between a bull market and a bear market rally, and other key concepts investors should know.

What is a bear market?

A 20% decline from recent highs is often considered a bear market. The performance of the S&P 500, which is typically seen as a benchmark indicator of the entire stock market, is the subject of the phrase’s most frequent use.

Bear markets, however, can refer to any stock index or a specific stock that has declined by 20% or more from recent highs. As an illustration, we may claim that the Nasdaq Composite entered a bear market when the dot-com bubble burst in 1999 and 2000. Or, suppose a certain company publishes weak earnings and sees a 30% decline in the value of its stock. We may say that the stock has entered a bear market due to its price decline.

Causes of a bear market

There are several potential causes for a bear market, but investor anxiety or uncertainty is typically one of them. The most recent bear market in 2020 was brought on by the global COVID-19 epidemic, but other factors in the past have included massive investor speculation, reckless lending, changes in the price of oil, excessive leverage in investments, and more.

Bear vs. bull

In many ways, a bull market is the polar opposite of a bear market. Bull markets happen when stock prices climb steadily, and they are frequently characterised by high consumer confidence, low unemployment, and robust economic development.

A bull market is typically thought of as a 20% increase from the lows of a bear market, albeit the definition is less exact than that of a bear market. Investors generally identify the bottom of a bear market as the beginning of a bull market. The S&P 500, for instance, reached the financial crisis’ lows in March 2009, which is seen as the beginning of the bull market, which lasted until early 2020.

How to invest in a bear market

Investors may experience fear during down markets, and nobody likes to see the value of their investments decline. On the other hand, while equities are trading at a discount, these can be opportunities to invest money for the long term.

In light of this, the following guidelines can help you invest wisely during a bad market:

Take a long view: Making impulsive decisions in response to market swings is one of the worst things you can do during a bear market. Over the long term, the typical investor severely underperforms the general stock market, and the main cause is that they enter and exit stock holdings too soon. When stock prices plummet and seem to go on forever.

- Focus on quality: When bear markets hit, it’s true that companies often go out of business. One of my all-time favorite Warren Buffett quotes is, “When the tide goes out, that’s when we find out who has been swimming naked.” In other words, when the economy goes bad, companies that are overleveraged or don’t have any real competitive advantages tend to get hit the hardest, while high-quality companies tend to outperform. During uncertain times, it’s important to focus on companies with rock-solid balance sheets and clear, durable competitive advantages.

- Don’t try to catch the bottom: Trying to time the market is generally a losing battle. One thing to keep in mind during bear markets is that you aren’t going to invest at the bottom. Buy stocks because you want to own the business for the long term, even if the share price goes down a little more after you buy.

- Build positions over time: This goes hand in hand with the previous tip. Instead of trying to time the bottom and throwing all your money in at once, a better strategy during a bear market is to build your stock positions gradually over time, even if you think prices are as low as they’re going to get. This way, if you’re wrong and the stock continues to fall, you’ll be able to take advantage of the new lower prices instead of sitting on the sidelines.

Bear market examples

Bear markets are rather typical. They have occurred 33 times since 1900, or once every 3.6 years on average. Just to give the most recent three prominent examples:

Dot-com crash of 2000–2002: As internet use grew in the late 1990s, technology stocks experienced a significant speculative bubble. The Nasdaq was particularly hard hit even though all major indices entered bear market territory once the bubble burst: By late 2002, it had fallen by about 75% from its previous highs.

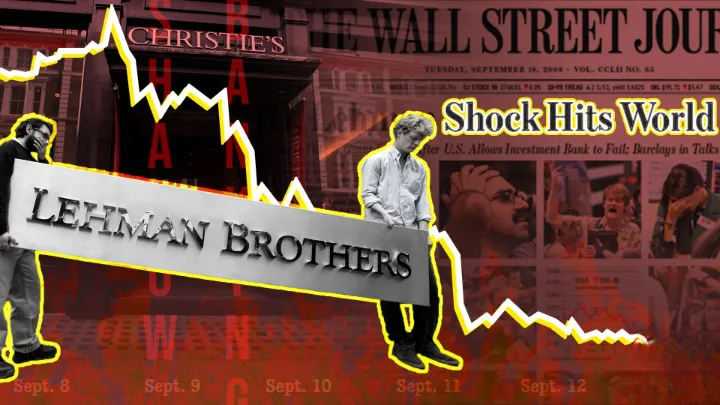

Financial crisis of 2008–2009: In 2008, a global financial crisis emerged due to a wave of subprime mortgage lending and the subsequent packaging of these debts into investable securities. Massive bailouts were needed after numerous bank failures in order to keep the U.S.