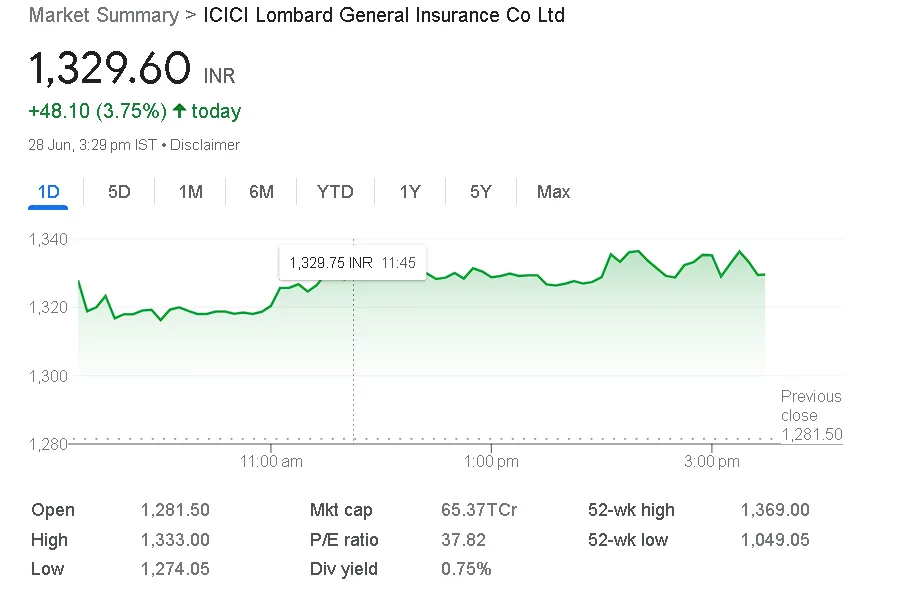

In Wednesday’s session, the stock of ICICI Lombard General Insurance ended flat at Rs 1329. The stock, which was trading near its 52 week high of Rs 1369 hit on August 17, 2022 opened at Rs 1,328 level in the previous session.

Motilal Oswal Research confirmed its buy call on ICICI Lombard General Insurance Company Ltd today, with a revised one-year target price of Rs 1,550. The aim represents a 17% increase over the previous BSE close of Rs 1327.05.

- ICICI Lombard General Insurance’s stock closed flat on Wednesday at Rs 1329. The stock, which was trading at its 52-week high of Rs 1369 on August 17, 2022, opened the previous session at Rs 1,328.

- The stock has risen 19% in a year and is expected to rise another 7% in 2023. In the most recent session, 1.29 lakh shares of the company changed hands, resulting in a turnover of Rs 17.13 crore.

In terms of technicals, the stock’s relative strength index (RSI) is 73.6, indicating that it is trading in the overbought zone.

- We believe these are possible through a) scale benefits driving down cost ratios and b) a stronger mix in the health segment with a bigger retail share.

ICICI Lombard General Insurance reported a 40% increase in profit in the March quarter of 2018 fiscal, at Rs 436.96 crore, compared to Rs 312.51 crore profit in the March quarter of 2022. The company reported a PAT of Rs 352.53 crore in the December 2022 quarter.

- Sales increased to Rs 5446.6 crore in Q4 2022, up from Rs 4799 crore in the previous quarter. In Q4, net premium earned increased by more than 12% year on year but decreased by 1.7% sequentially.

We raise our target multiple from 26x to 30x FY25E EPS as we believe the ICICI Bank share sale is now behind us. We maintain our BUY rating and revise our one-year target price to Rs 1,550.”

CONCLUSION

FOR MORE INDO CLICK THIS

SITE: https://learningsharks.in/

FOLLOW OUR