Psychology and Risk Management

• What to expect

• Risks

• Position sizing

• illusion of control

• Accepting critisism

• Paralyzed by fear

• Loss is a feedback, not a failure

• The flexible trader

• Focusing on the positive

• Short straddle

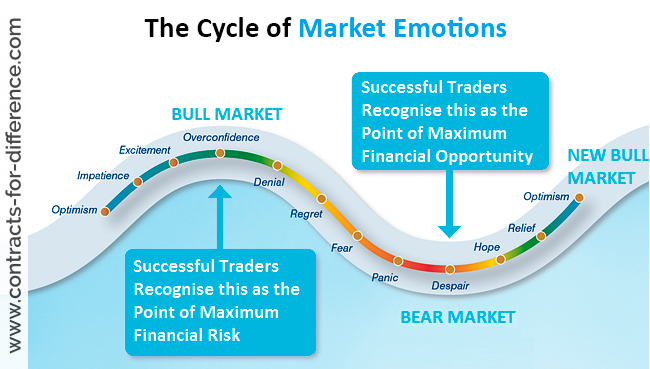

• The dynamics of greed

• The herd mentality

• Notes

Drive to Fail

Most traders will respond, “I want to make enormous returns,” Drive to fail in stock market, when asked why they trade. Although the majority of traders enter the industry with the intention of earning a sizable return on their investment, the vast majority blow out their funds. Why do traders lose so much money? The most obvious explanation for many is that they just lack trading knowledge. They don’t implement suitable risk controls. They lack sufficient financial resources. They lack enough training and a reliable trading platform. They lack effective, dependable trading methods. And for many, they lack useful benchmarks and a thorough understanding of how markets operate.

For a beginner trader, any one of these factors—or all of them—could be disastrous. Other reasons for failure can be discovered without having to delve deep inside of one’s mind. Nevertheless, many aspiring traders are curious in the degree to which unconscious processes thwart their trading endeavours. There can be an unconscious reason for self-sabotage. Experienced traders are particularly curious about this subject. Many well-known, extremely successful traders ultimately lose the majority of their cash, and many never return. Some have hypothesised that the cause of such failures is a covert intention to self-sabotage. Depending on your interests and point of view, it’s worth thinking about in some detail, either for pleasure or as a serious path of investigation.

In his book “Those Wrecked by Success,” Freud discussed those who Drive to fail in stock market, after experiencing enormous success. After realising a lifetime dream, some people, according to Freud, experience shame and physical illness. They are uncomfortable with success once they have it, therefore they unconsciously adopt actions to punish themselves.

Contrarily, the majority of study psychologists today disagree that people intentionally or unintentionally seek failure. People Drive to fail in stock market because they are unable to control challenging circumstances. In other words, traders don’t consistently lose because they have an underlying desire to undermine their efforts; rather, trading is challenging by nature. Because they lack adequate financial resources, sound trading tactics, or the right mindset, traders frequently fail.

However, according to psychoanalyst Roy Shafer, some people subconsciously perceive “success” as a form of failure and, in a perverse sense, actively shun it. For instance, in one case study, a young man avoided achievement out of fear that he would do better than his unsuccessful father. Similar observations have been reported by seasoned traders. Some new traders don’t just trade for financial gain. They have a secret goal in mind. They desire to demonstrate to their friends and family that they are capable of success.

The issue with being in this situation is that, despite one’s best efforts, a strong psychological message that one cannot succeed and is unworthy of accomplishment has been ingrained in one’s mind. Unconsciously, it’s challenging but not impossible to disprove these important partners. What people think of you, whether favourably or unfavourably, matters. Unconsciously, you might not want to want to disprove who they are since they define who you are. However, it’s essential to avoid letting such psychological difficulties affect your trade. Deal only with yourself. You should only trade if you want to, not because you’re trying to impress anyone or yourself.

But for some folks, it’s a problem. It’s a good idea to discuss some of these difficulties with a trading coach or other expert if you suspect that your motivations for trading may be driven by a desire to resolve underlying conflicts from the past. Don’t let irrational motivations rule your actions. Recognize them, navigate them, and trade profitably, easily, and without restriction.