Equity Share Meaning

One of the most popular ways for people to invest in the stock market is through equity shares. Equity shares are popular among investors who want to profit from the historically strong returns that equities have provided.

The BSE Sensex Index experienced compounded yearly growth of 11.12% within the same time period. This suggests that a 5,000 INR investment in the BSE Sensex in 2011 would have been worth 14,350 INR in 2020.

What Is A Share?

A share represents a portion of ownership in a business. The initial capital needed to start a business is provided by partners or investors who also own the business. The company needs more financing as it expands. The business has a number of options for raising funds, including engaging new investors, adding partners, and taking out business loans.

Issuing shares, also referred to as going public or conducting an initial public offering, is the most typical and favoured method of raising cash for businesses (IPO). Investors are given the option to trade these shares on major exchanges including the Bombay Stock Exchange and the National Stock Exchange (NSE) (BSE).

As a shareholder, the investor is also eligible to share in the company’s growth and success. The corporation issuing the shares makes sure that profits are distributed as dividends to all shareholders.

Types of Shareholding

Preference and equity shares can be broadly divided into two categories.

Preference Shares

A person who has preference shares has the following preferred rights:

- Get dividends at a certain rate. A dividend is the sum that is delivered to shareholders when a company records profits and extends the same. This is often determined from net profits after necessary expenses have been subtracted.

- Get the funds back in the event that the business fails. It is possible to dissolve a business by winding it up. When a business closes, it ceases operations and liquidates its assets to settle its debts with creditors, business partners, and shareholders.

Compared to equity shareholders, preference shareholders have less voting rights and may only vote on issues that directly affect their rights.

Equity Shares

Equity shares, often called ordinary shares, include all shares that are not preferred shares.

You have a claim to any earnings distributed to equity shareholders in the form of dividend payments. It is significant to highlight that a company’s management has the authority to determine whether:

- It wants to put the money back into the company for expansion or growth; alternatively

- Dividends are payments made to shareholders from a company’s profits.

Some businesses do not release any dividends at all. Additionally, even if a company has declared dividends in the past, there is no guarantee that it will do so in the future.

Benefits of Investing in Equity Shares

Equity share investing has some advantages. They consist of:

Potential to Earn a High Income

When you invest in equity shares, your earning potential is doubled:

1. Capital appreciation due to the increase in stock price.

A share that you paid less for may become more in demand while the supply is still constrained, giving you the chance to make money.

Since most investors anticipate growth in the pharmaceutical industry, there is a surge in demand for the company’s stock after a year, and the stock price rises to INR 150. This presents you with the chance to gain capital appreciation at a 50% rate within a year.

2. Regular income if the company declares dividends.

Shareholders have the right to receive profits that the firm chooses to distribute as a dividend. Your recurring income may increase if you have investments in companies that pay dividends on a yearly basis.

Protection Against Inflation

A product that cost 50 INR in 2010 will cost substantially more in 2020. Money depreciates over time, increasing the amount needed to purchase the same goods and services. Inflation is the name of this occurrence.

If you store your money in a savings account, you might not always be able to beat inflation rates. To maintain their purchasing power, many investors choose financial products that generate larger returns, such stock shares.

As a result, investing in stocks gives you a chance to beat inflation rates and keep the value of your investments constant.

Diversification Across Assets

Asset classes like equity, bonds, real estate, and commodities, among others, can be used to group the various investment possibilities that are accessible. These asset types are divided based on the possible return, the risk to the capital, and the tax consequences.

The earnings on your investment could, however, decrease if the central bank cuts interest rates. You can experience a decline in returns if all of your funds are in fixed deposits.

It is therefore wise to invest in a variety of asset classes so that poor performance in one does not affect your overall results. Even if fixed deposit interest decreases but the value of the equities you own increases, you can still make a profit.

Risks of Investing in Equity Shares

Even if you don’t lose all you invested, you can still find yourself in a situation where a business’s share never reaches the price you paid for it, whether because of company performance or general market attitude. As an investor, you take on these risks in the pursuit of increased profits and wealth accumulation.

The following are the most typical dangers connected with purchasing equity shares:

Capital Loss

Demand and supply for a share affect its market price. Most investors would want to invest in a firm and try to buy its shares if they believe it will perform well in the future.

As a result, there will be more sellers than purchasers in the market for the aforementioned stock, which will cause the supply to outweigh the demand and cause a decline in the company’s market price.

On the other hand, if the announcement of the policy change causes investors to have doubts about the company’s future, demand may decline, which would cause the share price to drop to, say, INR 75. You will experience a loss of INR 2,500 if you sell your shares at that time.

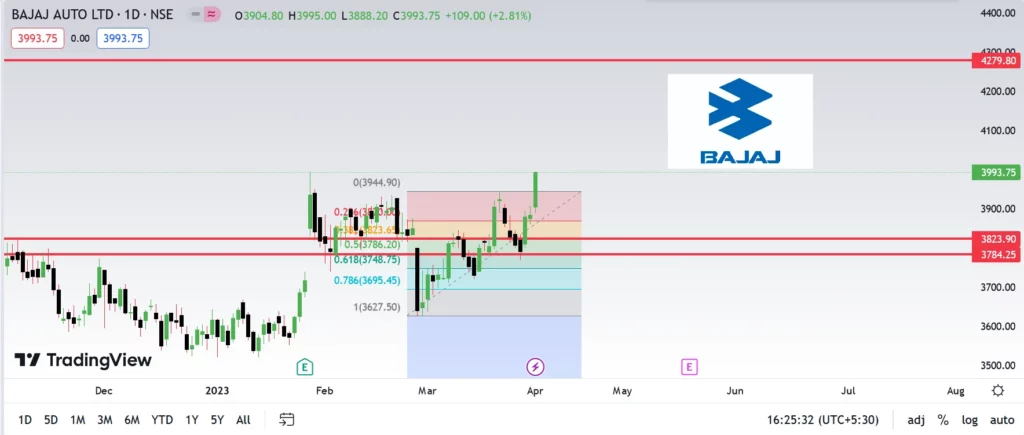

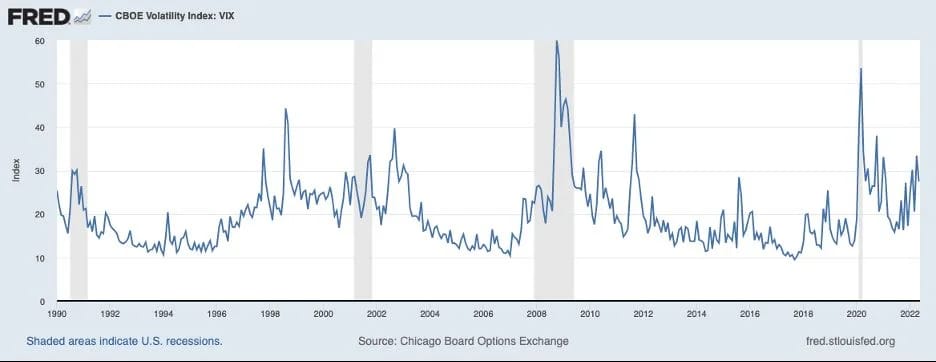

Volatility

The market price of a share may change over a specific time period, which is known as volatility.

Stock prices can quickly become volatile since the market price of a share is based on how investors feel about it generally and is impacted by a variety of outside influences, including social, political, and macroeconomic considerations.

But, if the stock price is extremely volatile, you run the danger of purchasing a stock at a high price, which will raise your profit price. The same holds true for investors selling highly volatile stocks.

They don’t promise you won’t lose money, but they significantly lower the risk compared to investing in one company’s equity share.

The IPO-way

A corporation announces an initial public offering, or IPO, when it issues its first batch of shares. As an investor, you can submit an application for an IPO via your net banking account or submit bids on stock markets for the company’s shares.