A derivative is a formal financial contract that allows a buyer and seller to buy and sell an asset at a future date. A derivative contract’s expiration date is fixed and predetermined. Derivative trading in the stock market is preferable to buying the underlying asset because the gains can be significantly inflated.

Furthermore, derivative trading is a leveraged form of trading, which means you can buy a large quantity of the underlying assets for a small fee. Stocks, commodities, currencies, benchmarks, and other derivatives can all be traded.

Futures and options are the two types of derivative contracts. In essence, both are the same because the investor and seller predict the underlying asset’s price for a specific future date. However, futures and options differ in that in futures, both the buyer and seller are legally obligated to honor the contract when it expires.

In the case of options, however, the buyer or seller can buy/sell before the contract expires by exercising their rights or letting the contract expire without exercising any rights. There are two types of options: call options and put options. Investors purchase a Call option when they believe the underlying asset will rise in value. In contrast, they purchase a Put option when they are confident that the underlying asset’s price will fall.

Types of Derivatives

Derivatives are financial contracts between two parties that derive their value from an underlying asset such as stocks, currencies, commodities, and so on. Entities in India effectively use such instruments to speculate on the price movement of the underlying asset, leverage holdings, or hedge a position. The derivatives market trades four different types of assets.

- Options Contract

Depending on the type of options contract, the buyer has the right but not the obligation to buy or sell the underlying securities to a different investor over a predetermined period. The strike price is the security price in the options contract, and the seller of the contract is known as the option’s writer.

In an options contract, the buyer has the option to pass on the exercise right because they are not required to do so after paying the premium to the option’s writer. Options contracts are classified into two types: call options and put options.

- Futures Contract

A futures contract in the derivatives sense legally binds both parties to carry out the agreement within the time frame specified. The parties involved agree on a quantity of the underlying assets and a price payable by the buyer at a future date.

In contrast to options, the buyer or seller of futures must exercise the contract before the expiration date. Currency futures, index futures, commodity futures, and so on are examples of futures contracts.

- Forwards

They are financial contracts between two parties that require the underlying securities to be executed before the expiry date at a predetermined quantity and price. Forwards, like futures, bind both parties to exercise the contract before the expiry date. Investors, however, can only trade such contracts through an OTC trading market rather than a supervised stock market exchange.

- Swaps

Two parties can use these financial instruments to swap or exchange their financial obligations or liabilities. The cash flow within the contract is determined by both parties based on an interest rate. One cash flow is usually fixed in this contract, while the other varies according to the benchmark interest rate.

Advantages of Derivatives

- Hedge Risks

Derivative trading allows you to hedge your cash market position. For instance, if you purchase a positional stock in the cash market, you can then purchase a Put option in the derivative market. If the stock falls in value in the cash market, the value of your Put option will rise. As a result, your losses will be minimal or non-existent.

- Low Expenses

Because derivative trading is done primarily to reduce risk, the fees are lower than for shares or debentures.

- Transfer Risks

In contrast to stock trading, derivative trading allows you to transfer risks to all parties involved in the process. As a result, your risks are significantly reduced.

Disadvantages of Derivatives

When used in conjunction with prior knowledge and extensive research, derivatives trading can provide numerous advantages for hedging or increasing profits. However, these financial instruments are complex at their core and have certain drawbacks for market participants.

- High Risk

These instruments are market-linked and derive their value in real-time from the underlying asset’s changing price. Such prices are volatile and are determined by demand and supply factors. Volatility puts such financial contracts at risk, forcing the entities to incur potentially massive losses.

- Speculation

A large portion of the derivatives market is based on a set of assumptions. Entities speculate on the underlying asset’s future price direction and hope to profit from the difference between the strike price and the exercise price. However, if the speculation goes wrong, entities may suffer losses.

- Counterparty Risk

While market participants can trade futures contracts on supervised exchanges, they must trade options contracts over the counter. It means that there is no defined system for due diligence, with the possibility of the other party failing to make a payment or exercising a promise. As a result, counterparty risk can expose market participants to financial losses.

Who is involved in the Derivatives Market?

Derivatives provide numerous advantages to market participants. However, each participating entity has a different motivation than the others, making it critical to understand how these participants affect this market and the included financial contracts.

- Hedgers

They are market participants who trade in financial contracts in order to hedge or reduce their risk exposure. Hedgers are typically manufacturers or producers of the underlying assets, which are typically commodities like oil, pulses, metals, and so on.

Financial contracts are used by hedgers to ensure that they receive a predetermined price for their produce/products if the price of the underlying assets falls within the contract’s expiration date. Hedgers ensure they mitigate their losses and get a guaranteed price by creating a financial agreement with a specific strike price.One can create such a contract and act as a hedger for any underlying asset, such as stocks, commodities, currencies, and so on.

- Speculators

They are traders who profit from the difference between the strike price (predetermined price) and the spot price (current market price) of the included financial contracts. Speculators use a variety of tools and techniques to analyze the market and forecast the future value of the underlying assets.

If they believe the underlying asset’s price will rise in the coming months, they will purchase a financial contract for that asset and sell it before the expiry date when the spot price is higher to profit. Speculators can trade in a variety of contracts, regardless of the underlying asset, which can range from equities to commodities.They usually sell the contract before the expiry date to avoid having to deliver the asset but still make a profit.

- Arbitrageurs

They are traders who profit from price differences between the same underlying securities in different markets. When such entities enter the market, they ensure that they will be able to obtain a higher price for the same underlying assets.

Once identified, arbitrageurs purchase the securities linked to financial contracts in one market, only to sell them at a higher price in another. Such entities profit from market imperfections that others are unaware of.

- Margin Traders

These traders use a portion of their investment funds to buy and sell financial contracts, but they also use stockbroker margins. They buy and sell contracts on a daily basis, and their profits are based on the price movement of the underlying assets in a single day.

When such margin traders identify profitable financial contracts, they obtain credit from stockbrokers in the form of a margin. They return the margin amount to the brokers with interest once they sell.

How To Trade In Derivatives Market?

After understanding the definition of derivatives, the next step in effective diversification and profit maximization is to learn about trading in these financial contracts. You can follow the steps outlined below.

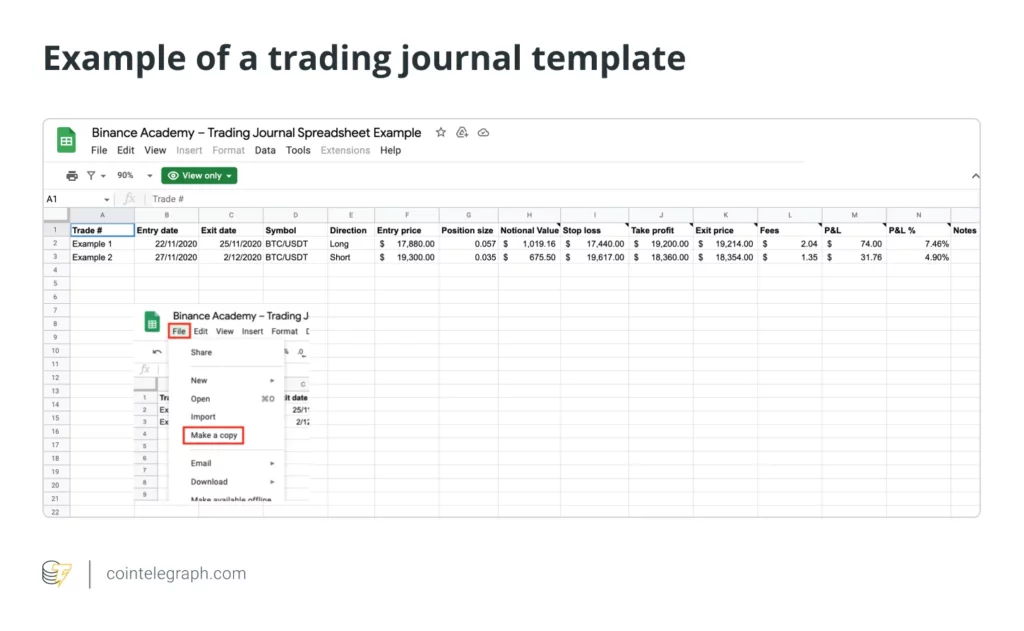

- Before you can begin trading in various financial contracts, you must first select a reputable lender and open an online trading account. The Demat account also allows you to trade in F&O contracts. After you have opened a Demat account, you can request that your stockbroker open an account with the F&O service.

- You must pay a margin amount to the broker, which you must keep until you execute or exit the contract. If your account falls below the minimum required margin while trading, you will receive a margin call to rebalance the trading account.

- You can only trade in marketable financial contracts that have a three-month expiry date and expire on the last Thursday of the month. As a result, you must settle the contract before the specified expiry date, or it will be automatically settled on the expiry date.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en