Introduction

Welcome to our in-depth introduction to trading options. You’ve come to the correct place if you’re wanting to increase your knowledge and expertise in the field of finance and investing. We’ll go deeply into the complex world of options trading in this article, giving you the knowledge and methods you need to succeed in it.

Understanding Options

What Are Options?

Options are a type of financial derivative that grant the holder the right, but not the responsibility, to buy or sell an underlying asset at a certain price (known as the striking price), on or before a particular expiration date. They are a flexible and effective tool for both traders and investors.

Types of Options

Call options and put options are the two main categories of options.

- Call Options: The holder of these has the option to purchase the underlying asset at the strike price before to the expiration date. Bullish investors who believe the asset’s price will increase frequently use call options.

- Put Options: The right to sell the underlying asset at the strike price before to the expiration date is offered by put options, on the other hand. They are frequently used by negative investors who anticipate a decline in the asset’s price.

Benefits of Options Trading

Options trading offers several advantages:

- Leverage: Options give investors the ability to control a sizable portion of the underlying asset for a relatively little initial investment. Potential gains (and losses) are boosted as a result.

- Hedging: Options can be used by investors to shield their portfolios against unfavorable price changes. For example, put options might serve as protection against a market slump.

- Diversification: By acquiring exposure to several asset classes without actually holding the assets, options can be utilized to diversify a portfolio of investments.

Getting Started with Options

Opening an Options Account

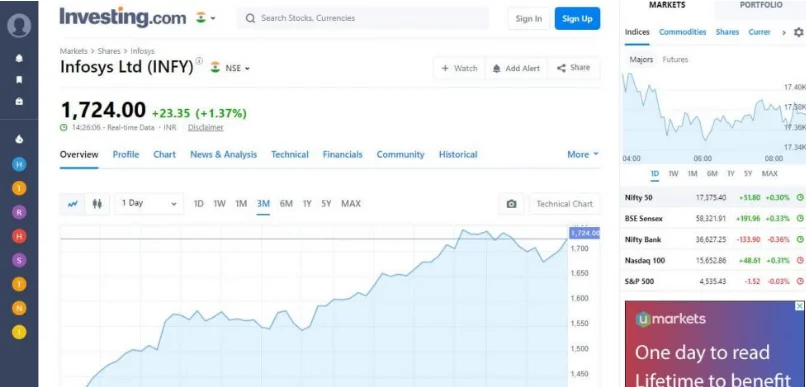

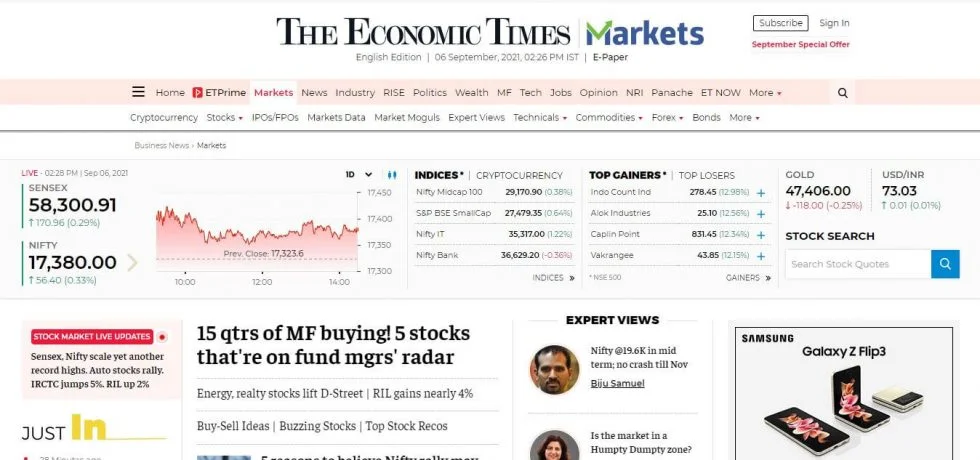

You must first open an options trading account with a brokerage firm in order to begin trading options. Pick a trustworthy brokerage with an easy-to-use interface and reasonable costs.

Understanding Option Contracts

Different amounts of the underlying asset are covered by different sized option contracts. Understanding contract details, such as the strike price, expiration date, and underlying asset itself, is essential.

Basic Option Strategies

- Covered Call: Selling call options on an existing underlying asset is a covered call strategy. As a result, your possessions may earn more money.

- Protective Put: To protect your portfolio against possible losses, use a protective put strategy. To counteract drops in the value of your assets, purchase put options.

- Straddle: Purchasing call and put options with the same strike price and expiration date is known as straddling. Regardless of the direction, this technique benefits from substantial price fluctuations.

Advanced Options Strategies

- Iron Condor: Call and put credit spreads are both used in the iron condor technique. It gains from a market that is steady and experiences little price changes.

- Butterfly Spread: employing a butterfly spread, you can profit from certain price ranges while limiting your losses by employing both call and put options.

Risk Management

Risks associated with options trading must be adequately managed because they are inherent. Here are some methods for risk management:

- Position Sizing: Depending on your risk tolerance and account size, decide the right size for each trade.

- Stop Loss Orders: To reduce possible losses on your transactions, use stop loss orders.

- Diversification: Do not invest all of your money in a single options trade. Make investments in a variety of assets and tactics.

Conclusion

Options trading is a challenging but lucrative area of finance. You may confidently move through this market by grasping the basics of options, investigating various methods, and putting smart risk management approaches into practice. Keep in mind that success in options trading depends on practice and ongoing learning. Open an options trading account with a reputed brokerage if you’re ready to take the plunge and begin your path to financial emancipation.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en