India’s top stock market apps: Today, it’s imperative to stay current with the minute market fluctuations if you work as a stock market trader. The current stock market traders monitor the ups and downs of the equities regularly, and occasionally even hourly.

The simple, quick, and efficient existence of traders has been made possible by high-speed internet and useful smartphone apps. The traders can always be updated and prepared thanks to these financial apps.

Everything is now available from your smartphone or tablet, including checking the stock’s real-time streaming market price, creating a virtual portfolio, creating stock charts, watching market trends, and tracking your portfolio.

In order to make your stock research in India easier, we are going to introduce to you the 7 Best Stock Market Apps today. Furthermore, every programme on this list is free. Be with us for the next 5-8 minutes to learn about the top stock market applications for Indian stock research, to put it briefly.

7 Best Stock Market Apps in India

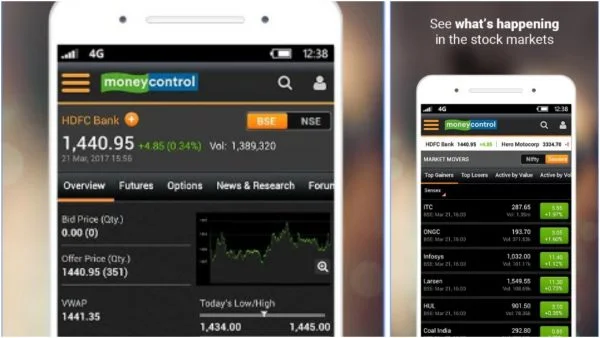

Best Stock Market Apps #1 – MoneyControl

Play store rating: 4.1/5 Stars (360k Reviews)

Downloads: +10 Million

Available on: Android, iOS, Windows

Our personal go-to app for stock market news and updates is this one. We strongly advise you to have this stock market app if you only intend to have one on your smartphone. The money management software is straightforward but packed with news and information.

With the Moneycontrol App, you can keep up with the most recent developments on the Indian and international financial markets on your smartphone. You may easily track indices (Sensex and Nifty), stocks, futures, options, mutual funds, commodities, and currencies because it covers a variety of assets from the BSE, NSE, MCX, and NCDEX markets.

Key Features:

1.Effortless Use: Easy access to the chat board, watchlist, and portfolio of financial data. Voice search in a single search bar for news, commodities, indices, mutual funds, stocks, etc.

2.Most recent market data From BSE, NSE, MCX, and NCDEX, the most recent quotes for equities, F&O, mutual funds, commodities, and currencies are available.

3.News: Daily market, business, and economic news coverage as well as senior management interviews

4.Portfolio: Portfolio tracking made simple for stocks, mutual funds, ULIPs, and gold. timely portfolio performance updates, news, and notifications, as well as information on the equities you own.

5.Creating a customised watchlist to track your preferred stocks, mutual funds, commodities, futures, and currencies. Receive timely notifications for news and company activity.

6.Discussion board: To receive recommendations, follow your favourite topics and the top boundaries. Participate in discussions about your portfolio or areas of interest.

You can download the MoneyControl App here!

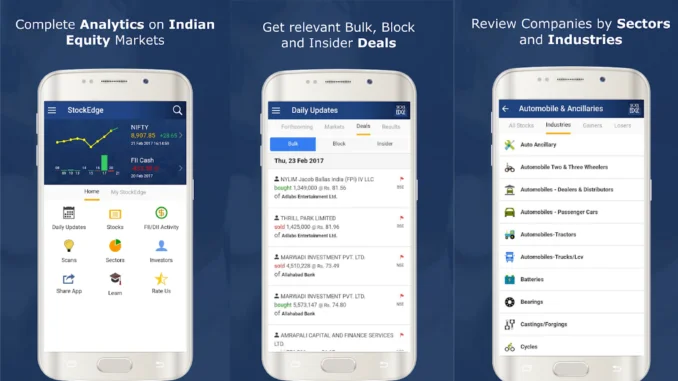

Best Stock Market Apps #2 – Stock Edge

Play store rating: 4.4/5 Stars (31k Reviews)

Downloads: +1 Million

Available on: Android, iOS

Stock Edge is one of the top share market apps since it offers end-of-day data, visualisations, and alerts that Indian stock market traders and investors can use to do independent research and make smarter judgements.

Key Features:

1. Everyday Updates News, NSE and BSE corporate announcements, upcoming events, corporate actions, and more are included in the section for filtered major market tracking.

2.Cash and derivatives for FIIs, FPIs, and DIIs with excellent historical data visualisation Daily, Monthly, and Annual.

3.Price scans, recent highs and lows, 52-week highs and lows, recent price behaviour over the past three days, etc. are all examples of opportunity scans.

4.Follow the activities of the major Indian investors. Create your own investor group with its various names, entities, etc. using the MyInvestorGroup feature.

5.Industry list, industries inside an industry, companies within an industry, Gainers, Losers, and Price Movement over the past 30 days are displayed in a straightforward graph.

You can download the StockEdge App here!

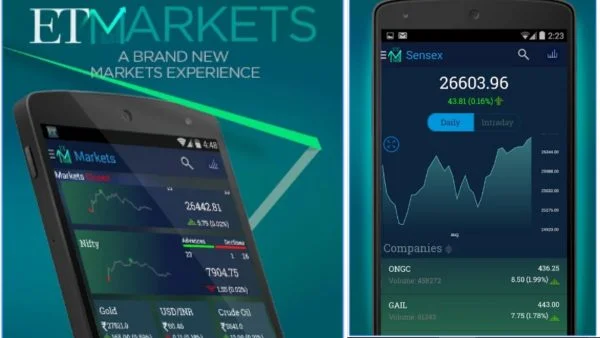

Best Stock Market Apps #3 – ET Markets

Play store rating: 4.7/5 Stars (52k Reviews)

Downloads: +1 Million

Available on: Android, iOS, Windows

Another one of the top stock market applications is this one. We frequently read market news and updates on the Economic Time (ET) Markets app because it has the most recent information. The stock information function on this app is also consistently extremely neatly laid out.

Key Features:

1.Live NSE Nifty charts and share prices are available for tracking the BSE Sensex.

2.Get tips on intraday trading, stock futures, commodities, the FX market, and ETFs while you’re on the road by following stock quotes in real time.

3.An all-in-one resource for information on mutual funds, NAVs, portfolio updates, fund analyses, and SIP calculators

4.Build, maintain, and access your portfolio with a single swipe. Receive individualised news, analysis, and stock market statistics.

5.To make a watch list and follow them regularly

6.Get insights and expert opinions sent to you, and take part in conversations by leaving comments.

You can download the ET Markets app here!

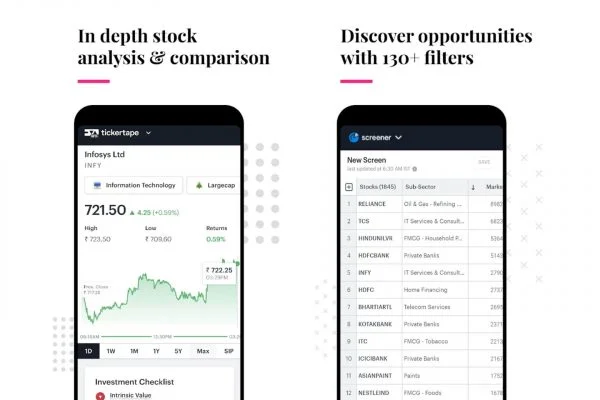

Best Stock Market Apps #4 – Tickertape

Play store rating: 4.5/5 Stars (19k reviews)

Downloads: +1 Million

Available on: Android, (Not available on iOS)

This app is somewhat newer compared to other applications on this list but has recently gained a lot of traction as one of the top stock market apps in India. Tickertape is a cutting-edge platform for stock analysis that puts you in control of the procedure.

It focuses on key metric analysis with strong ecosystem support and potent tools that can help you learn more about the market and how to participate in it.

Key Features:

- For each of India’s publicly traded corporations, a detailed stock analysis is provided.

- You may analyse any Indian stocks using an advanced screener with 130 filters.

- Market mood Index (MMI), a market attitude indicator, is used by traders to timing their trades appropriately.

- News, events, and peer comparisons are presented in a way that will support your investment choices.

- To help you log in and link your broker account to the Tickertape account, there is Broker Connect.

You can download the Tickertape app here

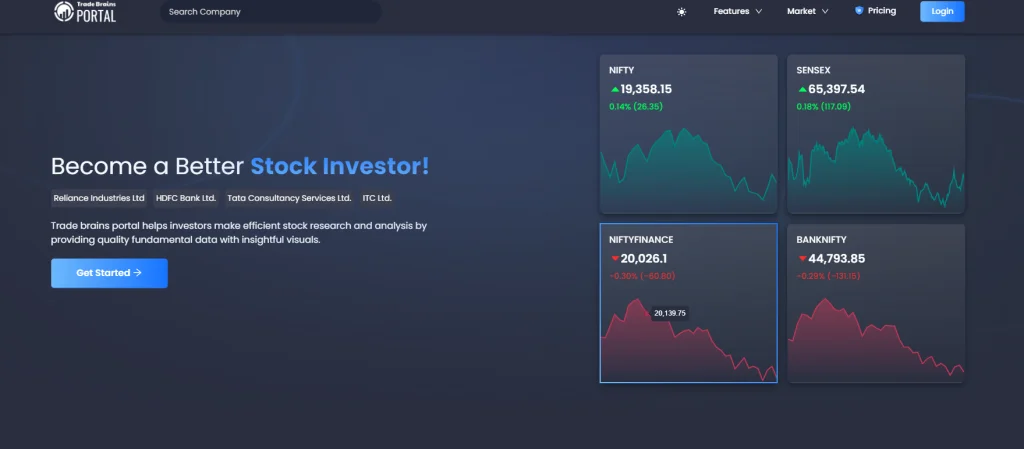

Best Stock Market Apps #5 – Trade Brains Portal

Play store rating: 4.8/5 Stars

Downloads: +10k Downloads

Available on: Android, iOS

An app for researching the stock market that is quickly gaining popularity among users in India is called Trade Brains Portal. It has many other important features including Stock Screener, the most recent market news, stock buckets, and more. It is one of the greatest alternatives to the Moneycontrol app for the Indian market.

Trade Brains Portal App’s high-quality fundamental data and illuminating visualisations assist investors in conducting effective stock research and analysis. Users of the software can make numerous watchlists and stock portfolios to track their stocks in a one location. The Superstar portfolio function of the portal app allows users to follow prominent investors and their most recent stock portfolio.

The Trade Brains Portal app is unquestionably among the top stock market apps in India because to its sleekest user interface and quick analytics tool. Both the Google Playstore and the App Store now offer the Trade Brains Portal app.

Key Features:

- Find stock analytics information for over 4,000 publicly traded businesses in India on the NSE/BSE, including financial ratios, charts, financial statements, shareholding patterns, and more.

- Stock Market News: Users can stay informed about everyday stock market news by using the Trade Brains Portal App.

- Multiple Watchlists: Make as many watchlists as you’d like to save your favourite stocks.

- Stock Screener: Trade Brains Screener is unquestionably one of the most sophisticated and quick stock screeners in India, with over +130 criteria.

- Superstar Portfolio: Follow the most recent stock market portfolios of your favourite superstar investors to learn which stocks they are holding and in what amounts.

- Stock Buckets: Selected stocks to help you begin your journey into stock analytics. Thematic can be discovered.

You can DOWNLOAD Trade Brains Portal App here!

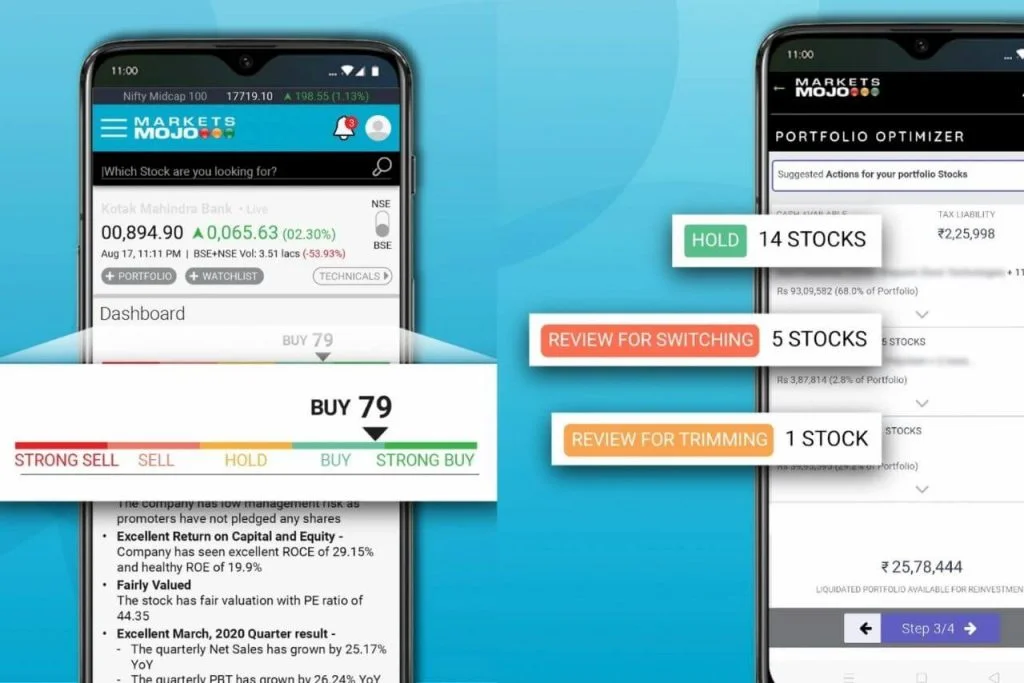

Best Stock Market Apps #6 – Market Mojo

Play store rating: 4.1/5 Stars (2.2k Reviews)

Downloads: +100,000

Available on: Android

This is a brand-new, potent app for researching the stock market. For conducting a fundamental study of equities, use Market Mojo. It provides pre-analyzed data on every stock, every financial, every news item, every price change, every broker recommendation, every technical, and every other relevant piece of information in the Indian stock markets.

Key Features:

- The company’s long-term performance in comparison to its competitors is reflected in the Mojo Quality rank.

- The stock’s valuation at the current price is determined by its valuation.

- The company’s ability to make money and its present financial trend show whether it is now on a growth path for the business.

- The Portfolio Analyser assesses every undiscovered opportunity and risk in the portfolio and advises the investor on what to do rather than merely track. Each portfolio is subjected to our seven-parameter examination, which looks at returns, risk, diversification, liquidity, quality, valuation, and financial trend.

You can download the Marketsmojo app here!

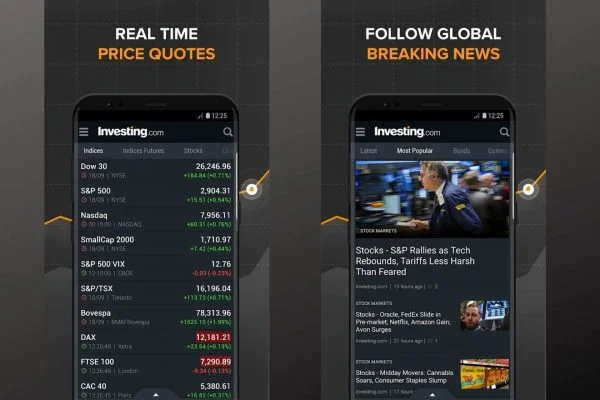

Best Stock Market Apps #7 – Investing.com

Play store rating: 4.4/5 Stars (448k Reviews)

Downloads: +10 Million Downloads

Available on: Android, iOS

An internationally utilised stock market app is investing.com. You can also get information about global indices and overseas stock exchanges in addition to information about Indian stocks. It provides a collection of financial informational tools that cover a wide range of national and international financial instruments.

Key Features:

- Live quotes and charts for more than 100,000 financial products that are traded on more than 70 international exchanges.

- Customised live updates on major economic happenings throughout the world.

- Create a watchlist that is unique to you and sync it with your Investing.com account to keep track of stock quotations, commodities, indices, ETFs, and bonds.

- breaking news, videos, analysis, and updates on the business, technology, and political landscapes, as well as on the world’s financial markets.

- All of our top-notch resources are easily accessible, including the Economic Calendar, Earnings Calendar, Technical Summary, Currency Converter, Market Quotes, sophisticated charts, and more.

You can download the Investing.com app here!

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en