Here is a list of the top 12 SEBI-registered Telegram channels that offer stock market news and suggestions for nothing.

Joining a Telegram channel is one of the best ways to learn about stock market trading and invest in other commodities.

If you want to join a Telegram channel for trading or the stock market, make sure the channel is reliable and the information is updated every day.

Because I’ve recently seen a bunch of Telegram channels making claims about how their calls and tips are always accurate and how joining them would help you make a lot of money.

But the majority of them are just looking to offer people expensive services in order to make money.

Most of these issues do not relate to Telegram channels that are registered with SEBI. Additionally, you should only join a qualified analyst’s telegram channel if you are looking for only honest recommendations.

List Of Top Best SEBI Registered Telegram Channels For Stock Market

SEBI-registered Telegram channels are regarded as the best channels overall in terms of reliability and truthful financial advice. The qualified administrators offer accurate and objective information because they have years of financial knowledge.

Here are the top 12 stock market-related Telegram channels that are registered with SEBI. Although some of these provide paid services, you may still sign up for all of them without paying anything.

1. StockPro®️Official (SEBI Registered)

One of the top SEBI Registered Telegram Channels on the list, StockPro official has more than 229K users. I’ve authored a lot of content for the stock market-related Telegram channels, and practically all of them have “StockPro official” listed as a contact.

The founder of StockPro, Dr. Seema Jain, is a SEBI-registered analyst who runs an excellent Telegram channel.

Although there are numerous sources that offer stock market information, you can never be sure if it is accurate. But the issue was completely eliminated by SEBI registered Telegram channels.

Additionally, StockPro Official provides a large choice of top-notch programmes and services. Anyone can learn all there is to know about the stock market and trading strategies, with or without making a purchase. More than three lakh people subscribe to the channel.

Important characteristics and Features of StockPro Official:

- Over three lakh people subscribe to StockPro’s Telegram channel.

- They are regarded as having the best call and tip accuracy in the business.

- You will occasionally also get a technical analysis of the stocks.

- Join StockPro, the most popular SEBI-registered Telegram channel, right away.

- Outstanding services offered by Stockpro include intraday calls and information, options, and positional trading.

- If you wish to trade equities, they also offer a master trading programme that you can join.

2. Stock Gainers Training (SEBI REGISTERED)

For newcomers who exhibit interest in learning about stock market investing and trading, Stock Gainers Training is more akin to a learning platform. An analyst who is registered with SEBI and the operator of the stock gainers training telegram channel is Kapil Verma.

This may be the most beneficial Telegram channel for you if you’re the kind of person who prefers clear, uncomplicated instruction on stock market investment.

You can study the stock market’s behaviours on Stock Gainers Training by examining the calls, charts, and data they provide.

To obtain more precise information or to learn how to invest in the stock market without further harming your wealth, you can, however, sign up for their elite membership.

The important features and characteristics of the Stock Gainers Training:

- Stock Gainers has more than 77805 subscribers, and the number is increasing as a result of the value they offer and the reliability of the channel.

- If you want to study more about the stock market in depth, you can enrol in their training programmes even though you can get free advice and information.

- One of their most well-liked courses is SG Millennium, where you can acquire all the stock market tactics as well as patterns like candlesticks, significant graph patterns, flag patterns, and other crucial ideas.

- On the Stock Gainers Training Telegram channel, you may study swing trading and positional trading.

- How to select the ideal stock at the ideal time is the most valuable lesson you can take away from Stock Gainers Training.

- They are reliable and offer crucial stock market information.

3. JACKPOTTRADEX

Jackpottradex is a well regarded research firm in the Indian stock market, however it is not SEBI registered. However, Jackpottradex offers you the most significant platform for trading and investing services, where the company’s purpose is met by excellence, effectiveness, and innovation.

The key benefit of joining this channel is that it gives good accuracy and is not SEBI registered. You will receive daily trading updates from qualified analysts, which will be of the greatest calibre. They are a team of the most knowledgeable professionals, and you can consult them for free at any time.

The channel has more than 13276 subscribers, and the numbers are certainly growing.

Important characteristics and features of Jackpottradex :

- They are experts at giving the top intraday advice.

- The best client retention and satisfaction rate is attained by Eqwires.

- Eqwires is more than just a Telegram channel that offers stock market advice and guidance.

- They offer a free consultation so that potential clients can learn more about how they operate and satisfy their clients.

- Additionally, they are honest and give their clientele their all. They are open about their successes and setbacks. That is the aspect of jackpottradex that I like the most.

4. Financial Independence Services Sebi Registered

One of the top Telegram channels for people looking for free calls and tips is Financial Independent Services, or FIS. The channel is fortunate to have approximately 27285 subscribers, and the number is increasing as a result of the completely free calls they offer.

FIS is reliable and consistent like the other channels on the list. Their opinions and free calls are reliable. Additionally, you will receive charts and technical analysis from licenced administrators.

Unique features and Characteristics of Financial Independent Services:

- They are experts at offering bank and nifty calls.

- You will also receive calls for intraday trading and option trading in addition to the aforementioned point.

- The fact that FIS does not provide any form of premium services or courses is the thing I enjoy most about them. You will receive all calls and tips without any strings attached.

- Nearly 27285 people subscribe to FIS, and you can sign up for them for nothing at all.

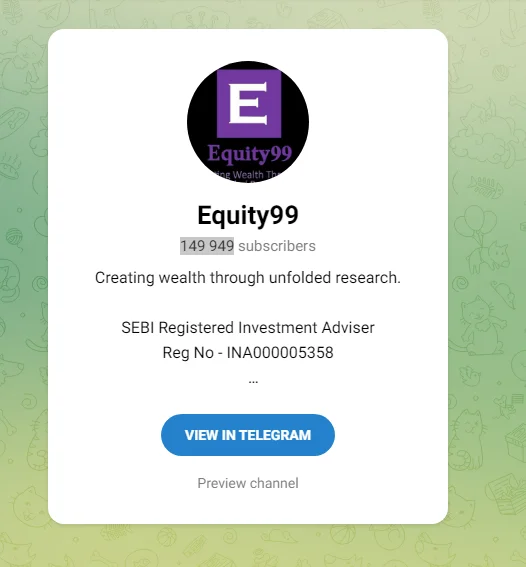

5. Equity99

Equity99 is one of the most subscribed Telegram channels on the list with over 149949 users. You will receive gratuitous calls and tips that are 90% accurate. Additionally, technical and fundamental analysis will be provided, along with the appropriate charts and data.

In addition to having a fantastic Telegram channel, Equity99 now has an Android app that you can download from the Google Play Store to keep up with the stock market. According to the users’ interests, Equity99 offers them unbiased, reliable information.

Some essential features and characteristics of Equity99:

- www.equity99.com. is a fantastic website run by Equity99. You can receive advice about the stock market.

- There are more than 149949 subscribers to the Telegram channel.

- Instead of analysing stocks, Team Equity99 looks at companies to find the finest investment opportunities.

- They are objective and offer reliable predictions and advice with appropriate stop loss techniques.

6. SharesNservices.com™ (SEBI REGISTERED RESEARCH ANALYST’S SITE)

One of the top Telegram channels for stock market trading and investment is SharesNservices.com. You can still gain from joining the channel for free if you don’t like paying for trading calls and recommendations on any Telegram community. At the same time, ShareNservices might be one of the greatest Telegram channels for you if you are willing to spend money on some premium services.

This channel was one of the more reliable ones I came across while conducting my study. Hardcore traders will surely find SharesNservies.com to be very beneficial.

Some unique features and characteristics of the SharesNservices.com telegram channel:

- More than 25 years of financial guidance and tip-giving knowledge may be found at ShareNservices.

- Through their Telegram channel, you can acquire dependable and accurate information based on the admin’s many years of experience and unbiased judgement.

- They assert that their returns are the most accurate and that you may scroll up to view the real outcomes based on calls they have made in the past.

- Their website, www.sharesnservices.com, also offers information and counselling.

- This sentence sums just how responsible the admin is: “I don’t mind losing a Client, but I mind the Client losing money.”

- They offer their customers Paid Research Calls & PMS services. However, by joining their Telegram channel, you can also receive free calls.

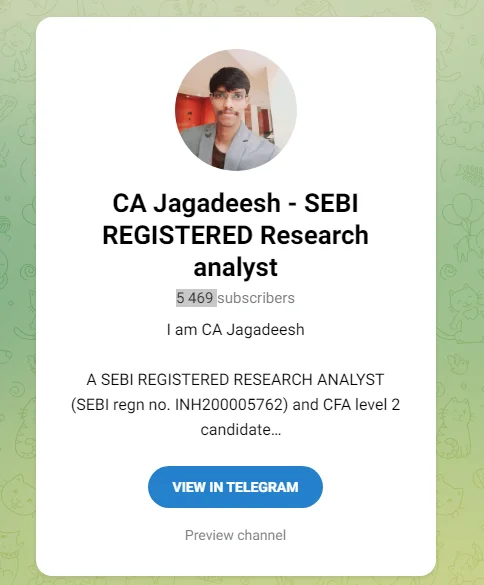

7. CA Jagadeesh – SEBI REGISTERED Research analyst

The originator of the channel is identified as Mr. Jagadeesh. He is a SEBI-registered analyst who offers his skills free of charge. He is therefore the most sincere and impartial person. Without a doubt, you ought to check out this channel.

He and his free calls are adored by the channel’s more than 5469 subscribers. In the form of charts and graphs, he also provides technical data and graphics.

However, Mr. Jagdeesh will provide you with both short and long term investment ideas on this channel. He offers the greatest trading advice along with graphs and illustrations that back up his data and technical and fundamental analyses.

The essential characteristics and features of CA Jagadeesh SEBI-Registered telegram channel:

- As a CFA level 2 candidate and a SEBI-Registered analyst (SEBI Regn no. INH200005762), CA Jagdeesh manages his channel.

- By subscribing to the channel, you can receive free calls and investment and trading advice.

- Calls and suggestions for both intraday and positional trading are shared on the channel.

- You’ll receive graphs and charts with accurate technical and fundamental analysis, which will show how much effort Mr. Jagdeesh puts into his study.

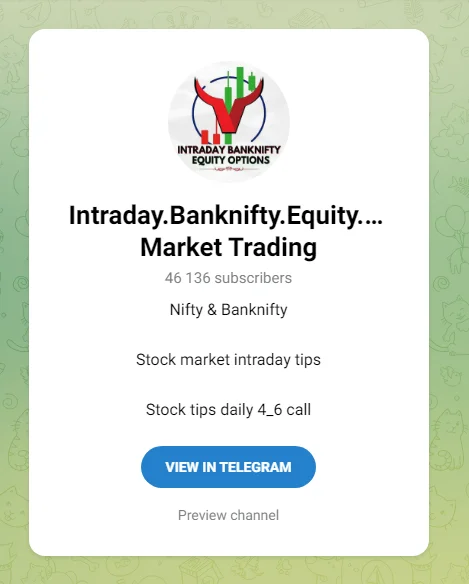

8. Raja Trades Stocks | SEBI REGISTERED

Another top-notch SEBI-registered Telegram channel on the list is Raja Trades Stocks. The channel, which has about 46136 subscribers, offers excellent stock market content that is beneficial for both investors and traders.

Whether you’re a trader or an investor, you’ll probably regularly receive stock market recommendations. Since the channel is registered with SEBI, it may be trusted to be real. However, in order to develop excellent trading instincts over the long run, you need constantly utilise common sense.

Additionally, Raja Trades Stocks provides you with current stock market news and updates. Additionally, you will receive the administrator’s unbiased personal opinions on stocks, IPOs, and other investable items.

The unique features and characteristics of Raja Trades Stocks:

- The channel is reliable and registered with SEBI.

- More than 46136 subscribers to Raja Trades Stock, and the number is continually rising.

- Given that the channel has SEBI approval, you may rely on it to provide accurate information about the Indian stock market.

- Raja Trades Stocks is a telegram channel that is both NSIM- and SEBI-certified.

- You’ll receive free information, advice, and unbiased opinions about the Indian stock market.

- You can get technical and fundamental analysis of the stocks, together with pictures and graphs, with the free information.

9. VG STOCK RESEARCH (SEBI REG. FIRM)

To acquire stock market information, the majority of people subscribe to random Telegram groups and channels, however those channels may be biassed and just interested in their own financial gain. In order to find accurate information, you should only watch SEBI-registered channels.

VG STOCK RESEARCH is thus one of the top SEBI Registered Telegram Channels that offers free beneficial information about the stock market. VG STOCK RESEARCH focuses on offering bank nifty and nifty trading. Additionally, you will receive daily stock market insights.

Long-term investors may find this SEBI Registered company useful as they offer some basic information about it. In addition to the screenshots, you will also receive stock market news.

The essential features and unique characteristics of VG STOCK RESEARCH firm:

- The channel has about 1980 subscribers and is registered with Sebi.

- The greatest Telegram channel for nifty and bank nifty traders is VG STOCK RESEARCH.

- VG STOCK RESEARCH is among your greatest selections if you’re looking for genuine stock market knowledge and free suggestions.

- You will also receive details on impending IPOs and deals in addition to the free insightful stock market views.

- The SEBI-registered company VG STOCK RESEARCH can also be found on Facebook and Twitter. To improve your stock market experience, you can join them.

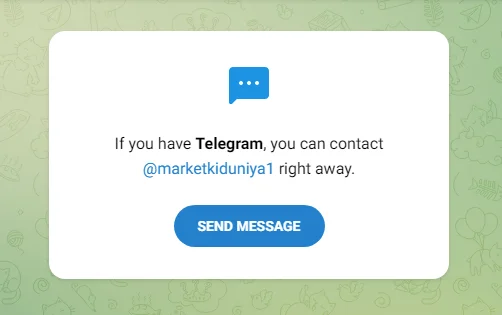

10. Market ki Duniya | SEBI Registered Analyst

Additionally among the top SEBI Registered Telegram channels on the list is Market ki Duniya. The other channels are not like this one. For the Indian stock market and international equities, information and advice will be provided.

However, as of the moment I’m writing this article, the channel has about 662 subscribers; you will frequently receive tips and calls.

For traders of the nifty and bank nifty, Market ki Duniya offers calls and recommendations. Additionally, you will learn more about positional and intraday stocks. The administrator delivers the necessary information in prepared charts and sheets for your use.

Unique features and characteristics of the Market Ki Duniya telegram channel:

- The least-subscribed Telegram channel on the list has roughly 662 subscribers.

- On nifty and bank nifty trades, you will receive some of the best analysis.

- Additionally, you will learn about intraday and positional stocks.

- Despite having the lowest subscriber count, Market Ki Duniya offers the most accurate and useful stock market information.

- Additionally, you will receive free stock market calls and guidance on effective stop-loss techniques.

11. SMT™ | SEBI REGISTERED RESEARCH ANALYST

I usually advise anyone who wishes to receive trading calls from a telegram channel to subscribe to one that has been registered with SEBI. “SMTTM | SEBI REGISTERED RESEARCH ANALYST” is the next top SEBI-registered Telegram channel.

The channel, though, has more than 133961 subscribers. SMT is a research analyst’s channel that is both NISM and SEBI certified. You will receive genuine trading calls for the Nifty, Bank Nifty, equities ETFs, and much more.

To at least get a sense of how well-written their postings are, you should subscribe to the channel. You are about to discover precious trade expertise on this channel. You’ll be able to trade on your own once you’ve learned by observing their posts.

Awesome features and unique characteristics of SMT SEBI registered telegram channel:

- By the time I update this article, there are 133961 subscribers to the channel.

- SMT is a telegram channel for analysts that is both NISM approved and SEBI registered. Multiple certificates increase the calls’ legitimacy.

- This channel focuses primarily on Equity, Banknify, and NIfty. Therefore, you must join SMT if you are interested in any of these trading alternatives.

- This channel will teach you a variety of techniques that will make stock market trading easy for you.

- You will receive current news and stock market knowledge that is necessary for the date.

- You don’t need to be concerned about finding the trade calls because SMT is quite reliable in sending updates.

12. Chase Alpha | SEBI Registered

Finally, one of the top SEBI registered Telegram channels is Chase Alpha. There are currently around 39436 subscribers to the channel. The administrator has a SEBI registration as an investment advisor. You won’t have to be concerned about transparency or honesty as a result.

You can receive calls and see the stock market for free, but the channel is completely free. This is one of the most reliable Telegram channels you can join if you’re trying to trade options on the Nifty and Bank Nifty.

Finally, trading is not easy; before spending any of your hard-earned money in stock trading, you must learn all of the tactics. This is why joining a SEBI-registered Telegram channel will facilitate your learning and speed up your progress.

Chase Alpha SEBI registered telegram channel has the following distinct features and characteristics:

- Currently, Chase Alpha has 39436 subscribers, and this figure is increasing as a result of the excellent stock market posts.

- Free chase alpha channel here. They also provide a range of stock market trading courses. If you want to fast understand about the stock market, you can search them up. You won’t require that, though, if you pay close attention to your instincts and common sense while you read the blogs.

- You may learn more about Chase Alpa and its CEO & Founder, Vishvesh, by visiting their website.

- Getting involved with Chase Alpha can be beneficial for you if you trade options or events.

- Additionally, the channel will send you notifications with inspirational thoughts and sentences.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en