Benefits Of Investing In Stock Market

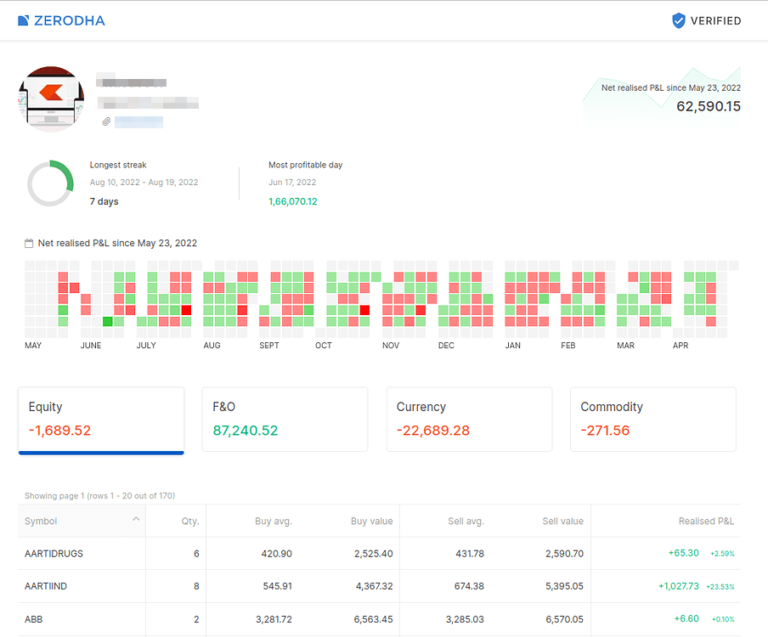

Hey there, future investors! Today, I want to talk to you about the benefits of investing in stock market. It is the beast financial decision you’ll ever make and here’s why with some real-time example

In the financial world small savings can change into great wealth. The advantage of the stock market is that it gives your perfect combination to your growth and accessibility . which is needed for building wealth . Then let’s talk about what is the reason that makes investing a game changer in the world of finance . So let’s find out how successful you can be in your life by investing in the financial world?

achievement is not immediate; it resulted from consistent, long-term investments, especially in companies such as Titan, which experienced significant growth over the years. financial success was achieved by patience, compounding returns, and deliberate decisions made over several decades.

The Power of Compounding: Watch Your Money Grow Exponentially:

The Strength of Compounding: Observe Your Wealth Increase Exponentially:

Compounding refers to the method by which the worth of an investment increases over time as both interest and capital gains are reinvested to generate additional earnings. In simple terms, it functions like generating “interest on interest,” and it’s crucial for accumulating wealth over the long term.

Let’s take Warren Buffett as an example. He began investing at the age of eleven.His first billion dollar came when he was 56 years old; by the time he was 60, it had grown to $10 billion; by the time he was 70, it had risen to $50 billion. By the time he was 90, it had reached 120 billion. .

For example:-

If you are investing ₹5000 monthly and12% you earn per year then first ₹8 lakh you earn tack 8 year but then to earn ₹8 lakh it took you only 4 years and after that for ₹8 lakh come in 3 years in fact if you invest for 20 years then after that year you will be adding 8 lakhs a year. This is the magic of compounding .

This is what compounding is . it lets you earn both on initial investment and the return you have already earned. Essentially, your money starts working for you as it multiplies over time

Risk Tolerance With Young Age – Best For Capitalizing Within The Market

One benefit that young investors have is that , thay have capacity to handle ups and down of the market . stock prices fluctuate in the short term because of their validity , but in the long term , thay have positive return . that means if you start to invest early then you can handle market crash and bearish market without panic and without liquidate your investment

Young people who invest also learn the mistakes that they make along the way. You are free to try out different ways of doing things and even invest in very risky options. The most important thing is how much time you have, a long-term investment means even if there are precedents of losses, there is so much time to recuperate.

Establishing Financial Discipline: Smart Investments Strategies

Investing at an early age eliminates the possibility of only achieving wealth, but also it halps to develop good habits in finance that would come in handy in the future. Investing every now and then also helps one to spend wisely, to save and to think before buying something that they did not plan to give into. When you are accustomed to making regular payments into investments or other assets, you learn to manage your priorities in order to ensure you adequately prepare for the future.

Investments may in fact become a more important aspect of young investors’ lives as they start to appreciate the value of their investments. Spending money will become a more thoughtful activity and saving will increase in encouragement as they begin to see positive growth from their investments at an early age. As years go by and when individuals begin to shift their focus towards creating wealth, it’s likely that this eventuality will be more of a habit and nothing more.

Utilizing the Compound Growth: Leverage Market Trends and Growth

Investing in the stock market even at an early point, will allow you to take advantage of the growth potential of large companies and their respective industries well in the future. The stock market indicates economic growth, development of new technologies and new ideas and those are the things that are expected to be on the rise with time. For those who will look to hold their investment for a period of decades, will most likely gain from the sustained upward movement in the growth of equities.

Envision putting your money into companies that are primarily involved in developing new technologies such as artificial intelligence, renewable energy and the likes of biotechnology. Investment in any of those rapidly expanding industries, even if small, will most likely pan out in stark profit in the coming years. Rotating this, investing at an early phase would make this type of equities longer and therefore net more returns.

The benefit of time in making early investments is that it allows one to take advantage of tax preferred accounts like Roth IRA or 401k, that help investments appreciate without taxes or with taxes deferred. Such types of accounts permits wealth to appreciate without growing payment of taxes on gains each year, a situation that can be very advantageous in case one starts early and allows compounding to take root.

Financial Security And Peace Of Mind - A Sound Investment

Investing in the stock market early and wisely enables you to be free and secure. This ‘freedom’ comes over time as wealth is created, which is a safety net for you and your family. So whether it’s financial freedom, early retirement, or going around the globe; all can be achieved with investing in the stock market properly.

Start with What You Can, Don’t Aim Too High at First:-

If you are thinking that “ I don’t have enuff money to start investing” then you don’t have to worry . You can start with your little investment and get good achievements with it too . because of fractional shares and zero commission trading. You can do compounding with your little investment . The thing which is important to start is not the amount . but it is to remember that you’re dining it for long term gain.