The alleged tax deficiency is worth Rs. 6,384 crore. With the most recent tax notification, Delta Corp’s total responsibility for unpaid taxes has increased significantly to Rs 23,206 crore.

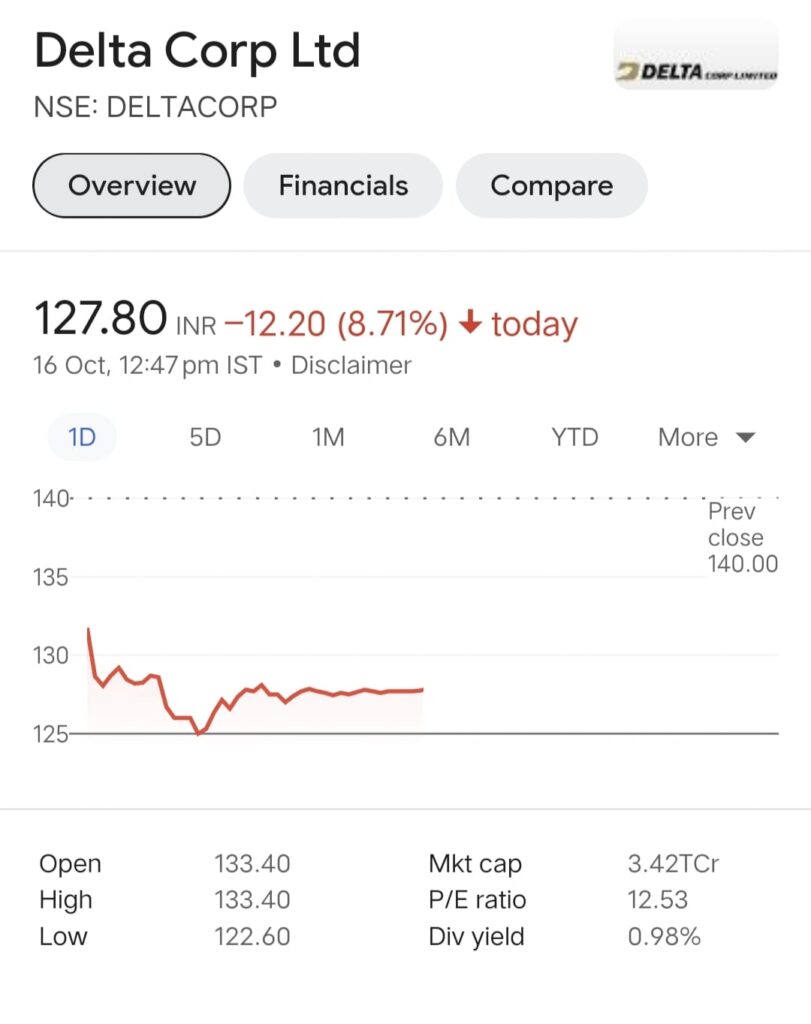

In Monday’s trading, Delta Corp Ltd. shares fell 12% and reached their lowest level in a year at Rs 122.60. The gambling and casino company reported that the Directorate General of GST Intelligence, Kolkata, has informed its subsidiary Deltatech gambling of the payment of shortfall tax.

- The company had last week in September received tax notices from the Directorate General of GST Intelligence totaling Rs 16,822 crore. The requested time frame was from July 2017 to March 2022. A single notification was sent to Delta Corp for Rs. 11,140 crore.

Regarding the technical setting, one analyst predicted that the stock may reach the Rs 80 mark soon, while another advised against buying it at the moment.

- On the daily charts, Delta Corp’s stock price is negative but also oversold, with the next support level currently at Rs 120.3. Investors should refrain from purchasing till the daily resistance of Rs. 149 is overcome on a closing basis, advised Tips2trades’ AR Ramachandran.

- The 5-day, 10-day, 20-day, 30-day, 50-day, 100-day, 150-day, and 200-day simple moving averages (SMAs) were all below the stock’s most recent closing price. The 14-day relative strength index (RSI) for the counter was 18.84. Oversold is defined as a value below 30, and overbought as a value beyond 70.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en