The process of buying and selling shares has been significantly streamlined and accelerated by online trading. Thanks to the internet, which has completely changed how trading is done today, trading can now be done immediately and remotely from any location. A trader or investor’s life depends on it. It is simpler to buy and sell financial products including stocks, bonds, NCDs, equities, and ETFs through an online trading platform.

A shareholder who wished to buy shares in the past had to call their broker and request to buy equities at a specific price. After discussing the share’s current market price with their client, the broker will then confirm the order. After this tedious process, the order would be registered on the stock exchange.

HOW TO TRADE ONLINE?

- The first step in starting to trade online is to apply for a Demat and trading account with a Depository Participant and finish all necessary documentation processes. When choosing a broker, it is essential to look for certification from the Securities and Exchange Board of India (SEBI) and registration with all stock markets.

- Before you start trading online, you must have a thorough understanding of how the stock market works. In a number of courses, the fundamentals of online trading are discussed. You should also keep an eye on financial news, websites, and podcasts to stay current on the financial markets.

- Additionally crucial are developing a strategy and a plan. Before you begin investing with real money, it is advised that you start out by practising with a demo trading account.

Think carefully about your financial strategies. You should plan out how much you want to invest in a specific business in advance.

Because stock trading is a long-term investment, becoming a successful investor necessitates having all of your bases covered.

BENEFITS OF ONLINE TRADING?

1.Ease of use: Everything that can be done online makes life easier and more convenient. Online trading enables traders to do deals quickly and easily. If you have an online demat account and a working internet connection, you can save time and effort.

2.Less Expensive: Executing your trades requires paying a broker a fee or commission, which raises your costs. However, when you trade online, you pay a price, or a brokerage fee, that is far less than the commission charged by the broker.

3.Total Control: Trading online gives you complete control over your portfolio, giving you additional leverage over your assets. Now, you have the freedom to trade anytime the market is open and decide for yourself without consulting a broker.

4.Watch Your Investment Whenever: Investments can be monitored at any time via websites and mobile applications. Viewing real-time gains and losses allows you to make an informed decision about the stocks you want to keep or sell.

HOW DOES ONLINE TRADING WORK?

You now fully understand the definition of “what is meant by online trading?” Now is the time to learn how to conduct a deal or how online trading works. The order to buy or sell shares is executed in a matter of seconds. The actions are detailed below:

1.The trade is carried out in accordance with the best purchase and sell prices when you place a buy or sell order.

2.Following execution, stockbrokers and exchanges send clients a deal confirmation message.

3.A contract note with details on the transactions is sent to the clients by the stockbroker.

4.The trade is completed and the clearing process is initiated after the buy and sell orders are matched.

5.All deals in the equity sector are subject to the T+2 settlement cycle. Exchanges have created a T+1 settlement cycle that will be carried out in stages as of right now.

6.The next step involves finalising the deal for the buyers and sellers and fulfilling the financial commitments mentioned in the clearance step.

7.If both the buyer and the seller receive the securities and the money, the trade is regarded to have been resolved.

8.Following the aforementioned procedures, the shares are transferred via the relevant depositories to the buyer’s Demat account, and the sale proceeds are credited to the seller’s account.

ONLINE TRADING VS OFFLINE TRADING

- The benefits of online business over offline trading have become clear with the growth of the internet over the past twenty years. We’ll talk about a few differences between online and offline trading.

- Trading is simple because to online trading, which obviates the need for a broker. On the other hand, a trader using an offline account is entirely dependent on the broker’s services and is given particular instructions. The broker is used for all trading. This dependence does not exist when you decide to trade online.

- Convenience: As long as you have access to the internet, you can trade online at any time and from any location. On the other hand, you must physically visit the broker’s office when trading offline.

- Trading commissions: Online trading has incredibly low brokerage costs, which boosts earnings. Brokers and brokerage companies, on the other hand, in offline trading demand exorbitant expenses that lower your earnings.

THINGS TO REMEMBER BEFORE YOU START ONLINE TRADING

- It is necessary to have a trading and Demat account.

- Pick a broker that will meet your needs.

- Before making any trades, gather enough data and perform analysis.

HOW TO MAKE LOTS OF MONEY IN ONLINE TRADING

1.Examine current trends: Many reputable sources offer information on market trends. A stock trading newspaper like Bloomberg BusinessWeek, Traders World, Investor’s Business Daily, Kiplinger, or Investor’s Business Daily might be something you’d like to subscribe to.You might also sign up for the blogs of trustworthy market analysts like Abnormal Returns, Deal Book, Footnoted, Calculated Risk, or Zero Hedge.

2.Pick a trading website. Some of the best options include Scottrade, OptionsHouse, TD Ameritrade, Motif Investing, and TradeKing. Make sure you are aware of any transaction fees or percentages that will be charged before selecting a website to utilise.

- Verify the service’s dependability before using it. Take a look at online reviews of the business.

- Pick a company that provides services like a mobile app, tools for investor education and research, low transaction costs, data that is simple to understand, and 24/7 customer assistance.

3.Open a trading account on one or more websites: Even though you won’t need more than one, you might want to start with two or more so you can eventually choose the one you prefer.

- Review the minimum balance requirements for each website. Your budget may prevent you from creating accounts on more than one or two websites.

- You might be unable to use other trading platforms due of their higher minimum investment requirements if you start small.

4.Experiment with trading before investing real money. Websites like ScottradeELITE, SureTrader, and OptionsHouse offer simulated trading environments where you may test your trading methods without taking any real financial risks. Of course, you cannot make money this way, but you also cannot lose it.Trading in this manner may help you become used to the approaches and decision-making techniques you will use when trading, but it is typically a subpar representation of actual trading.

- There will be a delay when buying and selling stocks in real trading, which can result in prices that aren’t what you were expecting for. Trading in digital money will also not fully prepare you for the pressure of trading in real money.

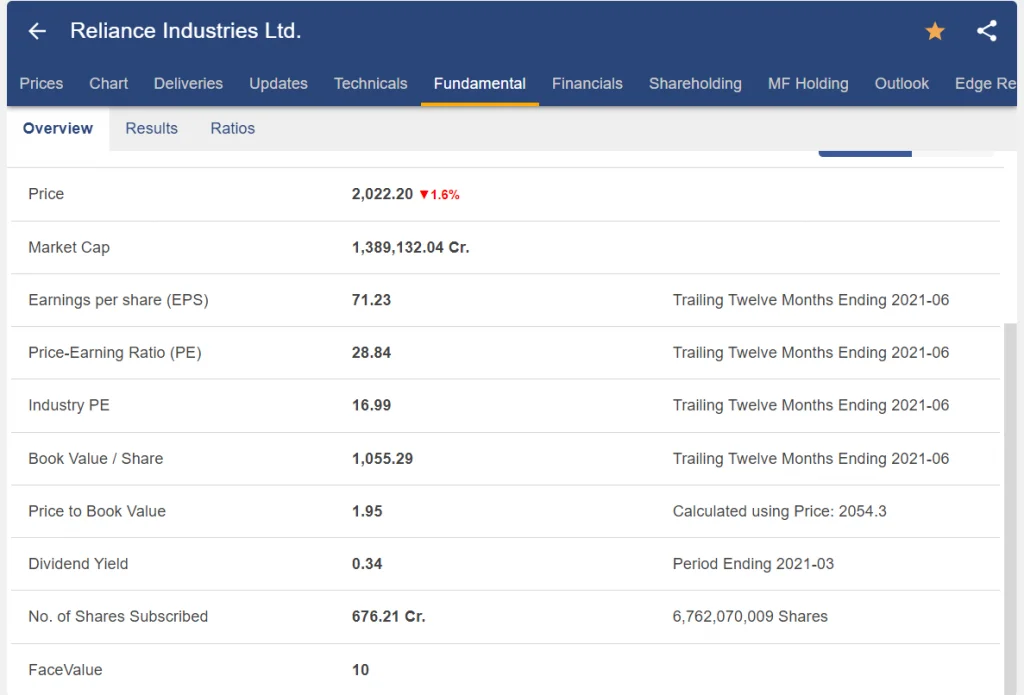

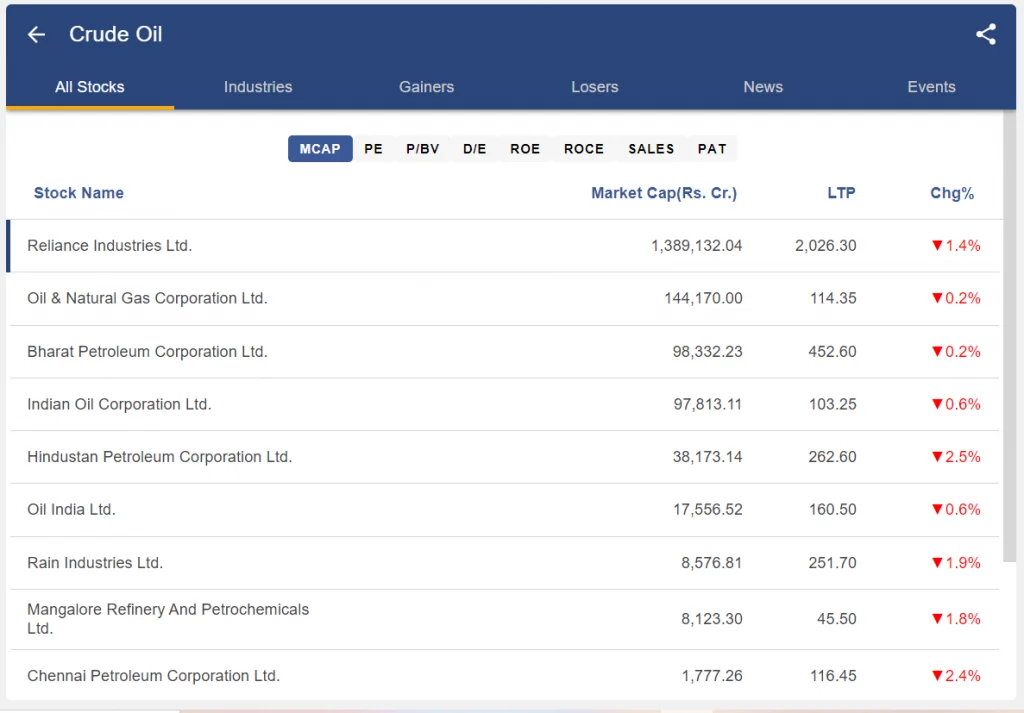

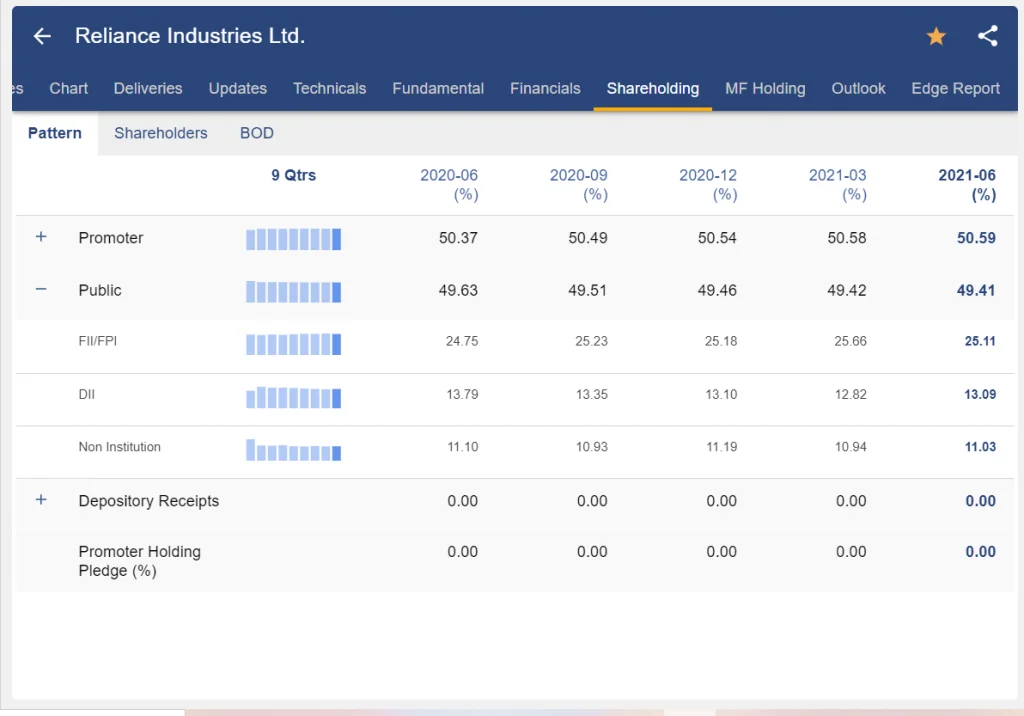

5.Select dependable stocks: Although you have numerous possibilities, you should eventually purchase shares from companies that are leaders in their area, have a good track record of success, a strong brand, a sound business strategy, and a product or service that people consistently want.

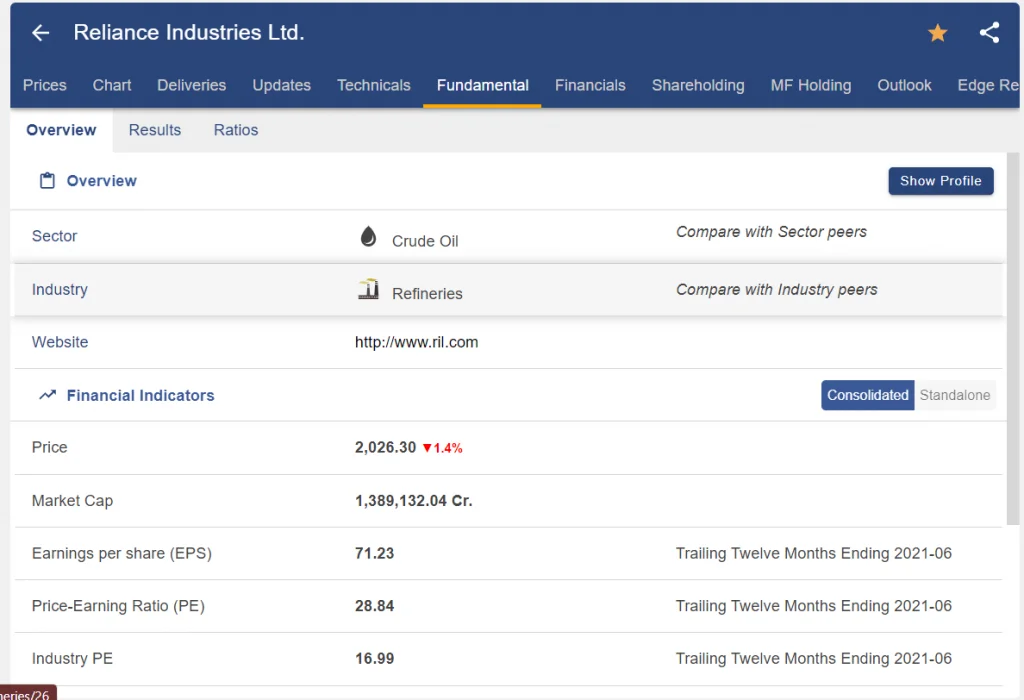

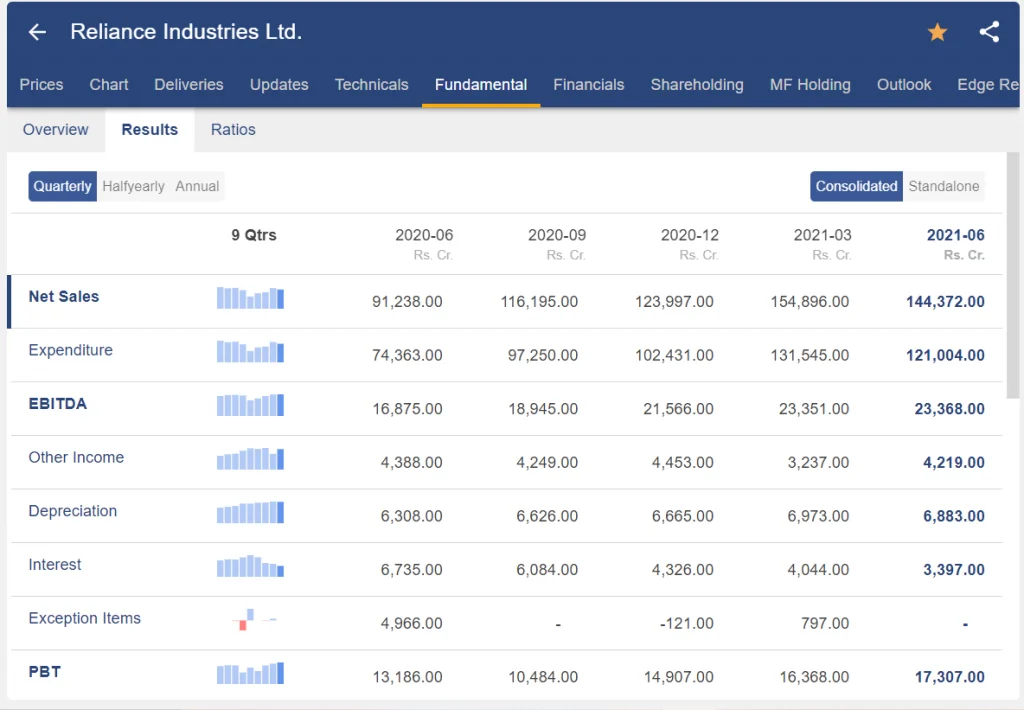

Look at a company’s public financial filings to find out how profitable it is. A more profitable company often has a more profitable stock. The most recent annual report of each publicly traded firm can be found there, along with comprehensive financial data. If it isn’t on the website, get in touch with the company and request a paper copy.

FOLLOW OUR WEBSITE: https://learningsharks.in/

FOLLOW OUR PAGE: https://www.instagram.com/learningsharks/