Introduction

Welcome to our thorough explanation to exchange-traded funds’ (ETFs’) benefits. In this post, we’ll examine the many advantages that ETFs offer to investors, from tax reduction to diversification. Whether you are an experienced investor or a novice, knowing the advantages of ETFs can be essential to making wise financial decisions. Let’s get going!

Tax Effectiveness

Tax efficiency is one of the main advantages of investing in ETFs. ETFs are created so that investors can reduce their tax obligations. ETFs have a unique formation and redemption process that minimises taxable events, in contrast to mutual funds, which commonly generate capital gains taxes by buying and selling shares. ETFs are a suitable option for long-term investors because of their structure, which allows investors to delay financial gains until they sell their shares.

Diversification

Investors can easily and effectively diversify their investment portfolios with the help of ETFs. By purchasing an ETF, investors can obtain exposure to a variety of products, such as stocks, bonds, commodities, or even entire market indices. By dividing assets over a variety of asset classes, diversification lowers risk. Additionally, ETFs give investors access to a variety of domestic and foreign markets, enabling them to take advantage of international opportunities.

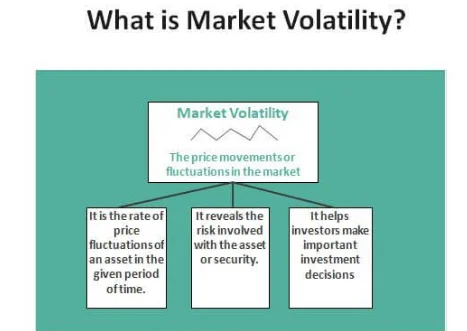

Flexibility in trading and liquidity

ETFs offer investors tremendous liquidity and trading flexibility because they are traded on significant stock exchanges. ETFs can be purchased and sold at market prices all day long, as opposed to conventional mutual funds, which are only priced and transacted at the close of each trading day. With the help of this feature, investors can take advantage of intraday trading possibilities and react rapidly to market changes. Additionally, the ability to trade ETFs on international exchanges exposes investors to a wider range of markets and increases their trading alternatives.

Transparency

ETFs’ transparency is a key component. Investors can accurately identify the assets they possess because the underlying holdings of an ETF are revealed each day. Investors can base their judgements on the composition of the ETF and its compatibility with their investment goals thanks to this level of openness. Additionally, compared to other investment vehicles, ETFs generally have low expense ratios, making them a less expensive investing option.

Flexible Investment Techniques

ETFs provide investors a selection of investment methods to match their unique preferences and objectives. There is almost certainly an ETF available that matches your investing plan if you want to increase your exposure to a certain industry, asset class, or investment theme. Investors have access to a variety of ETFs, including broad market ETFs, sector-specific ETFs, bond ETFs, and even thematic ETFs that concentrate on particular industries like renewable energy or technology. Investors can adjust their portfolios in accordance with their risk appetite and financial objectives thanks to this flexibility.

Cost-Effectiveness

ETFs clearly outperform many other investment options in terms of cost-effectiveness. Since ETF fee ratios are often lower than mutual fund expense ratios, investors can keep more of their profits. Investors can also avoid some of the expenses related to conventional mutual funds, such as sales loads and redemption fees, because ETFs are exchanged on exchanges. ETFs are appealing to both individual and institutional investors because of these cost benefits.

Conclusion

ETFs (Exchange-Traded Funds) are a beneficial addition to any investing portfolio since they provide a number of benefits to investors. ETFs offer a range of benefits, from tax efficiency and diversification to liquidity and transparency, that can enhance investing performance. The adaptability and affordability of ETFs contribute to their acceptance. ETFs can be included into your investment strategy to help you reach your financial goals, regardless of your level of experience. Conduct in-depth research and speak with a financial expert to decide the best course of action for your particular situation. In order to unlock the potential for better investment success, start your exploration of the world of ETFs.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en