You’ll need a basic comprehension of several important topics before you can begin investing in the stock market. The following is a list of fundamental knowledge you should possess before beginning:

Financial literacy basics

Learn the meanings of phrases like net worth, income, expenses, obligations, and assets in the financial world. This will assist you in comprehending financial statements of a company and in making wise investment choices.

Investment Objectives

Set your investment objectives. Do you plan to save for your future, purchase a home, pay for your child’s education, or amass wealth? Your investment strategy will take the form of clear goals.

Risk Acceptance

Know your risk tolerance, or how much turbulence and possible loss you can take. Your choice of investment types will be influenced by this.

Asset Types:

Discover the various asset classes, such as equities, bonds, properties, and cash equivalents. Each has distinct risk-return attributes.

Stock Market Foundations

Gain a solid understanding of the basic ideas behind how the stock market works, including how stocks are traded, stock exchanges, market orders, limit orders, bid-ask spreads, and market indexes.

Various Stock Types

Recognise the differences between preferred and common stocks, as well as the rights and dangers connected with each.

Company Evaluation:

Understand how to analyse businesses by looking at their financial statements (income statement, balance sheet, and cash flow statement), as well as their business strategies, competitive advantages, and growth prospects.

Market analysis

Learn to analyse market patterns, economic data, and world events that may have an impact on stock values.

Investment Techniques:

Learn about several investment approaches, including index investing, growth investing, dividend investing, and value investing.

Diversification:

Recognise the significance of portfolio diversification to reduce risk. Find out how to distribute your investments among various sectors and asset classes.

Future Perspective

Accept the value of compounding and the concept of long-term investing. Market swings in the short term are common, but it’s important to look at the big picture.

Relation between risk and reward:

Discover the connection between risk and possible profits. larger returns typically come with larger risks.

Tax Repercussions:

Learn about the potential tax implications of your investments. Recognise ideas like taxation of capital gains, dividends, and tax-advantaged accounts like IRAs.

Business Psychology:

Learn about the psychology of the market, including how herd mentality and emotions can affect financial choices.

Deposit Accounts:

Learn about several investment account types, including brokerage accounts and retirement accounts (such as 401(k) and IRAs), and how they effect your investments and taxes.

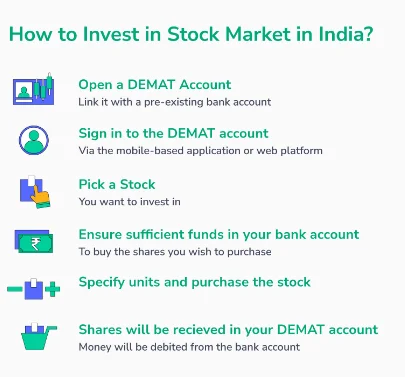

Platforms for Brokerage:

Learn how online brokerage platforms operate because you’ll utilise them to purchase and sell stocks.

Keep in mind that learning about investing is a lifelong endeavour. Start with a firm grasp of these fundamental ideas, and as your expertise and confidence grow, you can go further into more complex concepts and techniques.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en