Psychology and Risk Management

• What to expect

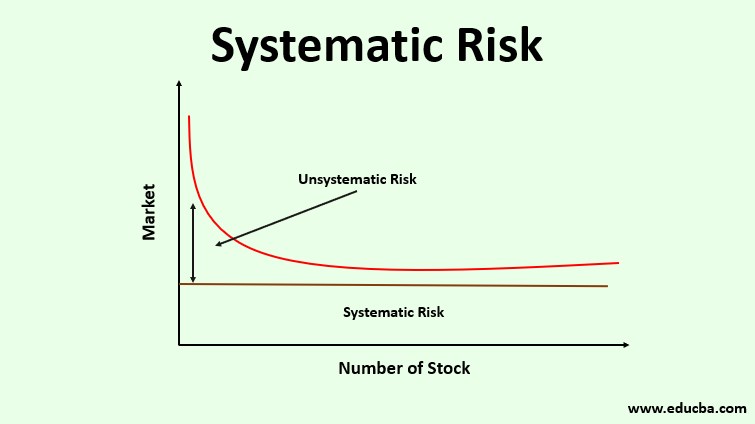

• Risks

• Position sizing

• illusion of control

• Accepting critisism

• Paralyzed by fear

• Loss is a feedback, not a failure

• The flexible trader

• Focusing on the positive

• Short straddle

• The dynamics of greed

• The herd mentality

• Notes

The Dynamics of Greed

Gordon Gecko states that “Greed is Good” in the feature film “Wall Street.” Although it might spur you on to pursue perfection and keep you going when things get tough, greed has drawbacks. It is frequently asserted that fear and greed are what drive the markets. The general populace naturally yearns for riches and all the benefits that money may offer. The general public invests in stocks because they are zealous and think that doing so will help them reach their financial objectives. However, when the price starts to fall, they become concerned about losing their investment and sell, frequently too soon and at a loss.Market dynamics are driven by the dynamics of greed.

You can become a trader driven by greed. A difficult career is trading. Not everyone succeeds. You must research the markets and discover how to profit from their movement. This is not straightforward to do. The search for profitable trading methods never ends. You could discover a tactic that performs well initially, but as market conditions shift, the tactic loses its effectiveness. Making money in the aftermarket market is the challenge. Why even try? You won’t succeed if you aren’t motivated to succeed. You won’t keep trying. You won’t attempt to overcome one setback after another. Greed has a strong motivating effect.

If you’re like most people, your dream is to live forever in happiness.

People have long believed that they could solve all of their issues if they had unlimited wealth, but this belief is frequently untrue. Human minds have the capacity to deceive themselves into thinking that outlandish desires can come true. Money cannot purchase happiness, yet it may be wonderful to have enough riches to make your life more comfortable. However, the desire for wealth and the knowledge of how to acquire significant fortune through trading serves as a tremendous incentive. It can be beneficial at times to indulge in imagination and take pleasure in the drive for success. In times of adversity, it keeps us going. It provides us a goal to work for.

Monster: greed

However, there are drawbacks to greed. Although money can be a strong incentive, many individuals are aware that it cannot fix all of our issues. Furthermore, our subconscious ideas and emotions frequently have the power to influence us against our will. When everything seems to be working against us, we can lose hope since we know that money won’t fix our problems. We must recognise how greed can be both a motivation and a hindrance. It may cause us to lose concentration on our trading strategy.