How much can I earn every day from intraday with capital 1L

Intraday trading means where traders buy and sell their stock within a day which helps traders to make more profit in less time. However, it’s important to understand the earning method in intraday trading. It depends on many factors like market conditions and the skill level of the traders.

There are many possible strategies to earn money through intraday trading so you can trade money in different cap’s such as large cap , mid cap and small cap and there are some methods which we are going to discussed in our blog so you will be able to earn profit while intraday trading. For beginners with capital of 1L potential. Profits exist but risk too exists this guide will help you to understand how much you can earn from the potential capital you have.

What is intraday trading?

Intraday trading is when traders buy and sell stock on the same day. Because traders don’t maintain positions overnight, there is less chance that events that take place after market hours may cause price gaps during the night. Nevertheless, there are particular difficulties associated with this trading method, including the requirement for rapid decision-making, efficient risk management, and a thorough grasp of technical analysis. It allows traders to avoid excessive risks and negative price differences between the closing price of one day and the beginning price of the following day. It’s an appealing option for traders to seek quick profit, intraday trading earnings depend on several factors including marketing conditions, capital allocation, and risk management.

Some key features of intraday trading

- One of the key distinguishing features of intraday trading is that there is no overnight risk for traders because it protects the traders from the overnight risk of price movement caused by news event earning reports or global market development that may negatively affect a trader’s position.

- Leverage Broker often provide intraday traders with large amounts of leverage which can help them to gain more profit than their capital allow

- Intraday traders have to make quick decisions as it involves short-term pierce movement.

- Intraday trading requires technical analysis chat, price patterns, and an indication of predicted price movement to make the right decision.

- Traders who do intraday trading focus on higher trading stock on assets that even have enough trading and can easily volume for easy entry and exit

For a better understanding of how intraday trading works here is the example

For example:-

If you have bought 1000 shares at rs 100 in the morning and after some horse soon its price climbed out 150 rs and you sold it at 150 rs then you will earn rs 50,000 profit.

profit = (selling price-purchase price)*numbers of shares

Purchase price = 100

Selling price= 150

Numbers of shares = 1000

Now plug in the values

Selling price – purchase =150-100=50

Profit :

50*1000 = 50,000.

How Much Can You Earn from ₹1,00,000 in Intraday Trading?

There are lots of strategies to do intraday trading from which your earnings can be increased. There is no confirmation of how much you will earn from intraday as it depends on factors which are strategy, market condition, use of leverage, and risk tolerance. Here are some different trading styles that can help

Conservative trading (daily 1-2%)

- Conservative trading is an investment strategy that focuses on minimizing risk. Investors who follow this method commonly opt for stable, well-known companies and avoid risky moves, focusing on consistent, long-term growth rather than instant profits. Focus on factors like

- Risk management (1-2%) per trade

- Trade realistic daily return (0.5 to1%)

- Stick to a disciplined

- Have a systematic approach for consistent gain

Conservative trading can help you earn around 500rs to 1000rs per day by using capital of 1,00,000.

Moderate trading (daily 2-3%)

- when the stocks were sold or bought not at a very high rate nor very low price. Moderate trading has more risk than conservative trading but it also helps to gain more than then conservative trading, moderate trading is neither too risky nor too safe. Moderate trading balance between liability and profit

- Risk management (2-3%) per day

- Position sizing :-2-5%of capital per day

- The Daily profit target should be (1-2%)

- Relying on both technical and fundamental analysis can help.

Moderate trading can help you earn around 1000rs to 2000rs per day using 1L capital.

Aggressive trading ( daily 5- 10%)

- Aggressive trading involves fast decision-making strong risk management and frequency trading to avoid large losses it focuses on higher risk and higher reward strategy this trading has more risk than both conversion trading and moderate trading as well it leads to more profit from then as well things to focus on will aggressive trading is following.

- Large position sizing (5-10%)

- Daily target return should be (2-5%)

- Aggressive trading needs the best execution

- Higher risk tolerance

Aggressive trading is expected to help to gain around 2000 rs to 5000 rs per day with one lakh capital.

Strategies to keep in mind will doing intraday trading

Potential earning in day trading through 1 lakh capital based on different ways, plus your risk management, tactics, market survey, and how they will implement shares. There are some following points of potential earning and day trading.

- Risk Management – Risk management is the process of finding analysis and handling legal strategic and security risks to capital and earn.

- Leverage-Many brokers offer margin (leverage), allowing you to trade with more capital than you have, amplifying both profits and losses.

- Trading Skills-Short-term scalping, momentum trading, and technical analysis can yield different results.

- Market Conditions– Volatile markets offer more opportunities but also increase risk.

- Broker Fees– A broker fee is a commission a broker charges executive transactions or provides specialized services on behalf of clients.

Buy shares and sell shares with the consultation of the broker and sell the shares and gain profit.

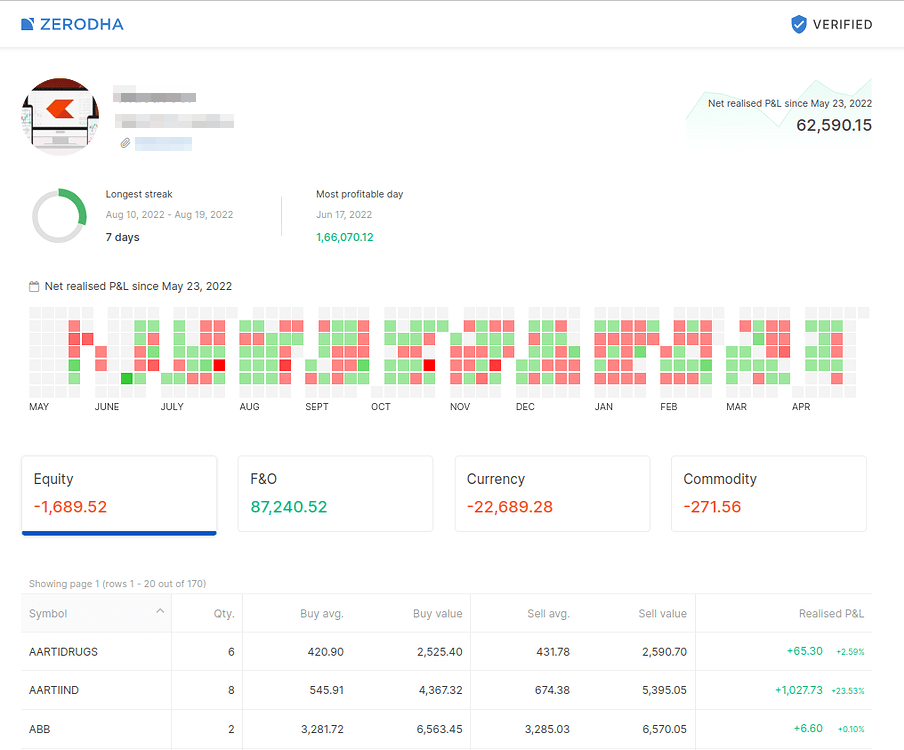

Approximate Earnings Calculation:

If you use ₹1 lakh and:

- Assume leverage of 10x, so your trading capital becomes ₹10 lakh.

- Aim for a conservative 1% profit on the entire trade.

Your potential daily earnings could be:

- ₹10 lakh × 1% = ₹10,000.

Now, if you trade multiple times a day, this could increase, but there’s also the risk of losses. With such leverage, even a small movement in the opposite direction (1% loss) can wipe out a significant portion of your capital.

Risks Involved:

- Market Volatility: Sudden market swings can lead to quick losses.

- Leverage Risk: Trading with leverage amplifies both gains and losses

- Brokerage and Taxes: Intraday trading incurs brokerage fees, Securities Transaction Tax (STT), and other charges, which can eat into your profits

Realistic Expectations:

With good risk management and strategy, a realistic daily profit range could be ₹2,000 to ₹5,000 consistently with ₹1 lakh capital. However, it’s essential to start cautiously and not over-leverage your position, as losses can be equally fast.

Points To Be Noted While Trading

While doing trading some traders miss important things which can impact their decision in a negative way. Therefor here are some point to be noted while trading:-

- 1. Stop-order– order is a trading process that allows you to cut your losses while trading in the stock market. When you set a stop-order criterion at a certain price of your stock, it automatically sells the shares when the price falls below the stop-order price level.

- Analyze– day trading requires a lot of homework. To Make quick design, which day trading essential offers have to be backed by A research company. Traders have to be skilled in charts, oscillators, trading metrics ratio, monitoring volume, and many other indicators that require trading. Stock market returns are volatile more so when you are buying and selling the shares on the same day.

- Regularly Monitor Your Investments- One of the most important qualities to be successful in the stock market is to monitor your investments and portfolio. Monitoring your portfolio regularly helps you to sell the stock immediately if you think the prices are likely to correct in the future. This requires even more day trading because your daily activity can decide your position (profit/loss) in the market and financial conditions.

To mack trading more effective and easy we can use some strategy which will help to gain more profit with minimum loss

Five Popular Trading Strategies

As we discussed early in our blog that before trading there are some risks .So here we discuss how we can overcome this mistake. There are some strategies for trading which makes it more secure.

- Inversion Intraday/day trading Strategy– Reversal intraday or day trading strategy means where a trader fixes the limit of the stock it means when the price movement happens in the stock so it reverses to the trader

- Averaging Down–Averaging down means where traders buy stock or assets and the price of stock decreases then the trader buys more shares which decrease the average value of stock this term is considered as an averaging down.

3.Pyramiding–Pyramiding means where the trader buys more stock or assets when the value of the stock increases and invests more in stock . They aim to make more profit out of it and they add more of the position as the assets perform well.

4.Breakout Trading–meanly when price of assets move beyond specific level of resistance . when price breaks out from a condolence phrase such as the previously defined range . breakout trading capitalize to the same movement that will follow the breakout.

5.SWING TRADING– Swing Trading revolves around the strategy of taking when traders buy and sell stocks within a month . where traders aim to capture price moves of the market. The main goal of the sewing trading is to identify opportunities when the price moves in a clear direction during the sewing, whether bullish or bearish to get profit from this movement.