On the daily chart, Tata Power had higher top and higher bottom formations. It is a symbol of power. The stock is currently maintaining its prior increase.

- Prior to the long weekend, domestic equities indices closed Friday’s trading session higher. To end the day at 65,828.41, the BSE Sensex gained 320.09 points, or 0.49 percent. To finish at 19,638.30, the NSE Nifty gained 114.75 points, or 0.59 percent.

- Today’s attention is likely to be focused on a few active counters, including Central Bank of India, Adani Ports & Special Economic Zone, and Tata Power Company.

Before Tuesday’s trading session, Mileen Vasudeo, Senior Technical Analyst at Arihant Capital Markets, had the following to say about these stocks:

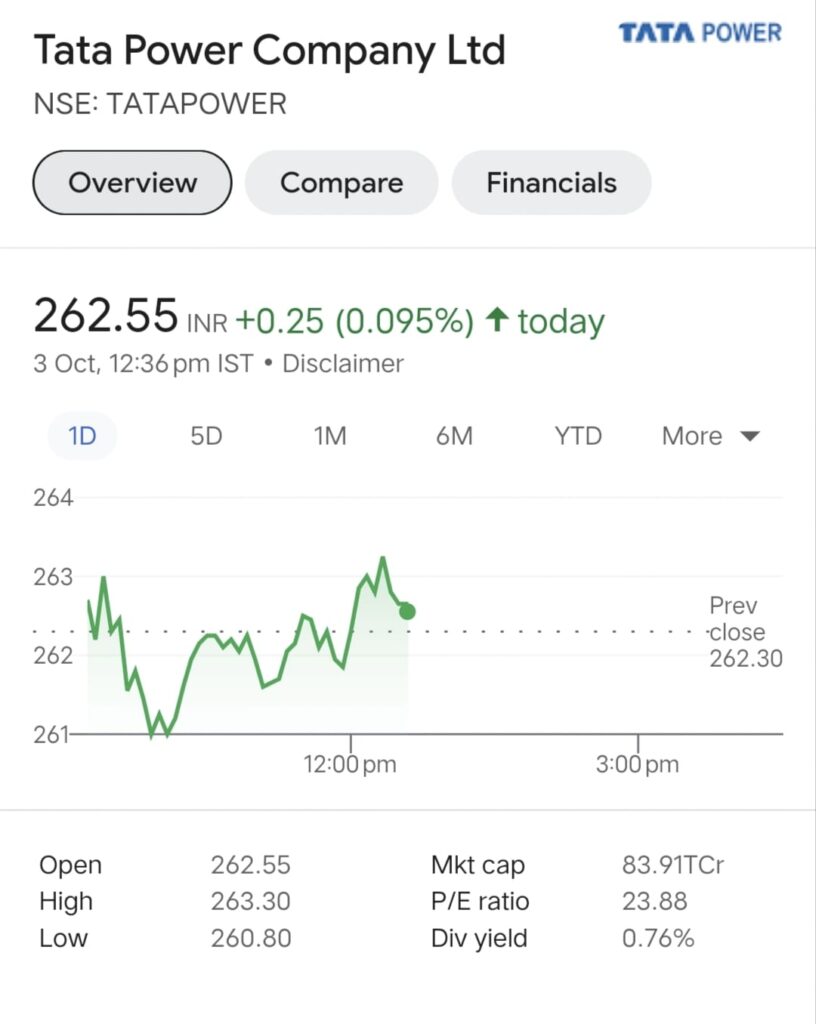

Hold; Target Price: Rs. 284–296; Stop Loss: Rs. 250; Tata Power Company

- On the daily chart for Tata Power, higher top and higher bottom formations were visible. It represents strength. The stock is currently holding steady after its prior increase.

- The stock is performing better than its peer benchmarks. Even the RSI momentum indicator is in a bullish position.

As a result, one can hold the stock at its current price with a stop loss of Rs. 250 in order to reach the target range of Rs. 284–296 in the coming few weeks.

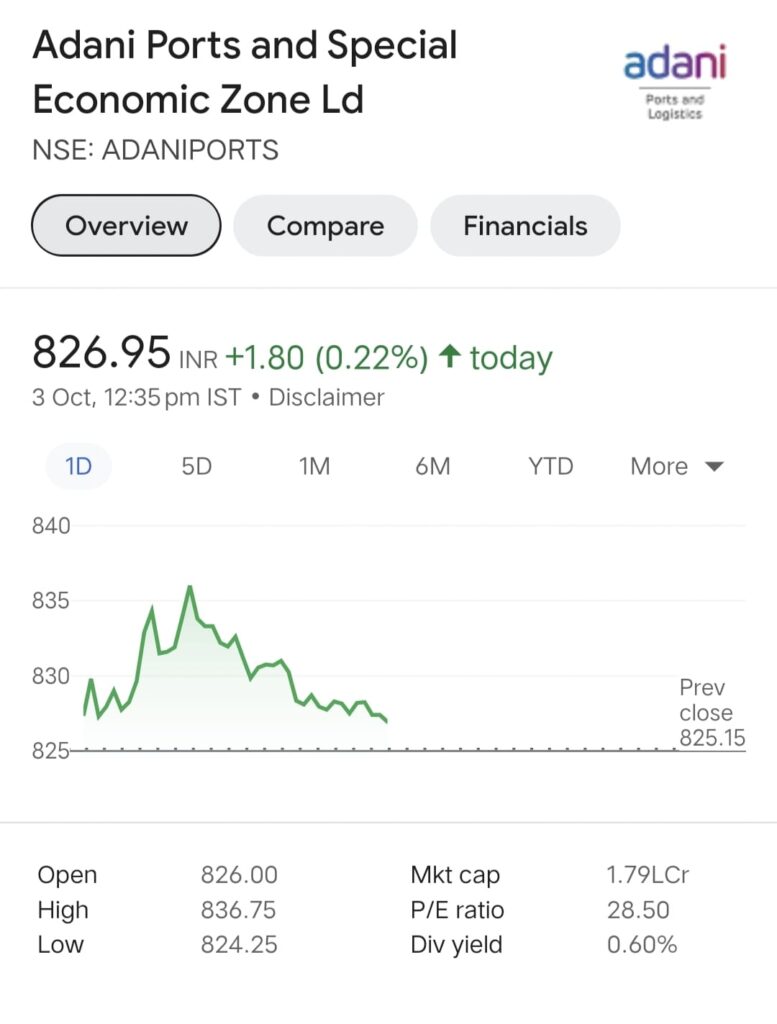

Hold; Target Price: Rs. 858–874; Stop Loss: Rs. 810; Adani Ports and Special Economic Zone

- On the daily chart for Adani Ports, higher top and higher bottom formations indicated strength. The stock is continuing its prior upward trend.

- Benchmark indices are underperforming the stock. Even the MACD momentum indicator is poised positively.

Therefore, with a stop loss of Rs. 810 and a target price of Rs. 858–874 within the next few months, one can “Hold” the stock at current levels.

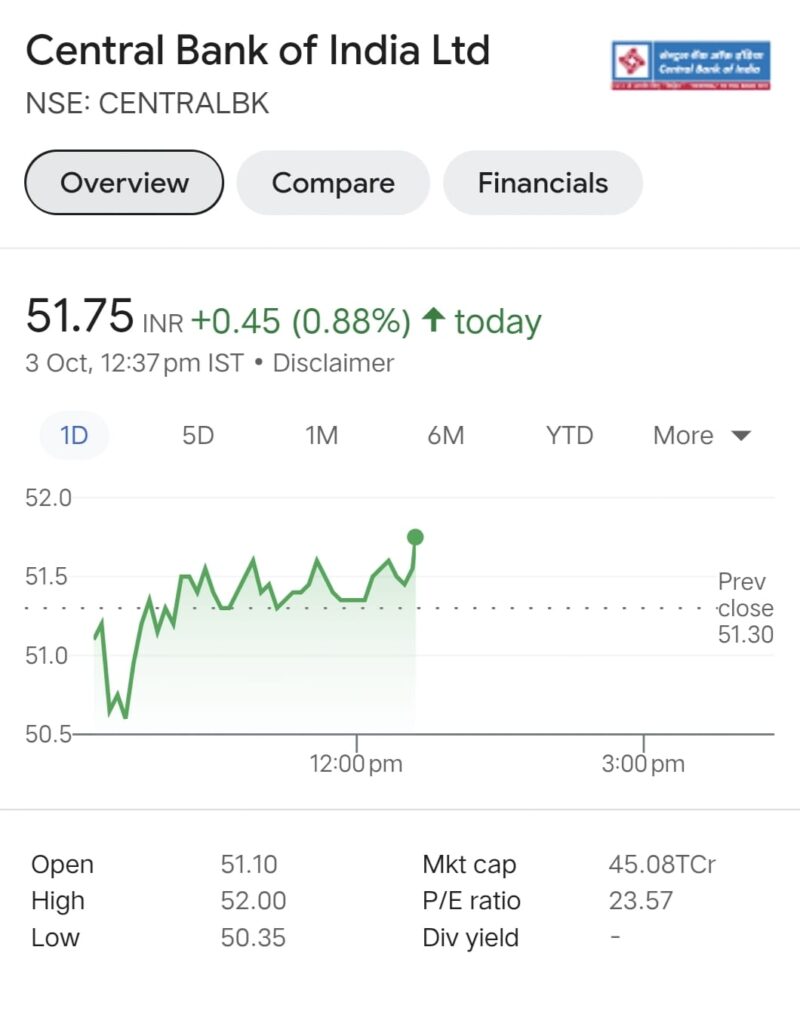

Hold | Target Price: Rs. 61-66 | Stop Loss: Rs. 46 | Central Bank of India

- On the daily chart, the Central Bank of India noticed higher top and higher bottom patterns. The stock has been moving sideways for nine trading sessions.

- Nevertheless, it outperforms comparison indices. The RSI, a momentum indicator, is trading unchanged.

Therefore, with a stop loss of Rs. 46 and a target price of Rs. 61–66 in the coming months, one can “Hold” the stock at the current market price.

CONCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en