Even in the midst of the pandemic, the Indian internet and e-commerce sector has emerged as one of the country’s fastest expanding sectors. In the Indian start-up ecosystem, 43 companies will become unicorns in 2021, compared to more than 30 unicorns formed up to 2020

However, history says that most unicorns struggle to survive, with only a handful thriving. Those who do make it have a few characteristics in common. We’ve tried to highlight some of the most important points here.

1) Low capital cost – Google, Airbnb, Facebook, LinkedIn, Uber, and other companies all have one thing in common: scalable virtual models that can be scaled up enormously without adding major assets. Unlike Maruti Suzuki or D-Mart, which would require land, factories, distribution centres, and warehouses to develop.

2) Data — In order to run targeted ads and customise the customer experience, new-age tech corporations acquire, store, organise, and analyse years of user data. The main difference between a client entering into a Walmart supercenter and a customer walking into an Amazon online store is that Amazon immediately reorganises the entire store in a way that is tailored to that customer.

3) Network impacts – The larger the network, the more valuable the company is for most new-age IT enterprises. While practically all platform firms have network impact, the quality of network effect varies per company.

4) Scale economies – Google, Microsoft, and Facebook can scale up their revenue with low variable expenses. Making another copy of Windows 10 or providing service to another Google or Facebook customer is relatively inexpensive.

In the Indian environment, we feel that Zomato is one of the listed firms that has the ability to thrive over the next decade.

Zomato is a disruptor in the food industry, but it also offers a win-win solution.

Zomato provided a solution by acting as a link between consumer needs and scalability and distribution.

As we all know, gross margins (ex-RM costs) in the food industry are extremely high (about 65 per cent to 75 per cent), but restaurant owners’ fixed overhead costs remain high. As a result, even if the restaurant must share a percentage (15 percent -25 percent) of incremental sales with a distribution partner like Zomato, the margin/contribution on marginal costing is still very significant. And, from the standpoint of the consumer, access to choice, the convenience of ordering, and delivery are excellent value propositions…for a small price compared to the time, logistics, and hassle that the consumer will face.

We like to focus on three essential elements when evaluating a company: scalability, inherent profitability, and managerial quality.

1. The ability to scale

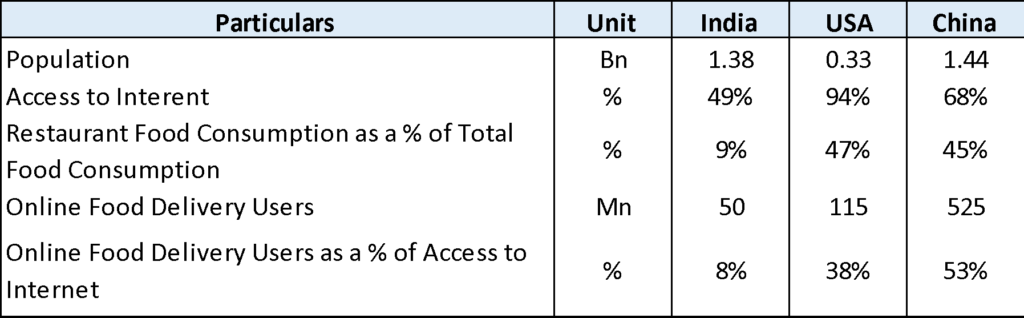

Food consumption will account for over a quarter of India’s GDP in 2020, with a value of US$607 billion. However, the majority of this is due to home-cooked meals. Restaurant food (or food services) currently accounts for just about 8%-9% (US$56 billion) of overall food consumption. When compared to the United States and China, this is far lower.

The Indian internet food services business has grown 7x (c.50 percent CAGR) in the last five years to US$3.6 billion, yet it still only accounts for 6% of the overall US$56 billion pie spent on eating out by Indians in FY20.

2) Inherent Profitability

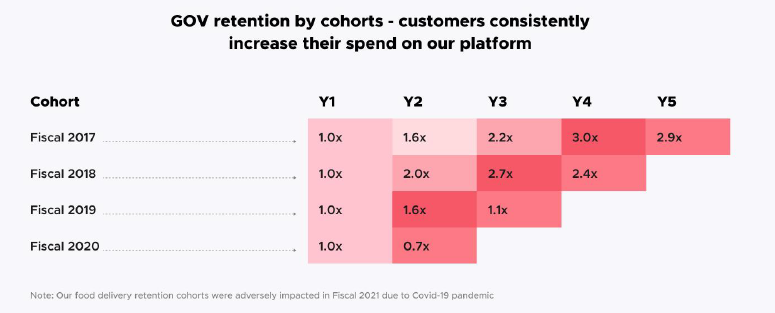

Since its inception, Zomato has been a cash-burning machine. However, we feel that all of these marketing and promotion activities were necessary to accelerate the adoption of food delivery and the formation of new categories. We expect a significant drop in promotional and marketing spending as customer stickiness improves, based on the cohort analysis (Exhibit 2) provided by the company in its DRHP.

As the market consolidates, Swiggy and Zomato are focusing on improving unit economics through marketing rationalisation, delivery fee introduction, operating leverage, and logistics cost optimization. The unit economics of Zomato has improved significantly.

3) Management Quality

In FY2011, Zomato began as a restaurant review platform before expanding to meal delivery in India in FY2015. In FY2016, it introduced the table reservation concept, followed by Zomato Pro in FY2017. Carthero Technologies was purchased in FY2018 to enhance hyperlocal distribution capabilities. HyperPure was introduced in the fiscal year 2019 (FY2019). Finally, in FY2020, Uber Eats India was purchased.

Zomato is one of the few Indian start-ups to successfully flip their business and prosper in a highly competitive environment, eventually becoming India’s first new-age start-up to issue an initial public offering (IPO). This reveals a great deal about the management’s competence and ability to execute.

Deepinder Goyal, the company’s creator (as well as its Managing Director and Chief Executive Officer), holds an integrated master’s degree in technology in mathematics and computing from the Indian Institute of Technology in Delhi. He worked at Bain & Company before launching Zomato.

To summarise

, we believe Zomato (which possesses all of the characteristics of a new-age tech company) has a huge runaway for high and profitable growth in the years ahead, led by a good management team with strong execution capabilities, with the goal of transforming the eating habits of the large Indian consumer base.

Let us know what do u think about this in the comments section.

About us

AMONG TOP STOCK MARKET INSTITUTES

Learning sharks

started in 2008 and is a renowned stock market institute among stock market traders and investors for training, and Investing. In addition, the Learning sharks Institute Provides various NSE & BSE share market courses like financial Derivatives, Technical Analysis courses, fundamentals analysis courses, NISM, and NCFM preparation courses. With 15+ experienced online & offline faculty Cum Traders and 25+ Share market courses for intermediates and professionals.

With comely course fees, learning sharks assist with jobs and exams along with self-trading and investing.