A trading journal keeps track of your trades, their results, and provides an overview of your trading history. It is not, however, a brokerage account statement since one can discover the justifications for selecting or eschewing a trading strategy.

Each successively executed trade is methodically planned, and the performance of each trading strategy can be tracked in a trading journal. Using a trading journal, you can effectively evaluate the potential of a particular trade regardless of how the market behaves.

Additionally, it won’t cost you much to start a trading journal. You could use Excel or spreadsheets, and it would help you develop discipline and stick to a set of trading strategies. If you find it difficult to consistently follow your trading plan, you should record trading entries in your journal. Noticing when things go wrong and why they did so will help you learn how to respond to similar situations in future trades without acting the same way. Why is it crucial to keep a trading journal? Find out by reading on!

What are the benefits of Trading journal?

A trading journal can yield significant benefits if it is regularly updated, which is a straightforward task. Keeping track of all your data with a pen and paper, a basic Excel spreadsheet, or trading journal software can naturally help you develop a successful trading strategy and prevent you from making the same mistakes repeatedly.

The key benefits of using a trading journal are:

- Finding the right trading style- If you are day trading but your journal demonstrates that you frequently experience stress and struggle to properly manage risk, you may be more of a swing trader. Although trading medium- to long-term is not any simpler than trading short-term, some traders find it to be more comfortable because they have more time to analyze the data and are not required to make quick decisions. Finding the right trading style can be aided by testing out various trading techniques.

- Identifying your strengths/weaknesses- Over time, if you keep up with your journal, you should start to notice some patterns. Finding the best trading style and strategy will depend on your ability to recognize your key strengths and weaknesses.

- Source of information- There is no trader who is an expert in everything and has the means to stop growing. Markets are constantly changing, which causes strategies to fail and edges to disappear. As a result, traders must constantly educate themselves. Making market observations and recording them is one way to go about it. Maybe one of those observations will eventually become an edge.

- Discipline- After some practice, maintaining a trading journal won’t seem as tedious and will instead become a routine part of your trading day. A trader will benefit from developing discipline and being more consistent.

- Numbers don’t lie- Even better if you include trading statistics in your trading journal. The statistics will help you gain important insights in addition to your own observations. Opening a trading journal is relatively simple, but maintaining consistency is challenging. A trading journal is also very private. There is no right or wrong way to do it because each trader must decide for themselves what is most crucial and how they want to structure it.

- Master emotions– Trading psychology can be better understood by tracking trades, which is a clever way to examine behavior patterns. It’s impossible to completely separate your trading process from your emotions. But being able to write down your thoughts and feelings at crucial moments, such as entry and exit points, can prevent you from making poor choices.

- Improve risk management– At its core, risk management entails determining the amount of risk you are willing to accept in light of all the relevant market factors. You might start to identify areas where you have the wrong mindset by recording every trade in the journal. By adjusting your risk tolerance, you’ll have a better chance of succeeding and maintaining your capital.

How to use a trading journal?

The idea of an ideal trading journal template is untrue. While entering transactions in their individual trading journals, traders should review the pertinent metrics they require or should avoid using. In light of this, a trade journal needs to be customized.

You can add justifications for adopting particular positions in your written document. In order to avoid having a negative effect on your trading performance, it is also crucial to note the indicators you see during your market watch hours. In your written document, you’ll also debate whether or not a particular trade concept you used is a sound one. You can better understand the benefits and drawbacks of each trade proposal by turning it inside out and backward.

Then, turn to your spreadsheet to enter the details of your daily trading. Keep it organized and up to date to accurately assess your success or failure. In order to avoid missing any important descriptions, try to write down trade details after you execute the trade.

Additionally, it’s a good habit to review your trade log spreadsheet daily to determine your current level of exposure and any potential for growing your trading portfolio. But how do you review the spreadsheet for your trading journal? While analyzing your current trades, carefully go over the written document’s documents and the spreadsheet’s entries.

By looking back at a trading history and identifying trends they should avoid, traders can have their tactics performance-driven rather than influenced by their emotions or conduct. As a result, keeping a trading journal helps you assess your performance, identify areas for development, and become an all-around better trader.

How to create your Trading Journal?

You must keep the following records both during and after the transaction:-

Relevant metrics

- Date – Date you entered your trade

- Time Frame – The time frame you entered on

- Setup – Trading setup that triggers your entry

- Market – Markets you’re trading

- Lot size – Size of your position

- Long/Short – Direction of your trade

- Price in – Price you entered

- Price out – Price you exited

- Stop loss – Price where you’ll exit when you’re wrong

- Profit & Loss in Rs. – Profit or loss from this trade

- Karma- Whether you are satisfied with the trade or not. If satisfied, we will add +1 in the Karma column; if not, then -1.

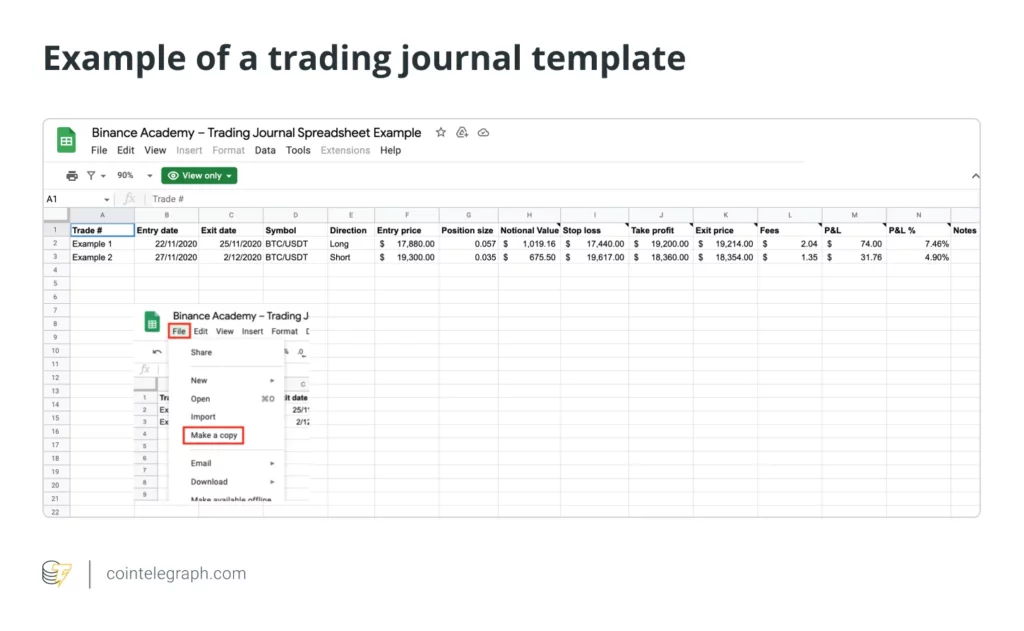

Here is an illustration of a trading journal that we created using the aforementioned metrics and an excel sheet:

Example

No matter what template you choose, make sure it has all the columns required for each trade. To make the journal more useful, you can also take screenshots of the trading charts you have followed and link them to the relevant trade on the sheet.

Let’s examine the columns that your spreadsheet should include when making a trading journal:-

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en