Sector rotation is a crucial ability for investors wanting to maximize their investment strategies over several economic cycles in the dynamic environment of the financial markets. Rotating your sector requires strategically moving your investments from one sector to another based on the current state of the economy. This sophisticated strategy enables investors to take advantage of opportunities and reduce risks, ultimately resulting in greater returns. In this thorough guide, we explore the nuances of sector rotation and offer insightful advice that can enable investors to outperform their contemporaries.

Understanding Sector Rotation

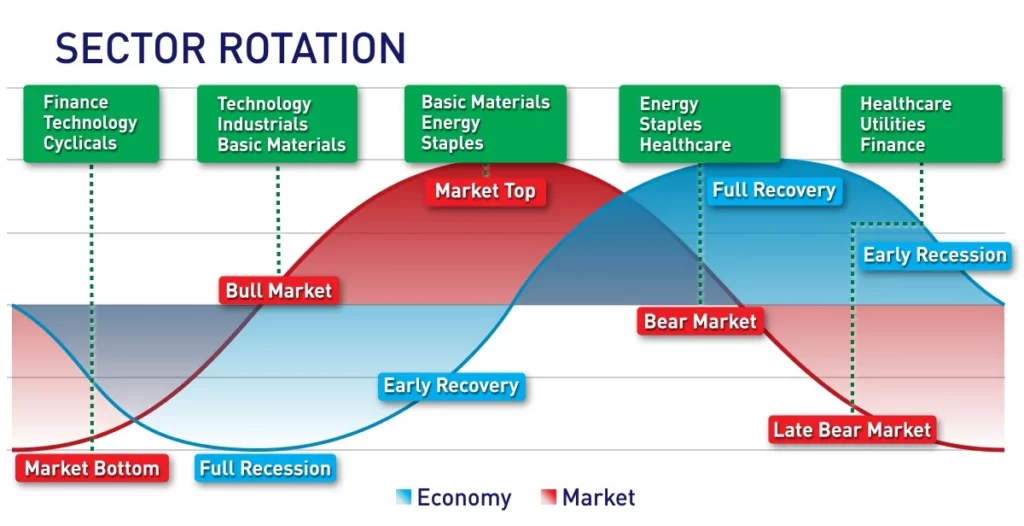

Sector rotation is a systematic strategy to investing that takes use of the cyclical structure of sectors rather than just being a tactical move. It is based on the notion that diverse economic sectors behave differently at various points in the economic cycle. The four primary phases of these cycles are typically expansion, peak, contraction, and trough.

KEY TAKEAWAYS

- The economic cycle, from boom to crash and back again, is predictable.

- Investors in stocks try to predict the following cycle months in advance. They invest their money in the sectors that typically outperform others in the following cycle.

Navigating Economic Cycles

1. Expansion Phase

Sector rotation is a systematic strategy to investing that takes use of the cyclical structure of sectors rather than just being a tactical move. It is based on the notion that diverse economic sectors behave differently at various points in the economic cycle. The four primary phases of these cycles are typically expansion, peak, contraction, and trough.

2. Peak Phase

Inflationary pressures could develop when the economy hits its peak, forcing central banks to adopt tighter monetary policies. During this time, defensive industries like healthcare and utilities frequently do well. Strategic allocation to these sectors can help investors protect their gains and limit their losses.

3. Contraction Phase

The contraction era, often referred to as the recessionary phase, is characterized by a slowdown in the economy, an increase in unemployment, and a decline in consumer expenditure. Here, defensive sectors are still preferred, but investors should also think about allocating to generally countercyclical industries like healthcare and consumer staples. These industries are more prepared to withstand economic downturns.

4. Trough Phase

Economic indicators exhibit evidence of stabilization and recovery during the trough phase. As the economy starts to recover, cyclical industries like finance, materials, and energy are primed for potential development. Strategic positioning in these areas is an option for investors looking to profit from the early phases of the rebound.

Implementing a Winning Strategy

1. Thorough Research

The key to succeeding in sector rotation is careful study. Examine past data, economic indicators, and industry performance during different economic cyclical periods. Find trends that can help you make better investing choices and give you a competitive advantage.

2. Diversification

An essential component of sector rotation is diversifying your portfolio across industries. You lower the danger that an individual industry may be negatively impacted by economic downturns by diversifying your investments. This tactic guarantees a more comfortable ride amid market volatility.

3. Regular Monitoring

It’s important to keep up with how the economy is changing. Keep an eye on sector performance on a regular basis, and be ready to change your portfolio as necessary. To make wise judgments, consult economic studies, financial news sources, and market analysis.

Advantages of Sector Rotation:

- Enhanced Returns: Investors can benefit from the various ways that sectors perform over economic cycles by changing their focus. Investors may increase returns by carefully reallocating their funds to industries that are expected to grow.

- Diversification: By diversifying your investments, you can lessen the effect that a particular industry’s bad performance will have on your portfolio as a whole. This strategy reduces risks and offers a more evenly distributed investment exposure.

- Risk Management: Defensive industries can serve as a buffer against market volatility during economic downturns. Investors can allocate to various sectors thanks to sector rotation, which lowers the total risk of their investments.

- Adaptability: Defensive industries can serve as a buffer against market volatility during economic downturns. Investors can allocate to various sectors thanks to sector rotation, which lowers the total risk of their investments.

- Active Management: Rotating your sectors promotes involvement in your portfolio. A deeper awareness of the market is cultivated and can result in more educated investment decisions when economic indicators and sector performance are routinely monitored.

Disadvantages of Sector Rotation:

- Complexity: Sector rotation necessitates a thorough understanding of market behavior, industry trends, and economic cycles. For new investors, mastering this approach without much study and education can be difficult.

- Timing Risk:It might be challenging to predict sector movements with accuracy. Investors may unintentionally expose themselves to losses or lose out on potential rewards if a transaction is conducted badly.

- Transaction Costs: Frequent asset purchases and sales might result in greater transaction costs, which can reduce gains. Particularly for smaller portfolios, these expenses may have an impact on overall performance.

- Overemphasis on Short-Term Trends: Some investors may become unduly preoccupied with short-term market movements, which might cause them to make snap judgments that don’t support their long-term objectives.

- Inaccurate Economic Predictions: Effective sector rotation requires reliance on precise economic forecasts. An investor’s sector allocations might not provide the intended outcomes if their economic estimates are off.

- Behavioral Biases:Investors are susceptible to emotional biases that can interfere with the disciplined approach necessary for effective sector rotation, such as herd mentality or fear of missing out.

Conclusion

Sector rotation is a complex investment technique that calls for a blend of diligence, self-control, and flexibility. You can put yourself in a position for long-term success by matching the composition of your portfolio to the economic environment at the time and being knowledgeable about the nuances of various industries. The important thing is to stay focused on your investing goals and keep up with the always shifting financial scene, regardless of whether you opt for a tactical or strategic approach. When done correctly, sector rotation can improve your investment performance and assist you in reaching your financial goals.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en