In the primary market, the sale of securities is conducted directly between the buyers and the sellers of the securities. A primary market is a market for newly issued securities, as opposed to the secondary market, where previously issued assets are bought and sold.

What exactly is Primary Market?

In a primary market, new securities are issued. A financial asset used by businesses, governments, and other organizations is a debt- or equity-based security. Investment banks manage the selling of securities to investors on the primary markets and determine the starting price range for securities.

Meaning of Primary Market

Security creation takes occur on the primary market. New stocks and bonds are “floated” (in finance parlance) by companies in this market for the first time.

Companies and governmental bodies sell fresh shares, bonds, notes, and bills on the primary market to raise money for improvements and expansions to their businesses. The issuer receives the majority of the proceeds, even if an investment bank may determine the securities’ initial price and be compensated for facilitating sales.

The primary market is more focused on the products itself than a physical place would be. One of the key features of a primary market is that securities are acquired directly from an issuer rather than being purchased from a previous buyer, or “second-hand.”

All transactions on the primary market are subject to a rigid set of rules. Companies must file statements with the Securities and Exchange Commission (SEC) and other regulatory bodies before they can sell securities to investors.

The primary market closes when all of the stocks or bonds in the initial offering have been sold. Trading on the secondary market then happens.

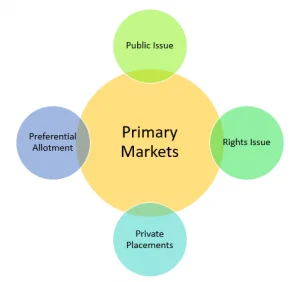

Types of Primary Markets

Public Issue

A public issue is the process of offering new securities, like shares or bonds, to the general public for subscription and purchase. It is a crucial component of the primary market.

Public issues, such as Initial Public Offerings (IPOs), are used by businesses to raise funds and list on stock markets. These opportunities give people the chance to invest in stocks or bonds and support the expansion of a business while maybe earning money. Companies can receive new funding through public issues for operations, research, and expansion, increasing their market awareness and allowing investors to participate in determining their future course.

Private Placement

Private placement refers to the sale of securities, such as shares or bonds, to an exclusive group of investors. Using this strategy, businesses can obtain financing directly from institutional or high-net-worth investors.

Private placements allow freedom in deal structuring and have less regulatory obligations than public offerings. Companies frequently select private placement due to its effectiveness and discretion. However, it restricts market liquidity and might not have the same level of transparency as open markets. Early-stage businesses frequently employ private placements.

Qualified Institutional Placement

Listed firms can issue shares to qualified institutional buyers (QIB), such as mutual funds, public financial institutions, insurers, foreign venture capital investors, etc., using the capital-raising instrument known as a qualified institutional placement (QIP). QIPs provide a quick way to raise money while still complying with regulations.

Preferential Issue

A preferential issue is a capital-raising strategy in which a business sells new shares to a small, usually strategic or existing, group of investors. Companies can quickly raise money using this technique while giving certain stakeholders precedence. Preferential difficulties frequently coincide with growth strategies, debt reduction efforts, or business alliances. Although effective in securing capital, it may dilute equity.

Rights Issue

A rights issue is when a company offers its existing shareholders the opportunity to buy additional shares at a discounted price, proportionate to their current holdings. This helps raise capital from within the shareholder base, often for expansion or debt reduction.

Bonus Issue

Bonus issues include issuing existing shareholders with free additional shares based on their present holdings. Without changing ownership ratios, it increases shareholder value. Bonus offerings are a popular choice among businesses to reward shareholders and boost market liquidity.

Functions of Primary Market

The purposes of such a market are several: –

New Issue Offer

New issues that have never been traded on other exchanges may be offered on a primary market. Setting up a new issue market entails, among other things, carefully assessing the project’s viability. As a result, a market for new issues also goes by the name “new issue market.” The promoters’ equity, liquidity ratio, debt-to-equity ratio, and foreign exchange needs are taken into consideration when financial arrangements are formed expressly for the project.

Services for underwriting

When starting a new issue, underwriting is essential. If the firm is unable to sell the required number of shares, underwriters are in charge of purchasing unsold shares in a main market. Financial institutions that take on the role of underwriters can receive underwriting commissions. Investors look on underwriters to help them decide if taking the risk and earning the rewards is worthwhile. Underwriters can buy IPOs and then sell them to investors.

New issue distribution

Additionally, new difficulties are dispersed throughout a significant marketing area. The issuance of a new prospectus marks the beginning of these payouts. It contains an invitation to the general public to purchase a new issue as well as comprehensive details on the issue, underwriters, and firm.

Advantages of Primary Market

- Companies are able to raise capital for a reasonable price, and the securities that are issued in the primary market as a result have high liquidity since they may be quickly sold in the secondary market.

- Primary markets play a crucial role in an economy’s ability to mobilize savings. Savings from the community are tapped into invest in different ways. This is used to finance investment options.

- The primary market has much lower odds of price manipulation than the secondary market. By deflating or inflating a security’s price, manipulations like this impact the fair and free operation of the market.

Disadvantages of Primary Market

- Investors may only have limited access to information prior to participating in an IPO because unlisted companies are not subject to the Securities and Exchange Board of India’s regulation and disclosure obligations.

- Each stock has a different level of risk, but since the company is issuing its shares through an IPO for the first time, there is no previous trading data for IPO shares to analyze.

- It might not always be advantageous for small investors. If a share is oversubscribed, allocations to small investors might not be made.

Examples of Primary Stock Market Selling

Here are a few examples of primary stock market selling:

- Rights issue

Leading Indian automaker Tata Motors launched a rights issue to its current shareholders in May 2015. Amounts of Ordinary Shares and ‘A’ Ordinary Shares were made available to shareholders who met the requirements. There were 9,040.56 crores of cash raised. The money was supposed to be used for a variety of things, including the purchase of equipment, financing research, paying off debt, and meeting ordinary business requirements.

- Initial Public Offering

Reliance Power held a prominent IPO in India in 2008. Shares of the company were sold to the public for 450 for non-retail investors and 430 for retail investors. The ambitious power generation projects spread across India were the focus of the IPO.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en