What Is a Moving Average (MA)?

A moving average (MA) is a stock indicator used frequently in technical analysis in the world of finance. The purpose of generating a stock’s moving average is to create a continuously updated average price in order to assist smooth out the price data.

The effects of random, short-term changes on the price of a stock over a given time period are reduced by using the moving average calculation. A basic arithmetic average of prices over a time period is used by simple moving averages (SMAs), but exponential moving averages (EMAs) give more weight to more recent values than to older ones over the same time period.

Types of Moving Averages

Simple Moving Average

By calculating the arithmetic mean of a given set of data over a certain period, a simple moving average (SMA) is created. Stock prices are calculated by adding up a group of numbers and dividing the result by the total number of prices in the group. The following formula can be used to determine a security’s simple moving average:

SMA=A1+A2+…+An/n

where:A=Average in period nn=Number of time periods

Exponential Moving Average (EMA)

The exponential moving average gives more weight to recent prices in an attempt to make them more responsive to new information. To calculate an EMA, the simple moving average (SMA) over a particular period is calculated first.

Then calculate the multiplier for weighting the EMA, known as the “smoothing factor,” which typically follows the formula: [2/(selected time period + 1)].

For a 20-day moving average, the multiplier would be [2/(20+1)]= 0.0952. The smoothing factor is combined with the previous EMA to arrive at the current value. The EMA thus gives a higher weighting to recent prices, while the SMA assigns an equal weighting to all values.

EMAt=[Vt×(1+ds)]+EMAy×[1−(1+ds)]

where:EMAt=EMA todayVt=Value todayEMAy=EMA yesterdays=Smoothingd=Number of days

Simple Moving Average (SMA) vs. Exponential Moving Average (EMA)

Recent data points are given more weight in the EMA computation. EMA is regarded as a weighted average calculation as a result.

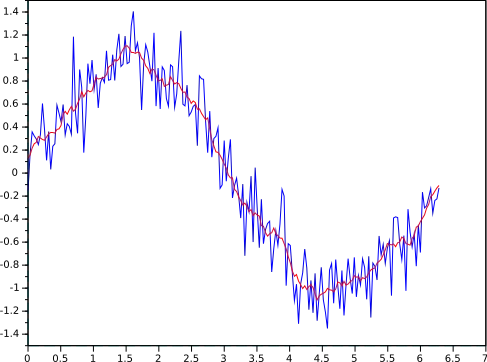

Each average in the graph below uses 15 periods, however the EMA reacts to changing prices more quickly than the SMA. When the price is rising, the EMA is more valuable than the SMA, and when the price is falling, the EMA is more valuable than the SMA. Some traders choose to employ the EMA over the SMA primarily due to its reactivity to price movements.

CONCLUSION

A moving average (MA) is a stock indicator that is frequently used in technical analysis. It creates a continuously updated average price to assist smooth out price data. A security is in an uptrend if its moving average is increasing, whereas a downtrend is indicated by a dropping moving average. Because it provides more weight to recent prices and exhibits a more distinct response to new information and trends, the exponential moving average is typically favored to the simple moving average.

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en