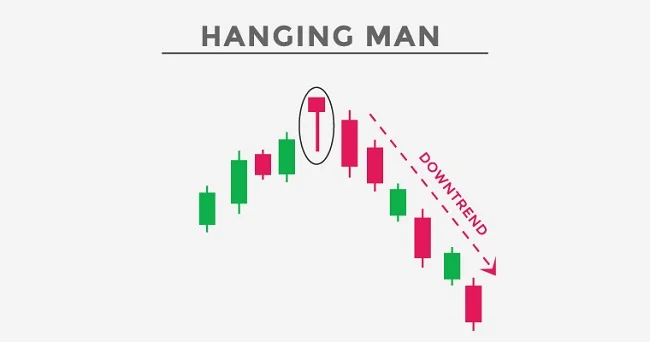

A potential reversal in an uptrend can be indicated by the attractive candlestick pattern known as the “hanging man.”

It’s not as scary as it sounds, so don’t worry. This pattern, which is a reversal pattern, really indicates that the market may be turning negative.

Understanding Candlestick Charts and Data Points

The open, close, high, and low are the four important data points that assist us comprehend what is happening. These facts help traders understand the ongoing struggle between the market’s bulls (buying) and bears (sellers).

You’ll be aware of a prospective market change the next time you see a hanging man!

Exploring the Appearance of the Hanging Man

Actually, it’s a single candlestick pattern that denotes a likely market reversal. Although there shouldn’t necessarily be an uptrend before this pattern appears, there should be some observable price growth.

How little the actual body is is what counts. There are many different shadow configurations, such as none, top and bottom shadows of the same size, or even elongated shadows on either end. Other candlestick patterns, such as the morning and evening star, can include these spinning tops.

However, it is referred to as a hammer if it does so following a price decline or during a downtrend. And what’s this? The meanings of these two motifs are completely different! To accurately grasp them, you must pay close attention to where they appear on a price chart.

Constructing the Hanging Man: Key Features

Regarding the upper shadow, it might or might not be present. If it does appear, it will be quite little. However, the hanging man typically lacks an upper shadow, so the open or close and the high are identical. So there you have it: the hanging man, with his small genuine body, long lower shadow, and typically absent above shadow.

A Quick Recap: The Hanging Man’s Role in Market Reversals

The high, low, opening, and closing prices for a specific time period serve as a kind of snapshot of how investor sentiment is affecting the pricing of an asset.

The candle must also have a lengthy lower shadow and a small true body. You have a hanging guy on your hands when all of these circumstances come together, and it’s time to keep an eye out for any prospective changes to the market!

Circle Launches Cross-Chain USDC Protocol; France Explores Fast- Tracking EU Compliance for Crypto Firms

Top 5 stories chosen this week to keep up with the crypto industry.

the trend being led by the UK. According to a research from the investing firm for digital assets, CoinShares, released in March of that year, the UK’s cryptocurrency market saw the most growth globally in 2021.

Circle introduces cross-chain USDC protocol

The Cross-Chain Transfer Protocol (CCTP), created by Circle, enables developers to transfer the USDC stablecoin quickly between Ethereum and Avalanche.

In essence, CCTP does away with the requirement for Circle partners or outside bridges to transport data between these networks.

Users will be able to “burn and mint” or “teleport” USDC between blockchains via apps that employ CCTP, claims Circle.

1. 2020 is a good indicator of 2024 and beyond

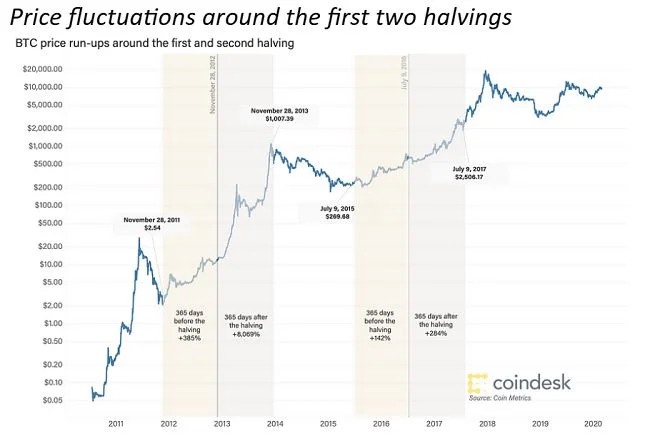

Due to BTC’s slow acceptance, the first two price halves in 2012 and 2016 were not as dramatic. However, the price increased noticeably both before the event and after it, both of which occurred gradually.

Price swings surrounding the first two halvings

The halving in 2020 is probably a good sign for how things might turn out in 2024.

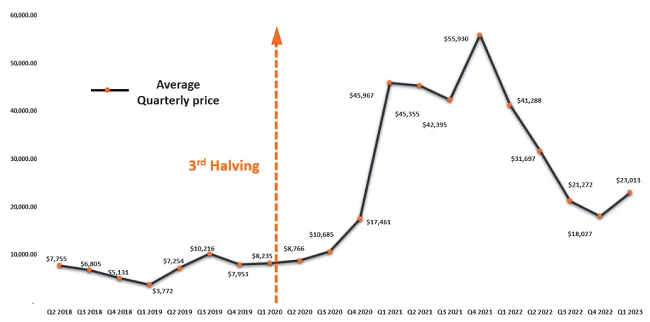

Price was stable before the 2020 price halving.

With the exogenous shock of the COVID-driven sell-off excluded, prices were almost steady prior to the third halving. They then rose to an all-time high of $69,000 in November 2021, over 18 months after the incident.

2. BTC dominance is likely to increase strongly in the next 12 months

After the halving, it continued to rise for the following six months, and then altseason gained control in the first few months of 2021. Currently, Bitcoin holds a 48% market share.

Prior to a halving, BTC dominance rises; after the event, it declines.

3. Bitcoin halving has never occurred during a potential recession

The likelihood of one in 2023 is still high. If it does, we predict that the price of BTC would behave similarly to 2020, albeit on a smaller scale or with a few months’ delay.

The coronavirus epidemic was present during the 2020 halving, however it had little impact on the adoption of BTC. Beincrypto reports that the amount of Bitcoin exchanged and traded in early 2020 was 2,800% greater than it was in 2016.