Option contracts are used in investing techniques referred to as options to achieve specific financial goals. Financial derivatives known as options give the holder the right, but not the duty, to buy or sell the underlying asset at a specified price within a preset window of time.

Here are some popular option trading tactics:

Insured Call: By employing this method, you can sell a call option on a stock that you already own the underlying. It provides some downside protection as well as the ability to profit from the premium received for selling the option.

Buy a Put Option: In order to protect against potential downside risk, purchase a put option on an underlying asset. In the case that the asset’s price declines, it acts as an insurance policy to protect losses.

Long Call: By buying a call option, you have the right to buy the underlying asset at a predetermined price (the strike price) within a predetermined time frame. You use this strategy when you think the asset’s value will increase.

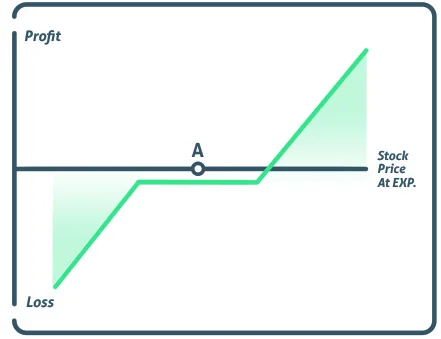

Long Put: Using this strategy, you buy a put option with the right to sell the underlying asset at a predetermined price within a predetermined window of time. You utilise it if you think the asset’s value will drop.

Straddle: When you straddle, you purchase a call option and a put option with the same strike price and expiration date. This strategy is used when you anticipate high price volatility but are unsure about the price movement’s direction.

Strangle: Similar to a straddle, a strangle involves buying both calls and put options, but with different strike prices. It is used when there will be significant volatility but with a preference for either a rise in price or a fall in price of the underlying asset.

A limited-risk, limited-reward trading strategy known as the butterfly spread combines long and short call (or put) options at different strike prices. You use it when you believe that the price of the underlying asset will remain within a specific range.

These are only a few instances of the many more advanced choosing procedures that are accessible. Each strategy has a distinct risk-reward profile and is appropriate for different market conditions. Prior to implementing any options strategy, it’s crucial to understand the risks associated with options trading and to consider consulting a financial advisor or other specialist.

Why trading methods for options fail

Understanding the potential risks and challenges associated with trading options is essential since there are many different reasons why options strategies can fail. Some typical reasons for option failures include the following:

- Inaccurate Market Prediction: The effectiveness of option strategies typically hinges on how well the price of the underlying asset is predicted to change. If the market behaves contrary to predictions, the strategy may incur losses or have a little chance of success.

- Options contracts are subject to time decay, which is the loss of all value after a certain period of time. Options lose value over time due to time decay, also known as theta decay. The strategy may face losses owing to time decay if the price of the underlying asset does not move in the anticipated direction within the specified time frame.

- Options strategies usually rely on predicting the future direction of underlying assets or the market as a whole. Inaccurate market projections. If the projections turn out to be wrong, the method might not be able to generate the expected profits.

- Ineffective risk management: Risk management is crucial while trading options. Strategies that ineffectively manage risk might cause significant losses. This involves investing an excessive amount of capital to a single deal, failing to diversify the portfolio, or failing to put appropriate stop-loss orders.

Conclusion

Option strategies can be effective tools for managing risk, generating income, and seizing market opportunities. They do, however, carry their own risks, and their financial success cannot be assured under all market circumstances.

It is crucial to have a solid understanding of options, risk management theories, and market dynamics prior to using any option strategy.

There is no one-size-fits-all “most working” option strategy because its effectiveness depends on factors like market conditions, underlying assets, risk tolerance, and personal investing goals. Different strategies have various objectives, and different investors may find them more or less appropriate.

Other pages to consider reading

- “Option Volatility and Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg. Click here to find the version on Amazon.

- Options as a Strategic Investment” by Lawrence G. McMillan. Find it here

- Investopedia (www.investopedia.com)

- OptionsPlay (www.optionsplay.com)

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en