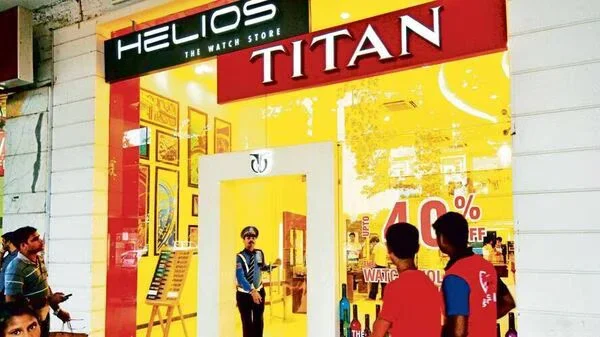

Brand Titan and foreign brands experienced great purchase momentum, with double-digit increases. “Consumer preferences for premium brands resulted in a significant increase in the average selling price for watches,” according to the Tata Group company.

Titan Company Ltd reported a 20% year-on-year (YoY) revenue increase in the June quarter of fiscal year 2023-24 (Q1 FY24). The company announced in a post-market hours announcement on Thursday.

- Despite significant volatility in gold prices throughout the quarter, Akshaya Tritiya sales in April and wedding purchases in June were robust,” said a spokesperson for the Jewellery business.

- The primary categories of gold and studded rose well, while the overall product mix remained stable. “New store openings, golden harvest, and exchange programmes performed well during the quarter,” Titan said.

- The 13% YoY growth in the Watches & Wearables division was comprised of 8% growth in the analogue watches segment and 84% YoY growth in wearables.Brand Titan and foreign brands experienced great purchase momentum, with double-digit increases.

- Sales in the EyeCare Division increased by 10% year on year. Titan also stated that the commerce and distribution channels expanded quicker than Titan Eye+.

- Titan reported that fragrances and fashion accessories grew 11% year on year, driven by 9% growth in fragrances and 13% growth in fashion accessories. Taneira’s first-quarter revenue increased by 81% year over year.

The 14-day relative strength index (RSI) for the stock was 79.96. A value less than 30 is considered oversold, while a value more than 70 is considered overbought.

CONCLUSION

FOR MORE INDO CLICK THIS

SITE: https://learningsharks.in/

FOLLOW OUR