Star Cement stock price: According to ICICI Direct, Star has a reliable cash flow profile, recording cumulative CFO (operating cashflows) of almost Rs 2,800 crore between FY18 and FY23, with an average CFO/EBITDA ratio of 105 percent.

INTRODUCTION

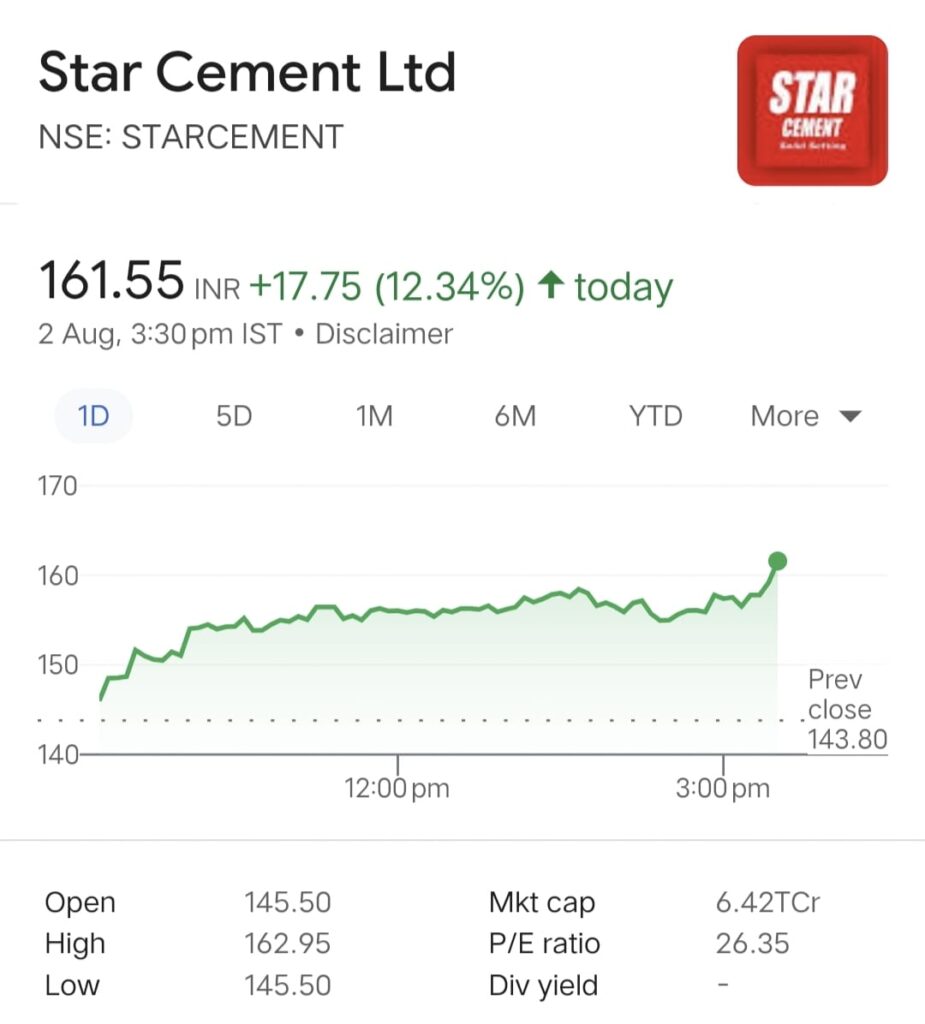

Star Cement Ltd. shares increased significantly in price on Wednesday despite a decline in the benchmarks for domestic equities. Today, the stock increased 10.78% to a 52-week high of Rs 159.35. At Rs 158.70, it ultimately finished 10.32% higher.

5.17 lakh shares were exchanged on the BSE, far exceeding the two-week average volume of 15,000 shares. The counter had a turnover of Rs. 8.02 crore and a market capitalization of Rs. 6,353.72 crore.

The company is building two 2 MT each grinding facilities in Assam (capex: Rs 800 crore, completion: Guwahati in Dec 23 and Silchar in Aug 24) as well as a 3 MT clinker unit with 12 MW WHRS in Meghalaya (capex: Rs 1300 crore, completion: Jan-24).

- According to ICICI Direct, Star has a reliable cash flow profile, recording cumulative CFO (operating cashflows) of almost Rs 2,800 crore between FY18 and FY23, with an average CFO/EBITDA ratio of 105%.

- Its balance sheet is cash-rich, with investments totaling Rs 485 crore. In the future, we anticipate that the company would produce total OCF of Rs.

- Oversold is defined as a value below 30, and overbought as a value beyond 70. The price-to-equity (P/E) ratio of the company’s stock is 35.45, while the price-to-book (P/B) ratio is 3.97.

COMCLUSION

FOR MORE INFO CLICK THIS SITE:https://learningsharks.in/

FOLLOW OUR PAGE:https://www.instagram.com/learningsharks/?hl=en